2022 Mortgage Trends - The Aftermath

4/3/2023 - Josh, OriginationData.com

As everyone has probably already heard-- the Fed raising rates in 2022 absolutely tanked consumer borrowing

through the year. But how much were mortgage originations impacted by the rate hikes? We use some of the data we have scattered

all over our site to put together some high level insights with some neat interactive tables and of course, maps.

The tl;dr? over 40%.

Total Mortgage Originations by Year

At the highest level, 2022 mortgage origination volume by dollar value decreased by 40% (-$1.9 trillion) and loan originations decreased by 44% (6.6 million originations). This origination dollar volume exceeds pre-covid levels, but the raw origination count only exceeds 2018's origination count.

| Year | Originations | Value |

|---|---|---|

| 2024 | 6,149,171 | $2,030,921,895,000 |

| 2023 | 5,685,171 | $1,774,472,955,000 |

| 2022 | 8,369,564 | $2,892,915,820,000 |

| 2021 | 14,937,950 | $4,735,378,410,000 |

| 2020 | 14,546,437 | $4,360,846,595,000 |

| 2019 | 9,325,241 | $2,661,739,305,000 |

| 2018 | 7,157,358 | $1,847,321,500,000 |

Mortgage Originations by Product Type, Annual Totals

Refinance

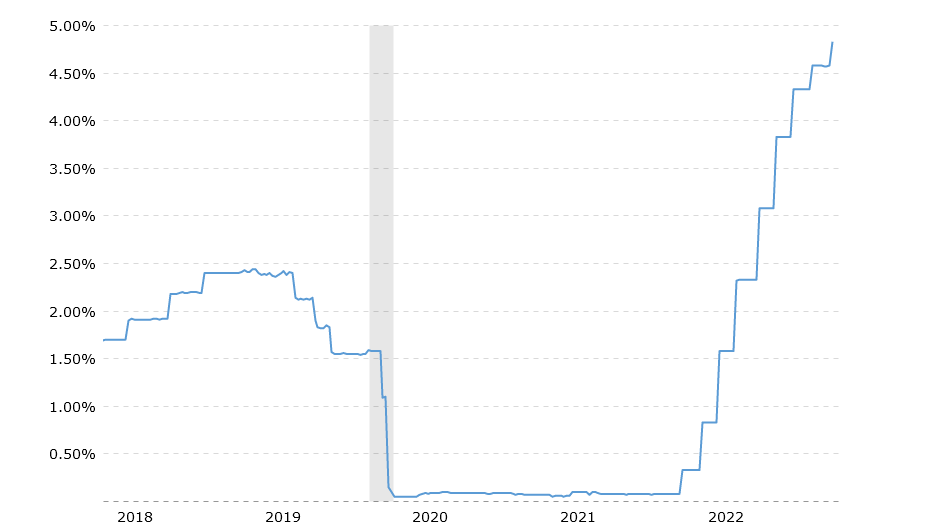

Refis are the single largest casualty of the interest rate environment-- and we will look at just conventional

non-cash-out refinances in this section. When rates went to effectively 0% at the end

of 2020Q1 (from ~1.5% prior), their origination volume exploded. 2019 (aka, pre-COVID-era) had 2.2 million

conventional refinances worth $781 billion, which was already more than double 2018's figures. 2020 saw originations spike

to 6.6MM and $2.07 trillion of value. 2021 slightly cooled, with *just* 5.6MM originations worth $1.8 trillion.

And then 2022 came along and rates did this:

The results? 1.08MM refis (-86% vs 2021) worth just $414 billion (-76% vs 2021)-- a similar

origination value to 2018-- but with ~27% higher

average loan value-- likely a result of the huge increase in home prices tied to lower rates ballooning purchase

prices due to lower mortgage payments.

Home Purchases

On the opposite end of the spectrum from refinance originations is the venerable home purchase origination-- what people who are buying a new-to-them home (either to live in, vacation in, speculate with or hoard) will typically use. 2021 was also the highest recent year for purchase originations, with 5.3MM originations worth $1.9 trillion, up from 4.9MM ($1.5 trillion) originations in 2020, 4.5MM ($1.3 trillion) in 2019 and 3.9MM ($1.1 trillion) in 2018. The 2022 results? Only a 19% decrease in originations and 10.5% decrease in origination value. The "softer" landing for 2022's home purchase originations is again bouyed by the same 27% average origination value increase as seen with refis.

Home Improvement Loans (A bright spot, or not?)

2022's biggest "winning" category has to be home improvement originations-- increasing 43% to 782k originations worth $139 billion (+96% vs 2021). As everyone has already seen, home prices have been increasing anywhere from 5-30%+ per year depending on market, so equity loans for home improvements have geen steadily growing. Not wanting to speculate, but perhaps homeowners feel guilty over their newfound wealth and want to improve their homes in the event of a sale? Or cynically, they're trying to increase the value of their home in the event of prices decreasing as rates continue to increase?

| Year | Loan Purpose | Originations | Value | Average Origination Value |

|---|---|---|---|---|

| 2024 | Cash Out Refi | 766,215 | $215,715,115,000 | $281,533 |

| 2024 | Home Improvement | 584,932 | $70,492,380,000 | $120,514 |

| 2024 | Home Purchase | 3,513,601 | $1,357,804,075,000 | $386,442 |

| 2024 | NA | 2,501 | $5,400,045,000 | $2,159,154 |

| 2024 | Other | 585,595 | $83,046,775,000 | $141,816 |

| 2024 | Refi | 696,327 | $298,463,505,000 | $428,625 |

| 2023 | Cash Out Refi | 648,500 | $164,623,210,000 | $253,852 |

| 2023 | Home Improvement | 603,440 | $69,206,060,000 | $114,686 |

| 2023 | Home Purchase | 3,443,425 | $1,279,370,035,000 | $371,540 |

| 2023 | NA | 1,175 | $3,898,635,000 | $3,317,987 |

| 2023 | Other | 554,316 | $78,726,650,000 | $142,025 |

| 2023 | Refi | 434,315 | $178,648,365,000 | $411,334 |

| 2022 | Cash Out Refi | 1,542,768 | $477,057,700,000 | $309,222 |

| 2022 | Home Improvement | 782,329 | $139,271,695,000 | $178,022 |

| 2022 | Home Purchase | 4,350,780 | $1,717,986,920,000 | $394,869 |

| 2022 | NA | 2,350 | $21,982,530,000 | $9,354,268 |

| 2022 | Other | 612,099 | $122,069,895,000 | $199,428 |

| 2022 | Refi | 1,079,238 | $414,547,080,000 | $384,111 |

| 2021 | Cash Out Refi | 2,972,156 | $897,876,240,000 | $302,096 |

| 2021 | Home Improvement | 546,649 | $71,045,075,000 | $129,965 |

| 2021 | Home Purchase | 5,335,834 | $1,915,247,060,000 | $358,941 |

| 2021 | NA | 1,548 | $1,416,460,000 | $915,026 |

| 2021 | Other | 422,384 | $91,059,900,000 | $215,586 |

| 2021 | Refi | 5,659,379 | $1,758,733,675,000 | $310,764 |

| 2020 | Cash Out Refi | 2,161,223 | $632,956,245,000 | $292,869 |

| 2020 | Home Improvement | 455,732 | $56,213,580,000 | $123,348 |

| 2020 | Home Purchase | 4,905,840 | $1,518,583,130,000 | $309,546 |

| 2020 | NA | 933 | $445,135,000 | $477,101 |

| 2020 | Other | 389,354 | $73,831,680,000 | $189,626 |

| 2020 | Refi | 6,633,355 | $2,078,816,825,000 | $313,388 |

| 2019 | Cash Out Refi | 1,497,523 | $422,443,255,000 | $282,095 |

| 2019 | Home Improvement | 541,014 | $58,075,940,000 | $107,346 |

| 2019 | Home Purchase | 4,512,573 | $1,327,937,125,000 | $294,275 |

| 2019 | NA | 7,212 | $6,319,460,000 | $876,242 |

| 2019 | Other | 490,225 | $65,612,285,000 | $133,841 |

| 2019 | Refi | 2,276,694 | $781,351,240,000 | $343,196 |

| 2018 | Cash Out Refi | 1,094,873 | $277,945,145,000 | $253,861 |

| 2018 | Home Improvement | 543,558 | $57,711,660,000 | $106,174 |

| 2018 | Home Purchase | 3,994,135 | $1,133,297,795,000 | $283,740 |

| 2018 | NA | 5,735 | $4,571,225,000 | $797,075 |

| 2018 | Other | 485,712 | $60,119,130,000 | $123,775 |

| 2018 | Refi | 1,033,345 | $313,676,545,000 | $303,555 |

Mortgage Originations by Lender, Annual Totals (>1BB originated)

A prudent hypothesis is that the only industry with more layoffs than big-tech has to have been anyone involved

in the mortgage industry-- whether you're looking at

VC funded startups

laying off hundreds via zoom,

the largest bank originator by volume for 2021 dropping thousands or even

one of the largest low-cost mortgage companies being acquired.

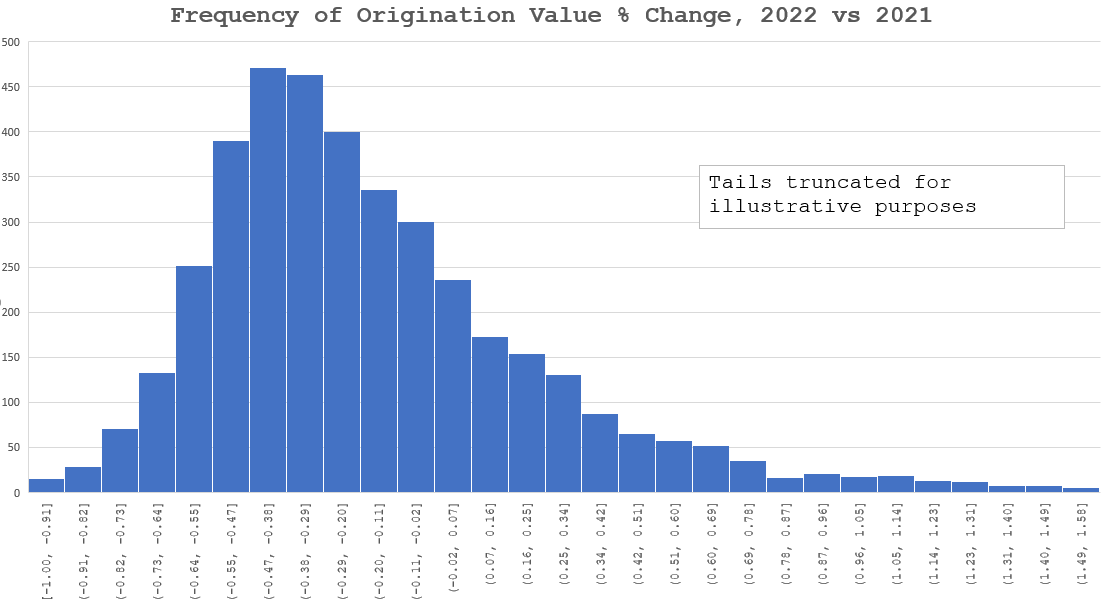

In terms of across-the-board performance, we track over 4,000 lenders and of those 73% (2,934) saw decreases in total

origination volume.

Takeaways

50% of lenders saw >25% decrease in origination volume value40% of lenders saw >33% decrease

18% of lenders saw >50% decrease

>100 lenders saw >75% decrease

(In)famous lenders as of late such as Better.com saw an 83% decrease-- from $47 billion to $7.8 billion.

The largest lender in America, Quicken/Rocket, saw a 62% decrease-- from $340 billion to $127 billion.

The majority of lenders with growth did so by being relatively small (only ~16 lenders grew volume by >$1 billion) or via acquisitions (e.g. PNC/BBVA)-- or in cases such as Guild/Cherry Creek, an acquisition and volume still off by 45% YoY.

| Year | LEI | Name | Value | vs PY | Average Origination Value |

|---|---|---|---|---|---|

| 2023 | 549300HW662MN1WU8550 | UNITED WHOLESALE MORTGAGE, LLC | $108,479,675,000 | -15% | $368,493 |

| 2023 | 549300FGXN1K3HLB1R50 | QUICKEN LOANS, LLC | $76,259,060,000 | -40% | $264,276 |

| 2023 | 7H6GLXDRUGQFU57RNE97 | JPMorgan Chase Bank | $38,395,100,000 | -47% | $599,118 |

| 2023 | KB1H1DSPRFMYMCUFXT09 | Wells Fargo Bank | $32,073,030,000 | -59% | $626,231 |

| 2023 | 549300VZVN841I2ILS84 | CROSSCOUNTRY MORTGAGE, LLC | $29,591,900,000 | -16% | $354,598 |

| 2023 | B4TYDEB6GKMZO031MB27 | Bank of America | $28,452,070,000 | -47% | $309,780 |

| 2023 | 549300MGPZBLQDIL7538 | FAIRWAY INDEPENDENT MORTGAGE CORPORATION | $26,928,060,000 | -34% | $311,906 |

| 2023 | 6BYL5QZYBDK8S7L73M02 | U.S. Bank | $25,708,780,000 | -40% | $356,452 |

| 2023 | 5493001SXWZ4OFP8Z903 | DHI MORTGAGE COMPANY, LTD. | $21,688,480,000 | 8% | $333,648 |

| 2023 | 549300AG64NHILB7ZP05 | LOANDEPOT.COM, LLC | $21,479,750,000 | -59% | $328,497 |

| 2023 | 549300U3721PJGQZYY68 | GUARANTEED RATE, INC. | $20,443,515,000 | -34% | $362,519 |

| 2023 | 549300DD4R4SYK5RAQ92 | MOVEMENT MORTGAGE, LLC | $19,325,190,000 | -15% | $324,979 |

| 2023 | AD6GFRVSDT01YPT1CS68 | PNC Bank | $19,208,095,000 | -49% | $287,061 |

| 2023 | E57ODZWZ7FF32TWEFA76 | Citibank | $18,897,280,000 | -16% | $1,302,004 |

| 2023 | 549300DD5QQUHO6PCH70 | Mortgage Research Center, LLC | $18,616,355,000 | -22% | $298,277 |

| 2023 | 549300H3IZO24NSOO931 | EAGLE HOME MORTGAGE, LLC | $17,444,010,000 | 24% | $368,343 |

| 2023 | 549300GKFNPRWNS0GF29 | CMG MORTGAGE, INC. | $15,862,995,000 | 25% | $355,553 |

| 2023 | DRMSV1Q0EKMEXLAU1P80 | Citizens Bank | $15,607,830,000 | -38% | $231,159 |

| 2023 | 5493003GQDUH26DNNH17 | NAVY FEDERAL CREDIT UNION | $14,830,605,000 | -21% | $207,650 |

| 2023 | 549300AQ3T62GXDU7D76 | GUILD MORTGAGE COMPANY | $14,518,905,000 | -21% | $298,283 |

| 2023 | 254900YA1AQXNM8QVZ06 | WALKER & DUNLOP, LLC | $13,781,685,000 | -32% | $20,849,750 |

| 2023 | RVDPPPGHCGZ40J4VQ731 | PENNYMAC LOAN SERVICES, LLC | $13,485,905,000 | -39% | $287,662 |

| 2023 | 549300JQALY53TH22D13 | JONES LANG LASALLE MULTIFAMILY, LLC | $11,777,230,000 | 180% | $51,205,348 |

| 2023 | JJKC32MCHWDI71265Z06 | Truist | $11,341,130,000 | -45% | $263,392 |

| 2023 | 2WHM8VNJH63UN14OL754 | The Huntington National Bank | $10,418,405,000 | -31% | $200,527 |

| 2023 | 549300GS0W0TEUQS8571 | Morgan Stanley Private Bank | $10,140,570,000 | -35% | $980,144 |

| 2023 | 549300FNXYY540N23N64 | NEWREZ LLC | $9,457,015,000 | 10% | $290,994 |

| 2023 | 549300E2UX99HKDBR481 | BROKER SOLUTIONS, INC. | $9,356,400,000 | -34% | $284,891 |

| 2023 | 03D0JEWFDFUS0SEEKG89 | TD Bank | $9,086,600,000 | -22% | $340,501 |

| 2023 | EQTWLK1G7ODGC2MGLV11 | Regions Bank | $8,639,010,000 | -11% | $276,820 |

| 2023 | SS1TRMSN6BRNMOREEV51 | Flagstar Bank, FSB | $8,614,065,000 | -65% | $282,216 |

| 2023 | 549300GNIV169ZIHU012 | BERKADIA COMMERCIAL MORTGAGE LLC | $8,154,780,000 | -52% | $15,562,557 |

| 2023 | 5493007Z7FTUKQGFMZ98 | GREYSTONE SERVICING COMPANY LLC | $7,975,625,000 | 12% | $12,968,496 |

| 2023 | 549300VORTI31GZTJL53 | CARDINAL FINANCIAL | $7,909,250,000 | -34% | $291,038 |

| 2023 | 549300121SF0K2LN2804 | PRIMELENDING, A PLAINSCAPITAL COMPANY | $7,816,570,000 | -35% | $301,054 |

| 2023 | 549300KIOYNU323LVJ37 | AMERICAN PACIFIC MORTGAGE CORPORATION | $7,766,160,000 | -25% | $356,639 |

| 2023 | YWC0TIKBQM2JV8L4IV08 | First Republic Bank | $7,553,180,000 | -83% | $1,300,031 |

| 2023 | 549300LYRWPSYPK6S325 | FREEDOM MORTGAGE CORPORATION | $7,002,065,000 | -61% | $307,932 |

| 2023 | 5493004WMLN60ZJ2ON46 | PULTE MORTGAGE LLC | $6,915,085,000 | -3% | $397,716 |

| 2023 | 3Y4U8VZURTYWI1W2K376 | BMO Harris Bank | $6,870,430,000 | 57% | $413,383 |

| 2023 | 5493005PKOSG7MYX0B34 | Prosperity Home Mortgage, LLC | $6,816,055,000 | -28% | $331,536 |

| 2023 | 254900ZFWS2106HWPH46 | Paramount Residential Mortgage Group, Inc. | $6,285,185,000 | -35% | $353,120 |

| 2023 | 549300LBCBNR1OT00651 | Mr. Cooper ( Nationstar Mortgage ) | $6,078,330,000 | -66% | $215,208 |

| 2023 | L9VVX1KT5TFTKS0MLF66 | First-Citizens Bank & Trust Company | $5,902,870,000 | -9% | $385,708 |

| 2023 | 549300KBWX4NV5Q1E376 | NVR Mortgage Finance, Inc. | $5,738,155,000 | -9% | $361,641 |

| 2023 | 549300MCIFZSDHUT8X63 | NFM, INC. | $5,571,150,000 | -20% | $351,492 |

| 2023 | 549300ASFUWYQO0RW077 | Arbor Realty Trust, Inc. | $5,398,145,000 | 1% | $10,401,050 |

| 2023 | 549300SHE1JTCOWBP090 | STATE EMPLOYEES' | $5,386,785,000 | -32% | $158,701 |

| 2023 | 54930001NSTOD85LT125 | GUARANTEED RATE AFFINITY, LLC | $5,377,695,000 | -36% | $362,647 |

| 2023 | 549300WTZMQSET2VY242 | ACADEMY MORTGAGE CORPORATION | $5,237,165,000 | -35% | $301,177 |

| 2023 | 549300XWUSRVVOHPRY47 | EVERETT FINANCIAL, INC. | $5,214,540,000 | -45% | $293,018 |

| 2023 | 549300RPOGWJRH63HS39 | UNION HOME MORTGAGE CORP. | $5,156,965,000 | -10% | $257,346 |

| 2023 | QFROUN1UWUYU0DVIWD51 | Fifth Third Bank | $4,908,760,000 | -43% | $175,000 |

| 2023 | 549300IBT3SCF2K09D58 | CBRE MULTIFAMILY CAPITAL, INC. | $4,877,315,000 | -14% | $26,363,865 |

| 2023 | 54930043BMDE130FJ617 | PROVIDENT FUNDING ASSOCIATES, L.P. | $4,781,920,000 | 19% | $399,893 |

| 2023 | 5493001GDRY0EL7VG372 | ARK-LA-TEX FINANCIAL SERVICES, LLC. | $4,519,645,000 | -5% | $305,898 |

| 2023 | COOWI3L2W9TPYR3WJX37 | First Horizon Bank | $4,500,770,000 | -28% | $404,309 |

| 2023 | IUGPUX5LWRZ3B6KIZ697 | Ameris Bank | $4,374,230,000 | -28% | $334,780 |

| 2023 | 5493006VAGP3GQ8FJT49 | LENDINGHOME FUNDING CORPORATION | $4,370,105,000 | -1% | $289,392 |

| 2023 | 549300KJ8PAJ7E52HG32 | Plains Commerce Bank | $4,368,540,000 | 32% | $323,787 |

| 2023 | 549300OPCWU6E72WUT29 | MUTUAL OF OMAHA MORTGAGE, INC. | $4,044,625,000 | -12% | $250,147 |

| 2023 | WWB2V0FCW3A0EE3ZJN75 | M&T Bank | $4,035,035,000 | -28% | $229,120 |

| 2023 | 8WH0EE09O9V05QJZ3V89 | Zions Bank | $3,971,570,000 | -49% | $385,066 |

| 2023 | C5654JQHZUHN0772B561 | USAA Federal Savings Bank | $3,967,800,000 | -26% | $326,675 |

| 2023 | 5493001WHVQBGRSWEU75 | HOMEBRIDGE FINANCIAL SERVICES, INC. | $3,964,755,000 | -66% | $262,758 |

| 2023 | 5493008NWHQT1R22C024 | AMERICAN FINANCIAL NETWORK, INC. | $3,844,990,000 | 0% | $338,825 |

| 2023 | 549300JYXTZDSPJEPI44 | PLAZA HOME MORTGAGE, INC. | $3,767,090,000 | 6% | $332,312 |

| 2023 | 549300YIQ7S7Z8PIHE53 | AMERISAVE MORTGAGE CORPORATION | $3,662,735,000 | -72% | $252,794 |

| 2023 | 5493002QI2ILHHZH8D20 | KBHS HOME LOANS, LLC | $3,631,715,000 | 9% | $390,717 |

| 2023 | F28JOQ8OBWCFUYM0UX93 | East West Bank | $3,601,280,000 | -33% | $588,637 |

| 2023 | 549300MZ8VZJOVC63092 | Century Mortgage Company DBA Century Lending Company | $3,589,765,000 | 80% | $378,149 |

| 2023 | 549300J7I82PNDVU8H22 | OCMBC, INC. | $3,587,635,000 | 35% | $403,513 |

| 2023 | 549300HINJH60UG3KG47 | BERKELEY POINT CAPITAL LLC | $3,583,565,000 | -36% | $25,415,355 |

| 2023 | 549300CY7WNAHKHYSJ73 | CORNERSTONE HOME LENDING, INC. | $3,570,445,000 | -31% | $355,728 |

| 2023 | 549300KM40FP4MSQU941 | Boeing Employees Credit Union | $3,539,215,000 | -28% | $250,812 |

| 2023 | 549300J7XKT2BI5WX213 | CALIBER HOME LOANS, INC. | $3,535,055,000 | -88% | $330,040 |

| 2023 | 549300PL8ER6H23P0Z91 | BAY EQUITY LLC | $3,521,690,000 | -30% | $383,543 |

| 2023 | 5493000YNV8IX4VD3X12 | VANDERBILT MORTGAGE AND FINANCE, INC. | $3,514,610,000 | -8% | $190,949 |

| 2023 | 549300RWXUAFD1WAE410 | ATLANTIC BAY MORTGAGE GROUP, L.L.C. | $3,506,935,000 | -22% | $273,062 |

| 2023 | 549300ZBBGOL4MIK0L71 | Three Rivers Federal Credit Union | $3,471,735,000 | 42% | $1,504,870 |

| 2023 | 549300UI36AJZ0WZ4U93 | South Pacific Financial Corporation | $3,447,320,000 | 12% | $467,877 |

| 2023 | 5493004AS1SPBQOFDR49 | Commerce Home Mortgage, Inc. | $3,445,240,000 | -42% | $473,247 |

| 2023 | N8T7HW55LK5D2ORCKP39 | First National Bank of Pennsylvania | $3,409,870,000 | -19% | $280,279 |

| 2023 | 549300BX448ALT10FI43 | The Federal Savings Bank | $3,267,285,000 | -28% | $348,883 |

| 2023 | Q7C315HKI8VX0SSKBS64 | BancorpSouth | $3,256,905,000 | -25% | $271,070 |

| 2023 | 549300UXY7OP0IC38293 | Northpointe Bank | $3,228,560,000 | -38% | $329,781 |

| 2023 | 8I3UVGYULPJQIP7FQV10 | South State Bank | $3,211,310,000 | -51% | $306,540 |

| 2023 | 549300JGMQJ4R419LR70 | ORIX REAL ESTATE CAPITAL, LLC | $3,176,405,000 | 78% | $9,895,343 |

| 2023 | 549300WYBPIWKK6SQC06 | Bell Bank | $3,146,205,000 | -30% | $318,539 |

| 2023 | 5493008CPTDVOS570626 | Third Federal Savings and Loan Association of Cleveland | $3,102,315,000 | -41% | $143,966 |

| 2023 | 549300O6Z0I6KYMESL47 | AMWEST FUNDING CORP. | $3,089,375,000 | -30% | $414,181 |

| 2023 | 549300GWD9H4FQ2VR805 | UBS Bank USA | $3,064,195,000 | -55% | $1,228,134 |

| 2023 | 549300XQVJ1XBNFA5536 | 21ST MORTGAGE CORPORATION | $3,045,905,000 | 5% | $109,585 |

| 2023 | 549300FX7K8PTEQUU487 | PENTAGON FEDERAL CREDIT UNION | $3,034,250,000 | -56% | $246,447 |

| 2023 | 1DU7IM20QESYGDO4HO54 | The Northwestern Mutual Life Insurance Company | $2,994,480,000 | -17% | $74,862,000 |

| 2023 | 549300AT7EB9FJAF0E61 | Old National Bank | $2,959,295,000 | -28% | $372,192 |

| 2023 | HUX2X73FUCYHUVH1BK78 | KeyBank | $2,948,800,000 | -84% | $248,718 |

| 2023 | 549300WRDGBHKR1BXL98 | Merchants Bank of Indiana | $2,939,405,000 | -36% | $3,822,373 |

| 2023 | WV0OVGBTLUP1XIUJE722 | Webster Bank | $2,934,760,000 | -32% | $776,803 |

| 2023 | 549300YB1H2FRI6JPM51 | LAKE MICHIGAN CREDIT UNION | $2,928,205,000 | -25% | $263,399 |

| 2023 | B2S31CFVSWTN3FR00Q90 | PGIM Real Estate Finance, LLC | $2,926,890,000 | -13% | $66,520,227 |

| 2023 | KI0VI4JRMCIJ329YTN75 | Valley National Bank | $2,900,055,000 | -39% | $963,794 |

| 2023 | 549300DH8EI64ITBY388 | Prudential Huntoon Paige Associates, LLC | $2,898,730,000 | -59% | $16,659,368 |

| 2023 | 254900KKWIJLOTNP7667 | M&T Realty Capital Corporation | $2,887,080,000 | -1% | $27,236,604 |

| 2023 | 1IE8VN30JCEQV1H4R804 | HSBC BANK USA, NATIONAL ASSOCIATION | $2,850,525,000 | -30% | $1,085,088 |

| 2023 | X05BVSK68TQ7YTOSNR22 | Discover Bank | $2,824,555,000 | 40% | $91,620 |

| 2023 | 549300F8C5JA44WNMI75 | AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCE COMPANY LLC | $2,806,580,000 | -32% | $314,216 |

| 2023 | 549300AENO88GEUWCZ39 | American Mortgage & Equity Consultants, Inc. | $2,784,515,000 | 230% | $360,829 |

| 2023 | COINQMNIM6RBU631DD85 | Arvest Bank | $2,749,865,000 | -22% | $229,213 |

| 2023 | 54930052M48FOD3CWA54 | PRIMARY RESIDENTIAL MORTGAGE, INC. | $2,716,365,000 | -46% | $273,689 |

| 2023 | 549300AEULLVYD8L9B04 | Barings Multifamily Capital | $2,689,875,000 | 0% | $27,170,455 |

| 2023 | 549300LXKO1O7CSK5J52 | FLAT BRANCH MORTGAGE, INC. | $2,689,135,000 | -8% | $213,848 |

| 2023 | 549300INFJ8TYNZ1G568 | Charles Schwab Bank, SSB | $2,641,515,000 | -55% | $968,652 |

| 2023 | 54930034MNPILHP25H80 | Gateway First Bank | $2,599,380,000 | -42% | $241,668 |

| 2023 | 549300RFPLMCMJL7BS81 | BELLWETHER ENTERPRISE REAL ESTATE CAPITAL, LLC | $2,558,915,000 | -28% | $13,831,973 |

| 2023 | 549300RN01LBYR8ZVX74 | HOMESIDE FINANCIAL, LLC | $2,528,005,000 | -36% | $289,014 |

| 2023 | 549300R9S3MVDV4MGF56 | Carrington Mortgage Services, LLC | $2,492,635,000 | -43% | $213,832 |

| 2023 | 254900TTZ395IC926125 | Sierra Pacific Mortgage Company, Inc. | $2,473,650,000 | -30% | $342,137 |

| 2023 | 549300DMHEHNYZ2OLB41 | First United Bank and Trust Company | $2,472,510,000 | -50% | $352,009 |

| 2023 | 5493001HHBUTXHS7TZ96 | HOMEAMERICAN MORTGAGE CORPORATION | $2,448,510,000 | -11% | $450,923 |

| 2023 | 549300PC4MFWQBNVKG88 | V.I.P. MORTGAGE, INC. | $2,422,775,000 | 3% | $380,999 |

| 2023 | 2549005SIVTHG14U2905 | A&D Mortgage LLC | $2,396,085,000 | -5% | $389,038 |

| 2023 | 549300ONBM4MGXXBTA44 | AMCAP MORTGAGE, LTD. | $2,256,105,000 | -29% | $288,911 |

| 2023 | 213800QUAI2VH5YM6310 | EMBRACE HOME LOANS, INC. | $2,250,205,000 | -38% | $422,574 |

| 2023 | 213800XR2TCBQJSF1X93 | NBKC BANK | $2,242,085,000 | -26% | $379,693 |

| 2023 | 593C3GZG957YOJPS2Z63 | City National Bank | $2,217,475,000 | -71% | $1,219,063 |

| 2023 | 549300CDOC4F7XSRG390 | Pinnacle Bank | $2,202,310,000 | -41% | $352,934 |

| 2023 | 5493007TLZJ73TKCO730 | Merchants Capital Corp. | $2,193,405,000 | 0% | $24,645,000 |

| 2023 | 549300D003QRZFSQ4N43 | Prosperity Bank | $2,188,395,000 | -36% | $444,525 |

| 2023 | 549300W4FT4H1UWPGU95 | GREENSTATE CREDIT UNION | $2,140,015,000 | -21% | $173,323 |

| 2023 | 5493005JPZ3LXXMB0S24 | FBC MORTGAGE, LLC | $2,133,565,000 | -22% | $353,415 |

| 2023 | 254900E6AIE4Z8YQM970 | Citadel Servicing Corporation | $2,126,445,000 | 10% | $455,439 |

| 2023 | 549300GRGZDEH4ZGQS06 | Waterstone Mortgage Corporation | $2,123,335,000 | -24% | $281,125 |

| 2023 | 549300DMYENRV818D594 | SWBC MORTGAGE CORPORATION | $2,116,200,000 | -25% | $308,574 |

| 2023 | 254900WEP08K7U7S3A80 | Nations Lending Corporation | $2,114,605,000 | -28% | $278,861 |

| 2023 | 549300S5YL3OH0IVCS62 | FINANCE OF AMERICA REVERSE LLC | $2,112,410,000 | -57% | $272,428 |

| 2023 | 549300GPO6DWUZR4UY30 | FIRST HOME MORTGAGE CORPORATION | $2,093,045,000 | -27% | $390,566 |

| 2023 | 549300PXL1KA5TOL2O82 | M/I FINANCIAL, LLC | $2,080,075,000 | 1% | $393,432 |

| 2023 | 549300GY4NTTEM7WWB64 | Bank of England | $2,045,995,000 | -34% | $303,695 |

| 2023 | 549300GSCUJKJINRJ980 | RUOFF MORTGAGE COMPANY, INC. | $2,037,350,000 | -30% | $207,554 |

| 2023 | 549300KHXD7JSQUZIJ22 | HIGHLANDS RESIDENTIAL MORTGAGE, LTD. | $2,037,150,000 | -13% | $305,328 |

| 2023 | C398JSK21YCXWM603F55 | Barrington Bank & Trust Company, N.A. | $2,023,735,000 | -26% | $289,229 |

| 2023 | 5493001R92DY5DI1DI85 | DRAPER AND KRAMER MORTGAGE CORP. | $2,003,365,000 | -48% | $346,543 |

| 2023 | 549300ZZME37MXI1EF14 | DAS Acquisition Company, LLC | $1,991,985,000 | -29% | $242,010 |

| 2023 | 549300XY701IELCE5Q08 | BETTER MORTGAGE CORPORATION | $1,988,290,000 | -75% | $382,511 |

| 2023 | 5493002RF1ERFA2XR050 | Renasant Bank | $1,981,750,000 | -35% | $263,881 |

| 2023 | DX0JX77PRMOELF7VG772 | Synovus Bank | $1,961,445,000 | -42% | $292,360 |

| 2023 | 5493008VVXQIDO1EZ460 | SUMMIT FUNDING, INC. | $1,948,935,000 | -43% | $325,528 |

| 2023 | 549300VQUTI5IU7GXT57 | SECURITYNATIONAL MORTGAGE COMPANY | $1,947,890,000 | -38% | $295,493 |

| 2023 | 5493001NJEVHTZW7FG34 | SCHOOLSFIRST | $1,932,350,000 | -35% | $184,808 |

| 2023 | 549300FK3AFCFVAPH234 | Leader Bank | $1,905,085,000 | -32% | $499,891 |

| 2023 | 5493007VW2EU20PZYU97 | INSPIRE HOME LOANS INC. | $1,904,675,000 | -7% | $350,704 |

| 2023 | LDVFX8JEECFFE8HRWA73 | First National Bank of Omaha | $1,895,960,000 | 9% | $315,363 |

| 2023 | FT6J43S06X6CLJ0R0B48 | Cathay Bank | $1,895,880,000 | 16% | $853,231 |

| 2023 | 5493006S869XKIESMV41 | MOUNTAIN AMERICA | $1,890,940,000 | -50% | $164,745 |

| 2023 | 549300R0SXC1JU7ZU290 | FIRST COMMUNITY MORTGAGE, INC. | $1,880,525,000 | 0% | $266,099 |

| 2023 | 549300BLL6VL7AXWYP56 | CHURCHILL MORTGAGE CORPORATION | $1,865,900,000 | -30% | $292,736 |

| 2023 | 549300UF3FPC7U6RFC59 | The Central Trust Bank | $1,850,240,000 | -25% | $245,065 |

| 2023 | 549300337GB2P1WP7003 | Grandbridge Real Estate Capital LLC | $1,841,805,000 | -22% | $18,604,091 |

| 2023 | 549300KTR1JGH3K6LU06 | Bethpage Federal Credit Union | $1,823,885,000 | -41% | $250,430 |

| 2023 | 254900O723MCLR701H50 | Neighborhood Loans, Inc. | $1,816,845,000 | -1% | $235,678 |

| 2023 | 5493007I0X1GRWIU8B34 | AMERICA FIRST | $1,814,130,000 | -31% | $111,859 |

| 2023 | 549300K4ZLGS7SRDTL86 | Equity Prime Mortgage LLC | $1,805,375,000 | -28% | $290,207 |

| 2023 | 54930021WPEXNHYZUL09 | PLANET HOME LENDING, LLC | $1,800,685,000 | -37% | $292,556 |

| 2023 | DZC62HF6UIZYJ08V1J90 | Fulton Bank | $1,773,530,000 | -26% | $317,041 |

| 2023 | 549300NWBS6MQJX15N44 | NexBank | $1,764,390,000 | -45% | $436,083 |

| 2023 | 549300EM8ID8J7F8OM55 | First Heritage Mortgage, LLC | $1,755,440,000 | -10% | $394,304 |

| 2023 | 254900UL88QFG0E40516 | Figure Lending LLC | $1,748,620,000 | -7% | $71,407 |

| 2023 | 549300R77W0P105C3S50 | HOMEXPRESS MORTGAGE CORP. | $1,746,035,000 | 6% | $407,286 |

| 2023 | 549300S5FVOSK5DQJN30 | INTERCAP LENDING INC. | $1,737,395,000 | -25% | $387,206 |

| 2023 | 549300Y5Y88FQLI7VE83 | DEEPHAVEN MORTGAGE LLC | $1,728,945,000 | 13% | $416,915 |

| 2023 | 549300HFBEONQN2CK447 | Union Savings Bank | $1,721,000,000 | -34% | $254,360 |

| 2023 | 54930095UWUUXAWASB02 | Atlantic Coast Mortgage, LLC | $1,714,850,000 | -9% | $391,518 |

| 2023 | QGPGHQ1ENZOOLJRFTH41 | WesBanco | $1,695,615,000 | -16% | $348,677 |

| 2023 | 549300TM179TSKK3HQ94 | THRIVE MORTGAGE, LLC | $1,694,465,000 | -10% | $274,052 |

| 2023 | 549300OBO7DOF2KOP535 | FirstBank | $1,680,010,000 | -54% | $262,666 |

| 2023 | 54930039UO39UJGI7078 | Towne Bank | $1,664,805,000 | -36% | $348,358 |

| 2023 | 5493009BD405QQTMXO12 | TBI MORTGAGE COMPANY | $1,664,065,000 | -16% | $510,920 |

| 2023 | 254900NTAC4H10MGSU23 | Summit Credit Union | $1,659,525,000 | -8% | $132,138 |

| 2023 | 5493001PXRJMPLXPG540 | IDAHO CENTRAL | $1,658,870,000 | -44% | $219,660 |

| 2023 | T68X8LLAQYRNDV034K14 | United Community Bank | $1,649,525,000 | -36% | $235,950 |

| 2023 | 01J4SO3XTWZF4PP38209 | Trustmark National Bank | $1,645,725,000 | -34% | $181,587 |

| 2023 | CKVBED0S4DMLKJJ5XH28 | Stifel Bank and Trust | $1,641,705,000 | -50% | $471,077 |

| 2023 | 549300ZJIC4LOLZH0M42 | THE GOLDEN 1 | $1,625,220,000 | -39% | $323,878 |

| 2023 | 549300GTVXJ2PGXNLM73 | T2 FINANCIAL LLC | $1,622,840,000 | -16% | $301,755 |

| 2023 | 5493001XKL0FTNOJ0866 | GENEVA FINANCIAL, LLC | $1,622,830,000 | -18% | $260,152 |

| 2023 | ZF85QS7OXKPBG52R7N18 | Associated Bank | $1,607,320,000 | -63% | $262,806 |

| 2023 | KD3XUN7C6T14HNAYLU02 | Goldman Sachs Bank USA | $1,607,195,000 | -50% | $2,100,908 |

| 2023 | 54930049L5WINET09Q97 | MID AMERICA MORTGAGE, INC. | $1,581,170,000 | -41% | $223,014 |

| 2023 | 549300JPGMCMBEJEK584 | DIGITAL Federal Credit Union | $1,577,700,000 | -19% | $286,230 |

| 2023 | 54930060G4MDPWHISD89 | EVERGREEN MONEYSOURCE MORTGAGE COMPANY | $1,573,810,000 | -42% | $389,364 |

| 2023 | 549300HIVO8XPBPNVG69 | NOVA FINANCIAL & INVESTMENT CORPORATION | $1,573,010,000 | -44% | $322,338 |

| 2023 | IFQSIUC9AGQV2NE8CN25 | Umpqua Bank | $1,566,455,000 | -78% | $292,304 |

| 2023 | 549300370QILXLFUWD20 | ZILLOW HOME LOANS, LLC | $1,551,320,000 | 0% | $296,506 |

| 2023 | 254900FBWEZ3YUPOBN33 | LIMA ONE CAPITAL, LLC | $1,550,730,000 | -6% | $394,588 |

| 2023 | 2549004FXPNKCLIN8250 | S1L, Inc. | $1,550,105,000 | -45% | $370,219 |

| 2023 | 549300JZD4L02YZI3Z50 | NJ LENDERS CORP. | $1,528,380,000 | -18% | $435,436 |

| 2023 | FU7RSW4CQQY98A2O7J66 | BOKF | $1,513,365,000 | -32% | $270,485 |

| 2023 | 254900O2K17TNH5CL873 | RF Renovo Management Company, LLC | $1,510,050,000 | 20% | $507,751 |

| 2023 | 549300QKL5FUBZ8LSF50 | NATIONS DIRECT MORTGAGE, LLC | $1,508,475,000 | -24% | $402,367 |

| 2023 | 549300SUCQ1358EGVE89 | NEW DAY FINANCIAL, LLC | $1,493,900,000 | -50% | $263,474 |

| 2023 | 549300VNBQD8FDHF7563 | MORTGAGE INVESTORS GROUP, INC. | $1,481,725,000 | -25% | $279,413 |

| 2023 | C4BXATY60WC6XEOZDX54 | Metropolitan Life Insurance Co | $1,474,495,000 | -72% | $58,979,800 |

| 2023 | 254900DTLHVWQ7NP7R34 | The Loan Store, Inc. | $1,465,525,000 | 2,183% | $358,231 |

| 2023 | 6GK3WNTSHBNJOVP1LV97 | Ent Credit Union | $1,464,685,000 | -40% | $178,164 |

| 2023 | 549300NJVKCDJA5YC939 | HOMEOWNERS FINANCIAL GROUP USA, LLC | $1,452,180,000 | -30% | $317,625 |

| 2023 | 549300SK2GVCQXPD4S58 | SUN WEST MORTGAGE COMPANY, INC. | $1,445,790,000 | -29% | $279,650 |

| 2023 | 549300OQMU3ID8QA6M46 | VELOCIO MORTGAGE L.L.C. | $1,432,880,000 | 29% | $355,730 |

| 2023 | 549300T9P3WXNMXX0I34 | Ixonia Bank | $1,426,990,000 | 76% | $258,513 |

| 2023 | 5493000NYUJT9UC6G261 | LEADERONE FINANCIAL CORPORATION | $1,426,745,000 | -14% | $267,933 |

| 2023 | 549300EKFFG3BU8DNX74 | NEXERA HOLDING LLC | $1,423,580,000 | -10% | $512,079 |

| 2023 | 549300MCPCNPQAOB4032 | GMFS LLC | $1,420,285,000 | -40% | $270,788 |

| 2023 | 254900JXCS783CPF1D02 | RCN Capital, LLC | $1,383,775,000 | -3% | $200,112 |

| 2023 | 549300ESRQ6OLBB56N04 | Glacier Bank | $1,381,710,000 | -50% | $356,662 |

| 2023 | WE0I402RW25AU38DTI13 | Banner Bank | $1,379,270,000 | -31% | $464,714 |

| 2023 | 549300CLRXFVF83ZL806 | NATIONWIDE MORTGAGE BANKERS, INC. | $1,374,865,000 | -25% | $389,591 |

| 2023 | ZXMJHJK466PBZTM5F379 | Raymond James Bank | $1,369,545,000 | -33% | $902,798 |

| 2023 | 549300BM4NS8HDJT3X28 | INTERCOASTAL MORTGAGE COMPANY | $1,355,765,000 | -38% | $449,673 |

| 2023 | 5493003V40VGM7YDFM54 | FIRST COLONY MORTGAGE CORPORATION | $1,347,175,000 | -27% | $369,393 |

| 2023 | 549300QR0KFPEDZPEI42 | STOCKTON MORTGAGE CORPORATION | $1,330,750,000 | -4% | $232,649 |

| 2023 | 549300VJQJVZKJBDWS17 | TOTAL MORTGAGE SERVICES, LLC | $1,311,265,000 | -25% | $280,005 |

| 2023 | 549300KSOOZZVXCMA627 | ANGEL OAK MORTGAGE SOLUTIONS LLC | $1,309,750,000 | -61% | $429,426 |

| 2023 | 5493008N1D96CHCTQC27 | SECURITY SERVICE | $1,303,985,000 | -32% | $234,572 |

| 2023 | 549300TYV7NDBX6FUR63 | JET HOMELOANS, LLC | $1,296,060,000 | 50% | $412,233 |

| 2023 | MV4O55SH8HO6KQSGW013 | First Financial Bank | $1,286,245,000 | -13% | $212,849 |

| 2023 | 549300RA3E0BUFO7YZ21 | Hometown Equity Mortgage, LLC | $1,279,080,000 | -24% | $421,582 |

| 2023 | 5493007CXTOHZ2JBEJ61 | THE MORTGAGE FIRM, INC. | $1,278,825,000 | -46% | $300,264 |

| 2023 | 549300PBTV7FCWLSMM53 | MORTGAGE SOLUTIONS OF COLORADO, LLC | $1,278,715,000 | -29% | $278,405 |

| 2023 | 549300J6N77Q8OHYNF23 | ENVOY MORTGAGE, LTD | $1,278,315,000 | -47% | $330,399 |

| 2023 | 337KMNHEWWWR6B7Q7W10 | MidFirst Bank | $1,271,465,000 | -32% | $560,364 |

| 2023 | 5493004N9PMBSLEZOF16 | K. HOVNANIAN AMERICAN MORTGAGE, L.L.C. | $1,264,310,000 | 8% | $423,129 |

| 2023 | 549300CB67L6KPJLHE19 | TRIAD FINANCIAL SERVICES, INC. | $1,260,250,000 | 2% | $101,290 |

| 2023 | TR24TWEY5RVRQV65HD49 | Santander Bank, N.A. | $1,252,640,000 | -65% | $17,894,857 |

| 2023 | S0Q3AHZRL5K6VQE35M07 | First Merchants Bank | $1,244,965,000 | -17% | $216,931 |

| 2023 | 2549006II76YXSS5XM65 | George Mason Mortgage, LLC | $1,236,000,000 | -52% | $413,378 |

| 2023 | 549300LLKEKXL2RM1F61 | CONTOUR MORTGAGE CORPORATION | $1,227,425,000 | -15% | $411,749 |

| 2023 | 549300EMNDEK4BA8WB53 | EMM LOANS LLC | $1,218,440,000 | -22% | $305,987 |

| 2023 | 549300T3F9S1MKFKHC53 | HOMESTEAD FUNDING CORP. | $1,217,880,000 | -34% | $254,043 |

| 2023 | 5493009V3WNJX9V2GZ85 | FirstBank | $1,202,120,000 | -67% | $350,472 |

| 2023 | 254900HA4DQWAE0W3342 | AmeriHome Mortgage Company, LLC | $1,192,815,000 | -49% | $322,819 |

| 2023 | 2549008LK3474E9U2888 | OnPoint Community Credit Union | $1,192,395,000 | -31% | $169,398 |

| 2023 | 70WY0ID1N53Q4254VH70 | Comerica Bank | $1,183,585,000 | -58% | $293,039 |

| 2023 | 5493006JISETNI0GLE61 | Farm Credit Mid-America, ACA | $1,170,785,000 | -2% | $358,367 |

| 2023 | TKT6FH38184ZYBTPKS77 | Rockland Trust Company | $1,169,900,000 | -33% | $385,851 |

| 2023 | 5493002Y5XYV7DV1ZV88 | GOLD STAR MORTGAGE FINANCIAL GROUP, CORPORATION | $1,160,060,000 | -25% | $285,307 |

| 2023 | 549300Q02LGIN9AXKP98 | FIRST TECHNOLOGY | $1,145,825,000 | -63% | $343,164 |

| 2023 | 549300RYBJHWWDENV610 | Alcova Mortgage LLC | $1,127,690,000 | -28% | $265,965 |

| 2023 | G5AHTAP80NWA3Q8RDC78 | Frost Bank | $1,125,855,000 | -11% | $164,286 |

| 2023 | 54930048P8RWCQHQM310 | ARC HOME LLC | $1,120,235,000 | -33% | $457,799 |

| 2023 | 254900CN1DD55MJDFH69 | University of Wisconsin Credit Union | $1,117,495,000 | -25% | $138,082 |

| 2023 | 549300VCMRO4ST680C11 | VILLAGE CAPITAL MORTGAGE | $1,113,625,000 | -1% | $311,678 |

| 2023 | X8V2II80XTQHRH7NCB19 | Eastern Bank | $1,111,405,000 | -47% | $378,931 |

| 2023 | 549300C04BJ0G297NC13 | Ally Bank | $1,101,585,000 | -69% | $407,542 |

| 2023 | 549300623VT8YKPHWM78 | ANCHOR LOANS, LP | $1,092,420,000 | -28% | $768,228 |

| 2023 | 549300B4IYL7TZT8FA34 | PREMIER MORTGAGE RESOURCES, L.L.C. | $1,091,275,000 | -30% | $334,234 |

| 2023 | 549300DCGBXW5FJMV921 | NMSI, INC. | $1,086,205,000 | -34% | $527,028 |

| 2023 | 549300XECJ0294F1ZG19 | MATTAMY HOME FUNDING, LLC | $1,082,290,000 | 28% | $405,960 |

| 2023 | 254900XN7UWEWK13RO81 | Premium Mortgage Corporation | $1,078,235,000 | -7% | $228,295 |

| 2023 | Q708HHR4LD2B7XIZNO92 | First Federal Bank | $1,067,005,000 | -21% | $334,589 |

| 2023 | 549300T94GSH3C4U5M59 | ALLIANT CREDIT UNION | $1,044,980,000 | -47% | $183,911 |

| 2023 | 549300NOCASXPA34X033 | LAKEVIEW LOAN SERVICING, LLC | $1,036,615,000 | -79% | $250,209 |

| 2023 | NSGZD26XPW2CUM2JKU70 | Hancock Whitney Bank | $1,033,830,000 | -51% | $283,552 |

| 2023 | VNOO6EITDJ2YUEBMSZ83 | UMB Bank | $1,028,895,000 | -30% | $445,216 |

| 2023 | 5493001XZBZCQEIYKY53 | CENTER STREET LENDING VIII, LLC | $1,024,835,000 | 7% | $965,914 |

| 2023 | 549300D4ZYLSQ5LMTV35 | ABSOLUTE HOME MORTGAGE CORPORATION | $1,021,985,000 | -32% | $325,369 |

| 2023 | XJCRTTYJVBMA22IXL619 | Bank of Hawaii | $1,021,080,000 | -56% | $564,757 |

| 2023 | 549300IVURCTJ6QVMD67 | First Financial Bank | $1,020,270,000 | -18% | $267,928 |

| 2023 | 2549009X2AG1P20YAJ63 | Axos Bank | $1,009,190,000 | -54% | $1,297,159 |

| 2023 | 5493000BR75YQF0VQC27 | HOMESTAR FINANCIAL CORPORATION | $1,003,525,000 | -60% | $261,539 |

Mortgage Originations by Market, Annual Totals

Zoom/scroll map to see metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results.

If you're still reading this far down and haven't gotten drawn into the ploys of cartography, you surely won't be surprised to hear that only 11 out of 941 metros had YoY increases in origination volume-- 10 of the 11 were small metros with <1k loans originated-- Aberdeen, WA was the largest market with only a 1% increase in origination value, driven by a huge increase in originations to offset the 40% decrease in average origination value. Count of markets down >30%, down >50%. Top performing, worst performing.

Takeaways

36 metros saw origination value decrease by 50%+

395 metros saw 33%+ decrease

657 metros saw 25%+ decrease

In terms of geographies, 9 of the top 10 percentage decreasing metros were in California-- but the top contracting market was Ames, IA at -61% (albeit with a 48% YoY increase in average origination size).

| Year | Market | Originations | (% vs PY) | Value | (vs PY) | Average Origination Value |

|---|---|---|---|---|---|---|

| 2023 | Aberdeen, SD | 470 | -42% | $93,990,000 | -53% | $199,979 |

| 2023 | Aberdeen, WA | 1,694 | -38% | $427,470,000 | -60% | $252,344 |

| 2023 | ABILENE, TX | 3,012 | -20% | $653,490,000 | -21% | $216,962 |

| 2023 | Ada, OK | 494 | -29% | $84,280,000 | -29% | $170,607 |

| 2023 | Adrian, MI | 1,877 | -32% | $279,695,000 | -49% | $149,012 |

| 2023 | AGUADILLA-ISABELA, PR | 754 | -28% | $117,010,000 | -24% | $155,186 |

| 2023 | AKRON, OH | 14,448 | -29% | $2,695,510,000 | -31% | $186,566 |

| 2023 | Alamogordo, NM | 859 | -30% | $171,115,000 | -26% | $199,203 |

| 2023 | ALBANY, GA | 1,932 | -24% | $353,320,000 | -28% | $182,878 |

| 2023 | ALBANY-LEBANON, OR | 2,302 | -40% | $952,500,000 | -17% | $413,771 |

| 2023 | ALBANY-SCHENECTADY-TROY, NY | 16,162 | -29% | $3,502,520,000 | -36% | $216,713 |

| 2023 | Albemarle, NC | 1,916 | -22% | $394,830,000 | -22% | $206,070 |

| 2023 | Albert Lea, MN | 426 | -25% | $59,030,000 | -29% | $138,568 |

| 2023 | Albertville, AL | 1,839 | -26% | $362,955,000 | -28% | $197,365 |

| 2023 | ALBUQUERQUE, NM | 17,225 | -28% | $4,317,145,000 | -29% | $250,633 |

| 2023 | Alexander City, AL | 908 | -26% | $262,170,000 | -24% | $288,733 |

| 2023 | ALEXANDRIA, LA | 2,018 | -26% | $374,510,000 | -22% | $185,585 |

| 2023 | Alexandria, MN | 650 | -28% | $148,690,000 | -34% | $228,754 |

| 2023 | Alice, TX | 335 | -17% | $66,115,000 | -13% | $197,358 |

| 2023 | ALLENTOWN-BETHLEHEM-EASTON, PA-NJ | 15,999 | -29% | $3,478,155,000 | -33% | $217,398 |

| 2023 | Alma, MI | 579 | -28% | $79,205,000 | -26% | $136,796 |

| 2023 | Alpena, MI | 252 | -25% | $35,070,000 | -23% | $139,167 |

| 2023 | ALTOONA, PA | 2,007 | -32% | $248,585,000 | -42% | $123,859 |

| 2023 | Altus, OK | 384 | -15% | $71,540,000 | -12% | $186,302 |

| 2023 | AMARILLO, TX | 4,500 | -24% | $943,360,000 | -31% | $209,636 |

| 2023 | Americus, GA | 363 | -16% | $49,585,000 | -18% | $136,598 |

| 2023 | AMES, IA | 2,049 | -23% | $394,985,000 | -30% | $192,770 |

| 2023 | Amsterdam, NY | 688 | -23% | $103,500,000 | -15% | $150,436 |

| 2023 | ANCHORAGE, AK | 6,247 | -34% | $2,132,615,000 | -31% | $341,382 |

| 2023 | Andrews, TX | 227 | -22% | $55,155,000 | -14% | $242,974 |

| 2023 | Angola, IN | 735 | -38% | $154,105,000 | -38% | $209,667 |

| 2023 | ANN ARBOR, MI | 5,716 | -33% | $2,059,910,000 | -25% | $360,376 |

| 2023 | ANNISTON-OXFORD, AL | 1,786 | -25% | $276,060,000 | -28% | $154,569 |

| 2023 | APPLETON, WI | 5,334 | -34% | $1,027,270,000 | -36% | $192,589 |

| 2023 | Arcadia, FL | 401 | -22% | $97,345,000 | -14% | $242,756 |

| 2023 | Ardmore, OK | 872 | -26% | $142,220,000 | -29% | $163,096 |

| 2023 | Arecibo, PR | 618 | -2% | $75,530,000 | 5% | $122,217 |

| 2023 | Arkadelphia, AR | 285 | -19% | $39,225,000 | -33% | $137,632 |

| 2023 | ASHEVILLE, NC | 9,596 | -35% | $2,815,300,000 | -40% | $293,383 |

| 2023 | Ashland, OH | 924 | -31% | $142,560,000 | -29% | $154,286 |

| 2023 | Ashtabula, OH | 1,550 | -26% | $209,920,000 | -30% | $135,432 |

| 2023 | Astoria, OR | 846 | -40% | $271,920,000 | -46% | $321,418 |

| 2023 | Atchison, KS | 263 | -18% | $36,285,000 | -18% | $137,966 |

| 2023 | Athens, OH | 448 | -28% | $76,350,000 | -45% | $170,424 |

| 2023 | Athens, TN | 1,150 | -20% | $223,300,000 | -19% | $194,174 |

| 2023 | Athens, TX | 1,499 | -30% | $428,535,000 | -33% | $285,881 |

| 2023 | ATHENS-CLARKE COUNTY, GA | 3,354 | -29% | $887,870,000 | -34% | $264,720 |

| 2023 | ATLANTA-SANDY SPRINGS-ALPHARETTA, GA | 127,182 | -30% | $41,343,790,000 | -33% | $325,076 |

| 2023 | ATLANTIC CITY-HAMMONTON, NJ | 5,063 | -27% | $1,408,635,000 | -28% | $278,221 |

| 2023 | Atmore, AL | 445 | -22% | $64,855,000 | -24% | $145,742 |

| 2023 | Auburn, IN | 1,014 | -26% | $153,830,000 | -27% | $151,706 |

| 2023 | Auburn, NY | 1,140 | -19% | $161,260,000 | -20% | $141,456 |

| 2023 | AUBURN-OPELIKA, AL | 3,622 | -27% | $1,036,600,000 | -29% | $286,195 |

| 2023 | AUGUSTA-RICHMOND COUNTY, GA-SC | 11,891 | -24% | $2,797,895,000 | -29% | $235,295 |

| 2023 | Augusta-Waterville, ME | 2,590 | -27% | $523,120,000 | -26% | $201,977 |

| 2023 | Austin, MN | 646 | -23% | $99,690,000 | -20% | $154,319 |

| 2023 | AUSTIN-ROUND ROCK-GEORGETOWN, TX | 46,271 | -36% | $20,892,315,000 | -38% | $451,521 |

| 2023 | Bainbridge, GA | 282 | -31% | $50,490,000 | -32% | $179,043 |

| 2023 | BAKERSFIELD, CA | 11,743 | -39% | $3,150,245,000 | -42% | $268,266 |

| 2023 | BALTIMORE-COLUMBIA-TOWSON, MD | 47,398 | -34% | $14,733,890,000 | -37% | $310,855 |

| 2023 | BANGOR, ME | 2,899 | -25% | $530,465,000 | -27% | $182,982 |

| 2023 | Baraboo, WI | 1,467 | -21% | $246,235,000 | -31% | $167,849 |

| 2023 | Bardstown, KY | 997 | -19% | $184,405,000 | -21% | $184,960 |

| 2023 | BARNSTABLE TOWN, MA | 6,537 | -38% | $2,531,355,000 | -41% | $387,235 |

| 2023 | Barre, VT | 1,067 | -33% | $230,015,000 | -37% | $215,572 |

| 2023 | Bartlesville, OK | 969 | -22% | $170,135,000 | -23% | $175,578 |

| 2023 | Batavia, NY | 919 | -25% | $140,125,000 | -18% | $152,476 |

| 2023 | Batesville, AR | 914 | -22% | $131,290,000 | -20% | $143,643 |

| 2023 | BATON ROUGE, LA | 12,474 | -35% | $3,080,200,000 | -38% | $246,930 |

| 2023 | BATTLE CREEK, MI | 2,792 | -22% | $408,280,000 | -24% | $146,232 |

| 2023 | BAY CITY, MI | 1,802 | -28% | $225,590,000 | -32% | $125,189 |

| 2023 | Bay City, TX | 397 | -21% | $92,295,000 | -31% | $232,481 |

| 2023 | Beatrice, NE | 377 | -27% | $58,355,000 | -24% | $154,788 |

| 2023 | BEAUMONT-PORT ARTHUR, TX | 5,032 | -25% | $1,037,900,000 | -27% | $206,260 |

| 2023 | Beaver Dam, WI | 2,018 | -19% | $300,320,000 | -27% | $148,821 |

| 2023 | BECKLEY, WV | 1,415 | -18% | $192,145,000 | -25% | $135,792 |

| 2023 | Bedford, IN | 1,013 | -18% | $153,995,000 | -18% | $152,019 |

| 2023 | Beeville, TX | 234 | -9% | $39,780,000 | -12% | $170,000 |

| 2023 | Bellefontaine, OH | 925 | -25% | $149,885,000 | -35% | $162,038 |

| 2023 | BELLINGHAM, WA | 3,937 | -36% | $1,411,685,000 | -59% | $358,569 |

| 2023 | Bemidji, MN | 531 | -19% | $97,385,000 | -16% | $183,399 |

| 2023 | BEND, OR | 5,298 | -40% | $1,986,370,000 | -46% | $374,928 |

| 2023 | Bennettsville, SC | 169 | -12% | $21,455,000 | -20% | $126,953 |

| 2023 | Bennington, VT | 429 | -37% | $125,795,000 | -38% | $293,228 |

| 2023 | Berlin, NH | 588 | -25% | $108,960,000 | -25% | $185,306 |

| 2023 | Big Rapids, MI | 781 | -30% | $126,485,000 | -28% | $161,953 |

| 2023 | Big Spring, TX | 351 | -31% | $68,865,000 | -37% | $196,197 |

| 2023 | Big Stone Gap, VA | 394 | -20% | $45,560,000 | -26% | $115,635 |

| 2023 | BILLINGS, MT | 3,676 | -33% | $1,011,870,000 | -36% | $275,264 |

| 2023 | BINGHAMTON, NY | 3,086 | -29% | $425,110,000 | -31% | $137,754 |

| 2023 | BIRMINGHAM-HOOVER, AL | 22,312 | -27% | $5,450,240,000 | -27% | $244,274 |

| 2023 | BISMARCK, ND | 2,429 | -30% | $650,595,000 | -29% | $267,845 |

| 2023 | Blackfoot, ID | 950 | -35% | $210,630,000 | -34% | $221,716 |

| 2023 | BLACKSBURG-CHRISTIANSBURG, VA | 2,316 | -30% | $551,850,000 | -26% | $238,277 |

| 2023 | BLOOMINGTON, IL | 2,987 | -25% | $562,975,000 | -26% | $188,475 |

| 2023 | BLOOMINGTON, IN | 2,821 | -29% | $862,365,000 | -21% | $305,695 |

| 2023 | BLOOMSBURG-BERWICK, PA | 1,272 | -26% | $213,900,000 | -36% | $168,160 |

| 2023 | Bluefield, WV-VA | 1,074 | -22% | $159,600,000 | -24% | $148,603 |

| 2023 | Bluffton, IN | 661 | -28% | $110,675,000 | -14% | $167,436 |

| 2023 | Blytheville, AR | 391 | -24% | $52,615,000 | -24% | $134,565 |

| 2023 | Bogalusa, LA | 509 | -12% | $71,615,000 | -15% | $140,697 |

| 2023 | BOISE CITY, ID | 19,837 | -39% | $6,288,065,000 | -41% | $316,987 |

| 2023 | Bonham, TX | 606 | -31% | $139,780,000 | -37% | $230,660 |

| 2023 | Boone, NC | 1,123 | -34% | $390,185,000 | -35% | $347,449 |

| 2023 | Borger, TX | 275 | -22% | $40,385,000 | -10% | $146,855 |

| 2023 | Boston-Cambridge-Newton, MA-NH | 74,364 | -38% | $33,515,910,000 | -43% | $450,701 |

| 2023 | BOULDER, CO | 5,691 | -40% | $2,930,045,000 | -36% | $514,856 |

| 2023 | BOWLING GREEN, KY | 3,704 | -27% | $843,240,000 | -38% | $227,657 |

| 2023 | Bozeman, MT | 2,085 | -41% | $1,164,895,000 | -48% | $558,703 |

| 2023 | Bradford, PA | 384 | -16% | $49,790,000 | -3% | $129,661 |

| 2023 | Brainerd, MN | 2,089 | -32% | $513,125,000 | -39% | $245,632 |

| 2023 | Branson, MO | 1,081 | -37% | $239,795,000 | -39% | $221,827 |

| 2023 | Breckenridge, CO | 1,174 | -42% | $774,930,000 | -45% | $660,077 |

| 2023 | BREMERTON-SILVERDALE-PORT ORCHARD, WA | 5,816 | -40% | $2,154,170,000 | -66% | $370,387 |

| 2023 | Brenham, TX | 535 | -29% | $172,785,000 | -30% | $322,963 |

| 2023 | Brevard, NC | 689 | -37% | $191,715,000 | -48% | $278,251 |

| 2023 | BRIDGEPORT-STAMFORD-NORWALK, CT | 14,277 | -38% | $7,547,275,000 | -44% | $528,632 |

| 2023 | Brookhaven, MS | 411 | -25% | $54,985,000 | -30% | $133,783 |

| 2023 | Brookings, OR | 362 | -40% | $105,550,000 | -37% | $291,575 |

| 2023 | Brookings, SD | 441 | -18% | $90,135,000 | -30% | $204,388 |

| 2023 | Brownsville, TN | 234 | -9% | $35,300,000 | -14% | $150,855 |

| 2023 | BROWNSVILLE-HARLINGEN, TX | 3,567 | -21% | $884,695,000 | -14% | $248,022 |

| 2023 | Brownwood, TX | 456 | -13% | $85,220,000 | -25% | $186,886 |

| 2023 | BRUNSWICK, GA | 2,371 | -22% | $724,855,000 | -27% | $305,717 |

| 2023 | Bucyrus-Galion, OH | 650 | -27% | $76,020,000 | -28% | $116,954 |

| 2023 | BUFFALO-CHEEKTOWAGA, NY | 18,089 | -26% | $4,056,895,000 | -21% | $224,274 |

| 2023 | Burley, ID | 991 | -29% | $187,405,000 | -35% | $189,107 |

| 2023 | Burlington, IA-IL | 530 | -28% | $61,360,000 | -40% | $115,774 |

| 2023 | BURLINGTON, NC | 4,182 | -23% | $941,610,000 | -18% | $225,158 |

| 2023 | BURLINGTON-SOUTH BURLINGTON, VT | 4,212 | -35% | $1,082,330,000 | -40% | $256,963 |

| 2023 | Butte-Silver Bow, MT | 584 | -31% | $119,130,000 | -35% | $203,990 |

| 2023 | Cadillac, MI | 903 | -29% | $142,555,000 | -24% | $157,868 |

| 2023 | Calhoun, GA | 1,201 | -25% | $249,565,000 | -21% | $207,798 |

| 2023 | CALIFORNIA-LEXINGTON PARK, MD | 2,201 | -33% | $714,705,000 | -35% | $324,718 |

| 2023 | Cambridge, MD | 697 | -23% | $157,085,000 | -23% | $225,373 |

| 2023 | Cambridge, OH | 656 | -27% | $89,420,000 | -26% | $136,311 |

| 2023 | Camden, AR | 331 | -15% | $43,285,000 | -7% | $130,770 |

| 2023 | Campbellsville, KY | 455 | -22% | $63,505,000 | -27% | $139,571 |

| 2023 | Cañon City, CO | 1,017 | -34% | $233,495,000 | -34% | $229,592 |

| 2023 | CANTON-MASSILLON, OH | 8,061 | -28% | $1,244,145,000 | -31% | $154,341 |

| 2023 | CAPE CORAL-FORT MYERS, FL | 20,996 | -29% | $6,926,070,000 | -28% | $329,876 |

| 2023 | CAPE GIRARDEAU, MO-IL | 1,671 | -25% | $312,695,000 | -32% | $187,130 |

| 2023 | CARBONDALE-MARION, IL | 1,763 | -21% | $258,625,000 | -30% | $146,696 |

| 2023 | Carlsbad-Artesia, NM | 790 | -26% | $178,030,000 | -23% | $225,354 |

| 2023 | Carroll, IA | 206 | -36% | $30,590,000 | -34% | $148,495 |

| 2023 | CARSON CITY, NV | 861 | -40% | $253,505,000 | -44% | $294,431 |

| 2023 | CASPER, WY | 1,606 | -30% | $339,890,000 | -30% | $211,638 |

| 2023 | Cedar City, UT | 1,719 | -32% | $443,365,000 | -34% | $257,920 |

| 2023 | CEDAR RAPIDS, IA | 7,202 | -32% | $1,118,330,000 | -35% | $155,280 |

| 2023 | Cedartown, GA | 750 | -22% | $138,640,000 | -24% | $184,853 |

| 2023 | Celina, OH | 397 | -23% | $60,775,000 | -26% | $153,086 |

| 2023 | Central City, KY | 423 | -31% | $48,555,000 | -36% | $114,787 |

| 2023 | Centralia, IL | 495 | -15% | $51,855,000 | -24% | $104,758 |

| 2023 | Centralia, WA | 1,778 | -39% | $478,750,000 | -40% | $269,263 |

| 2023 | CHAMBERSBURG-WAYNESBORO, PA | 3,099 | -25% | $585,675,000 | -27% | $188,988 |

| 2023 | CHAMPAIGN-URBANA, IL | 3,138 | -25% | $818,700,000 | -27% | $260,899 |

| 2023 | CHARLESTON, WV | 3,283 | -20% | $458,845,000 | -30% | $139,764 |

| 2023 | Charleston-Mattoon, IL | 609 | -5% | $81,665,000 | -3% | $134,097 |

| 2023 | CHARLESTON-NORTH CHARLESTON, SC | 21,589 | -28% | $8,158,235,000 | -31% | $377,889 |

| 2023 | CHARLOTTE-CONCORD-GASTONIA, NC-SC | 67,687 | -30% | $21,690,445,000 | -32% | $320,452 |

| 2023 | CHARLOTTESVILLE, VA | 4,025 | -32% | $1,349,075,000 | -33% | $335,174 |

| 2023 | CHATTANOOGA, TN-GA | 12,407 | -29% | $3,199,165,000 | -34% | $257,852 |

| 2023 | CHEYENNE, WY | 2,547 | -31% | $659,225,000 | -31% | $258,824 |

| 2023 | Chicago-Naperville-Elgin, IL-IN-WI | 143,322 | -31% | $41,986,010,000 | -35% | $292,949 |

| 2023 | CHICO, CA | 2,548 | -42% | $725,090,000 | -47% | $284,572 |

| 2023 | Chillicothe, OH | 1,189 | -21% | $190,005,000 | -21% | $159,802 |

| 2023 | CINCINNATI, OH-KY-IN | 47,987 | -31% | $10,952,435,000 | -31% | $228,238 |

| 2023 | Clarksburg, WV | 1,178 | -22% | $207,880,000 | -22% | $176,469 |

| 2023 | Clarksdale, MS | 125 | -18% | $13,955,000 | -14% | $111,640 |

| 2023 | CLARKSVILLE, TN-KY | 8,756 | -28% | $2,303,110,000 | -32% | $263,032 |

| 2023 | Clearlake, CA | 949 | -41% | $223,605,000 | -45% | $235,622 |

| 2023 | Cleveland, MS | 266 | -19% | $36,730,000 | -25% | $138,083 |

| 2023 | CLEVELAND, TN | 2,516 | -26% | $531,660,000 | -31% | $211,312 |

| 2023 | CLEVELAND-ELYRIA, OH | 40,859 | -29% | $7,967,805,000 | -30% | $195,007 |

| 2023 | Clewiston, FL | 802 | -18% | $181,370,000 | -17% | $226,147 |

| 2023 | Clinton, IA | 591 | -39% | $74,565,000 | -47% | $126,168 |

| 2023 | Clovis, NM | 652 | -37% | $127,770,000 | -39% | $195,966 |

| 2023 | Coamo, PR | 103 | -3% | $12,575,000 | 3% | $122,087 |

| 2023 | Coco, PR | 75 | -16% | $8,325,000 | -7% | $111,000 |

| 2023 | Coffeyville, KS | 407 | -15% | $47,995,000 | -19% | $117,924 |

| 2023 | Coldwater, MI | 719 | -29% | $112,215,000 | -41% | $156,071 |

| 2023 | COLLEGE STATION-BRYAN, TX | 3,537 | -30% | $1,097,505,000 | -37% | $310,293 |

| 2023 | COLORADO SPRINGS, CO | 19,857 | -40% | $6,684,365,000 | -42% | $336,625 |

| 2023 | COLUMBIA, MO | 3,801 | -26% | $885,935,000 | -38% | $233,079 |

| 2023 | COLUMBIA, SC | 17,877 | -25% | $3,997,985,000 | -30% | $223,638 |

| 2023 | COLUMBUS, GA-AL | 4,745 | -26% | $997,075,000 | -34% | $210,132 |

| 2023 | COLUMBUS, IN | 2,079 | -23% | $398,875,000 | -28% | $191,859 |

| 2023 | Columbus, MS | 881 | -24% | $156,445,000 | -24% | $177,577 |

| 2023 | Columbus, NE | 514 | -27% | $95,430,000 | -40% | $185,661 |

| 2023 | COLUMBUS, OH | 46,329 | -29% | $12,930,825,000 | -28% | $279,109 |

| 2023 | Concord, NH | 2,840 | -35% | $804,920,000 | -33% | $283,423 |

| 2023 | Connersville, IN | 463 | -28% | $59,825,000 | -15% | $129,212 |

| 2023 | Cookeville, TN | 1,980 | -28% | $409,080,000 | -32% | $206,606 |

| 2023 | Coos Bay, OR | 1,183 | -32% | $278,235,000 | -35% | $235,194 |

| 2023 | Cordele, GA | 173 | -40% | $35,645,000 | -24% | $206,040 |

| 2023 | Corinth, MS | 430 | -19% | $62,480,000 | -19% | $145,302 |

| 2023 | Cornelia, GA | 880 | -24% | $201,780,000 | -31% | $229,295 |

| 2023 | Corning, NY | 1,488 | -24% | $183,070,000 | -36% | $123,031 |

| 2023 | CORPUS CHRISTI, TX | 5,971 | -26% | $1,760,745,000 | -28% | $294,883 |

| 2023 | Corsicana, TX | 731 | -24% | $362,075,000 | 58% | $495,315 |

| 2023 | Cortland, NY | 618 | -24% | $92,230,000 | -19% | $149,239 |

| 2023 | CORVALLIS, OR | 1,111 | -44% | $367,325,000 | -44% | $330,626 |

| 2023 | Coshocton, OH | 580 | 2% | $75,450,000 | -5% | $130,086 |

| 2023 | Craig, CO | 238 | -39% | $51,320,000 | -38% | $215,630 |

| 2023 | Crawfordsville, IN | 854 | -26% | $131,510,000 | -25% | $153,993 |

| 2023 | Crescent City, CA | 268 | -44% | $74,290,000 | -42% | $277,201 |

| 2023 | CRESTVIEW-FORT WALTON BEACH-DESTIN, FL | 9,108 | -35% | $4,050,730,000 | -38% | $444,744 |

| 2023 | Crossville, TN | 1,149 | -27% | $243,445,000 | -25% | $211,876 |

| 2023 | Cullman, AL | 1,711 | -23% | $383,965,000 | -20% | $224,410 |

| 2023 | Cullowhee, NC | 995 | -35% | $335,335,000 | -42% | $337,020 |

| 2023 | CUMBERLAND, MD-WV | 1,357 | -30% | $176,925,000 | -32% | $130,380 |

| 2023 | Dallas-Fort Worth-Arlington, TX | 136,668 | -27% | $53,965,600,000 | -29% | $394,866 |

| 2023 | DALTON, GA | 2,017 | -27% | $435,985,000 | -14% | $216,155 |

| 2023 | DANVILLE, IL | 900 | -14% | $91,230,000 | -17% | $101,367 |

| 2023 | Danville, KY | 858 | -20% | $137,470,000 | -22% | $160,221 |

| 2023 | Danville, VA | 1,332 | -17% | $211,000,000 | -27% | $158,408 |

| 2023 | DAPHNE-FAIRHOPE-FOLEY, AL | 7,900 | -28% | $2,322,690,000 | -31% | $294,011 |

| 2023 | DAVENPORT-MOLINE-ROCK ISLAND, IA-IL | 7,176 | -33% | $1,106,000,000 | -36% | $154,125 |

| 2023 | Dayton, TN | 569 | -29% | $120,345,000 | -29% | $211,503 |

| 2023 | DAYTON-KETTERING, OH | 16,518 | -25% | $3,105,590,000 | -30% | $188,012 |

| 2023 | DECATUR, AL | 2,996 | -25% | $559,330,000 | -27% | $186,692 |

| 2023 | DECATUR, IL | 1,455 | -19% | $176,325,000 | -21% | $121,186 |

| 2023 | Decatur, IN | 647 | -29% | $86,995,000 | -29% | $134,459 |

| 2023 | Defiance, OH | 696 | -19% | $93,560,000 | -16% | $134,425 |

| 2023 | Del Rio, TX | 537 | -25% | $114,095,000 | -25% | $212,467 |

| 2023 | DELTONA-DAYTONA BEACH-ORMOND BEACH, FL | 18,465 | -25% | $4,934,505,000 | -28% | $267,236 |

| 2023 | Deming, NM | 189 | -21% | $24,235,000 | -25% | $128,228 |

| 2023 | DENVER-AURORA-LAKEWOOD, CO | 68,370 | -40% | $28,268,800,000 | -40% | $413,468 |

| 2023 | DeRidder, LA | 578 | -25% | $103,410,000 | -26% | $178,910 |

| 2023 | DES MOINES-WEST DES MOINES, IA | 18,075 | -29% | $3,900,575,000 | -35% | $215,799 |

| 2023 | Detroit-Warren-Dearborn, MI | 78,922 | -31% | $16,176,010,000 | -35% | $204,962 |

| 2023 | Dickinson, ND | 574 | -26% | $152,440,000 | -29% | $265,575 |

| 2023 | Dixon, IL | 361 | -28% | $49,415,000 | -25% | $136,884 |

| 2023 | Dodge City, KS | 326 | -13% | $61,720,000 | -5% | $189,325 |

| 2023 | DOTHAN, AL | 2,908 | -17% | $510,540,000 | -22% | $175,564 |

| 2023 | Douglas, GA | 358 | -15% | $62,140,000 | -12% | $173,575 |

| 2023 | DOVER, DE | 4,121 | -30% | $1,039,085,000 | -27% | $252,144 |

| 2023 | Dublin, GA | 620 | -31% | $101,030,000 | -37% | $162,952 |

| 2023 | DuBois, PA | 1,326 | -27% | $155,510,000 | -29% | $117,278 |

| 2023 | DUBUQUE, IA | 2,328 | -25% | $373,080,000 | -28% | $160,258 |

| 2023 | DULUTH, MN-WI | 5,506 | -21% | $1,141,900,000 | -23% | $207,392 |

| 2023 | Dumas, TX | 190 | -25% | $33,490,000 | -23% | $176,263 |

| 2023 | Duncan, OK | 770 | -20% | $105,020,000 | -21% | $136,390 |

| 2023 | Durango, CO | 1,087 | -39% | $415,235,000 | -45% | $382,001 |

| 2023 | Durant, OK | 873 | -24% | $159,135,000 | -28% | $182,285 |

| 2023 | DURHAM-CHAPEL HILL, NC | 13,265 | -34% | $4,212,375,000 | -34% | $317,556 |

| 2023 | Dyersburg, TN | 576 | -11% | $82,980,000 | -11% | $144,063 |

| 2023 | Eagle Pass, TX | 451 | -18% | $78,765,000 | -17% | $174,645 |

| 2023 | Easton, MD | 689 | -32% | $267,765,000 | -43% | $388,628 |

| 2023 | EAST STROUDSBURG, PA | 3,931 | -32% | $877,115,000 | -28% | $223,128 |

| 2023 | EAU CLAIRE, WI | 3,427 | -30% | $801,515,000 | -24% | $233,882 |

| 2023 | Edwards, CO | 1,181 | -45% | $960,285,000 | -50% | $813,112 |

| 2023 | Effingham, IL | 343 | -31% | $56,715,000 | -33% | $165,350 |

| 2023 | El Campo, TX | 360 | -30% | $76,770,000 | -35% | $213,250 |

| 2023 | EL CENTRO, CA | 1,321 | -45% | $397,855,000 | -36% | $301,177 |

| 2023 | El Dorado, AR | 432 | -29% | $68,100,000 | -27% | $157,639 |

| 2023 | Elizabeth City, NC | 1,181 | -27% | $247,935,000 | -33% | $209,936 |

| 2023 | ELIZABETHTOWN-FORT KNOX, KY | 3,637 | -23% | $812,245,000 | -20% | $223,328 |

| 2023 | Elk City, OK | 242 | -23% | $41,310,000 | -17% | $170,702 |

| 2023 | ELKHART-GOSHEN, IN | 4,294 | -28% | $658,460,000 | -34% | $153,344 |

| 2023 | Elkins, WV | 187 | -25% | $45,315,000 | 12% | $242,326 |

| 2023 | Elko, NV | 894 | -31% | $230,590,000 | -33% | $257,931 |

| 2023 | Ellensburg, WA | 1,004 | -43% | $445,530,000 | -48% | $443,755 |

| 2023 | ELMIRA, NY | 1,326 | -22% | $167,040,000 | -43% | $125,973 |

| 2023 | EL PASO, TX | 10,425 | -23% | $2,444,585,000 | -18% | $234,493 |

| 2023 | Emporia, KS | 408 | -1% | $70,680,000 | -2% | $173,235 |

| 2023 | ENID, OK | 913 | -13% | $136,115,000 | -23% | $149,085 |

| 2023 | Enterprise, AL | 1,207 | -28% | $246,225,000 | -27% | $203,998 |

| 2023 | ERIE, PA | 4,286 | -23% | $620,820,000 | -33% | $144,848 |

| 2023 | Escanaba, MI | 172 | -30% | $28,620,000 | -26% | $166,395 |

| 2023 | Española, NM | 286 | -34% | $61,560,000 | -34% | $215,245 |

| 2023 | Eufaula, AL-GA | 249 | -16% | $33,655,000 | -27% | $135,161 |

| 2023 | EUGENE-SPRINGFIELD, OR | 6,416 | -39% | $1,664,910,000 | -49% | $259,493 |

| 2023 | Eureka-Arcata, CA | 1,002 | -47% | $293,630,000 | -50% | $293,044 |

| 2023 | Evanston, WY | 296 | -26% | $68,430,000 | -27% | $231,182 |

| 2023 | EVANSVILLE, IN-KY | 6,555 | -28% | $1,163,005,000 | -28% | $177,423 |

| 2023 | FAIRBANKS, AK | 1,380 | -35% | $378,770,000 | -37% | $274,471 |

| 2023 | Fairfield, IA | 248 | -18% | $33,930,000 | -15% | $136,815 |

| 2023 | Fairmont, MN | 249 | -19% | $36,785,000 | -19% | $147,731 |

| 2023 | Fairmont, WV | 840 | -23% | $130,380,000 | -24% | $155,214 |

| 2023 | Fallon, NV | 456 | -39% | $120,870,000 | -40% | $265,066 |

| 2023 | FARGO, ND-MN | 4,915 | -25% | $1,158,295,000 | -36% | $235,665 |

| 2023 | Faribault-Northfield, MN | 1,047 | -30% | $225,355,000 | -38% | $215,239 |

| 2023 | Farmington, MO | 1,223 | -19% | $200,845,000 | -24% | $164,223 |

| 2023 | FARMINGTON, NM | 1,269 | -28% | $232,545,000 | -34% | $183,251 |

| 2023 | FAYETTEVILLE, NC | 13,093 | -22% | $3,074,505,000 | -21% | $234,821 |

| 2023 | FAYETTEVILLE-SPRINGDALE-ROGERS, AR | 14,018 | -23% | $4,228,310,000 | -18% | $301,634 |

| 2023 | Fergus Falls, MN | 1,072 | -24% | $218,410,000 | -27% | $203,741 |

| 2023 | Fernley, NV | 1,417 | -37% | $378,695,000 | -39% | $267,251 |

| 2023 | Findlay, OH | 1,340 | -33% | $228,710,000 | -37% | $170,679 |

| 2023 | Fitzgerald, GA | 152 | -17% | $50,530,000 | 124% | $332,434 |

| 2023 | FLAGSTAFF, AZ | 2,082 | -43% | $879,810,000 | -47% | $422,579 |

| 2023 | FLINT, MI | 7,250 | -26% | $1,090,930,000 | -33% | $150,473 |

| 2023 | FLORENCE, SC | 2,714 | -25% | $555,640,000 | -23% | $204,731 |

| 2023 | FLORENCE-MUSCLE SHOALS, AL | 3,062 | -28% | $562,280,000 | -28% | $183,632 |

| 2023 | FOND DU LAC, WI | 2,189 | -24% | $342,225,000 | -26% | $156,339 |

| 2023 | Forest City, NC | 1,279 | -33% | $238,155,000 | -38% | $186,204 |

| 2023 | Forrest City, AR | 135 | -12% | $16,415,000 | -61% | $121,593 |

| 2023 | FORT COLLINS, CO | 8,218 | -39% | $2,931,040,000 | -38% | $356,661 |

| 2023 | Fort Dodge, IA | 546 | -32% | $67,250,000 | -39% | $123,168 |

| 2023 | Fort Leonard Wood, MO | 968 | -30% | $179,100,000 | -35% | $185,021 |

| 2023 | Fort Madison-Keokuk, IA-IL-MO | 398 | -29% | $49,590,000 | -21% | $124,598 |

| 2023 | Fort Morgan, CO | 528 | -36% | $125,840,000 | -36% | $238,333 |

| 2023 | Fort Payne, AL | 892 | -14% | $145,310,000 | -15% | $162,904 |

| 2023 | Fort Polk South, LA | 569 | -25% | $106,585,000 | -22% | $187,320 |

| 2023 | FORT SMITH, AR-OK | 4,117 | -26% | $682,235,000 | -36% | $165,712 |

| 2023 | FORT WAYNE, IN | 9,591 | -29% | $3,369,245,000 | -13% | $351,292 |

| 2023 | Frankfort, IN | 754 | -25% | $102,150,000 | -27% | $135,477 |

| 2023 | Frankfort, KY | 1,651 | -27% | $273,775,000 | -30% | $165,824 |

| 2023 | Fredericksburg, TX | 409 | -37% | $192,875,000 | -41% | $471,577 |

| 2023 | Freeport, IL | 552 | -7% | $58,830,000 | -22% | $106,576 |

| 2023 | Fremont, NE | 807 | -12% | $136,035,000 | -26% | $168,569 |

| 2023 | Fremont, OH | 804 | -30% | $112,320,000 | -28% | $139,701 |

| 2023 | FRESNO, CA | 10,934 | -43% | $3,365,280,000 | -43% | $307,781 |

| 2023 | GADSDEN, AL | 1,746 | -21% | $276,570,000 | -30% | $158,402 |

| 2023 | Gaffney, SC | 994 | 3% | $186,750,000 | 6% | $187,877 |

| 2023 | GAINESVILLE, FL | 5,303 | -28% | $1,391,075,000 | -33% | $262,318 |

| 2023 | GAINESVILLE, GA | 4,233 | -28% | $1,270,205,000 | -35% | $300,072 |

| 2023 | Gainesville, TX | 770 | -16% | $216,710,000 | -12% | $281,442 |

| 2023 | Galesburg, IL | 825 | -12% | $85,295,000 | -13% | $103,388 |

| 2023 | Gallup, NM | 202 | -42% | $33,210,000 | -43% | $164,406 |

| 2023 | Garden City, KS | 331 | -26% | $53,335,000 | -24% | $161,133 |

| 2023 | Gardnerville Ranchos, NV | 938 | -43% | $437,410,000 | -46% | $466,322 |

| 2023 | Georgetown, SC | 1,299 | -35% | $460,855,000 | -30% | $354,777 |

| 2023 | GETTYSBURG, PA | 2,199 | -31% | $402,285,000 | -34% | $182,940 |

| 2023 | Gillette, WY | 734 | -35% | $167,350,000 | -37% | $227,997 |

| 2023 | Glasgow, KY | 1,045 | -19% | $153,955,000 | -21% | $147,325 |

| 2023 | GLENS FALLS, NY | 1,994 | -30% | $462,230,000 | -46% | $231,810 |

| 2023 | Glenwood Springs, CO | 1,802 | -39% | $1,442,160,000 | -55% | $800,311 |

| 2023 | Gloversville, NY | 755 | -30% | $132,265,000 | -24% | $175,185 |

| 2023 | GOLDSBORO, NC | 2,086 | -26% | $388,390,000 | -29% | $186,189 |

| 2023 | Granbury, TX | 1,477 | -30% | $421,605,000 | -30% | $285,447 |

| 2023 | GRAND FORKS, ND-MN | 1,556 | -24% | $385,370,000 | -24% | $247,667 |

| 2023 | GRAND ISLAND, NE | 1,280 | -23% | $227,780,000 | -32% | $177,953 |

| 2023 | GRAND JUNCTION, CO | 3,891 | -34% | $956,845,000 | -40% | $245,912 |

| 2023 | Grand Rapids, MN | 839 | -26% | $134,515,000 | -34% | $160,328 |

| 2023 | GRAND RAPIDS-KENTWOOD, MI | 23,468 | -31% | $5,195,160,000 | -33% | $221,372 |

| 2023 | Grants, NM | 114 | -32% | $15,200,000 | -32% | $133,333 |

| 2023 | GRANTS PASS, OR | 1,383 | -41% | $409,315,000 | -35% | $295,962 |

| 2023 | Great Bend, KS | 276 | -9% | $30,350,000 | 1% | $109,964 |

| 2023 | GREAT FALLS, MT | 1,583 | -28% | $384,995,000 | -29% | $243,206 |

| 2023 | GREELEY, CO | 9,760 | -35% | $3,035,230,000 | -39% | $310,987 |

| 2023 | GREEN BAY, WI | 7,564 | -27% | $1,520,530,000 | -28% | $201,022 |

| 2023 | Greeneville, TN | 1,387 | -16% | $259,235,000 | -17% | $186,903 |

| 2023 | GREENSBORO-HIGH POINT, NC | 15,250 | -26% | $3,418,730,000 | -28% | $224,179 |

| 2023 | Greensburg, IN | 521 | -27% | $81,735,000 | -26% | $156,881 |

| 2023 | Greenville, MS | 409 | -26% | $40,195,000 | -31% | $98,276 |

| 2023 | GREENVILLE, NC | 3,258 | -28% | $820,200,000 | -22% | $251,750 |

| 2023 | Greenville, OH | 812 | -25% | $412,980,000 | 174% | $508,596 |

| 2023 | GREENVILLE-ANDERSON, SC | 19,654 | -28% | $5,402,090,000 | -30% | $274,860 |

| 2023 | Greenwood, MS | 259 | -16% | $37,115,000 | -13% | $143,301 |

| 2023 | Greenwood, SC | 999 | -25% | $236,335,000 | -15% | $236,572 |

| 2023 | Grenada, MS | 288 | -23% | $38,320,000 | -26% | $133,056 |

| 2023 | GUAYAMA, PR | 244 | -1% | $29,890,000 | 25% | $122,500 |

| 2023 | GULFPORT-BILOXI, MS | 7,908 | -25% | $1,683,890,000 | -26% | $212,935 |

| 2023 | Guymon, OK | 199 | -22% | $31,575,000 | -11% | $158,668 |

| 2023 | HAGERSTOWN-MARTINSBURG, MD-WV | 6,778 | -30% | $1,665,820,000 | -29% | $245,769 |

| 2023 | Hailey, ID | 521 | -48% | $328,915,000 | -56% | $631,315 |

| 2023 | HAMMOND, LA | 2,010 | -31% | $451,620,000 | -27% | $224,687 |

| 2023 | HANFORD-CORCORAN, CA | 1,556 | -44% | $443,850,000 | -43% | $285,251 |

| 2023 | Hannibal, MO | 574 | -22% | $87,560,000 | -23% | $152,544 |

| 2023 | HARRISBURG-CARLISLE, PA | 11,950 | -31% | $2,254,330,000 | -39% | $188,647 |

| 2023 | Harrison, AR | 868 | -29% | $139,750,000 | -28% | $161,002 |

| 2023 | HARRISONBURG, VA | 1,898 | -38% | $489,910,000 | -34% | $258,119 |

| 2023 | HARTFORD-EAST HARTFORD-MIDDLETOWN, CT | 22,464 | -26% | $5,521,320,000 | -31% | $245,785 |

| 2023 | Hastings, NE | 505 | -19% | $78,295,000 | -24% | $155,040 |

| 2023 | HATTIESBURG, MS | 2,852 | -23% | $547,520,000 | -28% | $191,978 |

| 2023 | Hays, KS | 267 | -21% | $222,055,000 | 332% | $831,667 |

| 2023 | Heber, UT | 2,626 | -42% | $2,177,670,000 | -46% | $829,273 |

| 2023 | Helena, MT | 1,525 | -35% | $414,675,000 | -40% | $271,918 |

| 2023 | Helena-West Helena, AR | 101 | -18% | $9,655,000 | -15% | $95,594 |

| 2023 | Henderson, NC | 530 | -28% | $98,280,000 | -35% | $185,434 |

| 2023 | Hereford, TX | 171 | -36% | $28,155,000 | -30% | $164,649 |

| 2023 | Hermiston-Pendleton, OR | 1,355 | -31% | $303,995,000 | -37% | $224,351 |

| 2023 | HICKORY-LENOIR-MORGANTON, NC | 8,039 | -23% | $1,631,435,000 | -27% | $202,940 |

| 2023 | Hillsdale, MI | 696 | -28% | $116,290,000 | -21% | $167,083 |

| 2023 | Hilo, HI | 2,468 | -46% | $1,156,030,000 | -47% | $468,408 |

| 2023 | HILTON HEAD ISLAND-BLUFFTON, SC | 6,599 | -28% | $2,586,855,000 | -32% | $392,007 |

| 2023 | HINESVILLE, GA | 2,555 | -14% | $577,955,000 | -14% | $226,205 |

| 2023 | Hobbs, NM | 716 | -20% | $140,750,000 | -31% | $196,578 |

| 2023 | Holland, MI | 2,819 | -33% | $551,555,000 | -35% | $195,656 |

| 2023 | HOMOSASSA SPRINGS, FL | 4,429 | -27% | $916,205,000 | -27% | $206,865 |

| 2023 | Hood River, OR | 294 | -51% | $93,590,000 | -56% | $318,333 |

| 2023 | Hope, AR | 279 | -21% | $30,775,000 | -27% | $110,305 |

| 2023 | HOT SPRINGS, AR | 1,940 | -28% | $395,480,000 | -33% | $203,856 |

| 2023 | Houghton, MI | 462 | -28% | $78,250,000 | -24% | $169,372 |

| 2023 | HOUMA-THIBODAUX, LA | 2,375 | -26% | $445,665,000 | -29% | $187,648 |

| 2023 | HOUSTON-THE WOODLANDS-SUGAR LAND, TX | 105,896 | -28% | $35,302,120,000 | -34% | $333,366 |

| 2023 | Hudson, NY | 921 | -41% | $283,045,000 | -38% | $307,324 |

| 2023 | Huntingdon, PA | 655 | -32% | $77,835,000 | -43% | $118,832 |

| 2023 | Huntington, IN | 721 | -28% | $103,095,000 | -20% | $142,989 |

| 2023 | HUNTINGTON-ASHLAND, WV-KY-OH | 5,409 | -24% | $819,875,000 | -27% | $151,576 |

| 2023 | HUNTSVILLE, AL | 14,024 | -26% | $3,863,660,000 | -29% | $275,503 |

| 2023 | Huntsville, TX | 814 | -33% | $220,260,000 | -37% | $270,590 |

| 2023 | Huron, SD | 156 | -17% | $38,600,000 | 2% | $247,436 |

| 2023 | Hutchinson, KS | 893 | -9% | $111,325,000 | -18% | $124,664 |

| 2023 | Hutchinson, MN | 652 | -25% | $145,220,000 | -13% | $222,730 |

| 2023 | IDAHO FALLS, ID | 3,847 | -35% | $951,355,000 | -40% | $247,298 |

| 2023 | Indiana, PA | 1,201 | -25% | $149,065,000 | -23% | $124,117 |

| 2023 | INDIANAPOLIS-CARMEL-ANDERSON, IN | 51,049 | -29% | $13,968,535,000 | -29% | $273,630 |

| 2023 | Indianola, MS | 228 | -24% | $21,770,000 | -19% | $95,482 |

| 2023 | IOWA CITY, IA | 4,342 | -32% | $937,720,000 | -33% | $215,965 |

| 2023 | Iron Mountain, MI-WI | 335 | -16% | $48,775,000 | -24% | $145,597 |

| 2023 | ITHACA, NY | 1,091 | -20% | $667,755,000 | 85% | $612,058 |

| 2023 | JACKSON, MI | 2,948 | -29% | $470,660,000 | -30% | $159,654 |

| 2023 | JACKSON, MS | 10,264 | -21% | $2,054,100,000 | -33% | $200,127 |

| 2023 | Jackson, OH | 490 | -21% | $71,420,000 | -24% | $145,755 |

| 2023 | JACKSON, TN | 3,452 | -20% | $602,040,000 | -30% | $174,403 |

| 2023 | Jackson, WY-ID | 699 | -47% | $633,145,000 | -59% | $905,787 |

| 2023 | JACKSONVILLE, FL | 39,802 | -29% | $12,342,550,000 | -29% | $310,099 |

| 2023 | Jacksonville, IL | 386 | -20% | $48,190,000 | -7% | $124,845 |

| 2023 | JACKSONVILLE, NC | 5,734 | -32% | $1,444,120,000 | -32% | $251,852 |

| 2023 | Jacksonville, TX | 707 | -23% | $161,075,000 | -18% | $227,829 |

| 2023 | Jamestown, ND | 360 | -17% | $62,400,000 | -21% | $173,333 |

| 2023 | Jamestown-Dunkirk-Fredonia, NY | 1,612 | -26% | $223,110,000 | -25% | $138,406 |

| 2023 | JANESVILLE-BELOIT, WI | 4,445 | -18% | $666,015,000 | -27% | $149,835 |

| 2023 | Jasper, AL | 899 | -17% | $158,595,000 | -13% | $176,413 |

| 2023 | Jasper, IN | 875 | -28% | $129,005,000 | -25% | $147,434 |

| 2023 | Jayuya, PR | 10 | -55% | $930,000 | -59% | $93,000 |

| 2023 | Jefferson, GA | 2,996 | -14% | $910,200,000 | -9% | $303,805 |

| 2023 | JEFFERSON CITY, MO | 2,972 | -22% | $533,110,000 | -21% | $179,378 |

| 2023 | Jennings, LA | 399 | -28% | $66,275,000 | -31% | $166,103 |

| 2023 | Jesup, GA | 532 | -22% | $96,680,000 | -22% | $181,729 |

| 2023 | JOHNSON CITY, TN | 4,111 | -23% | $920,935,000 | -24% | $224,017 |

| 2023 | JOHNSTOWN, PA | 2,042 | -22% | $206,670,000 | -28% | $101,210 |

| 2023 | JONESBORO, AR | 2,508 | -24% | $461,440,000 | -40% | $183,987 |

| 2023 | JOPLIN, MO | 3,765 | -24% | $625,475,000 | -24% | $166,129 |

| 2023 | Juneau, AK | 403 | -36% | $132,925,000 | -42% | $329,839 |

| 2023 | KAHULUI-WAILUKU-LAHAINA, HI | 1,959 | -53% | $1,133,015,000 | -56% | $578,364 |

| 2023 | KALAMAZOO-PORTAGE, MI | 5,458 | -30% | $1,063,970,000 | -30% | $194,938 |

| 2023 | Kalispell, MT | 1,746 | -46% | $838,600,000 | -44% | $480,298 |

| 2023 | KANKAKEE, IL | 1,721 | -26% | $262,795,000 | -39% | $152,699 |

| 2023 | KANSAS CITY, MO-KS | 44,415 | -26% | $12,149,555,000 | -24% | $273,546 |

| 2023 | Kapaa, HI | 809 | -50% | $502,655,000 | -50% | $621,329 |

| 2023 | Kearney, NE | 767 | -27% | $142,545,000 | -38% | $185,847 |

| 2023 | Keene, NH | 1,181 | -32% | $256,875,000 | -35% | $217,506 |

| 2023 | Kendallville, IN | 1,013 | -28% | $152,885,000 | -26% | $150,923 |

| 2023 | Kennett, MO | 221 | -20% | $29,525,000 | -1% | $133,597 |

| 2023 | KENNEWICK-RICHLAND, WA | 5,715 | -39% | $1,633,745,000 | -44% | $285,870 |

| 2023 | Kerrville, TX | 643 | -32% | $182,555,000 | -41% | $283,911 |

| 2023 | Ketchikan, AK | 95 | -43% | $28,495,000 | -47% | $299,947 |

| 2023 | Key West, FL | 1,373 | -45% | $978,145,000 | -47% | $712,414 |

| 2023 | Kill Devil Hills, NC | 1,515 | -45% | $562,415,000 | -49% | $371,231 |

| 2023 | KILLEEN-TEMPLE, TX | 9,615 | -30% | $2,626,355,000 | -26% | $273,152 |

| 2023 | KINGSPORT-BRISTOL, TN-VA | 6,159 | -19% | $1,123,975,000 | -22% | $182,493 |

| 2023 | KINGSTON, NY | 2,676 | -36% | $778,090,000 | -38% | $290,766 |

| 2023 | Kingsville, TX | 306 | -20% | $60,890,000 | -34% | $198,987 |

| 2023 | Kinston, NC | 858 | -13% | $131,370,000 | -11% | $153,112 |

| 2023 | Kirksville, MO | 303 | -27% | $45,175,000 | -34% | $149,092 |

| 2023 | Klamath Falls, OR | 1,195 | -38% | $268,915,000 | -36% | $225,033 |

| 2023 | KNOXVILLE, TN | 20,993 | -30% | $5,749,785,000 | -30% | $273,891 |

| 2023 | KOKOMO, IN | 1,915 | -25% | $266,275,000 | -28% | $139,047 |

| 2023 | Laconia, NH | 1,647 | -32% | $510,995,000 | -31% | $310,258 |

| 2023 | LA CROSSE-ONALASKA, WI-MN | 2,894 | -26% | $551,750,000 | -31% | $190,653 |

| 2023 | LAFAYETTE, LA | 6,819 | -28% | $1,423,075,000 | -32% | $208,693 |

| 2023 | LAFAYETTE-WEST LAFAYETTE, IN | 4,297 | -26% | $1,011,105,000 | -21% | $235,305 |

| 2023 | La Grande, OR | 397 | -39% | $87,375,000 | -38% | $220,088 |

| 2023 | LaGrange, GA-AL | 1,555 | -21% | $304,685,000 | -22% | $195,939 |

| 2023 | LAKE CHARLES, LA | 2,821 | -32% | $625,025,000 | -30% | $221,562 |

| 2023 | Lake City, FL | 1,013 | -30% | $196,745,000 | -32% | $194,220 |

| 2023 | LAKE HAVASU CITY-KINGMAN, AZ | 4,918 | -37% | $1,195,980,000 | -40% | $243,184 |

| 2023 | LAKELAND-WINTER HAVEN, FL | 20,576 | -22% | $5,427,470,000 | -24% | $263,777 |

| 2023 | Lamesa, TX | 83 | -20% | $13,585,000 | -14% | $163,675 |

| 2023 | LANCASTER, PA | 9,936 | -31% | $2,092,010,000 | -31% | $210,549 |

| 2023 | LANSING-EAST LANSING, MI | 9,410 | -32% | $1,754,650,000 | -32% | $186,467 |

| 2023 | Laramie, WY | 583 | -36% | $144,035,000 | -40% | $247,058 |

| 2023 | LAREDO, TX | 2,357 | -20% | $512,685,000 | -22% | $217,516 |

| 2023 | LAS CRUCES, NM | 3,253 | -30% | $758,285,000 | -26% | $233,103 |

| 2023 | Las Vegas, NM | 282 | -19% | $53,670,000 | -14% | $190,319 |

| 2023 | LAS VEGAS-HENDERSON-PARADISE, NV | 41,865 | -37% | $14,109,375,000 | -40% | $337,021 |

| 2023 | Laurel, MS | 1,218 | -18% | $151,800,000 | -23% | $124,631 |

| 2023 | Laurinburg, NC | 405 | -24% | $63,955,000 | -26% | $157,914 |

| 2023 | LAWRENCE, KS | 1,857 | -28% | $451,865,000 | -28% | $243,331 |

| 2023 | Lawrenceburg, TN | 808 | -27% | $151,110,000 | -28% | $187,017 |

| 2023 | LAWTON, OK | 2,218 | -20% | $382,470,000 | -21% | $172,439 |

| 2023 | Lebanon, MO | 609 | -25% | $97,685,000 | -32% | $160,402 |

| 2023 | Lebanon, NH-VT | 3,920 | -29% | $1,060,780,000 | -30% | $270,607 |

| 2023 | LEBANON, PA | 2,790 | -24% | $467,950,000 | -32% | $167,724 |

| 2023 | Levelland, TX | 284 | -6% | $51,670,000 | -1% | $181,937 |

| 2023 | Lewisburg, PA | 553 | -28% | $102,275,000 | -24% | $184,946 |

| 2023 | Lewisburg, TN | 1,010 | -28% | $242,910,000 | -28% | $240,505 |

| 2023 | LEWISTON, ID-WA | 1,152 | -36% | $251,020,000 | -38% | $217,899 |

| 2023 | LEWISTON-AUBURN, ME | 2,033 | -30% | $446,735,000 | -26% | $219,742 |

| 2023 | Lewistown, PA | 746 | -25% | $86,290,000 | -25% | $115,670 |

| 2023 | Lexington, NE | 268 | -37% | $42,240,000 | -41% | $157,612 |

| 2023 | LEXINGTON-FAYETTE, KY | 10,282 | -32% | $2,551,890,000 | -34% | $248,190 |

| 2023 | Liberal, KS | 164 | -26% | $21,960,000 | -35% | $133,902 |

| 2023 | LIMA, OH | 1,929 | -26% | $269,785,000 | -22% | $139,857 |

| 2023 | Lincoln, IL | 459 | -14% | $50,515,000 | -14% | $110,054 |

| 2023 | LINCOLN, NE | 6,725 | -24% | $1,534,475,000 | -28% | $228,175 |

| 2023 | LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR | 14,516 | -26% | $3,138,870,000 | -35% | $216,235 |

| 2023 | Lock Haven, PA | 751 | -29% | $93,215,000 | -33% | $124,121 |

| 2023 | LOGAN, UT-ID | 3,176 | -37% | $833,030,000 | -40% | $262,289 |

| 2023 | Logansport, IN | 588 | -19% | $69,520,000 | -26% | $118,231 |

| 2023 | London, KY | 1,736 | -21% | $253,180,000 | -24% | $145,841 |

| 2023 | LONGVIEW, TX | 4,020 | -24% | $846,530,000 | -28% | $210,580 |

| 2023 | LONGVIEW, WA | 2,573 | -37% | $650,045,000 | -42% | $252,641 |

| 2023 | Los Alamos, NM | 436 | -29% | $152,940,000 | -28% | $350,780 |

| 2023 | Los Angeles-Long Beach-Anaheim, CA | 114,449 | -47% | $75,661,415,000 | -51% | $661,093 |

| 2023 | LOUISVILLE, KY | 28,591 | -28% | $6,518,875,000 | -33% | $228,004 |

| 2023 | LUBBOCK, TX | 5,738 | -25% | $1,382,030,000 | -39% | $240,856 |

| 2023 | Ludington, MI | 329 | -41% | $58,775,000 | -39% | $178,647 |

| 2023 | Lufkin, TX | 936 | -25% | $189,770,000 | -25% | $202,746 |

| 2023 | Lumberton, NC | 1,231 | -5% | $208,765,000 | -12% | $169,590 |

| 2023 | LYNCHBURG, VA | 5,161 | -24% | $1,137,445,000 | -31% | $220,392 |

| 2023 | Macomb, IL | 293 | -22% | $30,325,000 | -25% | $103,498 |

| 2023 | MACON-BIBB COUNTY, GA | 3,582 | -25% | $744,170,000 | -35% | $207,753 |

| 2023 | MADERA, CA | 2,341 | -40% | $740,125,000 | -38% | $316,158 |

| 2023 | Madison, IN | 734 | -24% | $106,700,000 | -25% | $145,368 |

| 2023 | MADISON, WI | 17,435 | -26% | $4,375,275,000 | -30% | $250,948 |

| 2023 | Madisonville, KY | 832 | -24% | $109,740,000 | -22% | $131,899 |

| 2023 | Magnolia, AR | 248 | -13% | $38,940,000 | -20% | $157,016 |

| 2023 | Malone, NY | 394 | -25% | $74,550,000 | -20% | $189,213 |

| 2023 | Malvern, AR | 479 | -10% | $68,075,000 | -15% | $142,119 |

| 2023 | MANCHESTER-NASHUA, NH | 8,003 | -36% | $2,253,765,000 | -45% | $281,615 |

| 2023 | MANHATTAN, KS | 2,181 | -26% | $450,305,000 | -27% | $206,467 |

| 2023 | Manitowoc, WI | 1,619 | -29% | $213,655,000 | -34% | $131,967 |

| 2023 | MANKATO, MN | 1,488 | -26% | $391,610,000 | -28% | $263,179 |

| 2023 | MANSFIELD, OH | 2,174 | -29% | $320,560,000 | -26% | $147,452 |

| 2023 | Marietta, OH | 830 | -27% | $121,510,000 | -31% | $146,398 |

| 2023 | Marinette, WI-MI | 1,169 | -24% | $157,645,000 | -27% | $134,855 |

| 2023 | Marion, IN | 1,011 | -18% | $132,635,000 | -22% | $131,192 |

| 2023 | Marion, NC | 739 | -33% | $159,675,000 | -38% | $216,069 |

| 2023 | Marion, OH | 1,159 | -20% | $159,425,000 | -20% | $137,554 |

| 2023 | Marquette, MI | 917 | -23% | $157,255,000 | -30% | $171,489 |

| 2023 | Marshall, MN | 320 | -25% | $66,320,000 | -10% | $207,250 |

| 2023 | Marshall, MO | 341 | -20% | $47,555,000 | -16% | $139,457 |

| 2023 | Marshalltown, IA | 494 | -26% | $63,920,000 | -43% | $129,393 |

| 2023 | Martin, TN | 442 | -21% | $65,600,000 | -28% | $148,416 |

| 2023 | Martinsville, VA | 871 | -14% | $120,985,000 | -18% | $138,904 |

| 2023 | Maryville, MO | 258 | -36% | $40,760,000 | -37% | $157,984 |

| 2023 | Mason City, IA | 482 | -24% | $82,330,000 | -28% | $170,809 |

| 2023 | MAYAGÜEZ, PR | 221 | -20% | $28,705,000 | -16% | $129,887 |

| 2023 | Mayfield, KY | 438 | -19% | $60,310,000 | -27% | $137,694 |

| 2023 | Maysville, KY | 207 | -39% | $27,555,000 | -44% | $133,116 |

| 2023 | McAlester, OK | 606 | -20% | $105,080,000 | -24% | $173,399 |

| 2023 | MCALLEN-EDINBURG-MISSION, TX | 6,763 | -21% | $1,684,565,000 | -14% | $249,085 |

| 2023 | McComb, MS | 421 | -21% | $60,715,000 | -19% | $144,216 |

| 2023 | McMinnville, TN | 788 | -21% | $153,730,000 | -17% | $195,089 |

| 2023 | McPherson, KS | 414 | 19% | $64,160,000 | 14% | $154,976 |

| 2023 | Meadville, PA | 1,331 | -24% | $159,745,000 | -26% | $120,019 |

| 2023 | MEDFORD, OR | 3,787 | -42% | $1,284,885,000 | -34% | $339,288 |

| 2023 | MEMPHIS, TN-MS-AR | 22,429 | -30% | $5,449,305,000 | -36% | $242,958 |

| 2023 | Menomonie, WI | 789 | -29% | $146,345,000 | -30% | $185,482 |

| 2023 | MERCED, CA | 2,909 | -41% | $852,985,000 | -43% | $293,223 |

| 2023 | Meridian, MS | 1,054 | -21% | $147,260,000 | -46% | $139,715 |

| 2023 | Mexico, MO | 378 | -28% | $49,070,000 | -29% | $129,815 |

| 2023 | Miami, OK | 307 | -22% | $47,135,000 | -13% | $153,534 |

| 2023 | Miami-Fort Lauderdale-Pompano Beach, FL | 89,339 | -33% | $39,362,315,000 | -36% | $440,595 |

| 2023 | MICHIGAN CITY-LA PORTE, IN | 2,276 | -30% | $394,040,000 | -27% | $173,128 |

| 2023 | Middlesborough, KY | 219 | -12% | $26,175,000 | -19% | $119,521 |