Great Western Bank Mortgage Rates, Fees & Info

Sioux Falls, SDLEI: GOJ1L4ZO0WN3FOYLH432

Tax ID: 46-0133550

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Great Western Bank is a smaller bank specializing in Refi and Home Purchase loans. Great Western Bank has a high proportion of conventional loans. They have a low ratio of USDA loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) Their top markets by origination volume include: Sioux Falls, Omaha, Des Moines, Watertown, and Phoenix among others. We have data for 76 markets. (Some data included below & more in-depth data is available with an active subscription.)Great Western Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Great Western Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

Originations

3,814Origination Dollar Volume (All Markets)

$727,470,000Employee count

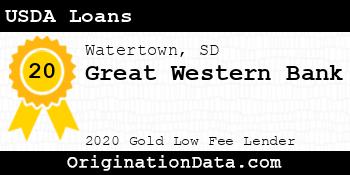

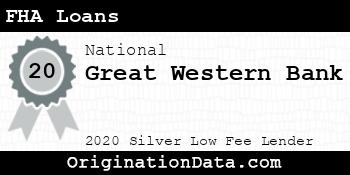

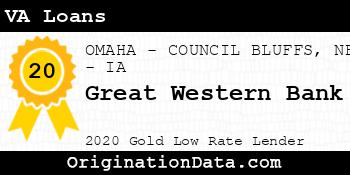

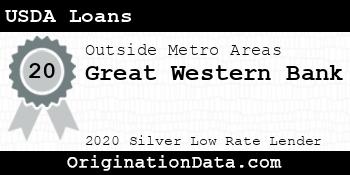

1,646 Show all (14) awardsGreat Western Bank - 2020

Great Western Bank is a 2020 , due to their low .

For 2020, less than of lenders were eligible for this award.

Work for Great Western Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| SIOUX FALLS, SD (FHA|USDA|VA) | 694 | $127,930,000 | $184,337 | $3,032 | 3.56% |

| Outside of Metro Areas | 728 | $83,210,000 | $114,299 | $2,792 | 3.98% |

| OMAHA-COUNCIL BLUFFS, NE-IA (FHA|USDA|VA) | 424 | $76,810,000 | $181,156 | $2,377 | 3.80% |

| DES MOINES-WEST DES MOINES, IA (FHA|USDA|VA) | 236 | $65,920,000 | $279,322 | $2,642 | 3.74% |

| Watertown, SD (FHA|USDA|VA) | 251 | $41,505,000 | $165,359 | $3,907 | 3.34% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 80 | $37,340,000 | $466,750 | $3,723 | 3.51% |

| LINCOLN, NE (FHA|USDA|VA) | 214 | $35,080,000 | $163,925 | $2,096 | 3.56% |

| Aberdeen, SD (FHA|USDA|VA) | 192 | $34,460,000 | $179,479 | $3,675 | 3.63% |

| FARGO, ND-MN (FHA|USDA|VA) | 14 | $27,690,000 | $1,977,857 | $3,836 | 3.74% |

| IOWA CITY, IA (FHA|USDA|VA) | 27 | $22,155,000 | $820,556 | $2,199 | 3.49% |

| Brookings, SD (FHA|USDA|VA) | 104 | $17,260,000 | $165,962 | $3,089 | 3.52% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 46 | $15,870,000 | $345,000 | $4,181 | 4.16% |

| AMES, IA (FHA|USDA|VA) | 91 | $14,215,000 | $156,209 | $2,219 | 3.84% |

| BOULDER, CO (FHA|USDA|VA) | 38 | $11,670,000 | $307,105 | $2,903 | 4.21% |

| Fort Dodge, IA (FHA|USDA|VA) | 92 | $9,850,000 | $107,065 | $2,251 | 4.05% |

| MINNEAPOLIS-ST. PAUL-BLOOMINGTON, MN-WI (FHA|USDA|VA) | 13 | $8,835,000 | $679,615 | $3,797 | 3.35% |

| TUCSON, AZ (FHA|USDA|VA) | 10 | $6,890,000 | $689,000 | $3,754 | 3.80% |

| GREELEY, CO (FHA|USDA|VA) | 32 | $6,500,000 | $203,125 | $2,767 | 4.00% |

| FORT COLLINS, CO (FHA|USDA|VA) | 27 | $5,305,000 | $196,481 | $2,375 | 4.31% |

| Kearney, NE (FHA|USDA|VA) | 26 | $5,080,000 | $195,385 | $2,369 | 3.88% |

| GRAND ISLAND, NE (FHA|USDA|VA) | 38 | $4,690,000 | $123,421 | $2,623 | 3.84% |

| Mitchell, SD (FHA|USDA|VA) | 26 | $4,510,000 | $173,462 | $2,803 | 3.81% |

| Marshalltown, IA (FHA|USDA|VA) | 48 | $4,460,000 | $92,917 | $1,991 | 3.85% |

| Yankton, SD (FHA|USDA|VA) | 30 | $4,240,000 | $141,333 | $2,682 | 3.52% |

| Burlington, IA-IL (FHA|USDA|VA) | 44 | $3,410,000 | $77,500 | $1,847 | 4.20% |

| WATERLOO-CEDAR FALLS, IA (FHA|USDA|VA) | 18 | $3,350,000 | $186,111 | $3,226 | 4.13% |

| RAPID CITY, SD (FHA|USDA|VA) | 26 | $3,270,000 | $125,769 | $2,885 | 4.10% |

| Marshall, MN (FHA|USDA|VA) | 22 | $3,250,000 | $147,727 | $3,064 | 3.26% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 14 | $3,200,000 | $228,571 | $2,069 | 3.77% |

| Spearfish, SD (FHA|USDA|VA) | 19 | $2,895,000 | $152,368 | $3,058 | 3.83% |

| SIOUX CITY, IA-NE-SD (FHA|USDA|VA) | 19 | $2,855,000 | $150,263 | $2,707 | 3.72% |

| Pierre, SD (FHA|USDA|VA) | 8 | $2,410,000 | $301,250 | $3,749 | 3.03% |

| Hastings, NE (FHA|USDA|VA) | 20 | $2,300,000 | $115,000 | $2,139 | 3.81% |

| Fergus Falls, MN (FHA|USDA|VA) | 2 | $2,240,000 | $1,120,000 | $3,935 | 3.18% |

| North Platte, NE (FHA|USDA|VA) | 19 | $1,995,000 | $105,000 | $2,324 | 4.24% |

| COLORADO SPRINGS, CO (FHA|USDA|VA) | 10 | $1,920,000 | $192,000 | $1,322 | 5.23% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 1 | $1,725,000 | $1,725,000 | $10,491 | 3.50% |

| Spirit Lake, IA (FHA|USDA|VA) | 5 | $1,505,000 | $301,000 | $2,993 | 2.65% |

| CEDAR RAPIDS, IA (FHA|USDA|VA) | 7 | $1,505,000 | $215,000 | $2,743 | 3.82% |

| Breckenridge, CO (FHA|USDA|VA) | 3 | $1,425,000 | $475,000 | $4,472 | 3.25% |

| Columbus, NE (FHA|USDA|VA) | 14 | $1,320,000 | $94,286 | $2,128 | 3.73% |

| Lexington, NE (FHA|USDA|VA) | 13 | $1,215,000 | $93,462 | $1,873 | 4.62% |

| Scottsbluff, NE (FHA|USDA|VA) | 9 | $1,175,000 | $130,556 | $1,996 | 4.37% |

| Heber, UT (FHA|USDA|VA) | 1 | $1,165,000 | $1,165,000 | $7,408 | 2.88% |

| Beatrice, NE (FHA|USDA|VA) | 10 | $1,120,000 | $112,000 | $2,281 | 3.73% |

| Norfolk, NE (FHA|USDA|VA) | 5 | $1,045,000 | $209,000 | $2,169 | 3.47% |

| Laramie, WY (FHA|USDA|VA) | 1 | $1,015,000 | $1,015,000 | $0 | 3.75% |

| Fremont, NE (FHA|USDA|VA) | 7 | $805,000 | $115,000 | $1,961 | 4.42% |

| SAN DIEGO-CHULA VISTA-CARLSBAD, CA (FHA|USDA|VA) | 1 | $765,000 | $765,000 | $4,700 | 3.00% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 1 | $645,000 | $645,000 | $4,255 | 2.63% |

| Vermillion, SD (FHA|USDA|VA) | 3 | $565,000 | $188,333 | $3,275 | 3.79% |

| Alexandria, MN (FHA|USDA|VA) | 1 | $555,000 | $555,000 | $3,515 | 3.50% |

| LAS VEGAS-HENDERSON-PARADISE, NV (FHA|USDA|VA) | 1 | $515,000 | $515,000 | $3,080 | 2.50% |

| Hutchinson, MN (FHA|USDA|VA) | 1 | $475,000 | $475,000 | $3,258 | 3.75% |

| Oskaloosa, IA (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $2,381 | 2.75% |

| YUMA, AZ (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $8,087 | 3.00% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $4,071 | 2.81% |

| Willmar, MN (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $1,961 | 2.50% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $4,346 | 2.88% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,359 | 2.63% |

| Pella, IA (FHA|USDA|VA) | 3 | $255,000 | $85,000 | $2,135 | 3.08% |

| Brainerd, MN (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $6,079 | 3.00% |

| Mason City, IA (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $1,927 | 2.88% |

| Fort Morgan, CO (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,592 | 3.00% |

| PEORIA, IL (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $1,397 | 3.25% |

| MANHATTAN, KS (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $3,726 | 2.75% |

| PROVO-OREM, UT (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,642 | 2.13% |

| Edwards, CO (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $0 | 4.75% |

| Jamestown, ND (FHA|USDA|VA) | 3 | $145,000 | $48,333 | $0 | 4.25% |

| Carroll, IA (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $1,857 | 3.75% |

| Kirksville, MO (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $0 | 4.25% |

| Steamboat Springs, CO (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $0 | 4.50% |

| ST. JOSEPH, MO-KS (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $1,973 | 3.00% |

| Fort Madison-Keokuk, IA-IL-MO (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $0 | 6.00% |

| Huron, SD (FHA|USDA|VA) | 1 | $35,000 | $35,000 | $2,924 | 3.75% |

| DAVENPORT-MOLINE-ROCK ISLAND, IA-IL (FHA|USDA|VA) | 1 | $5,000 | $5,000 | $155 | 4.75% |

Similar Lenders

We use machine learning to identify the top lenders compared against Great Western Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 120

Similarity Rank: 172

Similarity Rank: 207

Similarity Rank: 224

Similarity Rank: 252

Similarity Rank: 276

Similarity Rank: 288

Similarity Rank: 387

Similarity Rank: 441

Similarity Rank: 442

Product Mix

For 2020, Great Western Bank's most frequently originated type of loan was Conventional, with 2,598 originations. Their 2nd most popular type was HELOC, with 1,004 originations.

Loan Reason

For 2020, Great Western Bank's most frequently cited loan purpose was Refi, with 1,646 originations. The 2nd most popular reason was Home Purchase, with 948 originations.

Loan Duration/Length

For 2020, Great Western Bank's most frequently cited loan duration was 30 Year, with 1,394 originations. The 2nd most popular length was 10 Year, with 1,131 originations.

Origination Fees/Closing Costs

Great Western Bank's average total fees were $3,383, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 1,371 originations.

Interest Rates

During 2020, Great Western Bank's average interest rate for loans was 3.13%, while their most frequently originated rate bucket for loans was 3-4%, with 1,135 originations.

Loan Sizing

2020 saw Great Western Bank place emphasis on $100,000 or less loans with 1,435 originations, totaling $73,165,000 in origination value.

Applicant Income

Great Western Bank lent most frequently to those with incomes in the $50k-75k range, with 750 originations. The second most popular income band? $50k or less, with 710 originations.

Applicant Debt to Income Ratio

Great Western Bank lent most frequently to those with DTI ratios of 20-30%, with 1,030 originations. The next most common DTI ratio? 30-36%, with 713 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications81.72%

Great Western Bank has a below average approval rate.

Pick Rate

Approvals leading to origination73.44%

Great Western Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 3,814 | $727,470,000 | $190,737 |

Occupancy Type Mix

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2020 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| GREAT WESTERN BANCORP, INC. | Conventional home mortgage | Improper use of your report | 1 | 50.0% |

| GREAT WESTERN BANCORP, INC. | Other type of mortgage | Closing on a mortgage | 1 | 50.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Great Western Bank | 100 East South Street Mount Ayr, IA 50854 | Full Service B&M | $34,906 |

| Great Western Bank | 1000 East Court Street Beatrice, NE 68310 | Full Service B&M | $29,888 |

| Great Western Bank | 101 E Kimball St Callaway, NE 68825 | Full Service B&M | $24,399 |

| Great Western Bank | 101 East King Street Chamberlain, SD 57325 | Full Service B&M | $47,766 |

| Great Western Bank | 1010 North Roosevelt Avenue Burlington, IA 52601 | Full Service B&M | $41,809 |

| Great Western Bank | 10101 University Avenue Clive, IA 50325 | Full Service B&M | $794,462 |

| Great Western Bank | 1016 Central Avenue Nebraska City, NE 68410 | Full Service B&M | $17,367 |

| Great Western Bank | 102 S. Main Mt. Pleasant, IA 52641 | Full Service B&M | $28,476 |

| Great Western Bank | 102 W 5th St Canton, SD 57013 | Full Service B&M | $14,499 |

| Great Western Bank | 1020 Century Drive Louisville, CO 80027 | Full Service B&M | $48,316 |

| Great Western Bank | 1020 Main Street Hamburg, IA 51640 | Full Service B&M | $81,560 |

| Great Western Bank | 1028 Toledo Street Sidney, NE 69162 | Full Service B&M | $27,124 |

| Great Western Bank | 103 West Taylor Creston, IA 50801 | Full Service B&M | $14,814 |

| Great Western Bank | 1030 Broad Street Grinnell, IA 50112 | Full Service B&M | $45,061 |

| Great Western Bank | 106 East 7th Ave Redfield, SD 57469 | Full Service B&M | $31,730 |

| Great Western Bank | 10610 Shawnee Mission Parkway Shawnee, KS 66203 | Full Service B&M | $126,701 |

| Great Western Bank | 11 North First Avenue Marshalltown, IA 50158 | Full Service B&M | $154,967 |

| Great Western Bank | 110 South 9th Street Canon City, CO 81212 | Full Service B&M | $127,753 |

| Great Western Bank | 110 West 7th Street Lexington, NE 68850 | Full Service B&M | $106,456 |

| Great Western Bank | 111 N. East Street Gettysburg, SD 57442 | Full Service B&M | $51,448 |

| Great Western Bank | 111 North Main Leon, IA 50144 | Full Service B&M | $61,853 |

| Great Western Bank | 111 South Dewey Street North Platte, NE 69101 | Full Service B&M | $99,569 |

| Great Western Bank | 1111 141st Street Perry, IA 50220 | Full Service B&M | $37,642 |

| Great Western Bank | 114 West 15th Street Falls City, NE 68355 | Full Service B&M | $21,745 |

| Great Western Bank | 118 North Main Street Colman, SD 57017 | Full Service B&M | $74,424 |

| Great Western Bank | 119 6th Avenue S.E. Aberdeen, SD 57401 | Full Service B&M | $156,228 |

| Great Western Bank | 120 S 68th St West Des Moines, IA 50266 | Full Service B&M | $12,013 |

| Great Western Bank | 120 S. 1st Street Carlisle, IA 50047 | Full Service B&M | $52,492 |

| Great Western Bank | 121 South Tejon Street, Ste 110 Colorado Springs, CO 80903 | Full Service B&M | $52,029 |

| Great Western Bank | 1235 N Street Lincoln, NE 68508 | Full Service B&M | $112,413 |

| Great Western Bank | 12670 L Street Omaha, NE 68137 | Full Service B&M | $113,239 |

| Great Western Bank | 1300 East Florence Boulevard Casa Grande, AZ 85122 | Full Service B&M | $111,165 |

| Great Western Bank | 1301 Main Avenue Crete, NE 68333 | Full Service B&M | $15,891 |

| Great Western Bank | 1301 Main Street Webster, SD 57274 | Full Service B&M | $20,645 |

| Great Western Bank | 1302 6th Street Brookings, SD 57006 | Full Service B&M | $20,396 |

| Great Western Bank | 1305 E Cedar Brandon, SD 57005 | Full Service B&M | $40,805 |

| Great Western Bank | 13150 Hickman Road Clive, IA 50325 | Full Service B&M | $19,385 |

| Great Western Bank | 1347 E Euclid Des Moines, IA 50316 | Full Service B&M | $11,902 |

| Great Western Bank | 135 North Cotner Boulevard Lincoln, NE 68505 | Full Service B&M | $45,913 |

| Great Western Bank | 14 St. Joseph Street Rapid City, SD 57701 | Full Service B&M | $186,572 |

| Great Western Bank | 1401 South Washington Street Papillion, NE 68046 | Full Service B&M | $30,311 |

| Great Western Bank | 1402 Washington Street Eldora, IA 50627 | Full Service B&M | $16,092 |

| Great Western Bank | 1407 East 7th Street Atlantic, IA 50022 | Full Service B&M | $25,470 |

| Great Western Bank | 1418 E College Drive Marshall, MN 56258 | Full Service B&M | $20,741 |

| Great Western Bank | 1464 26th Avenue Columbus, NE 68602 | Full Service B&M | $48,163 |

| Great Western Bank | 1504 L Street Ord, NE 68862 | Full Service B&M | $32,608 |

| Great Western Bank | 151 South College Avenue Fort Collins, CO 80524 | Full Service B&M | $30,638 |

| Great Western Bank | 1516 East Saint Patrick Street Rapid City, SD 57703 | Full Service Retail | $14,584 |

| Great Western Bank | 1543 Wazee Street Denver, CO 80202 | Full Service B&M | $21,254 |

| Great Western Bank | 1552 E 23rd Avenue N Fremont, NE 68025 | Full Service B&M | $22,277 |

| Great Western Bank | 1609 Madison St Bedford, IA 50833 | Full Service B&M | $19,161 |

| Great Western Bank | 161 West Oak Street Globe, AZ 85501 | Full Service B&M | $57,603 |

| Great Western Bank | 163 Grand Avenue Burwell, NE 68823 | Full Service B&M | $35,954 |

| Great Western Bank | 16850 Evans Place Omaha, NE 68116 | Full Service B&M | $43,508 |

| Great Western Bank | 17929 Welch Plaza Omaha, NE 68135 | Full Service B&M | $59,402 |

| Great Western Bank | 180 S. Arizona Ave, Suite 108 Chandler, AZ 85225 | Full Service B&M | $124,067 |

| Great Western Bank | 1805 6th Ave Se Aberdeen, SD 57402 | Full Service B&M | $58,357 |

| Great Western Bank | 1811 West 2nd Street Grand Island, NE 68802 | Full Service B&M | $26,224 |

| Great Western Bank | 18511 N. Scottsdale Road, Suite 102, 200-201 Scottsdale, AZ 85260 | Full Service B&M | $13,632 |

| Great Western Bank | 1900 Ninth Street Boulder, CO 80302 | Full Service B&M | $162,340 |

| Great Western Bank | 1920 23rd Street Columbus, NE 68601 | Full Service B&M | $18,343 |

| Great Western Bank | 19750 N Maricopa Parkway Maricopa, AZ 85139 | Full Service B&M | $65,081 |

| Great Western Bank | 2 West 4th Street Grant City, MO 64456 | Full Service B&M | $40,651 |

| Great Western Bank | 200 West Littleton Boulevard Littleton, CO 80120 | Full Service B&M | $21,086 |

| Great Western Bank | 2001 Broadway Scottsbluff, NE 69361 | Full Service B&M | $24,026 |

| Great Western Bank | 201 Main Street Rosholt, SD 57260 | Full Service B&M | $30,505 |

| Great Western Bank | 201 North Main Street Chariton, IA 50049 | Full Service B&M | $51,050 |

| Great Western Bank | 201 South 25th Street Fort Dodge, IA 50501 | Full Service B&M | $39,933 |

| Great Western Bank | 201 South Locust Glenwood, IA 51534 | Full Service B&M | $24,302 |

| Great Western Bank | 202 West Highway 38 Hartford, SD 57033 | Full Service B&M | $50,554 |

| Great Western Bank | 203 South 25th Street Bethany, MO 64424 | Full Service B&M | $15,229 |

| Great Western Bank | 205 E Erie Missouri Valley, IA 51555 | Full Service B&M | $10,003 |

| Great Western Bank | 205 W. 2nd Street Cedar Falls, IA 50613 | Full Service B&M | $49,957 |

| Great Western Bank | 206 Broad Street Humeston, IA 50123 | Full Service B&M | $24,827 |

| Great Western Bank | 209 South Main Street Lennox, SD 57039 | Full Service B&M | $22,293 |

| Great Western Bank | 210 North West Avenue Crooks, SD 57020 | Full Service B&M | $35,090 |

| Great Western Bank | 2100 Commerce Red Oak, IA 51566 | Full Service B&M | $60,769 |

| Great Western Bank | 2100 Main Street Longmont, CO 80501 | Full Service B&M | $60,827 |

| Great Western Bank | 211 West C Street Mccook, NE 69001 | Full Service B&M | $15,415 |

| Great Western Bank | 2110 Southeast Delaware Street Ankeny, IA 50021 | Full Service B&M | $138,032 |

| Great Western Bank | 2120 First Avenue Kearney, NE 68848 | Full Service B&M | $50,595 |

| Great Western Bank | 215 Union Boulevard, Suites 150 And 175 Lakewood, CO 80228 | Full Service B&M | $33,191 |

| Great Western Bank | 217 Main Street Mc Intosh, SD 57641 | Full Service B&M | $21,420 |

| Great Western Bank | 21783 Us 65 Princeton, MO 64673 | Full Service B&M | $38,283 |

| Great Western Bank | 2228 Main Street Unionville, MO 63565 | Full Service B&M | $15,904 |

| Great Western Bank | 224 West Wood Street Albany, MO 64402 | Full Service B&M | $35,090 |

| Great Western Bank | 225 S. Main Ave. Sioux Falls, SD 57104 | Full Service B&M | $657,003 |

| Great Western Bank | 2408 North Broadway Yankton, SD 57078 | Full Service B&M | $34,469 |

| Great Western Bank | 2695 North Park Drive, Ste. 101 Lafayette, CO 80026 | Full Service Retail | $29,104 |

| Great Western Bank | 2739 1st Avenue Se Cedar Rapids, IA 52402 | Full Service B&M | $31,427 |

| Great Western Bank | 2770 8th Street Southwest Altoona, IA 50009 | Full Service B&M | $69,318 |

| Great Western Bank | 2775 Pearl Street Boulder, CO 80302 | Full Service B&M | $48,087 |

| Great Western Bank | 2936 University Avenue Waterloo, IA 50701 | Full Service B&M | $37,010 |

| Great Western Bank | 3 East South Ridge Road Marshalltown, IA 50158 | Full Service B&M | $39,659 |

| Great Western Bank | 3002 North Campbell Avenue Tucson, AZ 85719 | Full Service B&M | $102,855 |

| Great Western Bank | 301 E Washington Clarinda, IA 51632 | Full Service B&M | $16,616 |

| Great Western Bank | 301 N Egan Ave Madison, SD 57042 | Full Service B&M | $82,990 |

| Great Western Bank | 3010 North 90th Street Omaha, NE 68134 | Full Service B&M | $27,867 |

| Great Western Bank | 302 Main Street Morristown, SD 57645 | Full Service B&M | $8,663 |

| Great Western Bank | 302 South Main Street Milbank, SD 57252 | Full Service B&M | $100,675 |

| Great Western Bank | 304 South Commerce Drive Prairie City, IA 50228 | Full Service B&M | $45,637 |

| Great Western Bank | 309 East Jefferson Corydon, IA 50060 | Full Service B&M | $50,134 |

| Great Western Bank | 316 South Duff Avenue Ames, IA 50010 | Full Service B&M | $147,361 |

| Great Western Bank | 321 Burlington Street Holdrege, NE 68949 | Limited, Drive-thru | $0 |

| Great Western Bank | 321 North Third Street Burlington, IA 52601 | Full Service B&M | $75,116 |

| Great Western Bank | 330 East Douglas Street O'neill, NE 68763 | Full Service B&M | $49,069 |

| Great Western Bank | 3410 N 27th Street Lincoln, NE 68521 | Full Service B&M | $24,518 |

| Great Western Bank | 35 1st Avenue, N.E Watertown, SD 57201 | Full Service B&M | $673,360 |

| Great Western Bank | 3510 West Sturgis Road Rapid City, SD 57701 | Full Service B&M | $33,509 |

| Great Western Bank | 3601 Minnesota Dr, Ste 170 Bloomington, MN 55435 | Full Service B&M | $18,784 |

| Great Western Bank | 3650 East 1st Avenue Denver, CO 80206 | Full Service B&M | $18,181 |

| Great Western Bank | 3705 Twincreek Drive Bellevue, NE 68123 | Full Service B&M | $33,968 |

| Great Western Bank | 3711 John F. Kennedy Parkway Fort Collins, CO 80521 | Full Service B&M | $354,474 |

| Great Western Bank | 3717 East 10th Street Sioux Falls, SD 57103 | Full Service B&M | $40,733 |

| Great Western Bank | 3800 East 15th Street Loveland, CO 80534 | Full Service B&M | $42,681 |

| Great Western Bank | 3939 Normal Boulevard Lincoln, NE 68506 | Full Service B&M | $24,659 |

| Great Western Bank | 400 Braasch Avenue Norfolk, NE 68702 | Full Service B&M | $23,915 |

| Great Western Bank | 401 Broad Avenue Stanton, IA 51573 | Full Service B&M | $27,718 |

| Great Western Bank | 401 Second Street Gladbrook, IA 50635 | Full Service B&M | $22,043 |

| Great Western Bank | 404 Lincoln Way Nevada, IA 50201 | Full Service B&M | $67,807 |

| Great Western Bank | 408 Hwy 77 Dell Rapids, SD 57022 | Full Service B&M | $37,840 |

| Great Western Bank | 4140 South 84th Street Omaha, NE 68127 | Full Service B&M | $71,870 |

| Great Western Bank | 4141 N. Scottsdale Road, Suite 101 Scottsdale, AZ 85251 | Full Service B&M | $72,271 |

| Great Western Bank | 423 Broad Street Story City, IA 50248 | Full Service B&M | $26,847 |

| Great Western Bank | 423 West 3rd Street Alliance, NE 69301 | Full Service B&M | $9,924 |

| Great Western Bank | 424 West Avenue Holdrege, NE 68949 | Full Service B&M | $58,321 |

| Great Western Bank | 4718 L Street Omaha, NE 68117 | Full Service B&M | $52,668 |

| Great Western Bank | 4800 South Cliff Avenue Sioux Falls, SD 57103 | Full Service B&M | $65,734 |

| Great Western Bank | 4901 W. 41st St. Sioux Falls, SD 57106 | Full Service B&M | $46,055 |

| Great Western Bank | 4914 North Cliff Avenue Sioux Falls, SD 57104 | Full Service B&M | $31,226 |

| Great Western Bank | 4th St & Poplar Freeman, SD 57029 | Full Service B&M | $38,206 |

| Great Western Bank | 5000 South Louise Avenue Sioux Falls, SD 57108 | Full Service B&M | $69,942 |

| Great Western Bank | 501 Pioneer Avenue Oakland, IA 51560 | Full Service B&M | $23,863 |

| Great Western Bank | 505 N Main Mobridge, SD 57601 | Full Service B&M | $41,927 |

| Great Western Bank | 509 W. Broadway Council Bluffs, IA 51503 | Full Service B&M | $63,853 |

| Great Western Bank | 510 Main Street Spearfish, SD 57783 | Full Service B&M | $70,886 |

| Great Western Bank | 5100 West 26th Street Sioux Falls, SD 57110 | Full Service B&M | $80,765 |

| Great Western Bank | 511 1st Avenue East Newton, IA 50208 | Full Service B&M | $50,348 |

| Great Western Bank | 520 North Pearl Street Milan, MO 63556 | Full Service B&M | $26,004 |

| Great Western Bank | 5202 W. 20th Sreet Greeley, CO 80634 | Full Service B&M | $52,992 |

| Great Western Bank | 5225 N. Academy Blvd. Suite 100 Colorado Springs, CO 80918 | Full Service B&M | $24,379 |

| Great Western Bank | 5300 South 56th Street Lincoln, NE 68516 | Full Service B&M | $24,465 |

| Great Western Bank | 550 North 155th Plaza Omaha, NE 68154 | Full Service B&M | $99,581 |

| Great Western Bank | 5533 South 27th Street, Suite 101 Lincoln, NE 68512 | Full Service B&M | $29,874 |

| Great Western Bank | 5675 26th Avenue South, Suite 156 Fargo, ND 58104 | Full Service B&M | $8,524 |

| Great Western Bank | 5720 West 120th Avenue Broomfield, CO 80020 | Full Service B&M | $40,302 |

| Great Western Bank | 6001 Northwest Radial Highway Omaha, NE 68104 | Full Service B&M | $104,497 |

| Great Western Bank | 608 North Linden Street Wahoo, NE 68066 | Full Service B&M | $22,359 |

| Great Western Bank | 610 - 4th Street Sully, IA 50251 | Full Service B&M | $27,302 |

| Great Western Bank | 610 West Mclane Osceola, IA 50213 | Full Service B&M | $48,367 |

| Great Western Bank | 635 North Arizona Boulevard Coolidge, AZ 85128 | Full Service B&M | $13,774 |

| Great Western Bank | 6424 Havelock Avenue Lincoln, NE 68507 | Full Service B&M | $19,965 |

| Great Western Bank | 655 Community Drive North Liberty, IA 52317 | Full Service B&M | $96,485 |

| Great Western Bank | 6945 A Street Lincoln, NE 68510 | Full Service B&M | $28,525 |

| Great Western Bank | 700 N. Burlington Hastings, NE 68901 | Full Service B&M | $75,560 |

| Great Western Bank | 700 North Webb Road Grand Island, NE 68803 | Full Service B&M | $37,588 |

| Great Western Bank | 700 West Thomas Avenue Shenandoah, IA 51601 | Full Service B&M | $16,897 |

| Great Western Bank | 712 N. Main Street Eloy, AZ 85131 | Full Service B&M | $28,607 |

| Great Western Bank | 714 South Burr Mitchell, SD 57301 | Full Service B&M | $36,746 |

| Great Western Bank | 7300 Graceland Drive Omaha, NE 68134 | Full Service B&M | $1,004 |

| Great Western Bank | 751 Mountain View Road Rapid City, SD 57709 | Full Service Retail | $21,143 |

| Great Western Bank | 785 Cheesman Street Erie, CO 80516 | Full Service B&M | $40,107 |

| Great Western Bank | 800 South Bridge Street Lexington, NE 68850 | Limited, Drive-thru | $0 |

| Great Western Bank | 8001 Metcalf Avenue, Suite 100 Overland Park, KS 66204 | Full Service B&M | $18,282 |

| Great Western Bank | 801 Main Street, Suite 130 Louisville, CO 80027 | Full Service B&M | $27,245 |

| Great Western Bank | 811 South Public Road Lafayette, CO 80026 | Full Service B&M | $91,063 |

| Great Western Bank | 825 Central Avenue Fort Dodge, IA 50501 | Full Service B&M | $182,136 |

| Great Western Bank | 8380 Old Cheney Road Lincoln, NE 68516 | Full Service B&M | $17,139 |

| Great Western Bank | 839 Gordon Drive Sioux City, IA 51101 | Full Service B&M | $56,948 |

| Great Western Bank | 900 Illinois Sidney, IA 51652 | Full Service B&M | $22,428 |

| Great Western Bank | 901 South D Street Broken Bow, NE 68822 | Full Service B&M | $33,543 |

| Great Western Bank | 919 Galvin Road Bellevue, NE 68005 | Full Service B&M | $141,024 |

| Great Western Bank | 9290 West Dodge Road, Suite 101 Omaha, NE 68114 | Full Service B&M | $643,664 |

| Great Western Bank | Highways 212 And 81 Watertown, SD 57201 | Full Service B&M | $42,109 |

| Great Western Bank | Sixth And Lincoln Streets Lexington, NE 68850 | Limited, Drive-thru | $0 |

| Great Western Bank | State And Williams Streets Atkinson, NE 68713 | Full Service B&M | $46,291 |

For 2020, Great Western Bank had 176 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $478,429 |

| Net interest income | $426,979 |

| Total noninterest income | $-21,783 |

| Gross Fiduciary activities income | $8,631 |

| Service charges on deposit accounts | $18,441 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $-48,855 |

| Pre-tax net operating income | $-704,452 |

| Securities gains (or losses, -) | $7,890 |

| Income before extraordinary items | $-670,738 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $-670,738 |

| Minority interest net income | $0 |

| Net income | $-670,738 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $-678,312 |

Great Western Bank's gross interest income from loans was $478,429,000.

Great Western Bank's net interest income from loans was $426,979,000.

Great Western Bank's fee based income from loans was $18,441,000.

Great Western Bank's net income from loans was $-670,738,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $51,450 |

| Provision for credit losses | $122,265 |

| Total noninterest expense | $987,383 |

| Salaries and employee benefits | $145,844 |

| Premises and equipment expense | $23,420 |

| Additional noninterest expense | $818,119 |

| Applicable income taxes | $-25,824 |

| Net charge-offs | $63,541 |

| Cash dividends | $37,194 |

Great Western Bank's interest expense for loans was $51,450,000.

Great Western Bank's payroll and benefits expense were $145,844,000.

Great Western Bank's property, plant and equipment expenses $23,420,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 3.0% |

| Real Estate loans | 2.0% |

| Construction & Land Development loans | 2.0% |

| Nonfarm, nonresidential loans | 1.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 1.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.4% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $11,407,422 |

| Deposits held in domestic offices | $11,407,422 |

| Deposits by Individuals, partnerships, and corporations | $10,098,797 |

| Deposits by U.S. Government | $0 |

| Deposits by States and political subdivisions in the U.S. | $1,306,619 |

| Deposits by Commercial banks and other depository institutions in U.S. | $2,006 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $1,036,073 |

| Demand deposits | $1,036,073 |

| Nontransaction accounts | $10,371,349 |

| Money market deposit accounts (MMDAs) | $4,157,803 |

| Other savings deposits (excluding MMDAs) | $5,134,967 |

| Total time deposits | $1,078,579 |

| Total time and savings deposits | $10,371,349 |

| Noninterest-bearing deposits | $2,919,839 |

| Interest-bearing deposits | $8,487,583 |

| Retail deposits | $10,862,270 |

| IRAs and Keogh plan accounts | $134,380 |

| Brokered deposits | $261,518 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $12,809,603 |

| Cash & Balances due from depository institutions | $1,061,796 |

| Interest-bearing balances | $833,746 |

| Total securities | $2,059,997 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $9,209,082 |

| Loan and leases loss allowance | $308,794 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $139,502 |

| Other real estate owned | $18,085 |

| Goodwill and other intangibles | $6,967 |

| All other assets | $314,174 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $12,809,603 |

| Total Liabilities | $11,672,937 |

| Total deposits | $11,407,422 |

| Interest-bearing deposits | $8,487,583 |

| Deposits held in domestic offices | $11,407,422 |

| % insured (estimated) | $62 |

| Federal funds purchased and repurchase agreements | $80,355 |

| Trading liabilities | $0 |

| Other borrowed funds | $120,000 |

| Subordinated debt | $0 |

| All other liabilities | $65,160 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $9,209,082 |

| Loan and leases loss allowance | $308,794 |

| Total loans and leases (domestic) | $9,517,876 |

| All real estate loans | $6,017,735 |

| Real estate loans in domestic offices | $6,017,735 |

| Construction and development loans | $482,991 |

| Residential 1-4 family construction | $86,093 |

| Other construction, all land development and other land | $396,898 |

| Loans secured by nonfarm nonresidential properties | $3,582,377 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,308,652 |

| Commercial real estate & other non-farm, non-residential | $2,273,725 |

| Multifamily residential real estate | $474,420 |

| 1-4 family residential loans | $703,724 |

| Farmland loans | $774,223 |

| Loans held in foreign offices | $0 |

| Farm loans | $861,538 |

| Commercial and industrial loans | $1,693,848 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $46,869 |

| Credit card loans | $13,162 |

| Related Plans | $8,594 |

| Consumer Auto Loans | $16,056 |

| Other loans to individuals | $9,057 |

| All other loans & leases | $927,059 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $159,735 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $0 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $31,083 |

| Non 1-4 family restructured loans & leases | $30,813 |

| Total loans and leases (foreign) | $0 |

Great Western Bank had $9,209,082,000 of loans outstanding in 2020. $6,017,735,000 of loans were in real estate loans. $482,991,000 of loans were in development loans. $474,420,000 of loans were in multifamily mortgage loans. $703,724,000 of loans were in 1-4 family mortgage loans. $861,538,000 of loans were in farm loans. $13,162,000 of loans were in credit card loans. $16,056,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 1,881 | $464,295 | $246,834 |

| Nonfarm, nonresidential loans - <$100k | 414 | $15,872 | $38,338 |

| Nonfarm, nonresidential loans - $100-250k | 601 | $76,152 | $126,709 |

| Nonfarm, nonresidential loans - $250k-1MM | 866 | $372,271 | $429,874 |

| Commercial & Industrial, US addressed loans - <$1MM | 7,428 | $700,151 | $94,258 |

| Commercial & Industrial, US addressed loans - <$100k | 5,159 | $138,088 | $26,766 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,213 | $158,088 | $130,328 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,056 | $403,975 | $382,552 |

| Farmland loans - <$1MM | 1,329 | $164,122 | $123,493 |

| Farmland loans - <$100k | 515 | $19,262 | $37,402 |

| Farmland loans - $100-250k | 531 | $67,570 | $127,250 |

| Farmland loans - $250k-1MM | 283 | $77,290 | $273,110 |

| Agriculture operations loans - <$1MM | 2,559 | $167,098 | $65,298 |

| Agriculture operations loans - <$100k | 1,816 | $45,136 | $24,855 |

| Agriculture operations loans - $100-250k | 466 | $53,164 | $114,086 |

| Agriculture operations loans - $250k-1MM | 277 | $68,798 | $248,368 |