Columbia State Bank Mortgage Rates, Fees & Info

Tacoma, WALEI: 0S8H5NJFLHEVJXVTQ413

Tax ID: 91-0897063

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Columbia State Bank is a smaller bank specializing in Refi and Home Purchase loans. Columbia State Bank has a high proportion of conventional loans. Their top markets by origination volume include: Seattle, Portland, Salem, Spokane, and Bend among others. We have data for 78 markets. (Some data included below & more in-depth data is available with an active subscription.)Columbia State Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Columbia State Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

Originations

2,047Origination Dollar Volume (All Markets)

$792,085,000Employee count

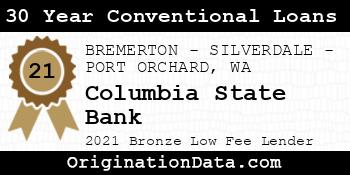

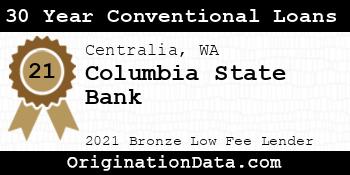

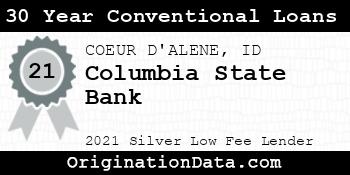

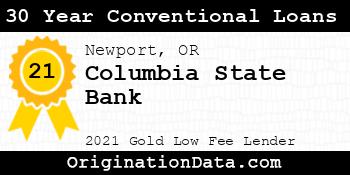

2,144 Show all (11) awardsColumbia State Bank - 2021

Columbia State Bank is a 2021 , due to their low .

For 2021, less than of lenders were eligible for this award.

Work for Columbia State Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 642 | $258,730,000 | $403,006 | $4,529 | 3.03% |

| PORTLAND-VANCOUVER-HILLSBORO, OR-WA (FHA|USDA|VA) | 263 | $134,095,000 | $509,867 | $4,352 | 3.09% |

| Outside of Metro Areas | 122 | $40,730,000 | $333,852 | $4,927 | 3.06% |

| SALEM, OR (FHA|USDA|VA) | 120 | $29,890,000 | $249,083 | $4,153 | 3.14% |

| SPOKANE-SPOKANE VALLEY, WA (FHA|USDA|VA) | 48 | $26,140,000 | $544,583 | $3,831 | 3.03% |

| BEND, OR (FHA|USDA|VA) | 51 | $21,705,000 | $425,588 | $6,125 | 3.12% |

| EUGENE-SPRINGFIELD, OR (FHA|USDA|VA) | 67 | $20,635,000 | $307,985 | $4,457 | 3.09% |

| BREMERTON-SILVERDALE-PORT ORCHARD, WA (FHA|USDA|VA) | 68 | $19,920,000 | $292,941 | $3,822 | 2.94% |

| Outside of Metro Areas | 61 | $18,555,000 | $304,180 | $4,358 | 2.99% |

| Sandpoint, ID (FHA|USDA|VA) | 53 | $17,075,000 | $322,170 | $4,992 | 3.09% |

| LONGVIEW, WA (FHA|USDA|VA) | 30 | $16,550,000 | $551,667 | $3,928 | 3.09% |

| Ontario, OR-ID (FHA|USDA|VA) | 27 | $13,425,000 | $497,222 | $4,198 | 3.04% |

| Newport, OR (FHA|USDA|VA) | 49 | $12,685,000 | $258,878 | $4,191 | 3.04% |

| Astoria, OR (FHA|USDA|VA) | 23 | $11,525,000 | $501,087 | $4,196 | 3.17% |

| OLYMPIA-LACEY-TUMWATER, WA (FHA|USDA|VA) | 35 | $11,345,000 | $324,143 | $4,082 | 3.07% |

| CHICO, CA (FHA|USDA|VA) | 1 | $10,375,000 | $10,375,000 | $0 | 4.00% |

| Hermiston-Pendleton, OR (FHA|USDA|VA) | 33 | $8,495,000 | $257,424 | $4,781 | 3.08% |

| Coos Bay, OR (FHA|USDA|VA) | 2 | $8,230,000 | $4,115,000 | $5,412 | 3.50% |

| MOUNT VERNON-ANACORTES, WA (FHA|USDA|VA) | 27 | $7,845,000 | $290,556 | $4,170 | 2.97% |

| BOISE CITY, ID (FHA|USDA|VA) | 24 | $6,730,000 | $280,417 | $5,013 | 3.08% |

| BELLINGHAM, WA (FHA|USDA|VA) | 20 | $6,590,000 | $329,500 | $3,572 | 3.12% |

| Pullman, WA (FHA|USDA|VA) | 17 | $6,565,000 | $386,176 | $3,518 | 3.47% |

| KENNEWICK-RICHLAND, WA (FHA|USDA|VA) | 27 | $6,315,000 | $233,889 | $4,065 | 3.33% |

| ALBANY-LEBANON, OR (FHA|USDA|VA) | 12 | $5,630,000 | $469,167 | $5,132 | 3.15% |

| Centralia, WA (FHA|USDA|VA) | 19 | $5,355,000 | $281,842 | $3,582 | 2.96% |

| SANTA ROSA-PETALUMA, CA (FHA|USDA|VA) | 3 | $5,105,000 | $1,701,667 | $13,722 | 3.88% |

| LEWISTON, ID-WA (FHA|USDA|VA) | 22 | $4,750,000 | $215,909 | $4,599 | 3.06% |

| YAKIMA, WA (FHA|USDA|VA) | 20 | $4,750,000 | $237,500 | $3,540 | 3.04% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 10 | $4,480,000 | $448,000 | $5,604 | 3.04% |

| Ellensburg, WA (FHA|USDA|VA) | 9 | $4,175,000 | $463,889 | $4,145 | 3.11% |

| Moses Lake, WA (FHA|USDA|VA) | 9 | $3,795,000 | $421,667 | $3,226 | 3.39% |

| MEDFORD, OR (FHA|USDA|VA) | 3 | $3,235,000 | $1,078,333 | $7,245 | 3.50% |

| WENATCHEE, WA (FHA|USDA|VA) | 7 | $3,085,000 | $440,714 | $4,191 | 3.26% |

| Hood River, OR (FHA|USDA|VA) | 12 | $2,740,000 | $228,333 | $3,630 | 2.68% |

| The Dalles, OR (FHA|USDA|VA) | 12 | $2,740,000 | $228,333 | $4,914 | 3.08% |

| CORVALLIS, OR (FHA|USDA|VA) | 7 | $1,925,000 | $275,000 | $3,875 | 3.70% |

| Oak Harbor, WA (FHA|USDA|VA) | 5 | $1,915,000 | $383,000 | $5,722 | 2.98% |

| RIVERSIDE-SAN BERNARDINO-ONTARIO, CA (FHA|USDA|VA) | 4 | $1,650,000 | $412,500 | $5,121 | 3.12% |

| Klamath Falls, OR (FHA|USDA|VA) | 5 | $1,595,000 | $319,000 | $4,512 | 3.00% |

| La Grande, OR (FHA|USDA|VA) | 2 | $1,590,000 | $795,000 | $8,922 | 3.73% |

| Moscow, ID (FHA|USDA|VA) | 7 | $1,565,000 | $223,571 | $4,917 | 2.84% |

| Shelton, WA (FHA|USDA|VA) | 7 | $1,415,000 | $202,143 | $3,422 | 2.73% |

| WALLA WALLA, WA (FHA|USDA|VA) | 3 | $1,265,000 | $421,667 | $4,088 | 3.41% |

| Othello, WA (FHA|USDA|VA) | 11 | $1,225,000 | $111,364 | $4,029 | 3.00% |

| SACRAMENTO-ROSEVILLE-FOLSOM, CA (FHA|USDA|VA) | 3 | $1,195,000 | $398,333 | $3,696 | 3.63% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 1 | $925,000 | $925,000 | $0 | 3.75% |

| Roseburg, OR (FHA|USDA|VA) | 4 | $910,000 | $227,500 | $3,550 | 2.72% |

| Aberdeen, WA (FHA|USDA|VA) | 3 | $885,000 | $295,000 | $5,324 | 3.41% |

| Prineville, OR (FHA|USDA|VA) | 3 | $875,000 | $291,667 | $4,035 | 2.87% |

| REDDING, CA (FHA|USDA|VA) | 2 | $730,000 | $365,000 | $2,299 | 3.38% |

| DAYTON-KETTERING, OH (FHA|USDA|VA) | 2 | $640,000 | $320,000 | $7,012 | 3.06% |

| CASPER, WY (FHA|USDA|VA) | 1 | $595,000 | $595,000 | $3,690 | 3.25% |

| SAN DIEGO-CHULA VISTA-CARLSBAD, CA (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $5,418 | 2.63% |

| Helena, MT (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $4,322 | 3.38% |

| Port Angeles, WA (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $3,137 | 3.00% |

| DULUTH, MN-WI (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $3,262 | 3.50% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $0 | 4.10% |

| Red Bluff, CA (FHA|USDA|VA) | 2 | $380,000 | $190,000 | $5,290 | 3.63% |

| Cedar City, UT (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $4,060 | 3.38% |

| VISALIA, CA (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $2,498 | 2.50% |

| BEAUMONT-PORT ARTHUR, TX (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $3,435 | 2.63% |

| TOLEDO, OH (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $4,001 | 3.38% |

| Grand Rapids, MN (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $4,077 | 3.25% |

| TUCSON, AZ (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $4,902 | 3.13% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $6,496 | 3.38% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,440 | 3.25% |

| MISSOULA, MT (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $5,557 | 3.75% |

| Los Angeles-Long Beach-Anaheim, CA (FHA|USDA|VA) | 1 | $265,000 | $265,000 | $7,398 | 3.63% |

| EL CENTRO, CA (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $3,585 | 3.38% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $4,111 | 2.99% |

| CEDAR RAPIDS, IA (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,214 | 3.25% |

| El Dorado, AR (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,426 | 2.88% |

| Hailey, ID (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,655 | 2.75% |

| New York-Newark-Jersey City, NY-NJ-PA (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $5,389 | 2.88% |

| STOCKTON, CA (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $4,849 | 3.00% |

| CLEVELAND-ELYRIA, OH (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $3,396 | 2.88% |

| KAHULUI-WAILUKU-LAHAINA, HI (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $0 | 4.25% |

| TWIN FALLS, ID (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $0 | 2.75% |

Similar Lenders

We use machine learning to identify the top lenders compared against Columbia State Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 86

Similarity Rank: 249

Similarity Rank: 360

Similarity Rank: 384

Similarity Rank: 447

Similarity Rank: 660

Similarity Rank: 748

Similarity Rank: 750

Similarity Rank: 840

Similarity Rank: 999

Product Mix

For 2021, Columbia State Bank's most frequently originated type of loan was Conventional, with 1,299 originations. Their 2nd most popular type was HELOC, with 713 originations.

Loan Reason

For 2021, Columbia State Bank's most frequently cited loan purpose was Refi, with 593 originations. The 2nd most popular reason was Cash Out Refi, with 436 originations.

Loan Duration/Length

For 2021, Columbia State Bank's most frequently cited loan duration was 30 Year, with 899 originations. The 2nd most popular length was Other, with 720 originations.

Origination Fees/Closing Costs

Columbia State Bank's average total fees were $4,583, while their most frequently occuring range of origination fees (closing costs) were in the $1k-2k bucket, with 871 originations.

Interest Rates

| Loan Rate | Originations | Total Value | Average Loan |

|---|---|---|---|

| 2.5-3% | 1,136 | $356,850,000 | $314,129 |

| 3-4% | 639 | $345,695,000 | $540,994 |

| <2.5% | 153 | $42,195,000 | $275,784 |

| 4-5% | 118 | $47,060,000 | $398,814 |

| 5-6% | 1 | $285,000 | $285,000 |

During 2021, Columbia State Bank's average interest rate for loans was 3.10%, while their most frequently originated rate bucket for loans was 2.5-3%, with 1,136 originations.

Loan Sizing

2021 saw Columbia State Bank place emphasis on $200k-400k loans with 764 originations, totaling $217,740,000 in origination value.

Applicant Income

Columbia State Bank lent most frequently to those with incomes in the $100k-150k range, with 429 originations. The second most popular income band? $50k-75k, with 324 originations.

Applicant Debt to Income Ratio

Columbia State Bank lent most frequently to those with DTI ratios of 20-30%, with 418 originations. The next most common DTI ratio? 30-36%, with 315 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications77.83%

Columbia State Bank has a below average approval rate.

Pick Rate

Approvals leading to origination83.73%

Columbia State Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 2,047 | $792,085,000 | $386,949 |

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2021 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| COLUMBIA BANKING SYSTEM, INC. | Conventional home mortgage | Trouble during payment process | 1 | 50.0% |

| COLUMBIA BANKING SYSTEM, INC. | Other type of mortgage | Trouble during payment process | 1 | 50.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Columbia State Bank | 10 N. 5th Avenue Yakima, WA 98902 | Full Service B&M | $46,367 |

| Columbia State Bank | 1000 Southwest Broadway, Suite 100 Portland, OR 97205 | Full Service B&M | $283,824 |

| Columbia State Bank | 101 E. 6th Street Ste 100 Vancouver, WA 98660 | Full Service B&M | $320,697 |

| Columbia State Bank | 101 S. Portage Ave Mattawa, WA 99349 | Full Service B&M | $46,688 |

| Columbia State Bank | 10100 Silverdale Way Nw Silverdale, WA 98383 | Full Service B&M | $72,660 |

| Columbia State Bank | 1011 Harlow Road Ste 101 Springfield, OR 97477 | Full Service B&M | $150,173 |

| Columbia State Bank | 10321 Canyon Road East Puyallup, WA 98373 | Full Service B&M | $116,990 |

| Columbia State Bank | 1033 S Hwy 395 Hermiston, OR 97838 | Full Service B&M | $95,408 |

| Columbia State Bank | 10350 Ne 10th Street Bellevue, WA 98004 | Full Service B&M | $167,595 |

| Columbia State Bank | 10355 Nw Glencoe Road, Suite 100 North Plains, OR 97133 | Full Service B&M | $82,080 |

| Columbia State Bank | 1060 Wallace Road Nw Salem, OR 97304 | Full Service B&M | $63,187 |

| Columbia State Bank | 1100 Olive Way, Suite 102 Seattle, WA 98101 | Full Service B&M | $271,886 |

| Columbia State Bank | 111 West 7th Avenue Eugene, OR 97401 | Full Service B&M | $282,564 |

| Columbia State Bank | 111 West Seventh Ave Eugene, OR 97401 | Limited, Administrative | $0 |

| Columbia State Bank | 1110 112th Avenue Ne, Suite 200 Bellevue, WA 98004 | Full Service B&M | $645,796 |

| Columbia State Bank | 11102 Evergreen Way Everett, WA 98204 | Full Service B&M | $40,125 |

| Columbia State Bank | 1122 Duane Street Astoria, OR 97103 | Full Service B&M | $104,742 |

| Columbia State Bank | 113 Main Avenue West Twin Falls, ID 83301 | Full Service B&M | $27,871 |

| Columbia State Bank | 1133 N. Evergreen Road Woodburn, OR 97071 | Full Service B&M | $69,683 |

| Columbia State Bank | 11675 Southwest Pacific Highway Tigard, OR 97223 | Full Service B&M | $51,044 |

| Columbia State Bank | 1207 Nw Glisan Portland, OR 97209 | Full Service B&M | $43,181 |

| Columbia State Bank | 1225 Washington Way Longview, WA 98632 | Full Service B&M | $89,880 |

| Columbia State Bank | 12255 Southwest First Street Beaverton, OR 97005 | Full Service B&M | $170,112 |

| Columbia State Bank | 1250 Meridian Street East Milton, WA 98354 | Full Service B&M | $109,386 |

| Columbia State Bank | 12812 N Addison St Spokane, WA 99218 | Full Service B&M | $28,111 |

| Columbia State Bank | 1301 A St Tacoma, WA 98402 | Full Service B&M | $1,283,080 |

| Columbia State Bank | 13305 Ne Highway 99, Suite 6 Vancouver, WA 98686 | Full Service B&M | $65,283 |

| Columbia State Bank | 139 Gage Boulevard Richland, WA 99352 | Full Service B&M | $51,193 |

| Columbia State Bank | 1450 High Street Eugene, OR 97401 | Full Service B&M | $114,782 |

| Columbia State Bank | 1455 Se First Avenue Canby, OR 97013 | Full Service B&M | $147,007 |

| Columbia State Bank | 150 West Ellendale Avenue Dallas, OR 97338 | Full Service B&M | $53,534 |

| Columbia State Bank | 1501 54th Ave East Fife, WA 98424 | Full Service B&M | $63,489 |

| Columbia State Bank | 1502 Sw Odem Medo Road Redmond, OR 97756 | Full Service B&M | $54,589 |

| Columbia State Bank | 15104 Main St E Sumner, WA 98390 | Full Service B&M | $56,697 |

| Columbia State Bank | 15820 Se Happy Valley Town Center Dr Happy Valley, OR 97086 | Full Service B&M | $59,838 |

| Columbia State Bank | 160 E. Charles St Mount Angel, OR 97362 | Full Service B&M | $36,790 |

| Columbia State Bank | 16200 Redmond Way Redmond, WA 98052 | Full Service B&M | $127,952 |

| Columbia State Bank | 167 Lincoln Avenue Snohomish, WA 98290 | Full Service B&M | $58,307 |

| Columbia State Bank | 1701 Northeast Third Street Bend, OR 97701 | Full Service B&M | $32,498 |

| Columbia State Bank | 17208 Meridian E Puyallup, WA 98375 | Full Service B&M | $102,114 |

| Columbia State Bank | 175 N. 16th Street Payette, ID 83661 | Full Service B&M | $72,182 |

| Columbia State Bank | 17502 Pacific Avenue Spanaway, WA 98387 | Full Service B&M | $108,531 |

| Columbia State Bank | 1755 Mount Hood Avenue Suite 120 Woodburn, OR 97071 | Full Service B&M | $85,607 |

| Columbia State Bank | 1800 Wilco Rd Stayton, OR 97383 | Full Service B&M | $212,544 |

| Columbia State Bank | 1806 3rd Street Tillamook, OR 97141 | Full Service B&M | $26,468 |

| Columbia State Bank | 1810 Everett Ave Everett, WA 98201 | Full Service B&M | $61,255 |

| Columbia State Bank | 190 N. 8th Street Boise, ID 83702 | Full Service B&M | $5,151 |

| Columbia State Bank | 19500 Highway 2 Monroe, WA 98272 | Full Service B&M | $40,673 |

| Columbia State Bank | 19550 Molalla Avenue, Suite 139 Oregon City, OR 97045 | Full Service B&M | $41,714 |

| Columbia State Bank | 1959 S Union Ave Tacoma, WA 98405 | Full Service B&M | $165,740 |

| Columbia State Bank | 19925 State Route 410 E Bonney Lake, WA 98391 | Full Service B&M | $59,672 |

| Columbia State Bank | 200 East Main Street Monmouth, OR 97361 | Full Service B&M | $50,977 |

| Columbia State Bank | 200 W Neider Ave Coeur D Alene, ID 83815 | Limited, Trust Office | $0 |

| Columbia State Bank | 200 W. Neider Avenue Coeur D Alene, ID 83814 | Full Service B&M | $58,166 |

| Columbia State Bank | 201 S. Main Street Colfax, WA 99111 | Full Service B&M | $90,098 |

| Columbia State Bank | 201 South 84th Street Tacoma, WA 98444 | Full Service B&M | $58,223 |

| Columbia State Bank | 201 West Main Avenue Ritzville, WA 99169 | Full Service B&M | $42,229 |

| Columbia State Bank | 20148 10th Avenue Ne, Suite B Poulsbo, WA 98370 | Full Service Retail | $51,478 |

| Columbia State Bank | 202 West Main Street Goldendale, WA 98620 | Full Service B&M | $60,758 |

| Columbia State Bank | 2041 Auburn Way North Auburn, WA 98002 | Full Service B&M | $101,045 |

| Columbia State Bank | 208 High School Road Ne Bainbridge Island, WA 98110 | Full Service B&M | $40,791 |

| Columbia State Bank | 2101 Sw Court Place Pendleton, OR 97801 | Full Service B&M | $65,753 |

| Columbia State Bank | 211 East Holly Street Bellingham, WA 98225 | Full Service B&M | $66,430 |

| Columbia State Bank | 2200 North 30th Street Tacoma, WA 98403 | Full Service B&M | $91,670 |

| Columbia State Bank | 2212 Nw 56th St, Suite 102 Seattle, WA 98107 | Full Service B&M | $14,766 |

| Columbia State Bank | 228 Bravo Terrace Port Orchard, WA 98367 | Full Service B&M | $48,732 |

| Columbia State Bank | 2307 Olympic Highway North Shelton, WA 98584 | Full Service B&M | $72,516 |

| Columbia State Bank | 233 Bridge Street Clarkston, WA 99403 | Full Service B&M | $39,748 |

| Columbia State Bank | 23924 225th Way Se Maple Valley, WA 98038 | Full Service B&M | $87,727 |

| Columbia State Bank | 2400 West 11th Avenue Eugene, OR 97402 | Full Service B&M | $64,523 |

| Columbia State Bank | 2401 Mildred St. West Fircrest, WA 98466 | Full Service B&M | $252,346 |

| Columbia State Bank | 24341 N Hwy 101 Hoodsport, WA 98548 | Full Service B&M | $29,123 |

| Columbia State Bank | 249 Winslow Way East Bainbridge Island, WA 98110 | Full Service B&M | $128,847 |

| Columbia State Bank | 25 Division Avenue Eugene, OR 97404 | Full Service B&M | $47,160 |

| Columbia State Bank | 255 Coburg Road Eugene, OR 97401 | Full Service B&M | $49,361 |

| Columbia State Bank | 2650 Cascade Avenue Hood River, OR 97031 | Full Service B&M | $189,033 |

| Columbia State Bank | 26563 Lindvog Road Ne Kingston, WA 98346 | Full Service B&M | $33,999 |

| Columbia State Bank | 2690 E. Lincoln Avenue Sunnyside, WA 98944 | Full Service B&M | $70,345 |

| Columbia State Bank | 2755 Pence Loop Se Salem, OR 97302 | Limited, Administrative | $0 |

| Columbia State Bank | 2820 Harrison Ave Nw Olympia, WA 98502 | Full Service B&M | $288,791 |

| Columbia State Bank | 285 West Sixth Street Junction, OR 97448 | Full Service B&M | $32,310 |

| Columbia State Bank | 290 Nw Chehalis Avenue Chehalis, WA 98532 | Full Service B&M | $155,649 |

| Columbia State Bank | 29702 Southwest Town Center Loop West Wilsonville, OR 97070 | Full Service B&M | $69,059 |

| Columbia State Bank | 300 Kootenai Cut Off Road Ponderay, ID 83852 | Full Service B&M | $43,424 |

| Columbia State Bank | 3006 Judson Street, Suite 101 Gig Harbor, WA 98335 | Full Service B&M | $64,029 |

| Columbia State Bank | 301 Avenue A Seaside, OR 97138 | Full Service B&M | $69,279 |

| Columbia State Bank | 302 W. Cameron Avenue Kellogg, ID 83837 | Full Service B&M | $23,966 |

| Columbia State Bank | 303 Union Avenue Southeast Olympia, WA 98501 | Full Service B&M | $448,690 |

| Columbia State Bank | 310 Southeast Washington Street Hillsboro, OR 97123 | Full Service B&M | $104,932 |

| Columbia State Bank | 315 East Main Street Silverton, OR 97381 | Full Service B&M | $106,692 |

| Columbia State Bank | 316 East Third Street The Dalles, OR 97058 | Full Service B&M | $152,641 |

| Columbia State Bank | 3235 E Mullan Ave Post Falls, ID 83854 | Full Service B&M | $24,712 |

| Columbia State Bank | 3305 Commercial Street Se Salem, OR 97302 | Full Service B&M | $118,198 |

| Columbia State Bank | 333 Sw 7th St Renton, WA 98057 | Full Service B&M | $44,362 |

| Columbia State Bank | 33515 9th Avenue S. Federal Way, WA 98003 | Full Service B&M | $79,556 |

| Columbia State Bank | 3500 Portland Rd Newberg, OR 97132 | Full Service B&M | $104,672 |

| Columbia State Bank | 390 Ne Tohomish St White Salmon, WA 98672 | Full Service B&M | $66,188 |

| Columbia State Bank | 401 East Main Street Molalla, OR 97038 | Full Service B&M | $92,889 |

| Columbia State Bank | 401 East Third Street Suite 200 The Dalles, OR 97058 | Limited, Administrative | $0 |

| Columbia State Bank | 404 North West Avenue Arlington, WA 98223 | Full Service B&M | $23,805 |

| Columbia State Bank | 4101 A Street Auburn, WA 98002 | Full Service B&M | $65,323 |

| Columbia State Bank | 4110 Pacific Avenue Forest Grove, OR 97116 | Full Service B&M | $74,306 |

| Columbia State Bank | 414 Church Street Sandpoint, ID 83864 | Full Service B&M | $200,442 |

| Columbia State Bank | 4157 North Highway 101, Suite 135 Lincoln City, OR 97367 | Full Service B&M | $58,340 |

| Columbia State Bank | 4220 S. Meridian Puyallup, WA 98373 | Full Service B&M | $195,331 |

| Columbia State Bank | 425 Northwest Hemlock Waldport, OR 97394 | Full Service B&M | $52,622 |

| Columbia State Bank | 4260 River Road, North Keizer, OR 97303 | Full Service B&M | $81,951 |

| Columbia State Bank | 440 E. Main Street Weiser, ID 83672 | Full Service B&M | $68,940 |

| Columbia State Bank | 4725 Road 68 Pasco, WA 99301 | Full Service B&M | $50,758 |

| Columbia State Bank | 473 Nw Burnside Rd Gresham, OR 97030 | Full Service B&M | $43,711 |

| Columbia State Bank | 4805 Sw 77th Avenue Portland, OR 97225 | Full Service B&M | $29,108 |

| Columbia State Bank | 500 Cherry Heights Road The Dalles, OR 97058 | Full Service B&M | $36,513 |

| Columbia State Bank | 500 W Main Street Walla Walla, WA 99362 | Full Service B&M | $34,950 |

| Columbia State Bank | 5000 Meadows Road Lake Oswego, OR 97035 | Full Service B&M | $161,298 |

| Columbia State Bank | 501 Roosevelt Avenue East Enumclaw, WA 98022 | Full Service B&M | $176,399 |

| Columbia State Bank | 504 West Meeker Street Kent, WA 98032 | Full Service B&M | $127,392 |

| Columbia State Bank | 505 W Riverside Ave, Ste 100 Spokane, WA 99201 | Full Service B&M | $75,367 |

| Columbia State Bank | 506 S 10th Avenue Caldwell, ID 83605 | Full Service B&M | $59,140 |

| Columbia State Bank | 506 Southwest Coast Highway Newport, OR 97365 | Full Service B&M | $123,454 |

| Columbia State Bank | 5083 Ne 122nd Ave Portland, OR 97230 | Full Service B&M | $72,817 |

| Columbia State Bank | 510 Lancaster Drive Ne Salem, OR 97301 | Full Service B&M | $111,650 |

| Columbia State Bank | 521 12th Avenue South Nampa, ID 83651 | Full Service B&M | $89,322 |

| Columbia State Bank | 5303 Point Fosdick Drive, N.W. Gig Harbor, WA 98335 | Full Service B&M | $229,975 |

| Columbia State Bank | 541 Northwest Highway 101 Depoe Bay, OR 97341 | Full Service B&M | $40,245 |

| Columbia State Bank | 550 Center Street Ne Salem, OR 97301 | Full Service B&M | $181,245 |

| Columbia State Bank | 5727 N 21st Street Tacoma, WA 98406 | Full Service B&M | $121,834 |

| Columbia State Bank | 601 North 1st Street Tacoma, WA 98403 | Full Service B&M | $61,890 |

| Columbia State Bank | 605 East Main Street Othello, WA 99344 | Full Service B&M | $64,694 |

| Columbia State Bank | 6202 Mount Tacoma Drive Sw Lakewood, WA 98499 | Full Service B&M | $188,447 |

| Columbia State Bank | 624 Southwest Fourth Street Madras, OR 97741 | Full Service B&M | $145,123 |

| Columbia State Bank | 630 Se Marlin Avenue Warrenton, OR 97146 | Full Service B&M | $39,863 |

| Columbia State Bank | 6552 Highway 2 Priest River, ID 83856 | Full Service B&M | $50,219 |

| Columbia State Bank | 665 Woodland Square Loop Southeast Lacey, WA 98503 | Full Service B&M | $126,487 |

| Columbia State Bank | 6750 Main Street Bonners Ferry, ID 83805 | Full Service B&M | $60,923 |

| Columbia State Bank | 6878 West Hwy 53 Rathdrum, ID 83858 | Full Service B&M | $40,412 |

| Columbia State Bank | 7111 Sw Nyberg St Tualatin, OR 97062 | Full Service B&M | $121,192 |

| Columbia State Bank | 715 Laneda Avenue Manzanita, OR 97130 | Full Service B&M | $51,360 |

| Columbia State Bank | 717 Ne Grand Ave Portland, OR 97232 | Full Service B&M | $137,122 |

| Columbia State Bank | 721 Second Avenue Seattle, WA 98104 | Full Service B&M | $447,565 |

| Columbia State Bank | 723 Haggen Dr, P.O. Box 805 Burlington, WA 98233 | Full Service B&M | $37,338 |

| Columbia State Bank | 723 Ne Baker Mcminnville, OR 97128 | Full Service B&M | $124,796 |

| Columbia State Bank | 746 Main Street Gooding, ID 83330 | Full Service B&M | $23,916 |

| Columbia State Bank | 7500 Ne 117th Ave Vancouver, WA 98662 | Full Service B&M | $38,855 |

| Columbia State Bank | 782 Goerig Street Woodland, WA 98674 | Full Service B&M | $90,428 |

| Columbia State Bank | 795 Southeast Bishop Boulevard Pullman, WA 99163 | Full Service B&M | $40,290 |

| Columbia State Bank | 805 Nw Bond St Bend, OR 97701 | Full Service B&M | $90,330 |

| Columbia State Bank | 8805 Sw Tualatin-Sherwood Rd Tualatin, OR 97062 | Full Service B&M | $82,122 |

| Columbia State Bank | 9000 Southeast 82nd Avenue Happy Valley, OR 97086 | Full Service B&M | $82,584 |

| Columbia State Bank | 98 South Oregon Street Ontario, OR 97914 | Full Service B&M | $98,289 |

For 2021, Columbia State Bank had 149 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $543,152 |

| Net interest income | $536,597 |

| Total noninterest income | $85,718 |

| Gross Fiduciary activities income | $0 |

| Service charges on deposit accounts | $25,549 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $60,169 |

| Pre-tax net operating income | $261,049 |

| Securities gains (or losses, -) | $256 |

| Income before extraordinary items | $206,609 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $206,609 |

| Minority interest net income | $0 |

| Net income | $206,609 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $206,406 |

Columbia State Bank's gross interest income from loans was $543,152,000.

Columbia State Bank's net interest income from loans was $536,597,000.

Columbia State Bank's fee based income from loans was $25,549,000.

Columbia State Bank's net income from loans was $206,609,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $6,555 |

| Provision for credit losses | $5,000 |

| Total noninterest expense | $356,266 |

| Salaries and employee benefits | $220,025 |

| Premises and equipment expense | $36,752 |

| Additional noninterest expense | $99,489 |

| Applicable income taxes | $54,696 |

| Net charge-offs | $978 |

| Cash dividends | $108,000 |

Columbia State Bank's interest expense for loans was $6,555,000.

Columbia State Bank's payroll and benefits expense were $220,025,000.

Columbia State Bank's property, plant and equipment expenses $36,752,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.0% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $18,023,395 |

| Deposits held in domestic offices | $18,023,395 |

| Deposits by Individuals, partnerships, and corporations | $16,678,761 |

| Deposits by U.S. Government | $1 |

| Deposits by States and political subdivisions in the U.S. | $1,343,532 |

| Deposits by Commercial banks and other depository institutions in U.S. | $1,100 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $2,833,229 |

| Demand deposits | $2,833,229 |

| Nontransaction accounts | $15,190,165 |

| Money market deposit accounts (MMDAs) | $13,117,022 |

| Other savings deposits (excluding MMDAs) | $1,627,186 |

| Total time deposits | $445,957 |

| Total time and savings deposits | $15,190,165 |

| Noninterest-bearing deposits | $8,867,771 |

| Interest-bearing deposits | $9,155,624 |

| Retail deposits | $17,863,156 |

| IRAs and Keogh plan accounts | $68,792 |

| Brokered deposits | $0 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $20,934,572 |

| Cash & Balances due from depository institutions | $825,731 |

| Interest-bearing balances | $671,300 |

| Total securities | $8,056,842 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $10,496,133 |

| Loan and leases loss allowance | $155,578 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $231,463 |

| Other real estate owned | $381 |

| Goodwill and other intangibles | $853,101 |

| All other assets | $470,921 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $20,934,572 |

| Total Liabilities | $18,345,354 |

| Total deposits | $18,023,395 |

| Interest-bearing deposits | $9,155,624 |

| Deposits held in domestic offices | $18,023,395 |

| % insured (estimated) | $56 |

| Federal funds purchased and repurchase agreements | $86,013 |

| Trading liabilities | $0 |

| Other borrowed funds | $73,734 |

| Subordinated debt | $0 |

| All other liabilities | $162,212 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $10,496,133 |

| Loan and leases loss allowance | $155,578 |

| Total loans and leases (domestic) | $10,651,711 |

| All real estate loans | $6,721,479 |

| Real estate loans in domestic offices | $6,721,479 |

| Construction and development loans | $384,756 |

| Residential 1-4 family construction | $156,901 |

| Other construction, all land development and other land | $227,855 |

| Loans secured by nonfarm nonresidential properties | $4,485,266 |

| Nonfarm nonresidential secured by owner-occupied properties | $2,315,079 |

| Commercial real estate & other non-farm, non-residential | $2,170,187 |

| Multifamily residential real estate | $495,997 |

| 1-4 family residential loans | $1,023,682 |

| Farmland loans | $331,778 |

| Loans held in foreign offices | $0 |

| Farm loans | $463,937 |

| Commercial and industrial loans | $2,442,490 |

| To non-U.S. addressees | $19,970 |

| Loans to individuals | $43,027 |

| Credit card loans | $0 |

| Related Plans | $16,274 |

| Consumer Auto Loans | $2,951 |

| Other loans to individuals | $23,802 |

| All other loans & leases | $980,778 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $410,451 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $128,946 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $10,086 |

| Non 1-4 family restructured loans & leases | $5,524 |

| Total loans and leases (foreign) | $0 |

Columbia State Bank had $10,496,133,000 of loans outstanding in 2021. $6,721,479,000 of loans were in real estate loans. $384,756,000 of loans were in development loans. $495,997,000 of loans were in multifamily mortgage loans. $1,023,682,000 of loans were in 1-4 family mortgage loans. $463,937,000 of loans were in farm loans. $0 of loans were in credit card loans. $2,951,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 2,615 | $963,033 | $368,273 |

| Nonfarm, nonresidential loans - <$100k | 82 | $3,401 | $41,476 |

| Nonfarm, nonresidential loans - $100-250k | 519 | $68,417 | $131,825 |

| Nonfarm, nonresidential loans - $250k-1MM | 2,014 | $891,215 | $442,510 |

| Commercial & Industrial, US addressed loans - <$1MM | 5,781 | $726,952 | $125,748 |

| Commercial & Industrial, US addressed loans - <$100k | 2,797 | $46,302 | $16,554 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,002 | $82,010 | $81,846 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,982 | $598,640 | $302,038 |

| Farmland loans - <$1MM | 181 | $34,554 | $190,906 |

| Farmland loans - <$100k | 14 | $611 | $43,643 |

| Farmland loans - $100-250k | 63 | $8,009 | $127,127 |

| Farmland loans - $250k-1MM | 104 | $25,934 | $249,365 |

| Agriculture operations loans - <$1MM | 729 | $58,805 | $80,665 |

| Agriculture operations loans - <$100k | 319 | $7,524 | $23,586 |

| Agriculture operations loans - $100-250k | 195 | $14,760 | $75,692 |

| Agriculture operations loans - $250k-1MM | 215 | $36,521 | $169,865 |