United Bank Mortgage Rates, Fees & Info

Fairfax, VALEI: 549300MKOZ81ZWTNKB12

Tax ID: 54-1071198

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

United Bank is a smaller bank specializing in Home Purchase and Refi loans. United Bank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Washington, Myrtle Beach, Huntington, Morgantown, and Charlotte among others. We have data for 90 markets. (Some data included below & more in-depth data is available with an active subscription.)United Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. United Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.72% | 8/31/25 |

| 30 Year Conventional Purchase | 6.69% | 8/31/25 |

| 30 Year Conventional Refi | 5.41% | 8/31/25 |

| 30 Year Cash-out Refi | 7.10% | 8/31/25 |

| 30 Year FHA Purchase | 7.08% | 8/31/25 |

| 30 Year FHA Refi | 7.08% | 8/31/25 |

| 30 Year VA Purchase | 6.24% | 8/31/25 |

| 30 Year VA Refi | 6.08% | 8/31/25 |

| 30 Year USDA Purchase | 6.61% | 8/31/25 |

| 15 Year Conventional Purchase | 4.81% | 8/31/25 |

| 15 Year Conventional Refi | 6.34% | 8/31/25 |

| 15 Year Cash-out Refi | 6.34% | 8/31/25 |

| 15 Year FHA Purchase | 6.00% | 8/31/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

United Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from United Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

2,573Origination Dollar Volume (All Markets)

$599,055,000Employee count

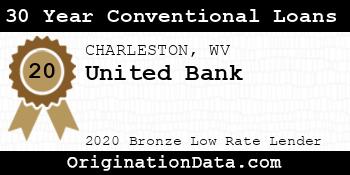

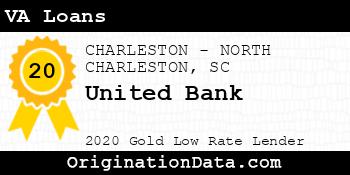

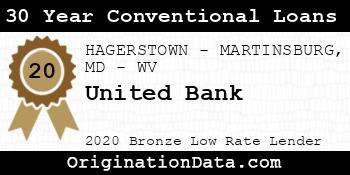

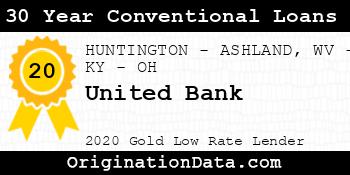

2,982 Show all (18) awardsUnited Bank - 2020

United Bank is a 2020 , due to their low .

For 2020, less than of lenders were eligible for this award.

Work for United Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 429 | $125,075,000 | $291,550 | $4,441 | 3.54% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 270 | $60,590,000 | $224,407 | $3,818 | 4.12% |

| HUNTINGTON-ASHLAND, WV-KY-OH (FHA|USDA|VA) | 217 | $46,875,000 | $216,014 | $3,319 | 3.22% |

| MORGANTOWN, WV (FHA|USDA|VA) | 190 | $41,160,000 | $216,632 | $3,192 | 3.29% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 119 | $35,585,000 | $299,034 | $5,030 | 4.11% |

| CHARLESTON, WV (FHA|USDA|VA) | 174 | $31,410,000 | $180,517 | $3,399 | 3.38% |

| HAGERSTOWN-MARTINSBURG, MD-WV (FHA|USDA|VA) | 113 | $21,805,000 | $192,965 | $3,588 | 3.38% |

| BALTIMORE-COLUMBIA-TOWSON, MD (FHA|USDA|VA) | 21 | $19,455,000 | $926,429 | $4,556 | 3.50% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 62 | $16,180,000 | $260,968 | $4,013 | 3.15% |

| PARKERSBURG-VIENNA, WV (FHA|USDA|VA) | 87 | $15,975,000 | $183,621 | $3,240 | 3.45% |

| Outside of Metro Areas | 94 | $12,930,000 | $137,553 | $3,259 | 3.64% |

| WHEELING, WV-OH (FHA|USDA|VA) | 82 | $11,600,000 | $141,463 | $2,703 | 3.36% |

| PITTSBURGH, PA (FHA|USDA|VA) | 84 | $11,490,000 | $136,786 | $3,194 | 3.77% |

| BECKLEY, WV (FHA|USDA|VA) | 73 | $10,245,000 | $140,342 | $2,929 | 3.26% |

| WILMINGTON, NC (FHA|USDA|VA) | 35 | $10,165,000 | $290,429 | $5,480 | 3.77% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 28 | $8,350,000 | $298,214 | $3,904 | 3.69% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 57 | $7,715,000 | $135,351 | $3,908 | 4.50% |

| WINCHESTER, VA-WV (FHA|USDA|VA) | 30 | $6,640,000 | $221,333 | $3,356 | 3.74% |

| RICHMOND, VA (FHA|USDA|VA) | 38 | $6,300,000 | $165,789 | $0 | 3.84% |

| COLUMBUS, OH (FHA|USDA|VA) | 3 | $6,045,000 | $2,015,000 | $3,819 | 3.19% |

| COLUMBIA, SC (FHA|USDA|VA) | 15 | $6,045,000 | $403,000 | $3,878 | 3.08% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 2 | $5,030,000 | $2,515,000 | $0 | 5.00% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 2 | $4,490,000 | $2,245,000 | $9,685 | 2.75% |

| Morehead City, NC (FHA|USDA|VA) | 13 | $3,835,000 | $295,000 | $4,168 | 3.73% |

| Rockingham, NC (FHA|USDA|VA) | 1 | $3,825,000 | $3,825,000 | $0 | 4.75% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 9 | $3,745,000 | $416,111 | $3,024 | 3.36% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 5 | $3,335,000 | $667,000 | $4,602 | 3.87% |

| NEW BERN, NC (FHA|USDA|VA) | 13 | $3,155,000 | $242,692 | $4,429 | 3.50% |

| RALEIGH-CARY, NC (FHA|USDA|VA) | 9 | $3,055,000 | $339,444 | $3,656 | 3.65% |

| CHARLOTTESVILLE, VA (FHA|USDA|VA) | 24 | $2,990,000 | $124,583 | $0 | 3.61% |

| HARRISONBURG, VA (FHA|USDA|VA) | 27 | $2,885,000 | $106,852 | $3,698 | 3.62% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 6 | $2,790,000 | $465,000 | $5,802 | 3.29% |

| GREENVILLE, NC (FHA|USDA|VA) | 20 | $2,680,000 | $134,000 | $3,945 | 3.71% |

| SALISBURY, MD-DE (FHA|USDA|VA) | 7 | $2,635,000 | $376,429 | $3,787 | 3.13% |

| Forest City, NC (FHA|USDA|VA) | 19 | $2,605,000 | $137,105 | $4,123 | 3.91% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 11 | $2,345,000 | $213,182 | $3,814 | 3.53% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 3 | $2,145,000 | $715,000 | $3,263 | 3.04% |

| Washington, NC (FHA|USDA|VA) | 16 | $2,110,000 | $131,875 | $4,821 | 3.46% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 6 | $1,950,000 | $325,000 | $3,736 | 3.06% |

| Clarksburg, WV (FHA|USDA|VA) | 9 | $1,815,000 | $201,667 | $3,186 | 3.47% |

| Georgetown, SC (FHA|USDA|VA) | 4 | $1,730,000 | $432,500 | $3,783 | 4.25% |

| Lumberton, NC (FHA|USDA|VA) | 4 | $1,580,000 | $395,000 | $5,145 | 3.09% |

| Mount Gay-Shamrock, WV (FHA|USDA|VA) | 13 | $1,365,000 | $105,000 | $2,994 | 3.65% |

| STAUNTON, VA (FHA|USDA|VA) | 15 | $1,355,000 | $90,333 | $0 | 3.78% |

| ROCKY MOUNT, NC (FHA|USDA|VA) | 12 | $1,290,000 | $107,500 | $5,253 | 3.27% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 2 | $1,200,000 | $600,000 | $5,028 | 3.13% |

| Kill Devil Hills, NC (FHA|USDA|VA) | 6 | $1,160,000 | $193,333 | $4,224 | 4.10% |

| LEXINGTON-FAYETTE, KY (FHA|USDA|VA) | 1 | $1,155,000 | $1,155,000 | $6,260 | 3.63% |

| Wilson, NC (FHA|USDA|VA) | 5 | $1,065,000 | $213,000 | $4,340 | 3.62% |

| Fairmont, WV (FHA|USDA|VA) | 7 | $945,000 | $135,000 | $3,228 | 3.00% |

| Point Pleasant, WV-OH (FHA|USDA|VA) | 2 | $920,000 | $460,000 | $3,970 | 2.81% |

| ASHEVILLE, NC (FHA|USDA|VA) | 2 | $890,000 | $445,000 | $3,452 | 4.00% |

| Marietta, OH (FHA|USDA|VA) | 6 | $800,000 | $133,333 | $2,800 | 3.54% |

| CHAMBERSBURG-WAYNESBORO, PA (FHA|USDA|VA) | 6 | $760,000 | $126,667 | $2,938 | 3.38% |

| WEIRTON-STEUBENVILLE, WV-OH (FHA|USDA|VA) | 10 | $760,000 | $76,000 | $3,072 | 3.20% |

| JACKSONVILLE, NC (FHA|USDA|VA) | 2 | $720,000 | $360,000 | $7,563 | 3.25% |

| Seneca, SC (FHA|USDA|VA) | 2 | $700,000 | $350,000 | $3,746 | 3.06% |

| SPARTANBURG, SC (FHA|USDA|VA) | 7 | $665,000 | $95,000 | $3,986 | 4.23% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 2 | $640,000 | $320,000 | $3,918 | 3.38% |

| HARRISBURG-CARLISLE, PA (FHA|USDA|VA) | 1 | $615,000 | $615,000 | $0 | 4.00% |

| Traverse City, MI (FHA|USDA|VA) | 1 | $585,000 | $585,000 | $9,988 | 3.75% |

| New York-Newark-Jersey City, NY-NJ-PA (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $6,133 | 3.63% |

| Whitewater, WI (FHA|USDA|VA) | 1 | $505,000 | $505,000 | $2,953 | 3.38% |

| WACO, TX (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $3,767 | 2.75% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $5,243 | 3.25% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 1 | $465,000 | $465,000 | $5,121 | 3.63% |

| AKRON, OH (FHA|USDA|VA) | 1 | $455,000 | $455,000 | $3,846 | 2.50% |

| ANN ARBOR, MI (FHA|USDA|VA) | 1 | $455,000 | $455,000 | $4,182 | 3.38% |

| Bluefield, WV-VA (FHA|USDA|VA) | 3 | $445,000 | $148,333 | $3,710 | 4.21% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $3,407 | 3.00% |

| Shelby, NC (FHA|USDA|VA) | 5 | $405,000 | $81,000 | $0 | 4.98% |

| Easton, MD (FHA|USDA|VA) | 1 | $375,000 | $375,000 | $0 | 3.00% |

| LYNCHBURG, VA (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $2,622 | 3.38% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 2 | $330,000 | $165,000 | $0 | 3.25% |

| CUMBERLAND, MD-WV (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $3,280 | 3.99% |

| VIRGINIA BEACH-NORFOLK-NEWPORT NEWS, VA-NC (FHA|USDA|VA) | 2 | $290,000 | $145,000 | $3,234 | 3.62% |

| BURLINGTON, NC (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $0 | 4.25% |

| Kinston, NC (FHA|USDA|VA) | 2 | $280,000 | $140,000 | $2,995 | 3.63% |

| Greenwood, SC (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $0 | 4.95% |

| Key West, FL (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $0 | 3.25% |

| Elkins, WV (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $6,246 | 3.50% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $3,252 | 2.75% |

| Brevard, NC (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $0 | 3.25% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $3,692 | 4.50% |

| Zanesville, OH (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $4,116 | 3.50% |

| Cullowhee, NC (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $0 | 5.00% |

| Boone, NC (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $0 | 5.00% |

| GOLDSBORO, NC (FHA|USDA|VA) | 2 | $120,000 | $60,000 | $0 | 4.13% |

| MANSFIELD, OH (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $0 | 3.25% |

| SUMTER, SC (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $3,583 | 3.75% |

Similar Lenders

We use machine learning to identify the top lenders compared against United Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 68

Similarity Rank: 102

Similarity Rank: 108

Similarity Rank: 112

Similarity Rank: 236

Similarity Rank: 264

Similarity Rank: 271

Similarity Rank: 289

Similarity Rank: 402

Similarity Rank: 420

Product Mix

For 2020, United Bank's most frequently originated type of loan was Conventional, with 1,518 originations. Their 2nd most popular type was HELOC, with 941 originations.

Loan Reason

For 2020, United Bank's most frequently cited loan purpose was Home Purchase, with 934 originations. The 2nd most popular reason was Refi, with 861 originations.

Loan Duration/Length

For 2020, United Bank's most frequently cited loan duration was Other, with 937 originations. The 2nd most popular length was 30 Year, with 837 originations.

Origination Fees/Closing Costs

United Bank's average total fees were $3,632, while their most frequently occuring range of origination fees (closing costs) were in the $1k-2k bucket, with 800 originations.

Interest Rates

During 2020, United Bank's average interest rate for loans was 3.21%, while their most frequently originated rate bucket for loans was 3-4%, with 1,144 originations.

Loan Sizing

2020 saw United Bank place emphasis on $100,000 or less loans with 789 originations, totaling $44,545,000 in origination value.

Applicant Income

United Bank lent most frequently to those with incomes in the $100k-150k range, with 459 originations. The second most popular income band? $250k+, with 424 originations.

Applicant Debt to Income Ratio

United Bank lent most frequently to those with DTI ratios of 20-30%, with 641 originations. The next most common DTI ratio? <20%, with 460 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications87.76%

United Bank has an average approval rate.

Pick Rate

Approvals leading to origination84.22%

United Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| 0.0 | 253 | $29,835,000 | $117,925 |

| NA | 2,320 | $569,220,000 | $245,353 |

Occupancy Type Mix

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2020 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| UNITED COMMUNITY BANK | Conventional home mortgage | Trouble during payment process | 3 | 50.0% |

| UNITED COMMUNITY BANK | Conventional home mortgage | Applying for a mortgage or refinancing an existing mortgage | 1 | 16.7% |

| UNITED COMMUNITY BANK | Conventional home mortgage | Closing on a mortgage | 1 | 16.7% |

| UNITED COMMUNITY BANK | Home equity loan or line of credit (HELOC) | Incorrect information on your report | 1 | 16.7% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| United Bank | 117 East Southerland Street Wallace, NC 28466 | Full Service B&M | $32,775 |

| United Bank | 1067 Brentway Avenue, Suite 136 Williamston, NC 27892 | Full Service B&M | $7,169 |

| United Bank | 425 Robert C Byrd Drive Sophia, WV 25921 | Full Service B&M | $33,622 |

| United Bank | 621 Seventh Street Moundsville, WV 26041 | Full Service B&M | $148,291 |

| United Bank | 1 Rosemar Circle Parkersburg, WV 26104 | Full Service B&M | $52,490 |

| United Bank | 100 Fifth Street Southeast Charlottesville, VA 22902 | Full Service B&M | $36,967 |

| United Bank | 100 Walnut Hill Road Uniontown, PA 15401 | Full Service B&M | $52,973 |

| United Bank | 1001 G Street, N.W. Washington, DC 20001 | Full Service B&M | $183,448 |

| United Bank | 1001 Wisconsin Avenue, N.W. Washington, DC 20007 | Full Service B&M | $253,291 |

| United Bank | 101 East Main Street Glenville, WV 26351 | Full Service B&M | $101,586 |

| United Bank | 101 Venture Drive Morgantown, WV 26508 | Full Service B&M | $63,718 |

| United Bank | 1014 South Main Street Woodstock, VA 22664 | Full Service B&M | $46,147 |

| United Bank | 103 Arcade Street Lake Lure, NC 28746 | Full Service B&M | $28,856 |

| United Bank | 105 Hickman Road Tabor City, NC 28463 | Full Service B&M | $23,159 |

| United Bank | 106 West Washington Street Charles Town, WV 25414 | Full Service B&M | $88,694 |

| United Bank | 10641 Fairfax Blvd Fairfax, VA 22030 | Full Service B&M | $170,572 |

| United Bank | 10695-B Braddock Road Fairfax, VA 22032 | Full Service B&M | $201,173 |

| United Bank | 1079 Charleston Town Center Charleston, WV 25389 | Full Service B&M | $23,299 |

| United Bank | 10800-A Courthouse Rd Fredericksburg, VA 22408 | Full Service B&M | $18,551 |

| United Bank | 10830 Balls Ford Road Manassas, VA 20109 | Full Service B&M | $79,633 |

| United Bank | 109 Three Springs Drive Weirton, WV 26062 | Full Service B&M | $79,838 |

| United Bank | 11 13th Avenue Ne Hickory, NC 28601 | Full Service B&M | $57,141 |

| United Bank | 110 North J.K. Powell Boulevard Whiteville, NC 28472 | Full Service B&M | $50,680 |

| United Bank | 110 University Boulevard Harrisonburg, VA 22801 | Full Service B&M | $142,774 |

| United Bank | 111 Strawberry Boulevard Chadbourn, NC 28431 | Full Service B&M | $44,150 |

| United Bank | 1111 West Poinsett Street Greer, SC 29650 | Full Service B&M | $167,608 |

| United Bank | 11185 Fairfax Blvd Fairfax, VA 22030 | Full Service B&M | $158,194 |

| United Bank | 113 North Street Ripley, WV 25271 | Full Service B&M | $128,040 |

| United Bank | 113 Penn Street Point Marion, PA 15474 | Full Service B&M | $27,539 |

| United Bank | 115 North Third St., Suite 101 Wilmington, NC 28403 | Full Service B&M | $19,394 |

| United Bank | 1180 Hwy 17 Little River, SC 29566 | Full Service B&M | $41,933 |

| United Bank | 11820 Spectrum Center Reston, VA 20190 | Full Service B&M | $236,934 |

| United Bank | 120 Ox Bow Drive Strasburg, VA 22657 | Full Service B&M | $9,753 |

| United Bank | 1200 Grosscup Avenue Dunbar, WV 25064 | Full Service B&M | $92,396 |

| United Bank | 1201 Knox Abbott Drive Cayce, SC 29033 | Full Service B&M | $56,501 |

| United Bank | 12127 Rockville Pike Rockville, MD 20852 | Full Service B&M | $207,559 |

| United Bank | 1219 Mount Aetna Rd Hagerstown, MD 21742 | Full Service B&M | $52,285 |

| United Bank | 124 North Main Street Clover, SC 29710 | Full Service B&M | $87,693 |

| United Bank | 125-E Trade Court Mooresville, NC 28117 | Full Service B&M | $23,778 |

| United Bank | 1265 Seminole Trail, P.O. Box 7704, Zip Code 22906-7704 Charlottesville, VA 22901 | Full Service B&M | $173,351 |

| United Bank | 1269 Warwood Ave Wheeling, WV 26003 | Full Service B&M | $18,392 |

| United Bank | 129 Main Street Beckley, WV 25802 | Full Service B&M | $202,445 |

| United Bank | 1293 Highway 16 North Denver, NC 28037 | Full Service B&M | $51,423 |

| United Bank | 1301 U Street, N.W. Washington, DC 20009 | Full Service B&M | $95,300 |

| United Bank | 13021 Ocean Highway Pawleys Island, SC 29585 | Full Service B&M | $29,482 |

| United Bank | 1304 Central Park Blvd Fredericksburg, VA 22401 | Full Service B&M | $39,854 |

| United Bank | 1311 Carolina Avenue Washington, NC 27889 | Full Service B&M | $58,989 |

| United Bank | 1320 Old Chain Bridge Road Mclean, VA 22101 | Full Service B&M | $334,257 |

| United Bank | 1378 Benvenue Rd. Rocky Mount, NC 27804 | Full Service B&M | $41,528 |

| United Bank | 13870 Smoketown Road - (Dale City) Woodbridge, VA 22192 | Full Service B&M | $94,385 |

| United Bank | 139 North Cameron Street Winchester, VA 22601 | Full Service B&M | $59,436 |

| United Bank | 14 Bethlehem Blvd Wheeling, WV 26003 | Full Service B&M | $33,828 |

| United Bank | 14000 Sullyfield Circle Chantilly, VA 20151 | Full Service B&M | $123,814 |

| United Bank | 142 N. Watkins Drive Forest City, NC 28043 | Full Service B&M | $43,674 |

| United Bank | 1447 North Frederick Pike Winchester, VA 22603 | Full Service B&M | $52,459 |

| United Bank | 145 West Maple Avenue Fayetteville, WV 25840 | Full Service B&M | $44,872 |

| United Bank | 1451 Dolly Madison Boulevard Mclean, VA 22101 | Full Service B&M | $174,760 |

| United Bank | 1492 Stuart Engals Boulevard Mount Pleasant, SC 29464 | Full Service B&M | $67,245 |

| United Bank | 1501 Market Street Wheeling, WV 26003 | Limited, Drive-thru | $0 |

| United Bank | 154 Fayette Street Morgantown, WV 26505 | Full Service B&M | $185,341 |

| United Bank | 1600 South Tarboro Street Wilson, NC 27893 | Full Service B&M | $28,140 |

| United Bank | 1612 Military Cutoff Road Wilmington, NC 28403 | Full Service B&M | $24,756 |

| United Bank | 16268 Frederick Road Gaithersburg, MD 20877 | Full Service B&M | $42,966 |

| United Bank | 1661 Smoot Avenue Danville, WV 25053 | Full Service B&M | $34,586 |

| United Bank | 1980 South Main Street Harrisonburg, VA 22801 | Full Service B&M | $48,332 |

| United Bank | 17054 Jefferson Davis Hwy Dumfries, VA 22026 | Full Service B&M | $21,317 |

| United Bank | 1707 Se Greenville Boulevard Greenville, NC 27858 | Full Service B&M | $12,236 |

| United Bank | 1724 State Road Summerville, SC 29483 | Full Service B&M | $25,608 |

| United Bank | 1725 South Glenburnie Road New Bern, NC 28560 | Full Service B&M | $34,424 |

| United Bank | 1729 Shenandoah Avenue Front Royal, VA 22630 | Full Service B&M | $14,823 |

| United Bank | 1737 King Street Alexandria, VA 22314 | Full Service B&M | $195,570 |

| United Bank | 1750 Earl L Core Road Morgantown, WV 26505 | Full Service B&M | $32,582 |

| United Bank | 1776 K Street, Nw Washington, DC 20006 | Full Service B&M | $962,788 |

| United Bank | 1825 Wisconsin Avenue, Nw Washington, DC 20007 | Full Service B&M | $35,980 |

| United Bank | 18750 North Pointe Drive Hagerstown, MD 21742 | Full Service B&M | $33,158 |

| United Bank | 1900 Centennial Park Drive Reston, VA 20191 | Full Service B&M | $92,539 |

| United Bank | 1900 W Vernon Avenue Kinston, NC 28504 | Full Service B&M | $41,877 |

| United Bank | 199 Front Royal Pike Winchester, VA 22602 | Full Service B&M | $34,947 |

| United Bank | 20 Catoctin Circle Se Leesburg, VA 20175 | Full Service B&M | $91,604 |

| United Bank | 200 Fourth Street Montgomery, WV 25136 | Full Service B&M | $70,062 |

| United Bank | 200 North Cedar Street Summerville, SC 29483 | Full Service B&M | $72,725 |

| United Bank | 200 Smith Ave Shallotte, NC 28470 | Full Service B&M | $60,694 |

| United Bank | 20020 Midland Trail Ansted, WV 25812 | Full Service B&M | $18,898 |

| United Bank | 2004 West Webster Road Summersville, WV 26651 | Full Service B&M | $72,538 |

| United Bank | 201 West Broad Street Elizabethtown, NC 28337 | Full Service B&M | $44,947 |

| United Bank | 202 Main Avenue Weston, WV 26452 | Full Service B&M | $87,141 |

| United Bank | 202 North Main Street Heath Springs, SC 29058 | Full Service B&M | $13,893 |

| United Bank | 2023 Sunset Boulevard West Columbia, SC 29169 | Full Service B&M | $70,109 |

| United Bank | 2030 Old Bridge Road Woodbridge, VA 22191 | Full Service B&M | $88,332 |

| United Bank | 2051 Northwestern Pike Winchester, VA 22603 | Full Service Retail | $17,010 |

| United Bank | 2069 East Hwy 501 Conway, SC 29526 | Full Service B&M | $39,794 |

| United Bank | 2071 Chain Bridge Road Vienna, VA 22182 | Full Service B&M | $952,741 |

| United Bank | 21 Twelfth Street Wheeling, WV 26003 | Full Service B&M | $160,396 |

| United Bank | 213 North Chestnut Street Mount Olive, NC 28365 | Full Service B&M | $29,404 |

| United Bank | 2180 National Rd Wheeling, WV 26003 | Full Service B&M | $53,377 |

| United Bank | 21885 Ryan Center Way Ashburn, VA 20147 | Full Service B&M | $258,982 |

| United Bank | 220 Main Street Logan, WV 25601 | Full Service B&M | $49,715 |

| United Bank | 2252 Valley Avenue Winchester, VA 22601 | Full Service B&M | $63,360 |

| United Bank | 234 Grand Central Mall Vienna, WV 26105 | Full Service B&M | $24,474 |

| United Bank | 23510 Overland Drive Sterling, VA 20166 | Full Service B&M | $37,854 |

| United Bank | 24 District Way Martinsburg, WV 25404 | Full Service B&M | $92,467 |

| United Bank | 2401 Mt. Vernon Ave. Alexandria, VA 22301 | Full Service B&M | $32,633 |

| United Bank | 2409 Columbia Pike Arlington, VA 22204 | Full Service B&M | $87,819 |

| United Bank | 241 Green Street Fayetteville, NC 28302 | Full Service B&M | $40,527 |

| United Bank | 2438 Robert C Byrd Drive Beckley, WV 25801 | Full Service B&M | $47,396 |

| United Bank | 2556 Jefferson Highway, Suite 110 Waynesboro, VA 22980 | Full Service B&M | $34,909 |

| United Bank | 2636 Highway 17 South Murrells Inlet, SC 29576 | Full Service B&M | $91,756 |

| United Bank | 2650 Grand Central Avenue Vienna, WV 26105 | Full Service B&M | $75,377 |

| United Bank | 2801 Cashwell Drive Goldsboro, NC 27534 | Full Service B&M | $21,633 |

| United Bank | 288 Meeting Street Charleston, SC 29401 | Full Service B&M | $486,799 |

| United Bank | 2889 Third Ave Huntington, WV 25702 | Full Service B&M | $189,354 |

| United Bank | 289 Garrisonville Road Stafford, VA 22554 | Full Service B&M | $41,858 |

| United Bank | 2901 Sunset Avenue Rocky Mount, NC 27804 | Full Service B&M | $84,261 |

| United Bank | 2930 Wilson Boulevard Arlington, VA 22201 | Full Service B&M | $185,039 |

| United Bank | 2999 U.S. Highway 17 South Chocowinity, NC 27817 | Full Service B&M | $40,940 |

| United Bank | 300 Market St Man, WV 25635 | Full Service B&M | $24,549 |

| United Bank | 300 North Market Street Washington, NC 27889 | Full Service B&M | $84,615 |

| United Bank | 300 Warren Avenue Front Royal, VA 22630 | Full Service B&M | $57,708 |

| United Bank | 301 East Arlington Boulevard Greenville, NC 27834 | Full Service B&M | $39,990 |

| United Bank | 309 N Main St Bridgewater, VA 22812 | Full Service B&M | $24,755 |

| United Bank | 310 Wright Blvd Conway, SC 29526 | Full Service B&M | $25,072 |

| United Bank | 3103 North Main Street Hope Mills, NC 28348 | Full Service B&M | $23,451 |

| United Bank | 3105 North Croatan Highway Kill Devil Hills, NC 27948 | Full Service B&M | $27,623 |

| United Bank | 3178 Holden Beach Road S.W. Supply, NC 28462 | Full Service B&M | $25,913 |

| United Bank | 3198 Belmont Street Bellaire, OH 43906 | Full Service B&M | $47,279 |

| United Bank | 3289 Woodburn Road Annandale, VA 22003 | Full Service B&M | $120,765 |

| United Bank | 3317 Wade Hampton Boulelvard Taylors, SC 29687 | Full Service B&M | $47,068 |

| United Bank | 3567 Main Street Weirton, WV 26062 | Full Service B&M | $13,194 |

| United Bank | 361 South Main St Broadway, VA 22815 | Full Service B&M | $17,113 |

| United Bank | 3695 East North Street Greenville, SC 29615 | Full Service B&M | $42,881 |

| United Bank | 374 Maple Avenue East Vienna, VA 22180 | Full Service B&M | $146,683 |

| United Bank | 40 Hurley St Morgantown, WV 26505 | Full Service B&M | $82,425 |

| United Bank | 4021 University Drive Fairfax, VA 22030 | Full Service B&M | $79,760 |

| United Bank | 4095 Valley Pike Winchester, VA 22602 | Full Service B&M | $39,615 |

| United Bank | 410 West Spotswood Trail Elkton, VA 22827 | Full Service B&M | $22,509 |

| United Bank | 4100 Monument Corner Drive Fairfax, VA 22030 | Full Service B&M | $60,010 |

| United Bank | 412 South Front Street New Bern, NC 28560 | Full Service B&M | $25,939 |

| United Bank | 4215-01 University Drive Durham, NC 27707 | Full Service B&M | $35,962 |

| United Bank | 4230 John Marr Drive Annandale, VA 22003 | Full Service B&M | $106,651 |

| United Bank | 430 Folly Road Charleston, SC 29412 | Full Service B&M | $43,750 |

| United Bank | 4309 Fayetteville Road Lumberton, NC 28358 | Full Service B&M | $45,915 |

| United Bank | 440 East Main Street Purcellville, VA 20132 | Full Service B&M | $57,597 |

| United Bank | 450 Foxcroft Avenue Martinsburg, WV 25401 | Full Service B&M | $239,508 |

| United Bank | 4501 Daly Drive Chantilly, VA 20151 | Full Service B&M | $135,077 |

| United Bank | 4506 Socastee Boulevard Myrtle Beach, SC 29588 | Full Service B&M | $20,029 |

| United Bank | 46005 Regal Plaza St 180 Sterling, VA 20165 | Full Service B&M | $107,137 |

| United Bank | 4605 Pennsylvania Avenue Charleston, WV 25302 | Full Service B&M | $44,021 |

| United Bank | 4710 Oleander Drive Wilmington, NC 28403 | Full Service B&M | $21,088 |

| United Bank | 47560 Highway 12 Buxton, NC 27920 | Full Service B&M | $38,031 |

| United Bank | 4800 Six Forks Road Raleigh, NC 27609 | Full Service B&M | $45,115 |

| United Bank | 4900 Massachusetts Avenue, N.W. Washington, DC 20016 | Full Service B&M | $76,704 |

| United Bank | 4901 Maccorkle Avenue Se Charleston, WV 25304 | Full Service B&M | $37,627 |

| United Bank | 4913 Arendell Street Morehead City, NC 28557 | Full Service B&M | $80,596 |

| United Bank | 4945 Southport Supply Road Southport, NC 28461 | Full Service B&M | $40,790 |

| United Bank | 500 Virginia Street East Charleston, WV 25301 | Full Service B&M | $890,547 |

| United Bank | 501 C Jefferson David Hwy Fredericksburg, VA 22401 | Full Service B&M | $36,194 |

| United Bank | 506 King Street Alexandria, VA 22314 | Full Service B&M | $87,497 |

| United Bank | 507 Holly Ave Route 10 Logan, WV 25601 | Full Service B&M | $18,467 |

| United Bank | 514 Market Street Parkersburg, WV 26101 | Full Service B&M | $510,252 |

| United Bank | 5140 Duke Street Alexandria, VA 22304 | Full Service B&M | $107,014 |

| United Bank | 517 9th Street Huntington, WV 25701 | Full Service B&M | $45,912 |

| United Bank | 5196 Charlotte Highway Lake Wylie, SC 29710 | Full Service B&M | $43,770 |

| United Bank | 531 A East Market Street Leesburg, VA 20176 | Full Service B&M | $40,581 |

| United Bank | 534 South New Hope Road Gastonia, NC 28054 | Full Service B&M | $109,532 |

| United Bank | 5350 Lee Highway Arlington, VA 22207 | Full Service B&M | $329,988 |

| United Bank | 54 Franklin St Suite 102 Weyers Cave, VA 24486 | Full Service B&M | $35,516 |

| United Bank | 5410 Wisconsin Avenue Chevy Chase, MD 20815 | Full Service B&M | $181,470 |

| United Bank | 5453 Williamsport Pike Martinsburg, WV 25404 | Full Service B&M | $24,613 |

| United Bank | 550 Emily Drive Clarksburg, WV 26301 | Full Service Retail | $15,750 |

| United Bank | 555 C Street Ceredo, WV 25507 | Full Service B&M | $89,369 |

| United Bank | 5561 West Memorial Blvd Saint George, SC 29477 | Full Service B&M | $39,412 |

| United Bank | 5766 Union Mill Road Clifton, VA 20124 | Full Service B&M | $98,766 |

| United Bank | 601 North Main Street Greer, SC 29650 | Full Service B&M | $40,608 |

| United Bank | 604 East Ehringhaus Street Elizabeth City, NC 27909 | Full Service B&M | $20,541 |

| United Bank | 624 Chicago Ave Harrisonburg, VA 22802 | Limited, Drive-thru | $0 |

| United Bank | 624 Chicago Avenue Harrisonburg, VA 22802 | Full Service B&M | $14,721 |

| United Bank | 6375 Multiplex Drive Centreville, VA 20121 | Full Service B&M | $75,676 |

| United Bank | 6500 Williamsburg Boulevard Arlington, VA 22213 | Full Service B&M | $124,794 |

| United Bank | 6801 Morrison Boulevard, Suite 102 Charlotte, NC 28211 | Full Service B&M | $44,565 |

| United Bank | 689 Fairmont Road Morgantown, WV 26501 | Full Service B&M | $61,761 |

| United Bank | 69 Main Street Smithfield, PA 15478 | Full Service B&M | $81,550 |

| United Bank | 700 Main Street North Myrtle Beach, SC 29582 | Full Service B&M | $60,332 |

| United Bank | 705 Executive Place Fayetteville, NC 28305 | Full Service B&M | $38,779 |

| United Bank | 7115 Leesburg Pike Ste 101 Falls Church, VA 22043 | Full Service B&M | $131,428 |

| United Bank | 716 West Main Street Ripley, WV 25271 | Limited, Drive-thru | $0 |

| United Bank | 7315 Wisconsin Avenue Bethesda, MD 20814 | Full Service B&M | $111,898 |

| United Bank | 7699 Winchester Avenue Inwood, WV 25428 | Full Service B&M | $31,878 |

| United Bank | 7830 Backlick Rd Ste 101 Springfield, VA 22150 | Full Service B&M | $51,646 |

| United Bank | 7845 Wisconsin Avenue Bethesda, MD 20814 | Full Service B&M | $581,318 |

| United Bank | 7867 Martinsburg Pike Shepherdstown, WV 25443 | Full Service B&M | $44,660 |

| United Bank | 7901 Richmond Highway Alexandria, VA 22306 | Full Service B&M | $26,922 |

| United Bank | 7905 Heritage Village Plaza Gainesville, VA 20155 | Full Service B&M | $48,340 |

| United Bank | 799 W Highway 27 Lincolnton, NC 28092 | Full Service B&M | $14,943 |

| United Bank | 81 W Main Street Uniontown, PA 15401 | Full Service B&M | $229,246 |

| United Bank | 8270 Greensboro Dr. Suite 500 Mclean, VA 22102 | Full Service B&M | $439,595 |

| United Bank | 840 Sunset Blvd North Sunset Beach, NC 28468 | Full Service B&M | $44,569 |

| United Bank | 8485 Dorchester Road North Charleston, SC 29418 | Full Service B&M | $33,258 |

| United Bank | 8630 Fenton Street Silver Spring, MD 20910 | Full Service B&M | $38,729 |

| United Bank | 871 S Buncombe Rd Greer, SC 29650 | Full Service B&M | $29,471 |

| United Bank | 884 Orleans Road Charleston, SC 29407 | Full Service B&M | $90,085 |

| United Bank | 90 Railroad Avenue East Cowen, WV 26206 | Full Service B&M | $13,544 |

| United Bank | 901 East Main Street Lincolnton, NC 28092 | Full Service B&M | $124,081 |

| United Bank | 907 E. Firetower Road Greenville, NC 27835 | Full Service B&M | $27,416 |

| United Bank | 907 N. Quincy Street Arlington, VA 22203 | Full Service B&M | $123,864 |

| United Bank | 9580 N.C. Highway 10 West Vale, NC 28168 | Full Service B&M | $23,804 |

| United Bank | 96 Main Street Stanardsville, VA 22973 | Full Service B&M | $51,555 |

| United Bank | 9626 Center Street Manassas, VA 20110 | Full Service B&M | $176,351 |

| United Bank | 9872 Liberia Avenue Manassas, VA 20110 | Full Service B&M | $61,519 |

| United Bank | 990 Elmer Prince Drive Morgantown, WV 26505 | Full Service B&M | $725,349 |

| United Bank | 991 38th Avenue North Myrtle Beach, SC 29577 | Full Service B&M | $224,871 |

| United Bank | One Court Square Webster Springs, WV 26288 | Full Service B&M | $37,764 |

| United Bank | Route 34 At Poplar Fork Road Scott Depot, WV 25560 | Full Service B&M | $54,163 |

For 2020, United Bank had 212 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $797,988 |

| Net interest income | $699,431 |

| Total noninterest income | $344,968 |

| Gross Fiduciary activities income | $13,903 |

| Service charges on deposit accounts | $21,305 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $309,760 |

| Pre-tax net operating income | $379,315 |

| Securities gains (or losses, -) | $2,598 |

| Income before extraordinary items | $307,054 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $307,054 |

| Minority interest net income | $0 |

| Net income | $307,054 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $304,975 |

United Bank's gross interest income from loans was $797,988,000.

United Bank's net interest income from loans was $699,431,000.

United Bank's fee based income from loans was $21,305,000.

United Bank's net income from loans was $307,054,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $98,557 |

| Provision for credit losses | $106,563 |

| Total noninterest expense | $558,521 |

| Salaries and employee benefits | $295,752 |

| Premises and equipment expense | $63,103 |

| Additional noninterest expense | $199,666 |

| Applicable income taxes | $74,859 |

| Net charge-offs | $23,597 |

| Cash dividends | $232,000 |

United Bank's interest expense for loans was $98,557,000.

United Bank's payroll and benefits expense were $295,752,000.

United Bank's property, plant and equipment expenses $63,103,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 1.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 1.7% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $20,743,628 |

| Deposits held in domestic offices | $20,743,628 |

| Deposits by Individuals, partnerships, and corporations | $19,331,331 |

| Deposits by U.S. Government | $5 |

| Deposits by States and political subdivisions in the U.S. | $1,412,111 |

| Deposits by Commercial banks and other depository institutions in U.S. | $181 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $6,230,074 |

| Demand deposits | $5,430,439 |

| Nontransaction accounts | $14,513,554 |

| Money market deposit accounts (MMDAs) | $10,321,761 |

| Other savings deposits (excluding MMDAs) | $1,281,804 |

| Total time deposits | $2,909,989 |

| Total time and savings deposits | $15,313,189 |

| Noninterest-bearing deposits | $7,407,300 |

| Interest-bearing deposits | $13,336,328 |

| Retail deposits | $19,868,844 |

| IRAs and Keogh plan accounts | $274,179 |

| Brokered deposits | $173,774 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $26,152,624 |

| Cash & Balances due from depository institutions | $2,207,186 |

| Interest-bearing balances | $1,909,841 |

| Total securities | $2,936,855 |

| Federal funds sold & reverse repurchase | $823 |

| Net loans and leases | $18,074,520 |

| Loan and leases loss allowance | $235,830 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $245,344 |

| Other real estate owned | $22,595 |

| Goodwill and other intangibles | $1,861,122 |

| All other assets | $804,179 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $26,152,624 |

| Total Liabilities | $21,686,381 |

| Total deposits | $20,743,628 |

| Interest-bearing deposits | $13,336,328 |

| Deposits held in domestic offices | $20,743,628 |

| % insured (estimated) | $59 |

| Federal funds purchased and repurchase agreements | $142,300 |

| Trading liabilities | $0 |

| Other borrowed funds | $584,532 |

| Subordinated debt | $0 |

| All other liabilities | $215,921 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $18,074,520 |

| Loan and leases loss allowance | $235,830 |

| Total loans and leases (domestic) | $18,310,350 |

| All real estate loans | $13,104,050 |

| Real estate loans in domestic offices | $13,104,050 |

| Construction and development loans | $1,826,349 |

| Residential 1-4 family construction | $255,015 |

| Other construction, all land development and other land | $1,571,334 |

| Loans secured by nonfarm nonresidential properties | $5,932,502 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,622,687 |

| Commercial real estate & other non-farm, non-residential | $4,309,815 |

| Multifamily residential real estate | $684,587 |

| 1-4 family residential loans | $4,637,287 |

| Farmland loans | $23,325 |

| Loans held in foreign offices | $0 |

| Farm loans | $5,822 |

| Commercial and industrial loans | $2,951,843 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $1,197,670 |

| Credit card loans | $8,938 |

| Related Plans | $6,130 |

| Consumer Auto Loans | $1,145,288 |

| Other loans to individuals | $37,314 |

| All other loans & leases | $1,050,965 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $679,678 |

| Loans to depository institutions and acceptances of other banks | $500 |

| Loans not secured by real estate | $39,338 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $14,275 |

| Non 1-4 family restructured loans & leases | $12,129 |

| Total loans and leases (foreign) | $0 |

United Bank had $18,074,520,000 of loans outstanding in 2020. $13,104,050,000 of loans were in real estate loans. $1,826,349,000 of loans were in development loans. $684,587,000 of loans were in multifamily mortgage loans. $4,637,287,000 of loans were in 1-4 family mortgage loans. $5,822,000 of loans were in farm loans. $8,938,000 of loans were in credit card loans. $1,145,288,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 3,144 | $841,884 | $267,775 |

| Nonfarm, nonresidential loans - <$100k | 413 | $20,408 | $49,414 |

| Nonfarm, nonresidential loans - $100-250k | 976 | $119,272 | $122,205 |

| Nonfarm, nonresidential loans - $250k-1MM | 1,755 | $702,204 | $400,116 |

| Commercial & Industrial, US addressed loans - <$1MM | 22,835 | $1,271,262 | $55,672 |

| Commercial & Industrial, US addressed loans - <$100k | 19,618 | $556,619 | $28,373 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,953 | $246,992 | $126,468 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,264 | $467,651 | $369,977 |

| Farmland loans - <$1MM | 92 | $13,628 | $148,130 |

| Farmland loans - <$100k | 30 | $1,129 | $37,633 |

| Farmland loans - $100-250k | 28 | $2,684 | $95,857 |

| Farmland loans - $250k-1MM | 34 | $9,815 | $288,676 |

| Agriculture operations loans - <$1MM | 88 | $5,256 | $59,727 |

| Agriculture operations loans - <$100k | 74 | $2,103 | $28,419 |

| Agriculture operations loans - $100-250k | 8 | $1,014 | $126,750 |

| Agriculture operations loans - $250k-1MM | 6 | $2,139 | $356,500 |