Associated Bank Mortgage Rates, Fees & Info

Green Bay, WILEI: ZF85QS7OXKPBG52R7N18

Tax ID: 39-1941673

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Associated Bank is a mid-sized bank specializing in Home Purchase and Refi loans. Associated Bank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Chicago, Milwaukee, Minneapolis, Green Bay, and St. Louis among others. We have data for 139 markets. (Some data included below & more in-depth data is available with an active subscription.)Associated Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Associated Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.72% | 8/3/25 |

| 30 Year Conventional Purchase | 6.70% | 8/3/25 |

| 30 Year Conventional Refi | 6.67% | 8/3/25 |

| 30 Year Cash-out Refi | 6.90% | 8/3/25 |

| 30 Year FHA Purchase | 7.11% | 8/3/25 |

| 30 Year FHA Refi | 6.72% | 8/3/25 |

| 30 Year VA Purchase | 6.58% | 8/3/25 |

| 30 Year USDA Purchase | 6.89% | 8/3/25 |

| 15 Year Conventional Purchase | 6.01% | 8/3/25 |

| 15 Year Conventional Refi | 6.14% | 8/3/25 |

| 15 Year Cash-out Refi | 6.14% | 8/3/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

Associated Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from Associated Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

14,670Origination Dollar Volume (All Markets)

$3,748,340,000Employee count

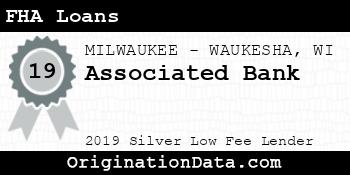

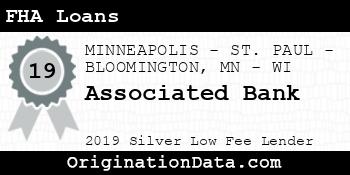

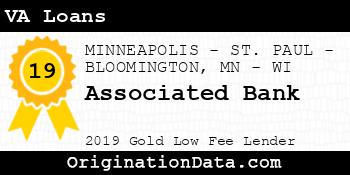

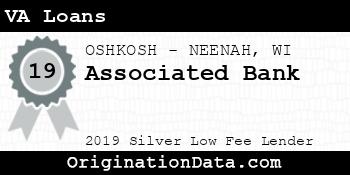

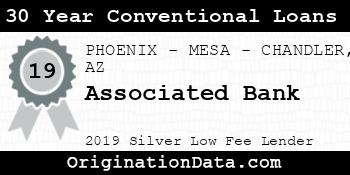

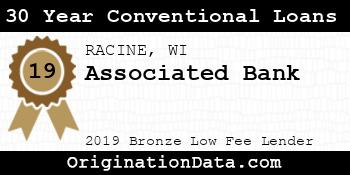

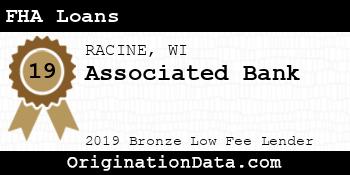

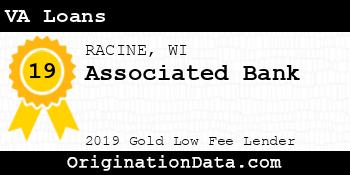

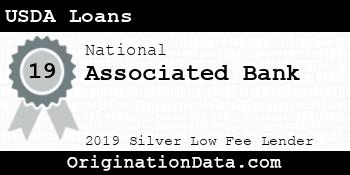

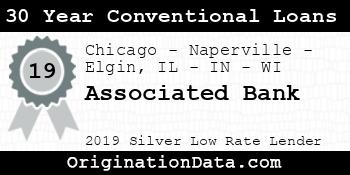

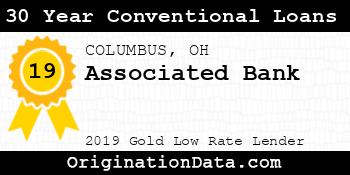

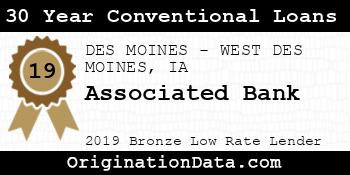

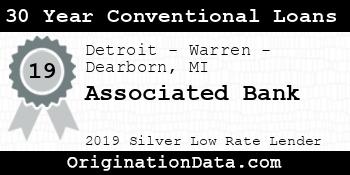

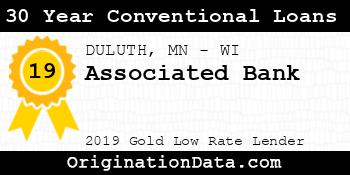

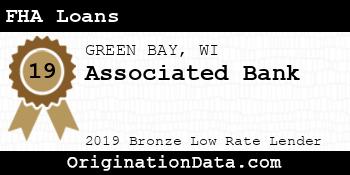

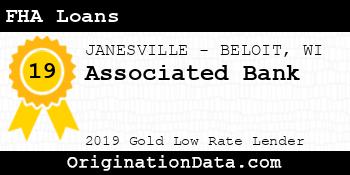

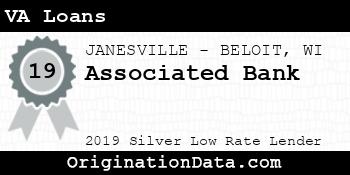

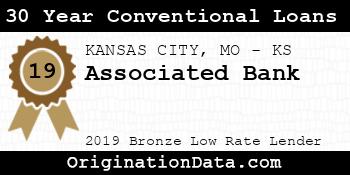

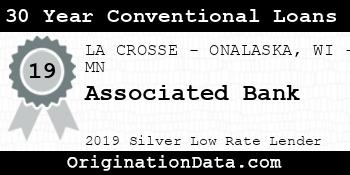

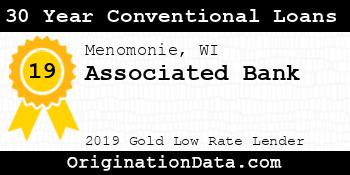

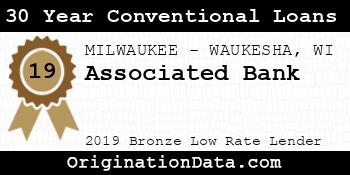

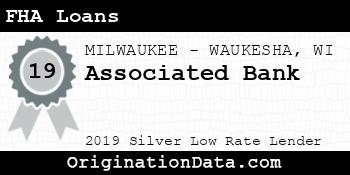

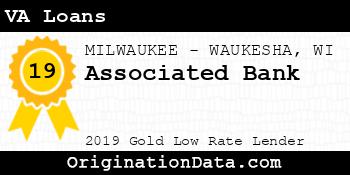

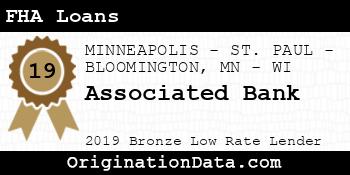

4,669 Show all (61) awardsAssociated Bank - 2019

Associated Bank is a 2019 , due to their low .

For 2019, less than of lenders were eligible for this award.

Work for Associated Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 2,457 | $1,132,065,000 | $460,751 | $4,069 | 4.06% |

| MILWAUKEE-WAUKESHA, WI (FHA|USDA|VA) | 2,420 | $610,230,000 | $252,161 | $2,092 | 4.51% |

| MINNEAPOLIS-ST. PAUL-BLOOMINGTON, MN-WI (FHA|USDA|VA) | 1,342 | $410,930,000 | $306,207 | $3,393 | 4.49% |

| GREEN BAY, WI (FHA|USDA|VA) | 1,230 | $190,750,000 | $155,081 | $1,936 | 4.64% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 446 | $171,910,000 | $385,448 | $3,452 | 4.26% |

| Outside of Metro Areas | 1,170 | $167,730,000 | $143,359 | $2,229 | 4.72% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 253 | $109,565,000 | $433,063 | $5,880 | 3.89% |

| MADISON, WI (FHA|USDA|VA) | 615 | $108,695,000 | $176,740 | $2,190 | 4.70% |

| APPLETON, WI (FHA|USDA|VA) | 509 | $87,665,000 | $172,230 | $1,981 | 4.60% |

| OSHKOSH-NEENAH, WI (FHA|USDA|VA) | 352 | $58,470,000 | $166,108 | $2,004 | 4.58% |

| RACINE, WI (FHA|USDA|VA) | 285 | $44,195,000 | $155,070 | $2,181 | 4.39% |

| FOND DU LAC, WI (FHA|USDA|VA) | 190 | $41,470,000 | $218,263 | $1,970 | 4.38% |

| LA CROSSE-ONALASKA, WI-MN (FHA|USDA|VA) | 214 | $38,960,000 | $182,056 | $1,926 | 4.86% |

| JANESVILLE-BELOIT, WI (FHA|USDA|VA) | 322 | $36,680,000 | $113,913 | $2,158 | 4.77% |

| EAU CLAIRE, WI (FHA|USDA|VA) | 285 | $35,595,000 | $124,895 | $2,133 | 4.96% |

| WAUSAU-WESTON, WI (FHA|USDA|VA) | 253 | $31,395,000 | $124,091 | $1,994 | 4.85% |

| Whitewater, WI (FHA|USDA|VA) | 164 | $26,080,000 | $159,024 | $2,017 | 5.08% |

| SHEBOYGAN, WI (FHA|USDA|VA) | 159 | $23,905,000 | $150,346 | $1,863 | 4.45% |

| PEORIA, IL (FHA|USDA|VA) | 174 | $23,870,000 | $137,184 | $2,121 | 4.74% |

| INDIANAPOLIS-CARMEL-ANDERSON, IN (FHA|USDA|VA) | 63 | $22,525,000 | $357,540 | $2,657 | 4.09% |

| COLUMBUS, OH (FHA|USDA|VA) | 32 | $21,000,000 | $656,250 | $4,089 | 3.88% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 1 | $20,405,000 | $20,405,000 | $0 | 3.34% |

| Stevens Point, WI (FHA|USDA|VA) | 146 | $18,130,000 | $124,178 | $1,844 | 4.74% |

| ROCHESTER, MN (FHA|USDA|VA) | 102 | $17,770,000 | $174,216 | $3,066 | 4.61% |

| ROCKFORD, IL (FHA|USDA|VA) | 217 | $17,415,000 | $80,253 | $2,398 | 4.92% |

| Manitowoc, WI (FHA|USDA|VA) | 128 | $16,810,000 | $131,328 | $1,892 | 4.68% |

| Wisconsin Rapids-Marshfield, WI (FHA|USDA|VA) | 129 | $16,335,000 | $126,628 | $1,895 | 4.65% |

| Marinette, WI-MI (FHA|USDA|VA) | 143 | $15,965,000 | $111,643 | $1,824 | 4.64% |

| SPRINGFIELD, MO (FHA|USDA|VA) | 53 | $14,265,000 | $269,151 | $2,249 | 4.07% |

| Beaver Dam, WI (FHA|USDA|VA) | 105 | $13,575,000 | $129,286 | $1,826 | 4.82% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 23 | $13,205,000 | $574,130 | $3,322 | 3.99% |

| Watertown-Fort Atkinson, WI (FHA|USDA|VA) | 79 | $13,175,000 | $166,772 | $2,379 | 4.71% |

| DULUTH, MN-WI (FHA|USDA|VA) | 18 | $12,000,000 | $666,667 | $3,056 | 4.44% |

| Shawano, WI (FHA|USDA|VA) | 111 | $11,855,000 | $106,802 | $1,955 | 5.09% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 24 | $8,050,000 | $335,417 | $2,752 | 4.08% |

| Brainerd, MN (FHA|USDA|VA) | 10 | $7,760,000 | $776,000 | $5,277 | 4.21% |

| ANN ARBOR, MI (FHA|USDA|VA) | 17 | $7,705,000 | $453,235 | $4,826 | 3.87% |

| BLOOMINGTON, IL (FHA|USDA|VA) | 3 | $7,355,000 | $2,451,667 | $2,237 | 4.30% |

| DES MOINES-WEST DES MOINES, IA (FHA|USDA|VA) | 14 | $7,290,000 | $520,714 | $2,638 | 3.94% |

| BISMARCK, ND (FHA|USDA|VA) | 2 | $7,070,000 | $3,535,000 | $0 | 4.65% |

| Red Wing, MN (FHA|USDA|VA) | 42 | $5,670,000 | $135,000 | $2,717 | 5.00% |

| RAPID CITY, SD (FHA|USDA|VA) | 2 | $5,370,000 | $2,685,000 | $0 | 4.46% |

| Menomonie, WI (FHA|USDA|VA) | 36 | $5,090,000 | $141,389 | $2,076 | 4.45% |

| Garden City, KS (FHA|USDA|VA) | 1 | $4,825,000 | $4,825,000 | $0 | 4.42% |

| Baraboo, WI (FHA|USDA|VA) | 51 | $4,735,000 | $92,843 | $1,912 | 5.30% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 9 | $4,155,000 | $461,667 | $7,317 | 3.60% |

| IOWA CITY, IA (FHA|USDA|VA) | 14 | $4,120,000 | $294,286 | $947 | 3.69% |

| Liberal, KS (FHA|USDA|VA) | 2 | $4,080,000 | $2,040,000 | $0 | 4.36% |

| SIOUX FALLS, SD (FHA|USDA|VA) | 1 | $3,885,000 | $3,885,000 | $0 | 4.73% |

| CINCINNATI, OH-KY-IN (FHA|USDA|VA) | 6 | $3,120,000 | $520,000 | $3,415 | 4.00% |

| GRAND FORKS, ND-MN (FHA|USDA|VA) | 1 | $2,755,000 | $2,755,000 | $0 | 4.65% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 10 | $2,690,000 | $269,000 | $3,512 | 4.41% |

| Traverse City, MI (FHA|USDA|VA) | 6 | $2,310,000 | $385,000 | $4,128 | 4.25% |

| NILES, MI (FHA|USDA|VA) | 4 | $2,070,000 | $517,500 | $3,447 | 3.78% |

| FORT WAYNE, IN (FHA|USDA|VA) | 11 | $2,065,000 | $187,727 | $1,791 | 4.16% |

| CEDAR RAPIDS, IA (FHA|USDA|VA) | 10 | $1,730,000 | $173,000 | $1,303 | 3.60% |

| Minot, ND (FHA|USDA|VA) | 1 | $1,575,000 | $1,575,000 | $0 | 4.65% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 10 | $1,550,000 | $155,000 | $2,561 | 4.19% |

| Alexandria, MN (FHA|USDA|VA) | 4 | $1,500,000 | $375,000 | $4,634 | 4.75% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 5 | $1,445,000 | $289,000 | $3,391 | 4.33% |

| Holland, MI (FHA|USDA|VA) | 1 | $1,435,000 | $1,435,000 | $19,801 | 3.13% |

| Yankton, SD (FHA|USDA|VA) | 1 | $1,385,000 | $1,385,000 | $0 | 4.74% |

| Glenwood Springs, CO (FHA|USDA|VA) | 1 | $1,325,000 | $1,325,000 | $0 | 4.31% |

| TOLEDO, OH (FHA|USDA|VA) | 3 | $1,315,000 | $438,333 | $4,526 | 4.04% |

| Key West, FL (FHA|USDA|VA) | 2 | $1,250,000 | $625,000 | $6,697 | 3.56% |

| COLUMBIA, MO (FHA|USDA|VA) | 2 | $1,220,000 | $610,000 | $2,902 | 4.06% |

| Spirit Lake, IA (FHA|USDA|VA) | 2 | $1,150,000 | $575,000 | $3,803 | 4.06% |

| AMES, IA (FHA|USDA|VA) | 3 | $1,125,000 | $375,000 | $2,240 | 3.92% |

| Marquette, MI (FHA|USDA|VA) | 10 | $1,100,000 | $110,000 | $1,780 | 4.00% |

| Mitchell, SD (FHA|USDA|VA) | 1 | $1,065,000 | $1,065,000 | $0 | 4.73% |

| MANKATO, MN (FHA|USDA|VA) | 3 | $1,055,000 | $351,667 | $3,340 | 3.46% |

| LANSING-EAST LANSING, MI (FHA|USDA|VA) | 5 | $1,045,000 | $209,000 | $1,532 | 4.33% |

| FLINT, MI (FHA|USDA|VA) | 2 | $970,000 | $485,000 | $5,856 | 3.94% |

| Platteville, WI (FHA|USDA|VA) | 12 | $970,000 | $80,833 | $1,710 | 4.61% |

| GRAND RAPIDS-KENTWOOD, MI (FHA|USDA|VA) | 3 | $965,000 | $321,667 | $3,517 | 3.88% |

| Iron Mountain, MI-WI (FHA|USDA|VA) | 6 | $940,000 | $156,667 | $1,868 | 4.38% |

| CHAMPAIGN-URBANA, IL (FHA|USDA|VA) | 3 | $925,000 | $308,333 | $2,368 | 3.71% |

| Houghton, MI (FHA|USDA|VA) | 5 | $825,000 | $165,000 | $2,222 | 4.80% |

| LEXINGTON-FAYETTE, KY (FHA|USDA|VA) | 1 | $825,000 | $825,000 | $4,874 | 3.50% |

| DUBUQUE, IA (FHA|USDA|VA) | 2 | $820,000 | $410,000 | $2,438 | 3.88% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 5 | $785,000 | $157,000 | $2,679 | 3.95% |

| TUCSON, AZ (FHA|USDA|VA) | 3 | $765,000 | $255,000 | $3,051 | 3.71% |

| Grand Rapids, MN (FHA|USDA|VA) | 2 | $760,000 | $380,000 | $3,570 | 3.88% |

| LOUISVILLE, KY (FHA|USDA|VA) | 2 | $710,000 | $355,000 | $2,386 | 3.81% |

| Winona, MN (FHA|USDA|VA) | 3 | $705,000 | $235,000 | $3,239 | 3.96% |

| Angola, IN (FHA|USDA|VA) | 1 | $685,000 | $685,000 | $3,810 | 3.50% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 2 | $670,000 | $335,000 | $4,486 | 4.63% |

| CARBONDALE-MARION, IL (FHA|USDA|VA) | 8 | $670,000 | $83,750 | $1,800 | 4.72% |

| Faribault-Northfield, MN (FHA|USDA|VA) | 5 | $645,000 | $129,000 | $3,439 | 4.05% |

| CLEVELAND-ELYRIA, OH (FHA|USDA|VA) | 3 | $645,000 | $215,000 | $3,368 | 4.58% |

| Kendallville, IN (FHA|USDA|VA) | 3 | $645,000 | $215,000 | $1,355 | 4.54% |

| MONROE, MI (FHA|USDA|VA) | 3 | $645,000 | $215,000 | $4,399 | 4.33% |

| BELLINGHAM, WA (FHA|USDA|VA) | 1 | $625,000 | $625,000 | $3,658 | 3.38% |

| Norwalk, OH (FHA|USDA|VA) | 1 | $615,000 | $615,000 | $5,351 | 4.25% |

| KALAMAZOO-PORTAGE, MI (FHA|USDA|VA) | 2 | $610,000 | $305,000 | $5,043 | 5.19% |

| COLUMBUS, IN (FHA|USDA|VA) | 1 | $605,000 | $605,000 | $3,127 | 3.63% |

| SOUTH BEND-MISHAWAKA, IN-MI (FHA|USDA|VA) | 3 | $595,000 | $198,333 | $2,194 | 4.13% |

| MICHIGAN CITY-LA PORTE, IN (FHA|USDA|VA) | 1 | $575,000 | $575,000 | $4,262 | 3.63% |

| THE VILLAGES, FL (FHA|USDA|VA) | 2 | $560,000 | $280,000 | $4,951 | 3.75% |

| LAWRENCE, KS (FHA|USDA|VA) | 1 | $555,000 | $555,000 | $4,324 | 3.75% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $2,647 | 4.17% |

| Branson, MO (FHA|USDA|VA) | 3 | $515,000 | $171,667 | $1,931 | 4.63% |

| Freeport, IL (FHA|USDA|VA) | 4 | $490,000 | $122,500 | $2,315 | 4.47% |

| Escanaba, MI (FHA|USDA|VA) | 4 | $440,000 | $110,000 | $2,427 | 4.50% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $4,306 | 3.13% |

| Sebastian-Vero Beach, FL (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $2,628 | 4.50% |

| ST. CLOUD, MN (FHA|USDA|VA) | 3 | $385,000 | $128,333 | $3,732 | 5.00% |

| Auburn, IN (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $1,912 | 4.06% |

| WATERLOO-CEDAR FALLS, IA (FHA|USDA|VA) | 1 | $365,000 | $365,000 | $1,730 | 3.50% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 1 | $345,000 | $345,000 | $2,736 | 3.88% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $4,001 | 4.00% |

| Galesburg, IL (FHA|USDA|VA) | 4 | $320,000 | $80,000 | $2,022 | 4.50% |

| Austin, MN (FHA|USDA|VA) | 3 | $295,000 | $98,333 | $2,316 | 3.67% |

| Bemidji, MN (FHA|USDA|VA) | 4 | $290,000 | $72,500 | $3,123 | 5.19% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $3,933 | 4.13% |

| Ottawa, IL (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $1,835 | 4.00% |

| Sturgis, MI (FHA|USDA|VA) | 1 | $265,000 | $265,000 | $2,156 | 3.13% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,838 | 3.63% |

| Alma, MI (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,904 | 3.88% |

| Crawfordsville, IN (FHA|USDA|VA) | 2 | $230,000 | $115,000 | $2,025 | 4.94% |

| Owatonna, MN (FHA|USDA|VA) | 2 | $200,000 | $100,000 | $2,306 | 4.69% |

| Centralia, IL (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $1,745 | 3.63% |

| Fergus Falls, MN (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,897 | 4.25% |

| Oskaloosa, IA (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $1,047 | 3.75% |

| KANKAKEE, IL (FHA|USDA|VA) | 2 | $150,000 | $75,000 | $2,056 | 4.88% |

| DANVILLE, IL (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $1,451 | 4.63% |

| JACKSON, MI (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $1,852 | 3.63% |

| OCALA, FL (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $3,034 | 4.00% |

| Ashland, OH (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $4,780 | 3.75% |

| SPRINGFIELD, IL (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,085 | 3.88% |

| LAKELAND-WINTER HAVEN, FL (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $2,772 | 4.75% |

| Farmington, MO (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $2,200 | 4.50% |

| JEFFERSON CITY, MO (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $0 | 4.38% |

| Fort Madison-Keokuk, IA-IL-MO (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $1,047 | 3.75% |

| KOKOMO, IN (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $2,016 | 3.63% |

| YUMA, AZ (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $2,259 | 4.25% |

| Dixon, IL (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $1,444 | 4.38% |

| PANAMA CITY, FL (FHA|USDA|VA) | 1 | $35,000 | $35,000 | $1,668 | 4.25% |

| Cookeville, TN (FHA|USDA|VA) | 1 | $15,000 | $15,000 | $0 | 8.75% |

Similar Lenders

We use machine learning to identify the top lenders compared against Associated Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 8

Similarity Rank: 14

Similarity Rank: 35

Similarity Rank: 96

Similarity Rank: 98

Similarity Rank: 117

Similarity Rank: 144

Similarity Rank: 190

Similarity Rank: 200

Similarity Rank: 220

Product Mix

For 2019, Associated Bank's most frequently originated type of loan was Conventional, with 10,659 originations. Their 2nd most popular type was HELOC, with 3,529 originations.

Loan Reason

For 2019, Associated Bank's most frequently cited loan purpose was Home Purchase, with 6,820 originations. The 2nd most popular reason was Refi, with 3,617 originations.

Loan Duration/Length

For 2019, Associated Bank's most frequently cited loan duration was 30 Year, with 12,917 originations. The 2nd most popular length was 15 Year, with 1,275 originations.

Origination Fees/Closing Costs

Associated Bank's average total fees were $2,916, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 8,280 originations.

Interest Rates

During 2019, Associated Bank's average interest rate for loans was 4.61%, while their most frequently originated rate bucket for loans was 3-4%, with 7,026 originations.

Loan Sizing

2019 saw Associated Bank place emphasis on $100,000 or less loans with 4,443 originations, totaling $227,225,000 in origination value.

Applicant Income

Associated Bank lent most frequently to those with incomes in the $50k-75k range, with 2,800 originations. The second most popular income band? $100k-150k, with 2,702 originations.

Applicant Debt to Income Ratio

Associated Bank lent most frequently to those with DTI ratios of 20-30%, with 3,952 originations. The next most common DTI ratio? 30-36%, with 2,966 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications84.75%

Associated Bank has a below average approval rate.

Pick Rate

Approvals leading to origination88.03%

Associated Bank has an average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 14,670 | $3,748,340,000 | $255,511 |

Occupancy Type Mix

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2019 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| ASSOCIATED BANC-CORP | Conventional home mortgage | Applying for a mortgage or refinancing an existing mortgage | 2 | 11.8% |

| ASSOCIATED BANC-CORP | Conventional home mortgage | Closing on a mortgage | 1 | 5.9% |

| ASSOCIATED BANC-CORP | Conventional home mortgage | Trouble during payment process | 7 | 41.2% |

| ASSOCIATED BANC-CORP | Home equity loan or line of credit (HELOC) | Trouble during payment process | 1 | 5.9% |

| ASSOCIATED BANC-CORP | Other type of mortgage | Closing on a mortgage | 2 | 11.8% |

| ASSOCIATED BANC-CORP | Other type of mortgage | Trouble during payment process | 4 | 23.5% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Associated Bank, National Association | 1 Brewers Way Milwaukee, WI 53214 | Limited, Mobile/Seasonal Office | $0 |

| Associated Bank, National Association | 1 Junction Drive West Glen Carbon, IL 62034 | Full Service B&M | $50,554 |

| Associated Bank, National Association | 1 South Genesee Street Waukegan, IL 60085 | Full Service B&M | $29,673 |

| Associated Bank, National Association | 10 North Lincoln Street Elkhorn, WI 53121 | Full Service B&M | $125,387 |

| Associated Bank, National Association | 10 West Murdock Street Oshkosh, WI 54901 | Full Service B&M | $106,239 |

| Associated Bank, National Association | 100 East Sunset Drive Waukesha, WI 53189 | Full Service B&M | $37,623 |

| Associated Bank, National Association | 100 East Washington Street Belleville, IL 62220 | Full Service B&M | $37,125 |

| Associated Bank, National Association | 100 West Wisconsin Avenue Neenah, WI 54956 | Full Service B&M | $252,212 |

| Associated Bank, National Association | 1007 North 4th Street Chillicothe, IL 61523 | Full Service B&M | $24,969 |

| Associated Bank, National Association | 101 1st Ave Sw Rochester, MN 55902 | Full Service B&M | $22,723 |

| Associated Bank, National Association | 101 East Court Street Richland Center, WI 53581 | Full Service B&M | $23,631 |

| Associated Bank, National Association | 101 Park Street New London, WI 54961 | Full Service B&M | $35,153 |

| Associated Bank, National Association | 102 Main Street Lodi, WI 53555 | Full Service B&M | $74,957 |

| Associated Bank, National Association | 102 North Water Street Milwaukee, WI 53202 | Full Service B&M | $7,733 |

| Associated Bank, National Association | 103 E Huron Street Berlin, WI 54923 | Full Service B&M | $12,971 |

| Associated Bank, National Association | 1035 Main Street Oconto, WI 54153 | Full Service B&M | $25,029 |

| Associated Bank, National Association | 104 East Pine Street Eagle River, WI 54521 | Full Service B&M | $34,012 |

| Associated Bank, National Association | 104 Homer M. Adams Parkway Alton, IL 62002 | Full Service B&M | $36,541 |

| Associated Bank, National Association | 10440 Townline Road Sister Bay, WI 54234 | Full Service B&M | $39,517 |

| Associated Bank, National Association | 1050 Milwaukee Avenue Burlington, WI 53105 | Full Service B&M | $61,809 |

| Associated Bank, National Association | 10562 Kansas Avenue Hayward, WI 54843 | Full Service B&M | $50,948 |

| Associated Bank, National Association | 106 South Main Street Jefferson, WI 53549 | Full Service B&M | $30,361 |

| Associated Bank, National Association | 10701 West National Avenue West Allis, WI 53227 | Full Service B&M | $171,931 |

| Associated Bank, National Association | 10708 West Janesville Road Hales Corners, WI 53130 | Full Service B&M | $124,090 |

| Associated Bank, National Association | 109 East Doty Avenue Neenah, WI 54956 | Limited, Drive-thru | $0 |

| Associated Bank, National Association | 10910 Main Street Richmond, IL 60071 | Full Service B&M | $28,611 |

| Associated Bank, National Association | 1107 Regis Court Eau Claire, WI 54701 | Full Service B&M | $122,254 |

| Associated Bank, National Association | 111 Tower Drive Columbus, WI 53925 | Full Service B&M | $46,299 |

| Associated Bank, National Association | 1121 Franklin Street Manitowoc, WI 54220 | Full Service B&M | $115,092 |

| Associated Bank, National Association | 11249 N Port Washington Road Mequon, WI 53092 | Full Service B&M | $78,044 |

| Associated Bank, National Association | 1155 16th Street S.W. Rochester, MN 55902 | Full Service B&M | $59,584 |

| Associated Bank, National Association | 1156 4th Avenue South Park Falls, WI 54552 | Full Service B&M | $16,763 |

| Associated Bank, National Association | 117 King Street Stoughton, WI 53589 | Full Service B&M | $75,725 |

| Associated Bank, National Association | 118 Business 141 Coleman, WI 54112 | Full Service B&M | $48,626 |

| Associated Bank, National Association | 118 North Broadway Street Stanley, WI 54768 | Full Service B&M | $13,886 |

| Associated Bank, National Association | 1195 North Casaloma Drive Appleton, WI 54913 | Full Service B&M | $68,807 |

| Associated Bank, National Association | 1203 17th Avenue Bloomer, WI 54724 | Full Service B&M | $24,594 |

| Associated Bank, National Association | 1217 North Taylor Drive Sheboygan, WI 53081 | Full Service B&M | $189,091 |

| Associated Bank, National Association | 123 East Main Street Wautoma, WI 54982 | Full Service B&M | $40,813 |

| Associated Bank, National Association | 124 W Main St Winneconne, WI 54986 | Full Service B&M | $26,482 |

| Associated Bank, National Association | 127 Sand Lake Rd Onalaska, WI 54650 | Full Service B&M | $47,575 |

| Associated Bank, National Association | 1270 West Sunset Drive Waukesha, WI 53189 | Full Service B&M | $63,969 |

| Associated Bank, National Association | 1270 Yankee Doodle Road Eagan, MN 55121 | Full Service B&M | $105,809 |

| Associated Bank, National Association | 129 East Division Street Shawano, WI 54166 | Full Service B&M | $169,615 |

| Associated Bank, National Association | 1301 N Martin Luther King Jr. Drive Milwaukee, WI 53212 | Full Service B&M | $23,953 |

| Associated Bank, National Association | 1301 Waukegan Road Glenview, IL 60025 | Full Service B&M | $63,961 |

| Associated Bank, National Association | 1305 Main Street Stevens Point, WI 54481 | Limited, Administrative | $0 |

| Associated Bank, National Association | 1312 Wisconsin Street Hudson, WI 54016 | Limited, Mobile/Seasonal Office | $0 |

| Associated Bank, National Association | 1313 Delany Road Gurnee, IL 60031 | Full Service B&M | $22,307 |

| Associated Bank, National Association | 1325 Church Street Stevens Point, WI 54481 | Full Service B&M | $88,483 |

| Associated Bank, National Association | 1332 Egg Harbor Road Sturgeon Bay, WI 54235 | Limited, Drive-thru | $0 |

| Associated Bank, National Association | 134 North Main Street Oconto Falls, WI 54154 | Full Service B&M | $54,416 |

| Associated Bank, National Association | 135 County Highway W Manitowish Waters, WI 54545 | Full Service B&M | $30,066 |

| Associated Bank, National Association | 1400 Capitol Drive Pewaukee, WI 53072 | Full Service B&M | $63,552 |

| Associated Bank, National Association | 1420 11th Street Monroe, WI 53566 | Full Service B&M | $32,770 |

| Associated Bank, National Association | 144 N. Washington Street Saint Croix Falls, WI 54024 | Full Service B&M | $8,674 |

| Associated Bank, National Association | 1456 Summit Avenue Oconomowoc, WI 53066 | Full Service B&M | $62,524 |

| Associated Bank, National Association | 1482 West Mason Street Green Bay, WI 54303 | Full Service B&M | $56,559 |

| Associated Bank, National Association | 15665 West National Avenue New Berlin, WI 53151 | Full Service B&M | $86,754 |

| Associated Bank, National Association | 1574 W Broadway Ste 107 Monona, WI 53713 | Full Service B&M | $21,222 |

| Associated Bank, National Association | 1594 East Sumner Street Hartford, WI 53027 | Full Service B&M | $44,278 |

| Associated Bank, National Association | 16 North Spring Street Elgin, IL 60120 | Full Service B&M | $51,321 |

| Associated Bank, National Association | 160 E. Pulaski St Pulaski, WI 54162 | Full Service B&M | $39,161 |

| Associated Bank, National Association | 160 Medford Plaza Medford, WI 54451 | Full Service Retail | $27,172 |

| Associated Bank, National Association | 1603 Monroe Street Madison, WI 53711 | Full Service B&M | $81,472 |

| Associated Bank, National Association | 1612 Belknap Street Superior, WI 54880 | Full Service B&M | $12,759 |

| Associated Bank, National Association | 1617 North Central Avenue Marshfield, WI 54449 | Full Service Retail | $31,299 |

| Associated Bank, National Association | 1660 11th Avenue Baldwin, WI 54002 | Full Service B&M | $31,315 |

| Associated Bank, National Association | 17100 W Capitol Dr Brookfield, WI 53005 | Full Service B&M | $45,761 |

| Associated Bank, National Association | 17595 West Bluemound Road Brookfield, WI 53045 | Full Service B&M | $135,093 |

| Associated Bank, National Association | 1763 West Howard Avenue Chicago, IL 60626 | Full Service Retail | $1,963 |

| Associated Bank, National Association | 180 West Virginia Street Crystal Lake, IL 60014 | Full Service B&M | $75,423 |

| Associated Bank, National Association | 1801 Riverside Drive Minneapolis, MN 55454 | Full Service B&M | $28,498 |

| Associated Bank, National Association | 1835 Radio Drive Woodbury, MN 55125 | Full Service B&M | $86,281 |

| Associated Bank, National Association | 1870 N Perryville Road Rockford, IL 61107 | Full Service B&M | $87,459 |

| Associated Bank, National Association | 1985 Commerce Dr Nw Rochester, MN 55901 | Full Service B&M | $20,998 |

| Associated Bank, National Association | 200 East Randolph Drive Chicago, IL 60601 | Full Service B&M | $1,013,793 |

| Associated Bank, National Association | 200 North Adams Street Green Bay, WI 54301 | Full Service B&M | $1,582,388 |

| Associated Bank, National Association | 200 West Bartlett Avenue Bartlett, IL 60103 | Full Service B&M | $33,792 |

| Associated Bank, National Association | 2001 Coulee Road Hudson, WI 54016 | Full Service B&M | $64,865 |

| Associated Bank, National Association | 240 Sw Jefferson Ave Peoria, IL 61602 | Full Service B&M | $31,209 |

| Associated Bank, National Association | 2001 Larkin Avenue Elgin, IL 60123 | Full Service B&M | $44,530 |

| Associated Bank, National Association | 2001 Londonderry Drive Madison, WI 53704 | Full Service B&M | $40,847 |

| Associated Bank, National Association | 2001 South Webster Avenue Green Bay, WI 54301 | Full Service B&M | $81,525 |

| Associated Bank, National Association | 201 Marcou Road Onalaska, WI 54650 | Full Service B&M | $42,613 |

| Associated Bank, National Association | 201 Park Avenue Beaver Dam, WI 53916 | Full Service B&M | $52,195 |

| Associated Bank, National Association | 2010 Stewart Avenue Wausau, WI 54401 | Full Service B&M | $248,081 |

| Associated Bank, National Association | 202 Snelling Avenue Saint Paul, MN 55104 | Full Service B&M | $528,138 |

| Associated Bank, National Association | 2030 Wisconsin Avenue Grafton, WI 53024 | Full Service B&M | $95,543 |

| Associated Bank, National Association | 205 4th Street N La Crosse, WI 54601 | Full Service B&M | $142,280 |

| Associated Bank, National Association | 205 E 4th St Kaukauna, WI 54130 | Full Service B&M | $42,362 |

| Associated Bank, National Association | 206 North Wisconsin Street De Pere, WI 54115 | Full Service B&M | $139,680 |

| Associated Bank, National Association | 206 South Broadway Rochester, MN 55904 | Full Service B&M | $28,309 |

| Associated Bank, National Association | 2060 South Robert Street West Saint Paul, MN 55118 | Full Service B&M | $76,028 |

| Associated Bank, National Association | 207 Wells Street Darlington, WI 53530 | Full Service B&M | $20,366 |

| Associated Bank, National Association | 208 N. Main St Thiensville, WI 53092 | Full Service B&M | $28,432 |

| Associated Bank, National Association | 208 Oak Creek Plaza Mundelein, IL 60060 | Full Service B&M | $17,165 |

| Associated Bank, National Association | 208 Steele Street Algoma, WI 54201 | Full Service B&M | $23,110 |

| Associated Bank, National Association | 210 South Lake Avenue Crandon, WI 54520 | Full Service B&M | $38,663 |

| Associated Bank, National Association | 213 North Lake Avenue Twin Lakes, WI 53181 | Full Service B&M | $52,493 |

| Associated Bank, National Association | 2151 S 42nd Street Manitowoc, WI 54220 | Full Service Retail | $45,431 |

| Associated Bank, National Association | 217 North Milwaukee Street Waterford, WI 53185 | Full Service B&M | $60,922 |

| Associated Bank, National Association | 217 West Washington Street Millstadt, IL 62260 | Full Service B&M | $29,599 |

| Associated Bank, National Association | 2175 South Memorial Drive Appleton, WI 54915 | Full Service B&M | $37,143 |

| Associated Bank, National Association | 219 Center Street Whitewater, WI 53190 | Full Service B&M | $49,600 |

| Associated Bank, National Association | 2200 Crestview Drive Hudson, WI 54016 | Full Service B&M | $99,947 |

| Associated Bank, National Association | 2201 Roosevelt Road Marinette, WI 54143 | Full Service B&M | $56,105 |

| Associated Bank, National Association | 221 4th Avenue West Ashland, WI 54806 | Full Service B&M | $61,509 |

| Associated Bank, National Association | 222 East Wisconsin Street Portage, WI 53901 | Full Service B&M | $118,090 |

| Associated Bank, National Association | 222 North Wisconsin Street Port Washington, WI 53074 | Full Service B&M | $78,758 |

| Associated Bank, National Association | 2241 East Main Street, Suite A Green Bay, WI 54302 | Full Service B&M | $126,027 |

| Associated Bank, National Association | 2262 University Avenue Green Bay, WI 54302 | Full Service B&M | $52,094 |

| Associated Bank, National Association | 227 West Wisconsin Avenue Tomahawk, WI 54487 | Full Service B&M | $28,057 |

| Associated Bank, National Association | 2311 West Pioneer Parkway Peoria, IL 61615 | Full Service B&M | $33,244 |

| Associated Bank, National Association | 2348 Lineville Road Suamico, WI 54313 | Full Service Retail | $39,167 |

| Associated Bank, National Association | 2357 S. Oneida St. Green Bay, WI 54304 | Full Service B&M | $101,683 |

| Associated Bank, National Association | 238 North Main Street Columbia, IL 62236 | Full Service B&M | $39,651 |

| Associated Bank, National Association | 2403 East Main Street Merrill, WI 54452 | Full Service B&M | $24,752 |

| Associated Bank, National Association | 825 North Main Viroqua, WI 54665 | Full Service B&M | $27,151 |

| Associated Bank, National Association | 2415 Westowne Avenue, Suite A Oshkosh, WI 54904 | Full Service Retail | $33,122 |

| Associated Bank, National Association | 2420 Allen Boulevard Middleton, WI 53562 | Full Service B&M | $67,318 |

| Associated Bank, National Association | 2424 W. Mason St. Green Bay, WI 54303 | Full Service B&M | $52,119 |

| Associated Bank, National Association | 250 East Wisconsin Avenue Milwaukee, WI 53202 | Full Service B&M | $3,189,585 |

| Associated Bank, National Association | 2500 State Rd La Crosse, WI 54601 | Full Service Retail | $56,444 |

| Associated Bank, National Association | 2534 A Steffens Court Green Bay, WI 54311 | Full Service Retail | $42,781 |

| Associated Bank, National Association | 2590 North Downer Avenue Milwaukee, WI 53211 | Full Service B&M | $52,928 |

| Associated Bank, National Association | 2613 North Clairemont Avenue Eau Claire, WI 54703 | Full Service Retail | $17,831 |

| Associated Bank, National Association | 2645 North Mayfair Road Wauwatosa, WI 53226 | Full Service B&M | $91,381 |

| Associated Bank, National Association | 2655 Campus Drive Plymouth, MN 55441 | Full Service B&M | $50,586 |

| Associated Bank, National Association | 269 S. Century Avenue Waunakee, WI 53597 | Full Service B&M | $47,861 |

| Associated Bank, National Association | 2701 North Richmond Street Appleton, WI 54911 | Full Service B&M | $178,015 |

| Associated Bank, National Association | 2720 11th Street Rockford, IL 61109 | Full Service Retail | $18,467 |

| Associated Bank, National Association | 2720 North Lexington Drive Janesville, WI 53545 | Full Service B&M | $443,941 |

| Associated Bank, National Association | 2722 Eddy Lane Eau Claire, WI 54701 | Full Service B&M | $23,448 |

| Associated Bank, National Association | 2727 Post Road Plover, WI 54467 | Full Service B&M | $46,425 |

| Associated Bank, National Association | 2811 18th Street Kenosha, WI 53140 | Full Service Retail | $7,319 |

| Associated Bank, National Association | 2812 Mall Drive Eau Claire, WI 54701 | Full Service B&M | $68,159 |

| Associated Bank, National Association | 2815 North Grandview Boulevard Pewaukee, WI 53072 | Full Service B&M | $71,203 |

| Associated Bank, National Association | 2815 South Chicago Avenue South Milwaukee, WI 53172 | Full Service B&M | $37,152 |

| Associated Bank, National Association | 2850 Pioneer Ave Rice Lake, WI 54868 | Full Service B&M | $33,339 |

| Associated Bank, National Association | 2999 West County Road 42, Suite 130 Burnsville, MN 55306 | Full Service B&M | $35,012 |

| Associated Bank, National Association | 300 East Washington Street Slinger, WI 53086 | Full Service B&M | $64,997 |

| Associated Bank, National Association | 300 N La Salle Drive Chicago, IL 60654 | Full Service B&M | $148,438 |

| Associated Bank, National Association | 300 North Mclean Boulevard South Elgin, IL 60177 | Full Service B&M | $76,167 |

| Associated Bank, National Association | 300 South 4th Street Pekin, IL 61554 | Full Service B&M | $32,500 |

| Associated Bank, National Association | 3002 Fish Hatchery Rd. Fitchburg, WI 53713 | Full Service B&M | $71,007 |

| Associated Bank, National Association | 301 West Galena Boulevard Aurora, IL 60506 | Full Service B&M | $371,809 |

| Associated Bank, National Association | 304 Lincoln Rhinelander, WI 54501 | Full Service B&M | $112,287 |

| Associated Bank, National Association | 305 Hwy, 141 Crivitz, WI 54114 | Full Service B&M | $34,953 |

| Associated Bank, National Association | 307 Second Street Hudson, WI 54016 | Full Service B&M | $66,322 |

| Associated Bank, National Association | 310 Silver Street Hurley, WI 54534 | Full Service B&M | $34,642 |

| Associated Bank, National Association | 319 East Grand Avenue Eau Claire, WI 54701 | Full Service B&M | $16,161 |

| Associated Bank, National Association | 326 Missouri Avenue East St. Louis, IL 62201 | Full Service B&M | $58,263 |

| Associated Bank, National Association | 327 Third Avenue Clear Lake, WI 54005 | Full Service B&M | $19,462 |

| Associated Bank, National Association | 3292 Main Street East Troy, WI 53120 | Full Service B&M | $33,988 |

| Associated Bank, National Association | 3333 North Rockton Avenue Rockford, IL 61103 | Full Service B&M | $62,906 |

| Associated Bank, National Association | 3432 South 27th Street Milwaukee, WI 53215 | Full Service B&M | $63,889 |

| Associated Bank, National Association | 34354 North Highway 45 Third Lake, IL 60030 | Full Service B&M | $22,624 |

| Associated Bank, National Association | 35 W Columbia St Chippewa Falls, WI 54729 | Full Service B&M | $31,963 |

| Associated Bank, National Association | 3501 Veterans Avenue Suamico, WI 54173 | Full Service B&M | $33,521 |

| Associated Bank, National Association | 36225 Sunset Drive Dousman, WI 53118 | Limited, Mobile/Seasonal Office | $0 |

| Associated Bank, National Association | 369 Cardinal Lane Green Bay, WI 54313 | Full Service B&M | $151,694 |

| Associated Bank, National Association | 3719 South Kinnickinnic Avenue Saint Francis, WI 53235 | Full Service B&M | $50,507 |

| Associated Bank, National Association | 3847 S Howell Ave Milwaukee, WI 53207 | Full Service B&M | $33,471 |

| Associated Bank, National Association | 38860 10th Avenue North Branch, MN 55056 | Full Service B&M | $82,346 |

| Associated Bank, National Association | 400 Scott Street Wausau, WI 54403 | Full Service B&M | $48,264 |

| Associated Bank, National Association | 400 South Chestnut Avenue Marshfield, WI 54449 | Full Service B&M | $237,654 |

| Associated Bank, National Association | 403 W 4th St Red Wing, MN 55066 | Full Service B&M | $101,461 |

| Associated Bank, National Association | 406 West Camp St East Peoria, IL 61611 | Full Service B&M | $32,613 |

| Associated Bank, National Association | 420 East Main Street Ellsworth, WI 54011 | Full Service B&M | $62,165 |

| Associated Bank, National Association | 430 East Silver Spring Drive Whitefish Bay, WI 53217 | Full Service B&M | $98,074 |

| Associated Bank, National Association | 4400 Center Terrace Rockford, IL 61108 | Full Service B&M | $79,969 |

| Associated Bank, National Association | 4402 E Towne Blvd Madison, WI 53704 | Full Service B&M | $42,822 |

| Associated Bank, National Association | 4407 Cottage Grove Road Madison, WI 53716 | Full Service B&M | $68,657 |

| Associated Bank, National Association | 444 North Sawyer Street Oshkosh, WI 54902 | Full Service B&M | $104,083 |

| Associated Bank, National Association | 448 South Gammon Road Madison, WI 53719 | Full Service B&M | $101,399 |

| Associated Bank, National Association | 450 North Holmen Drive Holmen, WI 54636 | Full Service B&M | $44,395 |

| Associated Bank, National Association | 4600 Brandywine Drive Peoria, IL 61614 | Full Service B&M | $56,474 |

| Associated Bank, National Association | 4801 W Brown Deer Rd Milwaukee, WI 53223 | Full Service B&M | $20,740 |

| Associated Bank, National Association | 4811 South 76th Street Greenfield, WI 53220 | Full Service B&M | $148,777 |

| Associated Bank, National Association | 4812 W Burleigh St Milwaukee, WI 53210 | Full Service B&M | $4,455 |

| Associated Bank, National Association | 501 South Webb Street Wittenberg, WI 54499 | Full Service B&M | $24,418 |

| Associated Bank, National Association | 509 Grand Ave Neillsville, WI 54456 | Full Service B&M | $30,176 |

| Associated Bank, National Association | 514 Fremont Street Kiel, WI 53042 | Full Service B&M | $63,206 |

| Associated Bank, National Association | 5170 W Rawson Ave Franklin, WI 53132 | Full Service B&M | $42,773 |

| Associated Bank, National Association | 5200 North Central Avenue Chicago, IL 60630 | Full Service B&M | $192,768 |

| Associated Bank, National Association | 5205 Washington Ave Racine, WI 53406 | Full Service B&M | $9,925 |

| Associated Bank, National Association | 5211 Alderson Street Schofield, WI 54476 | Full Service B&M | $37,463 |

| Associated Bank, National Association | 5220 Farwell Street Mcfarland, WI 53558 | Full Service B&M | $43,129 |

| Associated Bank, National Association | 525 W Monroe St Chicago, IL 60661 | Full Service B&M | $2,157,834 |

| Associated Bank, National Association | 5260 N. Us 51 Mercer, WI 54547 | Full Service B&M | $36,330 |

| Associated Bank, National Association | 5292 Second Avenue Pittsville, WI 54466 | Full Service B&M | $27,482 |

| Associated Bank, National Association | 530 West Highway 153 Mosinee, WI 54455 | Full Service Retail | $12,786 |

| Associated Bank, National Association | 5350 West Fond Du Lac Avenue Milwaukee, WI 53216 | Full Service B&M | $18,956 |

| Associated Bank, National Association | 5353 Wayzata Boulevard St. Louis Park, MN 55416 | Full Service B&M | $362,384 |

| Associated Bank, National Association | 5439 Durand Avenue Racine, WI 53406 | Full Service B&M | $23,119 |

| Associated Bank, National Association | 5453 Park Street, Hwy M Boulder Junction, WI 54512 | Full Service B&M | $24,316 |

| Associated Bank, National Association | 5521 Odana Road Madison, WI 53716 | Full Service B&M | $23,623 |

| Associated Bank, National Association | 5597 Highway Ten East Stevens Point, WI 54481 | Full Service B&M | $76,400 |

| Associated Bank, National Association | 56 East Irving Park Road Roselle, IL 60172 | Full Service B&M | $299,712 |

| Associated Bank, National Association | 57 North Third Avenue Sturgeon Bay, WI 54235 | Full Service B&M | $129,450 |

| Associated Bank, National Association | 5900 West North Avenue Milwaukee, WI 53208 | Full Service B&M | $23,035 |

| Associated Bank, National Association | 600 Main Street Watertown, WI 53094 | Full Service B&M | $65,704 |

| Associated Bank, National Association | 602 Henry Avenue Beloit, WI 53511 | Full Service B&M | $58,210 |

| Associated Bank, National Association | 612 North Main Street Rockford, IL 61103 | Full Service B&M | $422,348 |

| Associated Bank, National Association | 622 Roosevelt Road Machesney Park, IL 61115 | Full Service B&M | $71,558 |

| Associated Bank, National Association | 625 Chippewa Street Minocqua, WI 54548 | Full Service B&M | $44,609 |

| Associated Bank, National Association | 6343 Blanchars' Crossing Windsor, WI 53598 | Full Service B&M | $34,937 |

| Associated Bank, National Association | 6355 North Central Avenue Chicago, IL 60646 | Full Service B&M | $54,791 |

| Associated Bank, National Association | 640 Superior St Antigo, WI 54409 | Limited, Drive-thru | $0 |

| Associated Bank, National Association | 640 University Square Madison, WI 53715 | Full Service B&M | $8,176 |

| Associated Bank, National Association | 6419 S Green Bay Rd Kenosha, WI 53144 | Full Service Retail | $17,510 |

| Associated Bank, National Association | 647 S Green Bay Road Neenah, WI 54956 | Full Service Retail | $41,611 |

| Associated Bank, National Association | 6550 North Illinois Street Fairview Heights, IL 62208 | Full Service B&M | $89,641 |

| Associated Bank, National Association | 658 South Grand Avenue Sun Prairie, WI 53590 | Full Service B&M | $60,249 |

| Associated Bank, National Association | 6655a Mckee Road Madison, WI 53719 | Full Service Retail | $46,617 |

| Associated Bank, National Association | 6902 W Main St Belleville, IL 62223 | Full Service B&M | $48,477 |

| Associated Bank, National Association | 700 E Blackhawk Ave Prairie Du Chien, WI 53821 | Full Service B&M | $27,261 |

| Associated Bank, National Association | 7001 Bass Lake Road New Hope, MN 55428 | Full Service B&M | $45,074 |

| Associated Bank, National Association | 7020 North Port Washington Road Glendale, WI 53217 | Full Service B&M | $44,607 |

| Associated Bank, National Association | 704 North Grand Avenue Waukesha, WI 53186 | Full Service B&M | $52,862 |

| Associated Bank, National Association | 707 North Rochester Mukwonago, WI 53149 | Full Service B&M | $77,190 |

| Associated Bank, National Association | 711 Grand Avenue Wisconsin Rapids, WI 54495 | Full Service B&M | $43,941 |

| Associated Bank, National Association | 715 West Paradise Drive West Bend, WI 53095 | Full Service B&M | $56,972 |

| Associated Bank, National Association | 717 Main Street Menomonie, WI 54751 | Full Service B&M | $22,625 |

| Associated Bank, National Association | 724 Fifth Avenue Antigo, WI 54409 | Full Service B&M | $11,384 |

| Associated Bank, National Association | 728 Williams Street Lake Geneva, WI 53147 | Full Service Retail | $29,149 |

| Associated Bank, National Association | 733 Marquette Avenue Minneapolis, MN 55402 | Full Service B&M | $117,942 |

| Associated Bank, National Association | 743 East 47th Street Chicago, IL 60653 | Full Service B&M | $816 |

| Associated Bank, National Association | 749 Main Ave De Pere, WI 54115 | Full Service B&M | $93,548 |

| Associated Bank, National Association | 750 Viking Drive Reedsburg, WI 53959 | Full Service B&M | $66,692 |

| Associated Bank, National Association | 7533 Egan Drive Savage, MN 55378 | Full Service B&M | $28,250 |

| Associated Bank, National Association | 7675 Miller Road Carpentersville, IL 60110 | Full Service B&M | $12,401 |

| Associated Bank, National Association | 7760 France Avenue South Bloomington, MN 55435 | Full Service B&M | $74,486 |

| Associated Bank, National Association | 7900 West Brown Deer Road Milwaukee, WI 53223 | Full Service B&M | $20,088 |

| Associated Bank, National Association | 7940 S 6th St Oak Creek, WI 53154 | Full Service Retail | $62,850 |

| Associated Bank, National Association | 8040 Excelsior Drive Madison, WI 53717 | Full Service B&M | $539,228 |

| Associated Bank, National Association | 8050 West Capitol Drive Milwaukee, WI 53222 | Full Service B&M | $17,444 |

| Associated Bank, National Association | 815 North Water St Milwaukee, WI 53202 | Limited, Drive-thru | $0 |

| Associated Bank, National Association | 828 East Washington Avenue Madison, WI 53703 | Full Service B&M | $911,577 |

| Associated Bank, National Association | 829 West Mitchell Street Milwaukee, WI 53204 | Full Service B&M | $24,263 |

| Associated Bank, National Association | 8683 Highway 51 N Minocqua, WI 54548 | Full Service B&M | $49,326 |

| Associated Bank, National Association | 888 South Main Street Fond Du Lac, WI 54935 | Full Service B&M | $64,247 |

| Associated Bank, National Association | 929 North Milwaukee Avenue Libertyville, IL 60048 | Full Service B&M | $14,464 |

| Associated Bank, National Association | 9325 Upland Lane Maple Grove, MN 55369 | Full Service B&M | $25,698 |

| Associated Bank, National Association | N112 W16330 Mequon Road Germantown, WI 53022 | Full Service B&M | $68,065 |

| Associated Bank, National Association | N49 W35876 Wisconsin Avenue Oconomowoc, WI 53066 | Full Service B&M | $73,884 |

| Associated Bank, National Association | N64 W23710 Main Street Sussex, WI 53089 | Full Service B&M | $99,946 |

| Associated Bank, National Association | N88 W15491 Main Street Menomonee Falls, WI 53051 | Full Service B&M | $134,506 |

| Associated Bank, National Association | One West Thompson Avenue West Saint Paul, MN 55118 | Limited, Mobile/Seasonal Office | $0 |

| Associated Bank, National Association | S76 W17655 Janesville Road Muskego, WI 53150 | Full Service B&M | $69,236 |

| Associated Bank, National Association | W156 N5575 Pilgrim Road Menomonee Falls, WI 53051 | Full Service B&M | $78,690 |

| Associated Bank, National Association | W180n 7890 Town Hall Road Menomonee Falls, WI 53051 | Limited, Mobile/Seasonal Office | $0 |

| Associated Bank, National Association | W3122 County Road Kk Appleton, WI 54915 | Full Service B&M | $164,360 |

| Associated Bank, National Association | W6606a Highway 23 Fond Du Lac, WI 54937 | Full Service B&M | $25,543 |

For 2019, Associated Bank had 255 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $1,172,610 |

| Net interest income | $838,434 |

| Total noninterest income | $377,459 |

| Gross Fiduciary activities income | $54,648 |

| Service charges on deposit accounts | $63,135 |

| Trading account gains and fees | $13,757 |

| Additional Noninterest Income | $245,919 |

| Pre-tax net operating income | $409,142 |

| Securities gains (or losses, -) | $6,008 |

| Income before extraordinary items | $341,789 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $341,789 |

| Minority interest net income | $0 |

| Net income | $341,789 |

| Sale, conversion, retirement of capital stock, net | $24,775 |

| Net operating income | $336,862 |

Associated Bank's gross interest income from loans was $1,172,610,000.

Associated Bank's net interest income from loans was $838,434,000.

Associated Bank's fee based income from loans was $63,135,000.

Associated Bank's net income from loans was $341,789,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $334,176 |

| Provision for credit losses | $18,500 |

| Total noninterest expense | $788,251 |

| Salaries and employee benefits | $487,063 |

| Premises and equipment expense | $85,949 |

| Additional noninterest expense | $215,239 |

| Applicable income taxes | $73,361 |

| Net charge-offs | $55,152 |

| Cash dividends | $320,000 |

Associated Bank's interest expense for loans was $334,176,000.

Associated Bank's payroll and benefits expense were $487,063,000.

Associated Bank's property, plant and equipment expenses $85,949,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 2.0% |

| Credit card loans | 1.2% |

| Other individual loans | 3.0% |

| Auto loans | 0.0% |

| Other consumer loans | 3.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $23,823,251 |

| Deposits held in domestic offices | $23,823,251 |

| Deposits by Individuals, partnerships, and corporations | $20,719,255 |

| Deposits by U.S. Government | $0 |

| Deposits by States and political subdivisions in the U.S. | $2,800,148 |

| Deposits by Commercial banks and other depository institutions in U.S. | $303,848 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $2,983,955 |

| Demand deposits | $2,540,232 |

| Nontransaction accounts | $20,839,296 |

| Money market deposit accounts (MMDAs) | $7,667,984 |

| Other savings deposits (excluding MMDAs) | $10,548,508 |

| Total time deposits | $2,622,804 |

| Total time and savings deposits | $21,283,019 |

| Noninterest-bearing deposits | $5,467,710 |

| Interest-bearing deposits | $18,355,541 |

| Retail deposits | $21,616,200 |

| IRAs and Keogh plan accounts | $415,194 |

| Brokered deposits | $1,345,868 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $32,343,129 |

| Cash & Balances due from depository institutions | $580,638 |

| Interest-bearing balances | $207,624 |

| Total securities | $5,469,315 |

| Federal funds sold & reverse repurchase | $7,740 |

| Net loans and leases | $22,771,349 |

| Loan and leases loss allowance | $201,371 |

| Trading account assets | $89,960 |

| Bank premises and fixed assets | $437,472 |

| Other real estate owned | $21,101 |

| Goodwill and other intangibles | $1,321,401 |

| All other assets | $1,644,153 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $32,343,129 |

| Total Liabilities | $28,425,533 |

| Total deposits | $23,823,251 |

| Interest-bearing deposits | $18,355,541 |

| Deposits held in domestic offices | $23,823,251 |

| % insured (estimated) | $55 |

| Federal funds purchased and repurchase agreements | $433,097 |

| Trading liabilities | $14,970 |

| Other borrowed funds | $3,731,111 |

| Subordinated debt | $0 |

| All other liabilities | $423,104 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $22,771,349 |

| Loan and leases loss allowance | $201,371 |

| Total loans and leases (domestic) | $22,972,720 |

| All real estate loans | $15,251,966 |

| Real estate loans in domestic offices | $15,251,966 |

| Construction and development loans | $1,420,900 |

| Residential 1-4 family construction | $261,908 |

| Other construction, all land development and other land | $1,158,992 |

| Loans secured by nonfarm nonresidential properties | $3,501,103 |

| Nonfarm nonresidential secured by owner-occupied properties | $911,265 |

| Commercial real estate & other non-farm, non-residential | $2,589,838 |

| Multifamily residential real estate | $1,201,835 |

| 1-4 family residential loans | $9,125,284 |

| Farmland loans | $2,844 |

| Loans held in foreign offices | $0 |

| Farm loans | $9,327 |

| Commercial and industrial loans | $5,393,786 |

| To non-U.S. addressees | $22,451 |

| Loans to individuals | $351,159 |

| Credit card loans | $122,785 |

| Related Plans | $71,935 |

| Consumer Auto Loans | $2,982 |

| Other loans to individuals | $153,457 |

| All other loans & leases | $1,966,482 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $1,824,291 |

| Loans to depository institutions and acceptances of other banks | $2 |

| Loans not secured by real estate | $1,369,612 |

| Loans secured by real estate to non-U.S. addressees | $38 |

| Restructured Loans & leases | $25,116 |

| Non 1-4 family restructured loans & leases | $19,951 |

| Total loans and leases (foreign) | $0 |

Associated Bank had $22,771,349,000 of loans outstanding in 2019. $15,251,966,000 of loans were in real estate loans. $1,420,900,000 of loans were in development loans. $1,201,835,000 of loans were in multifamily mortgage loans. $9,125,284,000 of loans were in 1-4 family mortgage loans. $9,327,000 of loans were in farm loans. $122,785,000 of loans were in credit card loans. $2,982,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 1,180 | $301,233 | $255,282 |

| Nonfarm, nonresidential loans - <$100k | 229 | $8,877 | $38,764 |

| Nonfarm, nonresidential loans - $100-250k | 364 | $45,472 | $124,923 |

| Nonfarm, nonresidential loans - $250k-1MM | 587 | $246,884 | $420,586 |

| Commercial & Industrial, US addressed loans - <$1MM | 10,843 | $241,393 | $22,263 |

| Commercial & Industrial, US addressed loans - <$100k | 9,937 | $48,367 | $4,867 |

| Commercial & Industrial, US addressed loans - $100-250k | 377 | $34,432 | $91,332 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 529 | $158,594 | $299,800 |

| Farmland loans - <$1MM | 19 | $2,841 | $149,526 |

| Farmland loans - <$100k | 5 | $244 | $48,800 |

| Farmland loans - $100-250k | 10 | $980 | $98,000 |

| Farmland loans - $250k-1MM | 4 | $1,617 | $404,250 |

| Agriculture operations loans - <$1MM | 17 | $783 | $46,059 |

| Agriculture operations loans - <$100k | 15 | $239 | $15,933 |

| Agriculture operations loans - $100-250k | 1 | $67 | $67,000 |

| Agriculture operations loans - $250k-1MM | 1 | $477 | $477,000 |