United Community Bank Mortgage Rates, Fees & Info

Blairsville, GALEI: T68X8LLAQYRNDV034K14

Tax ID: 58-0554454

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

United Community Bank is a small bank specializing in Home Purchase and Refi loans. United Community Bank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Atlanta, Charleston, Asheville, Greenville, and Knoxville among others. We have data for 101 markets. (Some data included below & more in-depth data is available with an active subscription.)United Community Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. United Community Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.72% | 8/3/25 |

| 30 Year Conventional Purchase | 7.03% | 8/3/25 |

| 30 Year Conventional Refi | 6.85% | 8/3/25 |

| 30 Year Cash-out Refi | 7.26% | 8/3/25 |

| 30 Year FHA Purchase | 7.27% | 8/3/25 |

| 30 Year FHA Refi | 6.75% | 8/3/25 |

| 30 Year VA Purchase | 6.29% | 8/3/25 |

| 30 Year VA Refi | 6.73% | 8/3/25 |

| 30 Year USDA Purchase | 6.77% | 8/3/25 |

| 15 Year Conventional Purchase | 2.26% | 8/3/25 |

| 15 Year Conventional Refi | 7.70% | 8/3/25 |

| 15 Year Cash-out Refi | 7.70% | 8/3/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

United Community Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from United Community Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

7,219Origination Dollar Volume (All Markets)

$1,331,145,000Employee count

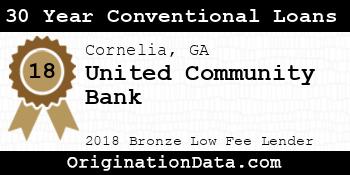

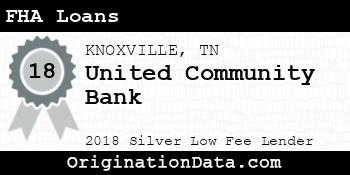

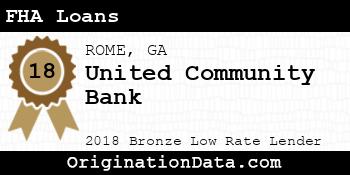

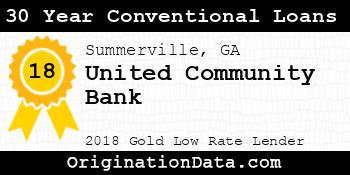

2,306 Show all (8) awardsUnited Community Bank - 2018

United Community Bank is a 2018 , due to their low .

For 2018, less than of lenders were eligible for this award.

Work for United Community Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 1,523 | $279,065,000 | $183,234 | $4,374 | 3.94% |

| Outside of Metro Areas | 1,818 | $262,790,000 | $144,549 | $3,764 | 3.89% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 168 | $84,470,000 | $502,798 | $4,562 | 4.46% |

| ASHEVILLE, NC (FHA|USDA|VA) | 300 | $68,720,000 | $229,067 | $4,204 | 4.08% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 440 | $67,970,000 | $154,477 | $3,764 | 3.49% |

| KNOXVILLE, TN (FHA|USDA|VA) | 364 | $63,030,000 | $173,159 | $3,822 | 3.79% |

| RALEIGH-CARY, NC (FHA|USDA|VA) | 243 | $51,255,000 | $210,926 | $3,865 | 4.66% |

| SAVANNAH, GA (FHA|USDA|VA) | 160 | $42,850,000 | $267,813 | $3,994 | 4.35% |

| GAINESVILLE, GA (FHA|USDA|VA) | 201 | $40,005,000 | $199,030 | $4,255 | 3.90% |

| BRUNSWICK, GA (FHA|USDA|VA) | 130 | $28,780,000 | $221,385 | $3,890 | 4.40% |

| CLEVELAND, TN (FHA|USDA|VA) | 212 | $28,660,000 | $135,189 | $3,571 | 4.36% |

| ROME, GA (FHA|USDA|VA) | 175 | $24,185,000 | $138,200 | $3,731 | 4.15% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 112 | $24,150,000 | $215,625 | $3,388 | 4.21% |

| SPARTANBURG, SC (FHA|USDA|VA) | 175 | $23,805,000 | $136,029 | $3,690 | 3.83% |

| Brevard, NC (FHA|USDA|VA) | 112 | $20,990,000 | $187,411 | $4,509 | 3.82% |

| Cornelia, GA (FHA|USDA|VA) | 136 | $19,180,000 | $141,029 | $3,587 | 3.94% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 61 | $18,875,000 | $309,426 | $5,673 | 3.77% |

| Cullowhee, NC (FHA|USDA|VA) | 108 | $18,300,000 | $169,444 | $4,494 | 3.73% |

| COLUMBIA, SC (FHA|USDA|VA) | 64 | $16,740,000 | $261,563 | $6,502 | 4.53% |

| Jefferson, GA (FHA|USDA|VA) | 65 | $9,685,000 | $149,000 | $4,098 | 3.74% |

| Summerville, GA (FHA|USDA|VA) | 96 | $9,270,000 | $96,563 | $3,125 | 3.82% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 51 | $7,425,000 | $145,588 | $3,729 | 4.24% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 29 | $7,295,000 | $251,552 | $5,403 | 4.18% |

| Boone, NC (FHA|USDA|VA) | 27 | $6,775,000 | $250,926 | $4,277 | 4.16% |

| Greenwood, SC (FHA|USDA|VA) | 58 | $6,770,000 | $116,724 | $4,088 | 3.75% |

| Seneca, SC (FHA|USDA|VA) | 24 | $6,200,000 | $258,333 | $5,491 | 4.17% |

| Statesboro, GA (FHA|USDA|VA) | 3 | $6,115,000 | $2,038,333 | $7,415 | 4.86% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 6 | $5,700,000 | $950,000 | $7,006 | 4.54% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 29 | $5,275,000 | $181,897 | $4,723 | 4.80% |

| MORRISTOWN, TN (FHA|USDA|VA) | 4 | $4,500,000 | $1,125,000 | $0 | 4.29% |

| GREENVILLE, NC (FHA|USDA|VA) | 1 | $4,305,000 | $4,305,000 | $0 | 3.15% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 6 | $3,940,000 | $656,667 | $2,997 | 4.97% |

| Georgetown, SC (FHA|USDA|VA) | 8 | $3,440,000 | $430,000 | $4,556 | 4.31% |

| Calhoun, GA (FHA|USDA|VA) | 23 | $3,405,000 | $148,043 | $3,497 | 4.26% |

| Newberry, SC (FHA|USDA|VA) | 12 | $3,310,000 | $275,833 | $7,795 | 4.20% |

| Gaffney, SC (FHA|USDA|VA) | 22 | $3,220,000 | $146,364 | $3,672 | 4.19% |

| Toccoa, GA (FHA|USDA|VA) | 16 | $3,150,000 | $196,875 | $3,202 | 4.47% |

| ATHENS-CLARKE COUNTY, GA (FHA|USDA|VA) | 17 | $2,835,000 | $166,765 | $3,883 | 4.18% |

| PANAMA CITY, FL (FHA|USDA|VA) | 3 | $2,685,000 | $895,000 | $5,207 | 4.92% |

| Cedartown, GA (FHA|USDA|VA) | 14 | $2,290,000 | $163,571 | $4,711 | 4.42% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 9 | $2,205,000 | $245,000 | $5,203 | 4.18% |

| Forest City, NC (FHA|USDA|VA) | 9 | $2,085,000 | $231,667 | $4,852 | 4.14% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 5 | $2,055,000 | $411,000 | $4,664 | 4.45% |

| Morehead City, NC (FHA|USDA|VA) | 7 | $1,835,000 | $262,143 | $3,806 | 4.22% |

| St. Marys, GA (FHA|USDA|VA) | 9 | $1,795,000 | $199,444 | $5,576 | 4.19% |

| WILMINGTON, NC (FHA|USDA|VA) | 6 | $1,760,000 | $293,333 | $2,529 | 4.77% |

| MACON-BIBB COUNTY, GA (FHA|USDA|VA) | 8 | $1,670,000 | $208,750 | $5,311 | 4.40% |

| Marion, NC (FHA|USDA|VA) | 4 | $1,630,000 | $407,500 | $6,256 | 4.28% |

| FLORENCE, SC (FHA|USDA|VA) | 8 | $1,560,000 | $195,000 | $5,018 | 4.23% |

| Athens, TN (FHA|USDA|VA) | 12 | $1,560,000 | $130,000 | $3,333 | 3.91% |

| Orangeburg, SC (FHA|USDA|VA) | 4 | $1,470,000 | $367,500 | $8,620 | 3.53% |

| Waycross, GA (FHA|USDA|VA) | 15 | $1,305,000 | $87,000 | $3,193 | 3.70% |

| Sevierville, TN (FHA|USDA|VA) | 8 | $1,270,000 | $158,750 | $3,989 | 4.75% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 5 | $1,245,000 | $249,000 | $4,917 | 4.53% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 6 | $1,180,000 | $196,667 | $6,076 | 4.17% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 4 | $990,000 | $247,500 | $5,708 | 4.26% |

| LaGrange, GA-AL (FHA|USDA|VA) | 7 | $915,000 | $130,714 | $4,233 | 4.40% |

| Sebastian-Vero Beach, FL (FHA|USDA|VA) | 1 | $885,000 | $885,000 | $5,232 | 4.50% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 4 | $820,000 | $205,000 | $3,537 | 4.75% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 4 | $810,000 | $202,500 | $4,025 | 4.50% |

| BURLINGTON, NC (FHA|USDA|VA) | 3 | $785,000 | $261,667 | $3,724 | 4.83% |

| MOBILE, AL (FHA|USDA|VA) | 1 | $505,000 | $505,000 | $0 | 5.50% |

| SUMTER, SC (FHA|USDA|VA) | 2 | $500,000 | $250,000 | $3,239 | 4.94% |

| Alexander City, AL (FHA|USDA|VA) | 2 | $500,000 | $250,000 | $3,434 | 3.77% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 2 | $490,000 | $245,000 | $2,469 | 3.83% |

| DALTON, GA (FHA|USDA|VA) | 3 | $485,000 | $161,667 | $3,560 | 3.85% |

| Cookeville, TN (FHA|USDA|VA) | 2 | $480,000 | $240,000 | $6,070 | 4.88% |

| Jesup, GA (FHA|USDA|VA) | 3 | $465,000 | $155,000 | $4,256 | 5.27% |

| ROCKY MOUNT, NC (FHA|USDA|VA) | 2 | $380,000 | $190,000 | $4,142 | 3.06% |

| JOHNSON CITY, TN (FHA|USDA|VA) | 4 | $370,000 | $92,500 | $4,330 | 3.65% |

| Milledgeville, GA (FHA|USDA|VA) | 1 | $355,000 | $355,000 | $3,996 | 4.88% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 1 | $355,000 | $355,000 | $0 | 4.25% |

| Sanford, NC (FHA|USDA|VA) | 2 | $350,000 | $175,000 | $4,461 | 5.19% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 2 | $350,000 | $175,000 | $3,501 | 5.00% |

| Roanoke Rapids, NC (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $3,279 | 4.38% |

| Wilson, NC (FHA|USDA|VA) | 4 | $280,000 | $70,000 | $0 | 5.78% |

| Crossville, TN (FHA|USDA|VA) | 3 | $265,000 | $88,333 | $3,002 | 4.06% |

| Scottsboro, AL (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $4,056 | 4.13% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $8,787 | 4.13% |

| Fort Payne, AL (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $2,652 | 4.88% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $3,993 | 5.13% |

| OCALA, FL (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $4,318 | 4.25% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,480 | 5.13% |

| MONTGOMERY, AL (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $2,459 | 4.25% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,489 | 4.75% |

| COLUMBUS, GA-AL (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $5,542 | 4.63% |

| Americus, GA (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,596 | 4.25% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 3 | $165,000 | $55,000 | $2,631 | 4.26% |

| Vidalia, GA (FHA|USDA|VA) | 2 | $150,000 | $75,000 | $2,578 | 3.90% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $3,646 | 4.38% |

| Kill Devil Hills, NC (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $0 | 5.50% |

| GOLDSBORO, NC (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,711 | 3.75% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $2,070 | 4.88% |

| HINESVILLE, GA (FHA|USDA|VA) | 2 | $130,000 | $65,000 | $2,965 | 3.46% |

| Pinehurst-Southern Pines, NC (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $0 | 6.50% |

| Dayton, TN (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $4,672 | 4.88% |

| Newport, TN (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $0 | 2.79% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $2,348 | 4.38% |

| Union, SC (FHA|USDA|VA) | 2 | $60,000 | $30,000 | $2,296 | 3.75% |

| JACKSONVILLE, NC (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $3,362 | 3.88% |

| VALDOSTA, GA (FHA|USDA|VA) | 1 | $25,000 | $25,000 | $0 | 2.25% |

Similar Lenders

We use machine learning to identify the top lenders compared against United Community Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 44

Similarity Rank: 60

Similarity Rank: 98

Similarity Rank: 285

Similarity Rank: 294

Similarity Rank: 312

Similarity Rank: 376

Similarity Rank: 392

Similarity Rank: 432

Similarity Rank: 493

Product Mix

For 2018, United Community Bank's most frequently originated type of loan was Conventional, with 3,976 originations. Their 2nd most popular type was HELOC, with 2,808 originations.

Loan Reason

For 2018, United Community Bank's most frequently cited loan purpose was Home Purchase, with 3,153 originations. The 2nd most popular reason was Refi, with 1,963 originations.

Loan Duration/Length

For 2018, United Community Bank's most frequently cited loan duration was 30 Year, with 3,185 originations. The 2nd most popular length was Other, with 2,975 originations.

Origination Fees/Closing Costs

United Community Bank's average total fees were $4,189, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 1,920 originations.

Interest Rates

During 2018, United Community Bank's average interest rate for loans was 4.79%, while their most frequently originated rate bucket for loans was 4-5%, with 2,883 originations.

Loan Sizing

2018 saw United Community Bank place emphasis on $100,000 or less loans with 2,651 originations, totaling $136,045,000 in origination value.

Applicant Income

United Community Bank lent most frequently to those with incomes in the $50k-75k range, with 1,596 originations. The second most popular income band? $50k or less, with 1,564 originations.

Applicant Debt to Income Ratio

United Community Bank lent most frequently to those with DTI ratios of 20-30%, with 1,703 originations. The next most common DTI ratio? 30-36%, with 1,307 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications79.47%

United Community Bank has a below average approval rate.

Pick Rate

Approvals leading to origination81.01%

United Community Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| 0.0 | 1 | $15,000 | $15,000 |

| NA | 7,218 | $1,331,130,000 | $184,418 |

Occupancy Type Mix

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2018 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| UNITED COMMUNITY BANK | Other type of mortgage | Trouble during payment process | 1 | 25.0% |

| UNITED COMMUNITY BANK | Conventional home mortgage | Trouble during payment process | 1 | 25.0% |

| UNITED COMMUNITY BANK | Other type of mortgage | Applying for a mortgage or refinancing an existing mortgage | 1 | 25.0% |

| UNITED COMMUNITY BANK | Other type of mortgage | Struggling to pay mortgage | 1 | 25.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| United Community Bank | 10 Park Place East Brevard, NC 28712 | Full Service B&M | $46,826 |

| United Community Bank | 100 West Greenwood St Abbeville, SC 29620 | Full Service B&M | $24,025 |

| United Community Bank | 1000 Georgia Hwy138 Se Conyers, GA 30013 | Full Service B&M | $116,774 |

| United Community Bank | 1001 Polk Street Marietta, GA 30064 | Full Service B&M | $94,947 |

| United Community Bank | 101 West Carolina Avenue Clinton, SC 29325 | Full Service B&M | $23,669 |

| United Community Bank | 101 West Main Street Laurens, SC 29360 | Full Service B&M | $110,195 |

| United Community Bank | 101 West Saint John Street Spartanburg, SC 29306 | Full Service B&M | $40,502 |

| United Community Bank | 1010 Plant Avenue Waycross, GA 31501 | Full Service B&M | $28,771 |

| United Community Bank | 1015 Buford Highway Cumming, GA 30041 | Full Service B&M | $53,565 |

| United Community Bank | 102 East Main Street Clayton, NC 27520 | Full Service B&M | $71,411 |

| United Community Bank | 10514 Kingston Pike Knoxville, TN 37922 | Full Service B&M | $55,395 |

| United Community Bank | 106 West College Street Simpsonville, SC 29681 | Full Service B&M | $63,226 |

| United Community Bank | 108 East Main Street Duncan, SC 29334 | Full Service B&M | $34,976 |

| United Community Bank | 1087 Hunters Crossing Alcoa, TN 37701 | Full Service B&M | $32,692 |

| United Community Bank | 109 Highway 53 West Dawsonville, GA 30534 | Full Service B&M | $116,139 |

| United Community Bank | 109 Scranton Connector Brunswick, GA 31521 | Full Service B&M | $95,455 |

| United Community Bank | 115 Four Oaks Place Dunn, NC 28334 | Full Service B&M | $17,544 |

| United Community Bank | 11500 Asheville Highway Inman, SC 29349 | Full Service B&M | $42,042 |

| United Community Bank | 116 Peachtree Street Murphy, NC 28906 | Full Service B&M | $124,663 |

| United Community Bank | 118 Whitfield Drive Jasper, GA 30143 | Full Service B&M | $53,696 |

| United Community Bank | 119 Maple Street Carrollton, GA 30117 | Full Service B&M | $169,126 |

| United Community Bank | 11915 Plaza Drive Murrells Inlet, SC 29576 | Full Service B&M | $36,001 |

| United Community Bank | 1220 Richard Sailors Parkway Powder Springs, GA 30127 | Full Service B&M | $79,532 |

| United Community Bank | 128 North Second Street Smithfield, NC 27577 | Full Service B&M | $73,044 |

| United Community Bank | 1300 2nd Avenue Conway, SC 29526 | Full Service B&M | $11,588 |

| United Community Bank | 1312 Professional Drive Myrtle Beach, SC 29577 | Full Service B&M | $36,759 |

| United Community Bank | 132 Rodney Orr Bypass Robbinsville, NC 28771 | Full Service B&M | $75,626 |

| United Community Bank | 1320 Joe Frank Harris Parkway Cartersville, GA 30120 | Full Service B&M | $31,550 |

| United Community Bank | 1400 Augusta Street Greenville, SC 29605 | Full Service B&M | $100,156 |

| United Community Bank | 14031 Highway 27 Trion, GA 30753 | Full Service B&M | $24,981 |

| United Community Bank | 1408 Garner Station Boulevard Raleigh, NC 27603 | Full Service B&M | $18,266 |

| United Community Bank | 145 Slope Street Bryson City, NC 28713 | Full Service B&M | $80,677 |

| United Community Bank | 1472 441 By-Pass Cornelia, GA 30531 | Full Service B&M | $115,689 |

| United Community Bank | 149 Brackett's Way Blairsville, GA 30512 | Full Service B&M | $25,074 |

| United Community Bank | 15 Cedartown Street Cave Spring, GA 30124 | Full Service B&M | $30,923 |

| United Community Bank | 1500 Commerce Drive Peachtree City, GA 30269 | Full Service B&M | $48,765 |

| United Community Bank | 1510 Old Trolley Road Summerville, SC 29485 | Full Service B&M | $39,588 |

| United Community Bank | 1524 East Main Street Easley, SC 29640 | Full Service B&M | $22,521 |

| United Community Bank | 1528 North Hwy 74 Tyrone, GA 30290 | Full Service B&M | $49,930 |

| United Community Bank | 153 East Kytle Street Cleveland, GA 30528 | Full Service B&M | $166,537 |

| United Community Bank | 1544 East Main Street Spartanburg, SC 29307 | Full Service B&M | $28,572 |

| United Community Bank | 160 West Main Street Brevard, NC 28712 | Full Service B&M | $52,244 |

| United Community Bank | 1627-A Church Street Conway, SC 29526 | Full Service B&M | $29,667 |

| United Community Bank | 1640 East Main Street Sylva, NC 28779 | Full Service B&M | $56,892 |

| United Community Bank | 165 North Main Street Waynesville, NC 28786 | Full Service B&M | $77,358 |

| United Community Bank | 1701 North Oak Street Myrtle Beach, SC 29577 | Full Service B&M | $42,862 |

| United Community Bank | 177 Highway 515 East Blairsville, GA 30512 | Full Service B&M | $915,201 |

| United Community Bank | 182 Blue Ridge Drive Mccaysville, GA 30555 | Full Service B&M | $72,562 |

| United Community Bank | 20 Frank Allen Road Cashiers, NC 28717 | Full Service B&M | $53,354 |

| United Community Bank | 200 Cherokee Street Marietta, GA 30090 | Full Service B&M | $121,718 |

| United Community Bank | 200 East Church Street Benson, NC 27504 | Full Service B&M | $33,045 |

| United Community Bank | 200 Glen Road Garner, NC 27529 | Full Service B&M | $35,318 |

| United Community Bank | 200 Linville Street Newland, NC 28657 | Full Service B&M | $39,416 |

| United Community Bank | 2001 Commercial Drive, South Brunswick, GA 31525 | Full Service B&M | $50,465 |

| United Community Bank | 201 West Center Street Holly Springs, NC 27540 | Full Service B&M | $25,126 |

| United Community Bank | 2055 Homer Road Commerce, GA 30529 | Full Service B&M | $65,546 |

| United Community Bank | 206 Morrison Moore Parkway Dahlonega, GA 30533 | Full Service B&M | $125,910 |

| United Community Bank | 207 North Cambridge Ninety Six, SC 29666 | Full Service B&M | $32,492 |

| United Community Bank | 2101 Woodruff Road Greenville, SC 29607 | Full Service B&M | $30,281 |

| United Community Bank | 214 North Main Street Hiawassee, GA 30546 | Full Service B&M | $161,809 |

| United Community Bank | 2157 Sandridge Court Gainesville, GA 30501 | Full Service B&M | $34,069 |

| United Community Bank | 2160 W Spring St Monroe, GA 30655 | Full Service B&M | $17,836 |

| United Community Bank | 2168 Scenic Highway Snellville, GA 30078 | Full Service B&M | $60,539 |

| United Community Bank | 2215 Riverstone Boulevard Canton, GA 30114 | Full Service B&M | $100,865 |

| United Community Bank | 2225 East Victory Drive Savannah, GA 31404 | Full Service B&M | $31,758 |

| United Community Bank | 223 North 3rd Street Kingston, TN 37763 | Full Service B&M | $42,039 |

| United Community Bank | 2230 Riverside Parkway Lawrenceville, GA 30043 | Full Service B&M | $258,229 |

| United Community Bank | 2245 East Highway 34 Newnan, GA 30265 | Full Service B&M | $21,115 |

| United Community Bank | 2461 Demere Road St. Simons Island, GA 31522 | Full Service B&M | $69,810 |

| United Community Bank | 2520 Chimney Rock Road Hendersonville, NC 28792 | Full Service B&M | $52,269 |

| United Community Bank | 2525 Keith St Nw Cleveland, TN 37312 | Full Service B&M | $38,382 |

| United Community Bank | 257 East Main Street Franklin, NC 28734 | Full Service B&M | $58,754 |

| United Community Bank | 257 Medical Park Drive Lenoir City, TN 37771 | Full Service B&M | $220,317 |

| United Community Bank | 27 Bull Street Savannah, GA 31401 | Full Service B&M | $84,485 |

| United Community Bank | 2760 Martha Berry Highway Rome, GA 30165 | Full Service B&M | $29,209 |

| United Community Bank | 290 Village Square Loudon, TN 37774 | Full Service B&M | $71,862 |

| United Community Bank | 291 East Us Highway 19e Burnsville, NC 28714 | Full Service B&M | $52,144 |

| United Community Bank | 300 North Weston Street Fountain Inn, SC 29644 | Full Service B&M | $47,201 |

| United Community Bank | 306 East North Street Greenville, SC 29601 | Full Service B&M | $93,291 |

| United Community Bank | 307 East 2nd Avenue Rome, GA 30162 | Full Service B&M | $196,278 |

| United Community Bank | 311 South Limestone Street Gaffney, SC 29340 | Full Service B&M | $51,689 |

| United Community Bank | 3187 Highway 9 East Little River, SC 29566 | Full Service B&M | $25,445 |

| United Community Bank | 3210 Highway 701 North Byp Loris, SC 29569 | Full Service B&M | $24,414 |

| United Community Bank | 325 N Judd Parkway, N.E. Fuquay Varina, NC 27526 | Full Service B&M | $63,275 |

| United Community Bank | 3273 U.S. Highway 441 North Whittier, NC 28789 | Full Service B&M | $38,653 |

| United Community Bank | 3310 Henderson Mill Road Atlanta, GA 30341 | Full Service B&M | $62,794 |

| United Community Bank | 351 Jesse Jewell Pkwy Gainesville, GA 30501 | Full Service B&M | $214,840 |

| United Community Bank | 3640 Ralph Ellis Blvd Loris, SC 29569 | Full Service Cyber Office | $2,692 |

| United Community Bank | 3781 Sixes Road Canton, GA 30114 | Full Service B&M | $41,210 |

| United Community Bank | 3785 Mundy Mill Road Oakwood, GA 30566 | Full Service B&M | $99,172 |

| United Community Bank | 3995 Sc Highway 9 Boiling Springs, SC 29316 | Full Service B&M | $33,144 |

| United Community Bank | 4000 Appalachian Highway Blue Ridge, GA 30513 | Full Service B&M | $247,212 |

| United Community Bank | 401 West Butler Road Mauldin, SC 29662 | Full Service B&M | $33,191 |

| United Community Bank | 403 South Brightleaf Boulevard Smithfield, NC 27577 | Limited, Drive-thru | $0 |

| United Community Bank | 406 East Main Street Wallace, NC 28466 | Full Service B&M | $55,291 |

| United Community Bank | 4356 South Lee Street Buford, GA 30518 | Full Service B&M | $76,603 |

| United Community Bank | 4365 Browns Bridge Road Cumming, GA 30041 | Full Service B&M | $194,277 |

| United Community Bank | 4425 North Ocoee Street Cleveland, TN 37312 | Full Service B&M | $27,287 |

| United Community Bank | 4519 Highway 411 Madisonville, TN 37354 | Full Service B&M | $17,173 |

| United Community Bank | 468 West Louise Street Clarkesville, GA 30523 | Full Service B&M | $92,683 |

| United Community Bank | 470 Haywood Road Greenville, SC 29607 | Full Service B&M | $41,336 |

| United Community Bank | 485 W. Bankhead Highway Villa Rica, GA 30180 | Full Service B&M | $21,548 |

| United Community Bank | 4970 Bill Gardner Parkway Locust Grove, GA 30248 | Full Service B&M | $34,412 |

| United Community Bank | 50 United Bank Drive Etowah, NC 28729 | Full Service B&M | $48,934 |

| United Community Bank | 5009 Broad Street Loris, SC 29569 | Full Service B&M | $47,777 |

| United Community Bank | 501 Church Street Laurens, SC 29360 | Full Service B&M | $61,316 |

| United Community Bank | 5100 Dallas Highway Powder Springs, GA 30127 | Full Service B&M | $79,132 |

| United Community Bank | 5125 Atlanta Highway Alpharetta, GA 30004 | Full Service B&M | $37,485 |

| United Community Bank | 516 Hwy 441 S Clayton, GA 30525 | Full Service B&M | $81,717 |

| United Community Bank | 5172 Cleveland Hwy Gainesville, GA 30506 | Full Service B&M | $39,876 |

| United Community Bank | 52 Burnt Church Road Bluffton, SC 29910 | Full Service B&M | $40,866 |

| United Community Bank | 525 North Jeff Davis Drive Fayetteville, GA 30214 | Full Service B&M | $100,983 |

| United Community Bank | 5264 Highway 9 Green Sea, SC 29545 | Full Service B&M | $12,622 |

| United Community Bank | 54 N Mitchell Ave Bakersville, NC 28705 | Full Service B&M | $41,746 |

| United Community Bank | 5504 Thompson Bridge Road Murrayville, GA 30564 | Full Service B&M | $33,582 |

| United Community Bank | 558 Industrial Boulevard Ellijay, GA 30540 | Full Service B&M | $183,273 |

| United Community Bank | 5679 Appalachian Highway Blue Ridge, GA 30513 | Full Service B&M | $7,277 |

| United Community Bank | 570 Roe Center Court Travelers Rest, SC 29690 | Full Service B&M | $20,828 |

| United Community Bank | 6144 Us Highway 301 South Four Oaks, NC 27524 | Full Service B&M | $103,612 |

| United Community Bank | 617 Hwy. 17 South North Myrtle Beach, SC 29582 | Full Service B&M | $32,715 |

| United Community Bank | 6372 Highway 53 East Dawsonville, GA 30534 | Full Service B&M | $87,297 |

| United Community Bank | 65 Washington Street Fairburn, GA 30213 | Full Service B&M | $155,966 |

| United Community Bank | 6600 Mcginnis Ferry Road Duluth, GA 30097 | Full Service B&M | $110,267 |

| United Community Bank | 6670 Church Street Douglasville, GA 30134 | Full Service B&M | $25,822 |

| United Community Bank | 701 Montague Avenue Greenwood, SC 29649 | Full Service B&M | $69,144 |

| United Community Bank | 71 Bullsboro Newnan, GA 30265 | Full Service B&M | $26,748 |

| United Community Bank | 732 Main Street Andrews, NC 28901 | Full Service B&M | $50,098 |

| United Community Bank | 7400 Adairsville Hwy Adairsville, GA 30103 | Full Service B&M | $70,795 |

| United Community Bank | 800 Summit Avenue Spruce Pine, NC 28777 | Full Service B&M | $41,982 |

| United Community Bank | 8036 Valley Blvd Blowing Rock, NC 28605 | Full Service B&M | $20,735 |

| United Community Bank | 805 North Arendell Avenue Zebulon, NC 27597 | Full Service B&M | $57,492 |

| United Community Bank | 809 West Wade Hampton Boulevard Greer, SC 29650 | Full Service B&M | $29,650 |

| United Community Bank | 815 North Main Street Anderson, SC 29621 | Full Service B&M | $72,553 |

| United Community Bank | 817 Mulberry Street Loudon, TN 37774 | Full Service B&M | $35,465 |

| United Community Bank | 8201 White Bluff Rd Savannah, GA 31406 | Full Service B&M | $29,348 |

| United Community Bank | 8460 Hwy 75 N Helen, GA 30545 | Limited, Drive-thru | $27,680 |

| United Community Bank | 850 Eagle's Landing Parkway Stockbridge, GA 30281 | Full Service B&M | $98,638 |

| United Community Bank | 865 Hampton Road Mcdonough, GA 30253 | Full Service B&M | $35,452 |

| United Community Bank | 875 Lowcountry Boulevard Mount Pleasant, SC 29464 | Full Service B&M | $69,941 |

| United Community Bank | 901 South Mechanic Street Pendleton, SC 29670 | Full Service B&M | $68,670 |

| United Community Bank | 9100 Covington Bypass Covington, GA 30014 | Full Service B&M | $36,137 |

| United Community Bank | 946 Orleans Road Charleston, SC 29407 | Full Service B&M | $64,409 |

| United Community Bank | 95 U.S. Highway 64 West Hayesville, NC 28904 | Full Service B&M | $70,853 |

| United Community Bank | 9699 Rome Boulevard Summerville, GA 30747 | Full Service B&M | $106,708 |

For 2018, United Community Bank had 144 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $496,287 |

| Net interest income | $446,665 |

| Total noninterest income | $96,656 |

| Gross Fiduciary activities income | $0 |

| Service charges on deposit accounts | $23,211 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $73,445 |

| Pre-tax net operating income | $231,623 |

| Securities gains (or losses, -) | $-656 |

| Income before extraordinary items | $179,525 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $179,525 |

| Minority interest net income | $0 |

| Net income | $179,525 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $180,043 |

United Community Bank's gross interest income from loans was $496,287,000.

United Community Bank's net interest income from loans was $446,665,000.

United Community Bank's fee based income from loans was $23,211,000.

United Community Bank's net income from loans was $179,525,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $49,622 |

| Provision for credit losses | $8,402 |

| Total noninterest expense | $303,296 |

| Salaries and employee benefits | $169,596 |

| Premises and equipment expense | $32,925 |

| Additional noninterest expense | $100,775 |

| Applicable income taxes | $51,442 |

| Net charge-offs | $6,113 |

| Cash dividends | $0 |

United Community Bank's interest expense for loans was $49,622,000.

United Community Bank's payroll and benefits expense were $169,596,000.

United Community Bank's property, plant and equipment expenses $32,925,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.0% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $10,683,286 |

| Deposits held in domestic offices | $10,683,286 |

| Deposits by Individuals, partnerships, and corporations | $9,340,253 |

| Deposits by U.S. Government | $0 |

| Deposits by States and political subdivisions in the U.S. | $1,333,381 |

| Deposits by Commercial banks and other depository institutions in U.S. | $9,652 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $590,007 |

| Demand deposits | $356,235 |

| Nontransaction accounts | $10,093,279 |

| Money market deposit accounts (MMDAs) | $2,375,393 |

| Other savings deposits (excluding MMDAs) | $5,575,257 |

| Total time deposits | $2,142,631 |

| Total time and savings deposits | $10,327,051 |

| Noninterest-bearing deposits | $3,214,945 |

| Interest-bearing deposits | $7,468,341 |

| Retail deposits | $9,753,180 |

| IRAs and Keogh plan accounts | $293,949 |

| Brokered deposits | $683,715 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $12,548,727 |

| Cash & Balances due from depository institutions | $322,516 |

| Interest-bearing balances | $88,943 |

| Total securities | $2,901,361 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $8,341,133 |

| Loan and leases loss allowance | $61,203 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $202,615 |

| Other real estate owned | $1,305 |

| Goodwill and other intangibles | $343,461 |

| All other assets | $436,336 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $12,548,727 |

| Total Liabilities | $11,026,326 |

| Total deposits | $10,683,286 |

| Interest-bearing deposits | $7,468,341 |

| Deposits held in domestic offices | $10,683,286 |

| % insured (estimated) | $69 |

| Federal funds purchased and repurchase agreements | $0 |

| Trading liabilities | $0 |

| Other borrowed funds | $214,996 |

| Subordinated debt | $0 |

| All other liabilities | $128,044 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $8,341,133 |

| Loan and leases loss allowance | $61,203 |

| Total loans and leases (domestic) | $8,402,336 |

| All real estate loans | $6,229,307 |

| Real estate loans in domestic offices | $6,229,307 |

| Construction and development loans | $1,007,118 |

| Residential 1-4 family construction | $277,716 |

| Other construction, all land development and other land | $729,402 |

| Loans secured by nonfarm nonresidential properties | $3,024,534 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,515,207 |

| Commercial real estate & other non-farm, non-residential | $1,509,327 |

| Multifamily residential real estate | $109,383 |

| 1-4 family residential loans | $2,025,462 |

| Farmland loans | $62,810 |

| Loans held in foreign offices | $0 |

| Farm loans | $4,343 |

| Commercial and industrial loans | $1,781,874 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $328,440 |

| Credit card loans | $0 |

| Related Plans | $13,068 |

| Consumer Auto Loans | $243,053 |

| Other loans to individuals | $72,319 |

| All other loans & leases | $58,371 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $1,299 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $24,092 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $43,637 |

| Non 1-4 family restructured loans & leases | $30,766 |

| Total loans and leases (foreign) | $1 |

United Community Bank had $8,341,133,000 of loans outstanding in 2018. $6,229,307,000 of loans were in real estate loans. $1,007,118,000 of loans were in development loans. $109,383,000 of loans were in multifamily mortgage loans. $2,025,462,000 of loans were in 1-4 family mortgage loans. $4,343,000 of loans were in farm loans. $0 of loans were in credit card loans. $243,053,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 3,895 | $887,612 | $227,885 |

| Nonfarm, nonresidential loans - <$100k | 611 | $28,056 | $45,918 |

| Nonfarm, nonresidential loans - $100-250k | 1,301 | $149,945 | $115,254 |

| Nonfarm, nonresidential loans - $250k-1MM | 1,983 | $709,611 | $357,847 |

| Commercial & Industrial, US addressed loans - <$1MM | 6,801 | $466,045 | $68,526 |

| Commercial & Industrial, US addressed loans - <$100k | 4,515 | $91,589 | $20,285 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,208 | $101,583 | $84,092 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,078 | $272,873 | $253,129 |

| Farmland loans - <$1MM | 303 | $28,555 | $94,241 |

| Farmland loans - <$100k | 136 | $4,693 | $34,507 |

| Farmland loans - $100-250k | 122 | $13,374 | $109,623 |

| Farmland loans - $250k-1MM | 45 | $10,488 | $233,067 |

| Agriculture operations loans - <$1MM | 93 | $3,039 | $32,677 |

| Agriculture operations loans - <$100k | 79 | $1,545 | $19,557 |

| Agriculture operations loans - $100-250k | 9 | $853 | $94,778 |

| Agriculture operations loans - $250k-1MM | 5 | $641 | $128,200 |