Trustmark National Bank Mortgage Rates, Fees & Info

Jackson, MSLEI: 01J4SO3XTWZF4PP38209

Tax ID: 64-0180810

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Trustmark National Bank is a mid-sized bank specializing in Home Purchase and Refi loans. Trustmark National Bank has a high proportion of conventional loans. They have an average proportion of FHA loans. They have a low ratio of USDA loans. Their top markets by origination volume include: Jackson, Montgomery, Birmingham, Daphne, and Mobile among others. We have data for 121 markets. (Some data included below & more in-depth data is available with an active subscription.)Trustmark National Bank has an above average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Trustmark National Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.85% | 8/31/25 |

| 30 Year Conventional Purchase | 6.05% | 8/31/25 |

| 30 Year Conventional Refi | 6.83% | 8/31/25 |

| 30 Year Cash-out Refi | 7.30% | 8/31/25 |

| 30 Year FHA Purchase | 7.16% | 8/31/25 |

| 30 Year FHA Refi | 7.27% | 8/31/25 |

| 30 Year VA Purchase | 6.46% | 8/31/25 |

| 30 Year VA Refi | 6.43% | 8/31/25 |

| 30 Year USDA Purchase | 6.60% | 8/31/25 |

| 15 Year Conventional Purchase | 4.26% | 8/31/25 |

| 15 Year Conventional Refi | 7.24% | 8/31/25 |

| 15 Year Cash-out Refi | 7.24% | 8/31/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

Trustmark National Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from Trustmark National Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

15,228Origination Dollar Volume (All Markets)

$3,165,110,000Employee count

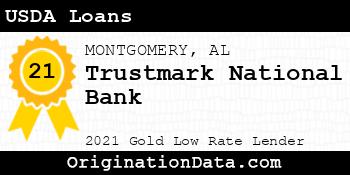

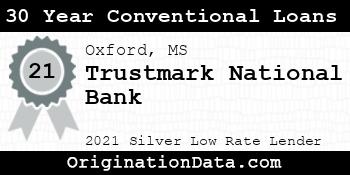

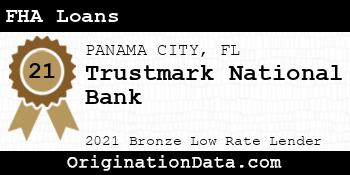

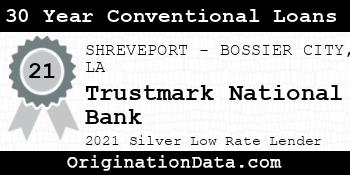

2,692 Show all (63) awardsTrustmark National Bank - 2021

Trustmark National Bank is a 2021 , due to their low .

For 2021, less than of lenders were eligible for this award.

Work for Trustmark National Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| JACKSON, MS (FHA|USDA|VA) | 2,857 | $547,055,000 | $191,479 | $3,665 | 2.53% |

| MONTGOMERY, AL (FHA|USDA|VA) | 1,215 | $246,605,000 | $202,967 | $3,995 | 2.92% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 1,038 | $242,700,000 | $233,815 | $3,385 | 2.89% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 838 | $221,460,000 | $264,272 | $4,118 | 2.59% |

| MOBILE, AL (FHA|USDA|VA) | 1,048 | $214,950,000 | $205,105 | $3,788 | 2.87% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 1,083 | $205,585,000 | $189,829 | $3,664 | 2.60% |

| PANAMA CITY, FL (FHA|USDA|VA) | 663 | $136,515,000 | $205,905 | $4,656 | 2.49% |

| Outside of Metro Areas | 899 | $134,925,000 | $150,083 | $3,660 | 2.65% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 314 | $122,980,000 | $391,656 | $5,505 | 2.64% |

| GULFPORT-BILOXI, MS (FHA|USDA|VA) | 630 | $105,320,000 | $167,175 | $3,800 | 2.56% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 319 | $97,835,000 | $306,693 | $5,021 | 2.62% |

| HATTIESBURG, MS (FHA|USDA|VA) | 518 | $95,000,000 | $183,398 | $4,063 | 2.61% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 408 | $87,670,000 | $214,877 | $4,077 | 2.81% |

| FLORENCE-MUSCLE SHOALS, AL (FHA|USDA|VA) | 401 | $68,435,000 | $170,661 | $3,803 | 2.83% |

| AUBURN-OPELIKA, AL (FHA|USDA|VA) | 227 | $53,595,000 | $236,101 | $4,105 | 2.96% |

| Meridian, MS (FHA|USDA|VA) | 289 | $50,475,000 | $174,654 | $4,533 | 2.36% |

| Oxford, MS (FHA|USDA|VA) | 221 | $47,915,000 | $216,810 | $3,042 | 2.66% |

| TUSCALOOSA, AL (FHA|USDA|VA) | 182 | $42,950,000 | $235,989 | $4,366 | 2.84% |

| SUMTER, SC (FHA|USDA|VA) | 198 | $40,740,000 | $205,758 | $4,890 | 2.84% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 124 | $37,880,000 | $305,484 | $4,943 | 2.81% |

| Vicksburg, MS (FHA|USDA|VA) | 217 | $36,785,000 | $169,516 | $4,404 | 2.58% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 8 | $29,600,000 | $3,700,000 | $4,715 | 2.97% |

| Tupelo, MS (FHA|USDA|VA) | 184 | $25,610,000 | $139,185 | $3,481 | 2.49% |

| Brookhaven, MS (FHA|USDA|VA) | 162 | $25,080,000 | $154,815 | $3,360 | 2.26% |

| BRUNSWICK, GA (FHA|USDA|VA) | 1 | $23,315,000 | $23,315,000 | $0 | 2.65% |

| SHREVEPORT-BOSSIER CITY, LA (FHA|USDA|VA) | 77 | $21,285,000 | $276,429 | $4,074 | 2.77% |

| Columbus, MS (FHA|USDA|VA) | 121 | $18,995,000 | $156,983 | $4,267 | 2.59% |

| Laurel, MS (FHA|USDA|VA) | 136 | $17,500,000 | $128,676 | $3,311 | 2.45% |

| COLUMBIA, SC (FHA|USDA|VA) | 71 | $14,875,000 | $209,507 | $4,554 | 2.93% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 33 | $12,185,000 | $369,242 | $3,464 | 2.61% |

| Alexander City, AL (FHA|USDA|VA) | 33 | $10,235,000 | $310,152 | $3,443 | 2.93% |

| McComb, MS (FHA|USDA|VA) | 61 | $8,185,000 | $134,180 | $3,778 | 2.35% |

| DECATUR, AL (FHA|USDA|VA) | 31 | $6,825,000 | $220,161 | $4,268 | 2.80% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 21 | $6,715,000 | $319,762 | $5,349 | 2.51% |

| Starkville, MS (FHA|USDA|VA) | 37 | $6,535,000 | $176,622 | $3,441 | 2.97% |

| Selma, AL (FHA|USDA|VA) | 54 | $6,460,000 | $119,630 | $3,428 | 2.56% |

| Greenwood, MS (FHA|USDA|VA) | 48 | $6,370,000 | $132,708 | $3,556 | 2.36% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 22 | $5,750,000 | $261,364 | $3,785 | 2.52% |

| Atmore, AL (FHA|USDA|VA) | 54 | $5,720,000 | $105,926 | $4,103 | 2.49% |

| Greenville, MS (FHA|USDA|VA) | 57 | $4,725,000 | $82,895 | $3,054 | 2.79% |

| Corinth, MS (FHA|USDA|VA) | 37 | $4,395,000 | $118,784 | $4,166 | 1.92% |

| Cullman, AL (FHA|USDA|VA) | 8 | $3,840,000 | $480,000 | $3,540 | 2.98% |

| BATON ROUGE, LA (FHA|USDA|VA) | 11 | $3,425,000 | $311,364 | $4,634 | 2.79% |

| DOTHAN, AL (FHA|USDA|VA) | 16 | $3,250,000 | $203,125 | $4,484 | 3.14% |

| Eufaula, AL-GA (FHA|USDA|VA) | 21 | $2,745,000 | $130,714 | $3,260 | 3.14% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 6 | $2,570,000 | $428,333 | $6,250 | 3.00% |

| GADSDEN, AL (FHA|USDA|VA) | 9 | $2,405,000 | $267,222 | $6,459 | 2.37% |

| Cleveland, MS (FHA|USDA|VA) | 13 | $2,395,000 | $184,231 | $5,072 | 2.75% |

| AUSTIN-ROUND ROCK-GEORGETOWN, TX (FHA|USDA|VA) | 4 | $2,250,000 | $562,500 | $6,811 | 2.94% |

| Fort Payne, AL (FHA|USDA|VA) | 8 | $2,220,000 | $277,500 | $4,840 | 2.83% |

| West Point, MS (FHA|USDA|VA) | 15 | $1,955,000 | $130,333 | $3,853 | 2.82% |

| Scottsboro, AL (FHA|USDA|VA) | 5 | $1,905,000 | $381,000 | $3,326 | 2.98% |

| Talladega-Sylacauga, AL (FHA|USDA|VA) | 8 | $1,740,000 | $217,500 | $4,914 | 2.98% |

| Albertville, AL (FHA|USDA|VA) | 8 | $1,440,000 | $180,000 | $3,178 | 2.90% |

| LaGrange, GA-AL (FHA|USDA|VA) | 13 | $1,395,000 | $107,308 | $3,140 | 3.42% |

| Troy, AL (FHA|USDA|VA) | 6 | $1,370,000 | $228,333 | $3,172 | 2.96% |

| Sevierville, TN (FHA|USDA|VA) | 4 | $1,350,000 | $337,500 | $5,589 | 2.94% |

| Jasper, AL (FHA|USDA|VA) | 9 | $1,315,000 | $146,111 | $3,540 | 3.05% |

| Mineral Wells, TX (FHA|USDA|VA) | 1 | $1,305,000 | $1,305,000 | $9,691 | 2.88% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 2 | $1,170,000 | $585,000 | $6,065 | 3.38% |

| ABILENE, TX (FHA|USDA|VA) | 3 | $1,155,000 | $385,000 | $6,889 | 2.54% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 5 | $1,125,000 | $225,000 | $4,300 | 2.98% |

| Natchez, MS-LA (FHA|USDA|VA) | 6 | $1,110,000 | $185,000 | $5,300 | 2.06% |

| JACKSON, TN (FHA|USDA|VA) | 5 | $1,105,000 | $221,000 | $3,132 | 3.18% |

| GAINESVILLE, FL (FHA|USDA|VA) | 3 | $1,105,000 | $368,333 | $6,800 | 2.92% |

| Picayune, MS (FHA|USDA|VA) | 8 | $1,100,000 | $137,500 | $4,612 | 2.92% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 2 | $1,030,000 | $515,000 | $4,230 | 3.50% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 4 | $950,000 | $237,500 | $5,279 | 3.03% |

| Indianola, MS (FHA|USDA|VA) | 6 | $840,000 | $140,000 | $3,189 | 3.49% |

| Clarksdale, MS (FHA|USDA|VA) | 5 | $795,000 | $159,000 | $3,224 | 2.22% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 3 | $735,000 | $245,000 | $3,658 | 2.88% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 2 | $670,000 | $335,000 | $1,772 | 1.99% |

| HOT SPRINGS, AR (FHA|USDA|VA) | 2 | $610,000 | $305,000 | $3,273 | 3.50% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 2 | $580,000 | $290,000 | $4,628 | 2.94% |

| Newberry, SC (FHA|USDA|VA) | 1 | $565,000 | $565,000 | $23,732 | 3.00% |

| Ozark, AL (FHA|USDA|VA) | 2 | $560,000 | $280,000 | $3,780 | 2.81% |

| WARNER ROBINS, GA (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $3,695 | 3.38% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 2 | $540,000 | $270,000 | $5,375 | 3.44% |

| ANNISTON-OXFORD, AL (FHA|USDA|VA) | 4 | $530,000 | $132,500 | $2,893 | 3.28% |

| LAFAYETTE, LA (FHA|USDA|VA) | 2 | $520,000 | $260,000 | $5,989 | 2.94% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 1 | $475,000 | $475,000 | $6,504 | 2.75% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $2,845 | 3.06% |

| LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $2,790 | 3.00% |

| OCALA, FL (FHA|USDA|VA) | 3 | $445,000 | $148,333 | $3,293 | 3.46% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 1 | $435,000 | $435,000 | $18,303 | 2.88% |

| MACON-BIBB COUNTY, GA (FHA|USDA|VA) | 2 | $430,000 | $215,000 | $3,352 | 2.05% |

| GOLDSBORO, NC (FHA|USDA|VA) | 2 | $410,000 | $205,000 | $2,609 | 2.31% |

| Milledgeville, GA (FHA|USDA|VA) | 1 | $405,000 | $405,000 | $3,529 | 3.25% |

| Grenada, MS (FHA|USDA|VA) | 2 | $390,000 | $195,000 | $6,493 | 3.00% |

| HAMMOND, LA (FHA|USDA|VA) | 3 | $385,000 | $128,333 | $2,615 | 1.87% |

| ATHENS-CLARKE COUNTY, GA (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $2,606 | 2.75% |

| Enterprise, AL (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $3,103 | 2.50% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $3,581 | 3.00% |

| FLORENCE, SC (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $1,895 | 3.00% |

| Tifton, GA (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $3,838 | 2.88% |

| KINGSPORT-BRISTOL, TN-VA (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $3,166 | 2.50% |

| Seneca, SC (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $3,179 | 3.50% |

| CLARKSVILLE, TN-KY (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $7,285 | 2.50% |

| Rockport, TX (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $4,930 | 2.88% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,484 | 3.25% |

| Lufkin, TX (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $5,631 | 2.63% |

| THE VILLAGES, FL (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $2,360 | 2.38% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $3,164 | 3.00% |

| Brevard, NC (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $3,590 | 2.50% |

| COLLEGE STATION-BRYAN, TX (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $3,968 | 2.25% |

| BOWLING GREEN, KY (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $4,470 | 3.25% |

| SAVANNAH, GA (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,925 | 3.13% |

| COLUMBUS, GA-AL (FHA|USDA|VA) | 2 | $210,000 | $105,000 | $1,764 | 3.73% |

| Minden, LA (FHA|USDA|VA) | 2 | $210,000 | $105,000 | $909 | 2.88% |

| HOUMA-THIBODAUX, LA (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $0 | 0.98% |

| Crossville, TN (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $2,363 | 2.88% |

| Thomasville, GA (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $2,881 | 3.38% |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $2,871 | 2.50% |

| Bogalusa, LA (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,021 | 3.38% |

| Huntsville, TX (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,474 | 2.38% |

| Bennettsville, SC (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $987 | 3.00% |

| JOHNSON CITY, TN (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $4,772 | 3.13% |

| KNOXVILLE, TN (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $1,822 | 3.13% |

| Brownsville, TN (FHA|USDA|VA) | 2 | $80,000 | $40,000 | $0 | 0.98% |

| El Campo, TX (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $0 | 5.45% |

| Cookeville, TN (FHA|USDA|VA) | 1 | $25,000 | $25,000 | $0 | 0.98% |

Similar Lenders

We use machine learning to identify the top lenders compared against Trustmark National Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 85

Similarity Rank: 248

Similarity Rank: 340

Similarity Rank: 675

Similarity Rank: 793

Similarity Rank: 900

Similarity Rank: 980

Similarity Rank: 1116

Similarity Rank: 1173

Similarity Rank: 1188

Product Mix

For 2021, Trustmark National Bank's most frequently originated type of loan was Conventional, with 9,150 originations. Their 2nd most popular type was HELOC, with 2,256 originations.

Loan Reason

For 2021, Trustmark National Bank's most frequently cited loan purpose was Home Purchase, with 8,449 originations. The 2nd most popular reason was Refi, with 3,630 originations.

Loan Duration/Length

For 2021, Trustmark National Bank's most frequently cited loan duration was 30 Year, with 9,603 originations. The 2nd most popular length was 10 Year, with 2,313 originations.

Origination Fees/Closing Costs

Trustmark National Bank's average total fees were $4,403, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 8,923 originations.

Interest Rates

During 2021, Trustmark National Bank's average interest rate for loans was 2.97%, while their most frequently originated rate bucket for loans was <2.5%, with 5,570 originations.

Loan Sizing

2021 saw Trustmark National Bank place emphasis on $200k-400k loans with 5,379 originations, totaling $1,457,205,000 in origination value.

Applicant Income

Trustmark National Bank lent most frequently to those with incomes in the $50k or less range, with 3,520 originations. The second most popular income band? $50k-75k, with 3,514 originations.

Applicant Debt to Income Ratio

Trustmark National Bank lent most frequently to those with DTI ratios of 20-30%, with 3,395 originations. The next most common DTI ratio? 30-36%, with 2,643 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications90.35%

Trustmark National Bank has an average approval rate.

Pick Rate

Approvals leading to origination80.94%

Trustmark National Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 15,228 | $3,165,110,000 | $207,848 |

Occupancy Type Mix

| Dwelling Type | Originations | Total Value | Average Loan |

|---|---|---|---|

| 15,228 | $3,165,110,000 | $207,848 |

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2021 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| TRUSTMARK CORPORATION | Conventional home mortgage | Struggling to pay mortgage | 1 | 10.0% |

| TRUSTMARK CORPORATION | Conventional home mortgage | Trouble during payment process | 2 | 20.0% |

| TRUSTMARK CORPORATION | FHA mortgage | Closing on a mortgage | 1 | 10.0% |

| TRUSTMARK CORPORATION | FHA mortgage | Trouble during payment process | 2 | 20.0% |

| TRUSTMARK CORPORATION | Home equity loan or line of credit (HELOC) | Trouble during payment process | 1 | 10.0% |

| TRUSTMARK CORPORATION | Other type of mortgage | Trouble during payment process | 1 | 10.0% |

| TRUSTMARK CORPORATION | VA mortgage | Struggling to pay mortgage | 1 | 10.0% |

| TRUSTMARK CORPORATION | VA mortgage | Trouble during payment process | 1 | 10.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Trustmark National Bank | 212 Howard Street Greenwood, MS 38930 | Full Service B&M | $94,186 |

| Trustmark National Bank | 1 Chase Corporation Drive Ste 105 Birmingham, AL 35244 | Full Service B&M | $0 |

| Trustmark National Bank | 100 Main Street New Augusta, MS 39462 | Full Service B&M | $37,326 |

| Trustmark National Bank | 1001 Highway 49 South Richland, MS 39208 | Full Service B&M | $89,346 |

| Trustmark National Bank | 1005 Sawmill Road Laurel, MS 39440 | Full Service B&M | $92,606 |

| Trustmark National Bank | 101 Highway 72 Corinth, MS 38834 | Full Service B&M | $36,741 |

| Trustmark National Bank | 101 Laurel Park Drive Flowood, MS 39232 | Full Service B&M | $63,599 |

| Trustmark National Bank | 101 Main Street Raleigh, MS 39153 | Full Service B&M | $55,435 |

| Trustmark National Bank | 101 West Water Street Carthage, MS 39051 | Limited, Drive-thru | $0 |

| Trustmark National Bank | 1015 Highway 51 North Madison, MS 39110 | Full Service B&M | $219,226 |

| Trustmark National Bank | 102 Brooks Street Pelahatchie, MS 39145 | Full Service B&M | $43,479 |

| Trustmark National Bank | 102 South Cummings Street Fulton, MS 38843 | Full Service B&M | $82,855 |

| Trustmark National Bank | 1025 Highway 43 South Saraland, AL 36571 | Full Service B&M | $37,423 |

| Trustmark National Bank | 1029 Highland Colony Parkway Ridgeland, MS 39157 | Full Service B&M | $254,313 |

| Trustmark National Bank | 103 Pinola Dr Sw Magee, MS 39111 | Full Service B&M | $93,557 |

| Trustmark National Bank | 104 Mayfair Road Hattiesburg, MS 39402 | Full Service B&M | $73,665 |

| Trustmark National Bank | 10497 Town And Country Way Houston, TX 77024 | Limited, Administrative | $0 |

| Trustmark National Bank | 105 Caldwell Drive Hazlehurst, MS 39083 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 105 Caldwell Drive Hazlehurst, MS 39083 | Full Service B&M | $114,254 |

| Trustmark National Bank | 106 Courthouse Square Oxford, MS 38655 | Full Service B&M | $84,569 |

| Trustmark National Bank | 106 Highway 16 Carthage, MS 39051 | Full Service B&M | $34,992 |

| Trustmark National Bank | 107 South Highland Street Memphis, TN 38111 | Full Service B&M | $1,638 |

| Trustmark National Bank | 107 St. Francis Street Mobile, AL 36602 | Full Service B&M | $205,048 |

| Trustmark National Bank | 10711 Louetta Road Houston, TX 77070 | Full Service B&M | $56,852 |

| Trustmark National Bank | 110 Choctaw Town Center Choctaw, MS 39350 | Full Service B&M | $338,489 |

| Trustmark National Bank | 110 East Main Street, Suite A Tupelo, MS 38804 | Full Service B&M | $88,987 |

| Trustmark National Bank | 111 Market Street East Athens, AL 35611 | Limited, Drive-thru | $13,950 |

| Trustmark National Bank | 112 North Jefferson Street Athens, AL 35611 | Full Service B&M | $52,816 |

| Trustmark National Bank | 114 South Pearl Street Carthage, MS 39051 | Full Service B&M | $66,945 |

| Trustmark National Bank | 114 South Tyndall Parkway Parker, FL 32401 | Full Service B&M | $49,949 |

| Trustmark National Bank | 1151 Pinehaven Blvd Clinton, MS 39056 | Full Service B&M | $127,011 |

| Trustmark National Bank | 117 South Main Street Petal, MS 39465 | Full Service B&M | $46,075 |

| Trustmark National Bank | 11709 Wilcrest Drive Houston, TX 77099 | Full Service B&M | $5,548 |

| Trustmark National Bank | 118 Jefferson Street S Huntsville, AL 35801 | Full Service B&M | $25,311 |

| Trustmark National Bank | 11915 Highway 70 Arlington, TN 38002 | Full Service B&M | $32,118 |

| Trustmark National Bank | 1200 North State Street, Suite 140 Jackson, MS 39202 | Full Service Retail | $16,843 |

| Trustmark National Bank | 1201 Douglas Street Brewton, AL 36426 | Full Service B&M | $51,048 |

| Trustmark National Bank | 12050 County Line Road Madison, AL 35756 | Full Service B&M | $31,532 |

| Trustmark National Bank | 121 Beulah Avenue Tylertown, MS 39667 | Full Service B&M | $58,675 |

| Trustmark National Bank | 1215 Delaware Avenue Mccomb, MS 39648 | Full Service B&M | $59,478 |

| Trustmark National Bank | 122 Greenville Bypass Greenville, AL 36037 | Full Service B&M | $22,080 |

| Trustmark National Bank | 125 Hazel Avenue Centreville, AL 35042 | Full Service B&M | $55,144 |

| Trustmark National Bank | 128 Hwy 12 West Starkville, MS 39759 | Full Service B&M | $12,266 |

| Trustmark National Bank | 1283 North Houston Levee Cordova, TN 38018 | Full Service B&M | $22,906 |

| Trustmark National Bank | 1301 Washington Street Vicksburg, MS 39180 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 1301 Washington Street Vicksburg, MS 39180 | Full Service B&M | $181,266 |

| Trustmark National Bank | 133 North Broadway Mccomb, MS 39648 | Full Service B&M | $80,067 |

| Trustmark National Bank | 1351 East Northside Drive Jackson, MS 39211 | Full Service B&M | $195,845 |

| Trustmark National Bank | 1363 West Government Street Brandon, MS 39042 | Full Service B&M | $344,321 |

| Trustmark National Bank | 140 Main Street Liberty, MS 39645 | Full Service B&M | $53,924 |

| Trustmark National Bank | 1400 Us Highway 80 East Demopolis, AL 36732 | Full Service B&M | $18,497 |

| Trustmark National Bank | 1404 Old Aberdeen Rd. Columbus, MS 39701 | Full Service B&M | $50,341 |

| Trustmark National Bank | 1405 South Germantown Road Germantown, TN 38138 | Full Service B&M | $63,744 |

| Trustmark National Bank | 144 Harrison Ave Panama City, FL 32401 | Full Service B&M | $90,114 |

| Trustmark National Bank | 14604 Northwest Freeway Houston, TX 77040 | Full Service B&M | $37,878 |

| Trustmark National Bank | 148 East Main Street Prattville, AL 36067 | Full Service B&M | $85,357 |

| Trustmark National Bank | 148 South Whitworth Avenue Brookhaven, MS 39601 | Full Service B&M | $133,823 |

| Trustmark National Bank | 14870 Space Center Blvd Suite G Houston, TX 77062 | Full Service B&M | $27,383 |

| Trustmark National Bank | 15 Kowaliga Road Eclectic, AL 36024 | Full Service B&M | $32,676 |

| Trustmark National Bank | 16045 Emerald Coast Parkway Destin, FL 32541 | Full Service B&M | $185,102 |

| Trustmark National Bank | 162 Main Street Gloster, MS 39638 | Full Service B&M | $23,280 |

| Trustmark National Bank | 16234 Highway 331 South Freeport, FL 32439 | Full Service B&M | $63,359 |

| Trustmark National Bank | 1637 Highway 1 South Greenville, MS 38701 | Full Service B&M | $42,246 |

| Trustmark National Bank | 16790 Us 64 Somerville, TN 38068 | Full Service B&M | $128,793 |

| Trustmark National Bank | 1695 Popps Ferry Road Biloxi, MS 39532 | Full Service B&M | $33,982 |

| Trustmark National Bank | 1725 Terry Road Jackson, MS 39204 | Full Service B&M | $18,122 |

| Trustmark National Bank | 17255 Panama City Beach Parkway Panama City Beach, FL 32413 | Full Service B&M | $80,429 |

| Trustmark National Bank | 1808 29th Avenue South Birmingham, AL 35209 | Full Service B&M | $24,457 |

| Trustmark National Bank | 1845 Highway 6 Sugar Land, TX 77478 | Full Service B&M | $61,142 |

| Trustmark National Bank | 1884 County Hwy 393 Santa Rosa Beach, FL 32459 | Full Service B&M | $111,096 |

| Trustmark National Bank | 1895 Lakeland Drive Jackson, MS 39216 | Full Service B&M | $67,502 |

| Trustmark National Bank | 19 W Garden St Pensacola, FL 32502 | Full Service B&M | $37,422 |

| Trustmark National Bank | 1916 Cobbs Ford Road Prattville, AL 36066 | Full Service B&M | $47,868 |

| Trustmark National Bank | 200 Highway 51 Brookhaven, MS 39601 | Full Service B&M | $66,802 |

| Trustmark National Bank | 2001 Highway 45 North Meridian, MS 39301 | Full Service B&M | $39,576 |

| Trustmark National Bank | 201 North Broad Street Leland, MS 38756 | Full Service B&M | $24,225 |

| Trustmark National Bank | 201 North Main Avenue Demopolis, AL 36732 | Full Service B&M | $45,257 |

| Trustmark National Bank | 2021 Cecil Ashburn Drive Huntsville, AL 35802 | Full Service B&M | $17,177 |

| Trustmark National Bank | 203 Clinton Boulevard Clinton, MS 39056 | Full Service B&M | $88,143 |

| Trustmark National Bank | 205 Meadowbrook Road Jackson, MS 39206 | Full Service B&M | $28,949 |

| Trustmark National Bank | 207 Alabama Street Columbus, MS 39702 | Full Service B&M | $50,142 |

| Trustmark National Bank | 212 Howard Street Greenwood, MS 38930 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 218-220 East Broad Street Eufaula, AL 36027 | Full Service B&M | $67,943 |

| Trustmark National Bank | 220 West 19th Street Panama City, FL 32405 | Full Service B&M | $96,831 |

| Trustmark National Bank | 2205 N Frontage Rd Vicksburg, MS 39180 | Full Service B&M | $96,254 |

| Trustmark National Bank | 22236 Us Hwy 72 Athens, AL 35613 | Full Service B&M | $49,901 |

| Trustmark National Bank | 227 Belleville Avenue Brewton, AL 36426 | Full Service B&M | $118,846 |

| Trustmark National Bank | 229 New Mansdale Road Madison, MS 39110 | Full Service B&M | $106,443 |

| Trustmark National Bank | 2305 Thomas Drive Panama City Beach, FL 32408 | Full Service B&M | $81,307 |

| Trustmark National Bank | 2315 State Highway 77 Lynn Haven, FL 32444 | Full Service B&M | $125,871 |

| Trustmark National Bank | 2320 14th Street, Suite 1-A Gulfport, MS 39501 | Full Service B&M | $25,230 |

| Trustmark National Bank | 2330 University Boulevard Tuscaloosa, AL 35401 | Full Service B&M | $16,475 |

| Trustmark National Bank | 236 North Greeno Road, Greeno Professional Village Fairhope, AL 36532 | Full Service B&M | $70,497 |

| Trustmark National Bank | 2402 West Main Tupelo, MS 38801 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 2402 West Main Street Tupelo, MS 38801 | Full Service B&M | $25,248 |

| Trustmark National Bank | 2409 Highway 80 East Pearl, MS 39208 | Full Service B&M | $21,751 |

| Trustmark National Bank | 2425 Highway 80 East Pearl, MS 39208 | Full Service B&M | $50,529 |

| Trustmark National Bank | 2475 Goodman Road Horn Lake, MS 38637 | Full Service B&M | $45,699 |

| Trustmark National Bank | 248 East Capitol Jackson, MS 39201 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 248 East Capitol Street Jackson, MS 39201 | Full Service B&M | $2,098,338 |

| Trustmark National Bank | 2507 U. S. Highway 98 Daphne, AL 36526 | Full Service B&M | $45,362 |

| Trustmark National Bank | 2510 Highway 51 South Hernando, MS 38632 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 2510 Highway 51 South Hernando, MS 38632 | Full Service B&M | $76,344 |

| Trustmark National Bank | 2516 Robinson Road Jackson, MS 39209 | Full Service B&M | $30,130 |

| Trustmark National Bank | 2795 Kirby Whitten Road Bartlett, TN 38134 | Full Service B&M | $0 |

| Trustmark National Bank | 2853 Goodman Road East Southaven, MS 38671 | Full Service B&M | $50,899 |

| Trustmark National Bank | 300 Pine Street West Hattiesburg, MS 39401 | Limited, Mobile/Seasonal Office | $0 |

| Trustmark National Bank | 300-314 East Commerce Street Greenville, AL 36037 | Full Service B&M | $54,024 |

| Trustmark National Bank | 302 Woodrow Wilson Boulevard Jackson, MS 39213 | Full Service B&M | $30,247 |

| Trustmark National Bank | 304 Barnett Boulevard Tallassee, AL 36078 | Full Service B&M | $53,858 |

| Trustmark National Bank | 305 Poplar View Parkway Collierville, TN 38017 | Full Service B&M | $86,383 |

| Trustmark National Bank | 30723 State Hwy 181 Spanish Fort, AL 36527 | Full Service B&M | $35,877 |

| Trustmark National Bank | 3081 Highway 49 South Florence, MS 39073 | Full Service B&M | $73,990 |

| Trustmark National Bank | 310 Broad Street Selma, AL 36701 | Full Service B&M | $199,486 |

| Trustmark National Bank | 3105 Lakeland Drive Flowood, MS 39232 | Full Service B&M | $152,415 |

| Trustmark National Bank | 3112 Hardy Street Hattiesburg, MS 39401 | Full Service B&M | $31,769 |

| Trustmark National Bank | 3145 Audubon Drive Laurel, MS 39440 | Full Service B&M | $58,217 |

| Trustmark National Bank | 318 Highway 51 North Ridgeland, MS 39157 | Full Service B&M | $83,218 |

| Trustmark National Bank | 3221 Old Canton Road Jackson, MS 39216 | Full Service B&M | $84,829 |

| Trustmark National Bank | 3254 Dauphin Street Mobile, AL 36606 | Full Service B&M | $55,854 |

| Trustmark National Bank | 3311 Terry Road Jackson, MS 39212 | Full Service B&M | $26,882 |

| Trustmark National Bank | 3319 South Liberty Street Canton, MS 39046 | Full Service B&M | $250,170 |

| Trustmark National Bank | 3335 Hwy 64 Eads, TN 38028 | Full Service B&M | $39,147 |

| Trustmark National Bank | 3714 Canada Road Lakeland, TN 38002 | Full Service B&M | $69,574 |

| Trustmark National Bank | 3907 N. Gloster Tupelo, MS 38801 | Full Service B&M | $32,218 |

| Trustmark National Bank | 4003 E County Hwy 30a Santa Rosa Beach, FL 32459 | Full Service B&M | $52,781 |

| Trustmark National Bank | 401 Adams Avenue Montgomery, AL 36104 | Full Service B&M | $24,594 |

| Trustmark National Bank | 404 Highway 28 East Taylorsville, MS 39168 | Full Service B&M | $63,165 |

| Trustmark National Bank | 412 Highway 106 West Georgiana, AL 36033 | Full Service B&M | $42,652 |

| Trustmark National Bank | 415 North Dean Road Auburn, AL 36830 | Full Service B&M | $48,071 |

| Trustmark National Bank | 415 North Magnolia Street Laurel, MS 39440 | Full Service B&M | $68,900 |

| Trustmark National Bank | 420 20th Street North Birmingham, AL 35203 | Full Service B&M | $34,425 |

| Trustmark National Bank | 4290 Carmichael Road Montgomery, AL 36106 | Full Service B&M | $44,452 |

| Trustmark National Bank | 4295 Hwy 80 East Pearl, MS 39208 | Full Service B&M | $52,590 |

| Trustmark National Bank | 4425 Old Shell Road Mobile, AL 36608 | Full Service B&M | $53,948 |

| Trustmark National Bank | 4572 Elvis Presley Blvd. Memphis, TN 38116 | Full Service B&M | $11,599 |

| Trustmark National Bank | 4660 East Sam Houston Parkway South Pasadena, TX 77504 | Full Service B&M | $73,162 |

| Trustmark National Bank | 4801 Highway 18 Jackson, MS 39209 | Full Service B&M | $80,037 |

| Trustmark National Bank | 4890 Medgar Evers Boulevard Jackson, MS 39213 | Full Service B&M | $32,739 |

| Trustmark National Bank | 4921 Poplar Springs Drive Meridian, MS 39301 | Full Service B&M | $65,206 |

| Trustmark National Bank | 501 Fillmore Street Corinth, MS 38834 | Full Service B&M | $118,021 |

| Trustmark National Bank | 504 South State Street Jackson, MS 39201 | Full Service B&M | $76,018 |

| Trustmark National Bank | 516 Spring Street Wesson, MS 39191 | Full Service B&M | $36,420 |

| Trustmark National Bank | 5328 Highway 90 West Service Road Mobile, AL 36619 | Full Service B&M | $70,034 |

| Trustmark National Bank | 534 East Commerce Street Hernando, MS 38632 | Limited, Drive-thru | $16,996 |

| Trustmark National Bank | 5350 Poplar Avenue Memphis, TN 38119 | Full Service B&M | $46,837 |

| Trustmark National Bank | 5627 Highway 25 Flowood, MS 39232 | Full Service B&M | $155,680 |

| Trustmark National Bank | 5725 Highway 57 Rossville, TN 38066 | Full Service B&M | $33,245 |

| Trustmark National Bank | 5799 San Felipe St Houston, TX 77057 | Full Service B&M | $198,717 |

| Trustmark National Bank | 60 Hines Street Monroeville, AL 36461 | Full Service B&M | $134,446 |

| Trustmark National Bank | 604 Washington Avenue Greenville, MS 38701 | Full Service B&M | $52,003 |

| Trustmark National Bank | 605 Main Street Greenville, MS 38701 | Limited, Drive-thru | $18,503 |

| Trustmark National Bank | 611 Fillmore Street Corinth, MS 38834 | Limited, Drive-thru | $24,714 |

| Trustmark National Bank | 612 Highway 11 South Meridian, MS 39301 | Full Service B&M | $53,923 |

| Trustmark National Bank | 6165 Poplar Avenue Memphis, TN 38119 | Full Service B&M | $7,352 |

| Trustmark National Bank | 624 Main Street Columbus, MS 39701 | Full Service B&M | $81,328 |

| Trustmark National Bank | 6248 Old Canton Road Jackson, MS 39211 | Full Service B&M | $57,007 |

| Trustmark National Bank | 6401 Us Highway 98 Hattiesburg, MS 39402 | Full Service B&M | $63,270 |

| Trustmark National Bank | 654 Caldwell Drive Hazlehurst, MS 39083 | Limited, Drive-thru | $16,619 |

| Trustmark National Bank | 6767 Summer Avenue Bartlett, TN 38134 | Full Service B&M | $42,212 |

| Trustmark National Bank | 6809 Fm 1960 West Houston, TX 77069 | Full Service B&M | $133,262 |

| Trustmark National Bank | 699 South Mckenzie Foley, AL 36535 | Full Service B&M | $48,243 |

| Trustmark National Bank | 700 23rd Avenue Meridian, MS 39301 | Full Service B&M | $120,418 |

| Trustmark National Bank | 709 Main Street Columbia, MS 39429 | Full Service B&M | $99,311 |

| Trustmark National Bank | 7100 South Fry Road Katy, TX 77494 | Full Service B&M | $17,079 |

| Trustmark National Bank | 714 Jackson Avenue Oxford, MS 38655 | Full Service B&M | $26,123 |

| Trustmark National Bank | 722 Broad Street Columbia, MS 39429 | Full Service B&M | $55,236 |

| Trustmark National Bank | 7270 Siwell Road Jackson, MS 39212 | Full Service B&M | $137,252 |

| Trustmark National Bank | 748 Beulah Avenue Tylertown, MS 39667 | Full Service B&M | $52,646 |

| Trustmark National Bank | 752 Lake Harbour Drive Ridgeland, MS 39157 | Full Service B&M | $150,496 |

| Trustmark National Bank | 7522 Front Beach Road Panama City Beach, FL 32407 | Full Service B&M | $92,890 |

| Trustmark National Bank | 776 Brookway Boulevard Brookhaven, MS 39601 | Full Service B&M | $64,879 |

| Trustmark National Bank | 7980 Highway 51 North Millington, TN 38053 | Full Service B&M | $87,797 |

| Trustmark National Bank | 799 East John Sims Parkway Niceville, FL 32578 | Full Service B&M | $21,480 |

| Trustmark National Bank | 835 Main Street Montevallo, AL 35115 | Full Service B&M | $80,916 |

| Trustmark National Bank | 840 13th Street Hempstead, TX 77445 | Full Service B&M | $38,392 |

| Trustmark National Bank | 850 Hillcrest Road Mobile, AL 36608 | Full Service B&M | $72,183 |

| Trustmark National Bank | 876 Highway 61 North Vicksburg, MS 39180 | Full Service B&M | $51,747 |

| Trustmark National Bank | 9039 Pigeon Roost Rd Olive Branch, MS 38654 | Full Service B&M | $59,266 |

| Trustmark National Bank | 935 Lodge Street Beaumont, MS 39423 | Full Service B&M | $27,424 |

| Trustmark National Bank | 938 Hwy 82 West Greenwood, MS 38930 | Full Service B&M | $59,183 |

| Trustmark National Bank | 945 Bunker Hill Road Houston, TX 77024 | Full Service B&M | $61,061 |

| Trustmark National Bank | 951 Broadway Drive Hattiesburg, MS 39401 | Full Service B&M | $200,147 |

| Trustmark National Bank | 951 Taylor Road Montgomery, AL 36117 | Full Service B&M | $46,479 |

| Trustmark National Bank | 963 South Gloster Street Tupelo, MS 38801 | Full Service B&M | $87,350 |

| Trustmark National Bank | 993 Us Highway 31 South Defuniak Springs, FL 32435 | Full Service Retail | $51,851 |

| Trustmark National Bank | Mack Bayou Road And U.S. Highway 98 Santa Rosa Beach, FL 32459 | Full Service B&M | $153,688 |

| Trustmark National Bank | One Trustmark Plaza Hattiesburg, MS 39401 | Full Service B&M | $153,357 |

| Trustmark National Bank | South Eufaula Avenue & Hunters Inlet Road Eufaula, AL 36027 | Full Service B&M | $33,909 |

| Trustmark National Bank | Thomason Drive, 1801 Thomason Drive Opelika, AL 36801 | Full Service B&M | $71,290 |

For 2021, Trustmark National Bank had 190 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $442,475 |

| Net interest income | $424,202 |

| Total noninterest income | $219,109 |

| Gross Fiduciary activities income | $20,899 |

| Service charges on deposit accounts | $35,585 |

| Trading account gains and fees | $-7,107 |

| Additional Noninterest Income | $169,732 |

| Pre-tax net operating income | $183,487 |

| Securities gains (or losses, -) | $0 |

| Income before extraordinary items | $153,425 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $153,425 |

| Minority interest net income | $0 |

| Net income | $153,425 |

| Sale, conversion, retirement of capital stock, net | $5,601 |

| Net operating income | $153,425 |

Trustmark National Bank's gross interest income from loans was $442,475,000.

Trustmark National Bank's net interest income from loans was $424,202,000.

Trustmark National Bank's fee based income from loans was $35,585,000.

Trustmark National Bank's net income from loans was $153,425,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $18,273 |

| Provision for credit losses | $-24,448 |

| Total noninterest expense | $484,272 |

| Salaries and employee benefits | $284,158 |

| Premises and equipment expense | $51,380 |

| Additional noninterest expense | $148,734 |

| Applicable income taxes | $30,062 |

| Net charge-offs | $-3,650 |

| Cash dividends | $45,284 |

Trustmark National Bank's interest expense for loans was $18,273,000.

Trustmark National Bank's payroll and benefits expense were $284,158,000.

Trustmark National Bank's property, plant and equipment expenses $51,380,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 1.0% |

| Real Estate loans | 1.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 3.0% |

| HELOC loans | 0.0% |

| All other family | 4.0% |

| Commercial & industrial loans | 1.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.7% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 85.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $15,162,697 |

| Deposits held in domestic offices | $15,162,697 |

| Deposits by Individuals, partnerships, and corporations | $12,278,181 |

| Deposits by U.S. Government | $443,143 |

| Deposits by States and political subdivisions in the U.S. | $2,434,611 |

| Deposits by Commercial banks and other depository institutions in U.S. | $6,762 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $4,505,361 |

| Demand deposits | $3,012,168 |

| Nontransaction accounts | $10,657,336 |

| Money market deposit accounts (MMDAs) | $2,954,844 |

| Other savings deposits (excluding MMDAs) | $6,504,035 |

| Total time deposits | $1,198,457 |

| Total time and savings deposits | $12,150,529 |

| Noninterest-bearing deposits | $4,771,065 |

| Interest-bearing deposits | $10,391,632 |

| Retail deposits | $14,969,168 |

| IRAs and Keogh plan accounts | $253,429 |

| Brokered deposits | $29,563 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $17,593,319 |

| Cash & Balances due from depository institutions | $2,266,829 |

| Interest-bearing balances | $2,069,043 |

| Total securities | $3,581,414 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $10,457,414 |

| Loan and leases loss allowance | $99,457 |

| Trading account assets | $22,908 |

| Bank premises and fixed assets | $205,644 |

| Other real estate owned | $4,557 |

| Goodwill and other intangibles | $476,998 |

| All other assets | $577,555 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $17,593,319 |

| Total Liabilities | $15,743,777 |

| Total deposits | $15,162,697 |

| Interest-bearing deposits | $10,391,632 |

| Deposits held in domestic offices | $15,162,697 |

| % insured (estimated) | $57 |

| Federal funds purchased and repurchase agreements | $238,577 |

| Trading liabilities | $4,558 |

| Other borrowed funds | $91,025 |

| Subordinated debt | $0 |

| All other liabilities | $246,920 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $10,457,414 |

| Loan and leases loss allowance | $99,457 |

| Total loans and leases (domestic) | $10,556,871 |

| All real estate loans | $7,265,608 |

| Real estate loans in domestic offices | $7,265,608 |

| Construction and development loans | $1,308,781 |

| Residential 1-4 family construction | $292,828 |

| Other construction, all land development and other land | $1,015,953 |

| Loans secured by nonfarm nonresidential properties | $2,977,085 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,205,307 |

| Commercial real estate & other non-farm, non-residential | $1,771,778 |

| Multifamily residential real estate | $649,155 |

| 1-4 family residential loans | $2,253,699 |

| Farmland loans | $76,888 |

| Loans held in foreign offices | $0 |

| Farm loans | $31,684 |

| Commercial and industrial loans | $1,446,692 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $159,472 |

| Credit card loans | $31,670 |

| Related Plans | $17,427 |

| Consumer Auto Loans | $34,701 |

| Other loans to individuals | $75,674 |

| All other loans & leases | $1,653,415 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $507,164 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $5,165 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $2,401 |

| Non 1-4 family restructured loans & leases | $2,401 |

| Total loans and leases (foreign) | $0 |

Trustmark National Bank had $10,457,414,000 of loans outstanding in 2021. $7,265,608,000 of loans were in real estate loans. $1,308,781,000 of loans were in development loans. $649,155,000 of loans were in multifamily mortgage loans. $2,253,699,000 of loans were in 1-4 family mortgage loans. $31,684,000 of loans were in farm loans. $31,670,000 of loans were in credit card loans. $34,701,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 1,683 | $362,115 | $215,160 |

| Nonfarm, nonresidential loans - <$100k | 352 | $14,731 | $41,849 |

| Nonfarm, nonresidential loans - $100-250k | 567 | $66,166 | $116,695 |

| Nonfarm, nonresidential loans - $250k-1MM | 764 | $281,218 | $368,086 |

| Commercial & Industrial, US addressed loans - <$1MM | 5,135 | $343,116 | $66,819 |

| Commercial & Industrial, US addressed loans - <$100k | 3,727 | $99,839 | $26,788 |

| Commercial & Industrial, US addressed loans - $100-250k | 756 | $87,070 | $115,172 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 652 | $156,207 | $239,581 |

| Farmland loans - <$1MM | 305 | $28,184 | $92,407 |

| Farmland loans - <$100k | 153 | $5,567 | $36,386 |

| Farmland loans - $100-250k | 103 | $10,782 | $104,680 |

| Farmland loans - $250k-1MM | 49 | $11,835 | $241,531 |

| Agriculture operations loans - <$1MM | 634 | $22,113 | $34,879 |

| Agriculture operations loans - <$100k | 561 | $11,518 | $20,531 |

| Agriculture operations loans - $100-250k | 43 | $4,634 | $107,767 |

| Agriculture operations loans - $250k-1MM | 30 | $5,961 | $198,700 |