The Park National Bank Mortgage Rates, Fees & Info

Newark, OHLEI: 549300CEHN5CVC6INV48

Tax ID: 31-1198067

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

The Park National Bank is a small bank specializing in Refi, Home Purchase, and Cash Out Refi loans. The Park National Bank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Columbus, Cincinnati, Zanesville, Mount Vernon, and Greenville among others. We have data for 131 markets. (Some data included below & more in-depth data is available with an active subscription.)The Park National Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. The Park National Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.72% | 8/3/25 |

| 30 Year Conventional Purchase | 7.20% | 8/3/25 |

| 30 Year Conventional Refi | 7.18% | 8/3/25 |

| 30 Year Cash-out Refi | 6.78% | 8/3/25 |

| 30 Year FHA Purchase | 7.06% | 8/3/25 |

| 30 Year FHA Refi | 6.72% | 8/3/25 |

| 30 Year VA Purchase | 6.17% | 8/3/25 |

| 30 Year USDA Purchase | 7.74% | 8/3/25 |

| 15 Year Conventional Purchase | 7.06% | 8/3/25 |

| 15 Year Conventional Refi | 8.21% | 8/3/25 |

| 15 Year Cash-out Refi | 8.21% | 8/3/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

The Park National Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from The Park National Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

9,015Origination Dollar Volume (All Markets)

$1,615,275,000Employee count

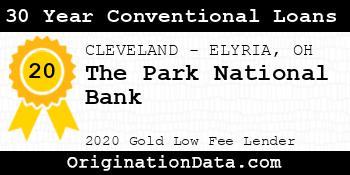

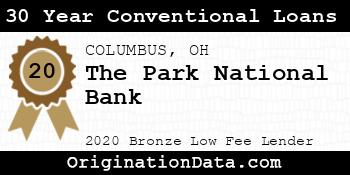

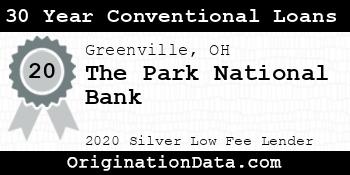

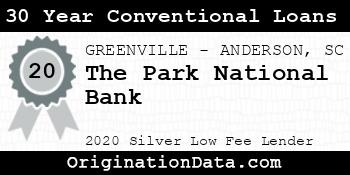

1,738 Show all (33) awardsThe Park National Bank - 2020

The Park National Bank is a 2020 , due to their low .

For 2020, less than of lenders were eligible for this award.

Work for The Park National Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| COLUMBUS, OH (FHA|USDA|VA) | 2,601 | $493,725,000 | $189,821 | $2,657 | 2.99% |

| CINCINNATI, OH-KY-IN (FHA|USDA|VA) | 566 | $129,270,000 | $228,392 | $2,391 | 3.15% |

| Zanesville, OH (FHA|USDA|VA) | 827 | $114,595,000 | $138,567 | $2,546 | 3.07% |

| Mount Vernon, OH (FHA|USDA|VA) | 710 | $105,190,000 | $148,155 | $2,590 | 3.09% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 449 | $96,715,000 | $215,401 | $2,766 | 3.00% |

| MANSFIELD, OH (FHA|USDA|VA) | 597 | $76,335,000 | $127,864 | $2,561 | 2.96% |

| DAYTON-KETTERING, OH (FHA|USDA|VA) | 375 | $59,715,000 | $159,240 | $2,849 | 2.99% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 125 | $59,505,000 | $476,040 | $3,519 | 3.12% |

| ASHEVILLE, NC (FHA|USDA|VA) | 175 | $55,205,000 | $315,457 | $3,267 | 3.01% |

| SPARTANBURG, SC (FHA|USDA|VA) | 173 | $54,275,000 | $313,728 | $3,238 | 3.13% |

| SPRINGFIELD, OH (FHA|USDA|VA) | 310 | $37,530,000 | $121,065 | $2,752 | 3.19% |

| Greenville, OH (FHA|USDA|VA) | 281 | $35,075,000 | $124,822 | $2,363 | 2.97% |

| Outside of Metro Areas | 227 | $34,475,000 | $151,872 | $2,924 | 3.20% |

| Coshocton, OH (FHA|USDA|VA) | 263 | $29,855,000 | $113,517 | $2,581 | 3.27% |

| Ashland, OH (FHA|USDA|VA) | 180 | $23,490,000 | $130,500 | $2,618 | 3.03% |

| Cambridge, OH (FHA|USDA|VA) | 125 | $17,965,000 | $143,720 | $2,651 | 3.20% |

| Wooster, OH (FHA|USDA|VA) | 95 | $15,715,000 | $165,421 | $2,697 | 2.91% |

| Celina, OH (FHA|USDA|VA) | 84 | $13,210,000 | $157,262 | $2,582 | 2.87% |

| New Philadelphia-Dover, OH (FHA|USDA|VA) | 75 | $12,135,000 | $161,800 | $2,659 | 3.17% |

| Bucyrus-Galion, OH (FHA|USDA|VA) | 117 | $12,095,000 | $103,376 | $2,471 | 2.84% |

| CLEVELAND-ELYRIA, OH (FHA|USDA|VA) | 51 | $11,565,000 | $226,765 | $3,011 | 2.92% |

| Athens, OH (FHA|USDA|VA) | 62 | $10,050,000 | $162,097 | $3,144 | 3.24% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 17 | $7,865,000 | $462,647 | $3,551 | 3.19% |

| Sidney, OH (FHA|USDA|VA) | 45 | $7,115,000 | $158,111 | $2,759 | 3.01% |

| CANTON-MASSILLON, OH (FHA|USDA|VA) | 40 | $6,680,000 | $167,000 | $3,079 | 3.37% |

| Urbana, OH (FHA|USDA|VA) | 54 | $6,410,000 | $118,704 | $2,892 | 3.28% |

| LOUISVILLE, KY (FHA|USDA|VA) | 16 | $4,920,000 | $307,500 | $2,332 | 3.09% |

| Marion, OH (FHA|USDA|VA) | 42 | $4,910,000 | $116,905 | $2,453 | 3.09% |

| AKRON, OH (FHA|USDA|VA) | 25 | $4,255,000 | $170,200 | $2,908 | 3.35% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 13 | $3,755,000 | $288,846 | $4,342 | 3.04% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 11 | $3,685,000 | $335,000 | $3,856 | 2.98% |

| Norwalk, OH (FHA|USDA|VA) | 19 | $3,235,000 | $170,263 | $2,909 | 3.28% |

| Seneca, SC (FHA|USDA|VA) | 13 | $3,065,000 | $235,769 | $2,694 | 2.97% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 11 | $2,795,000 | $254,091 | $3,027 | 2.75% |

| TOLEDO, OH (FHA|USDA|VA) | 13 | $2,645,000 | $203,462 | $2,864 | 3.31% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 7 | $2,545,000 | $363,571 | $4,538 | 3.11% |

| Bellefontaine, OH (FHA|USDA|VA) | 14 | $2,440,000 | $174,286 | $3,039 | 2.67% |

| Key West, FL (FHA|USDA|VA) | 3 | $2,175,000 | $725,000 | $6,568 | 2.92% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 7 | $2,055,000 | $293,571 | $3,361 | 2.84% |

| Marion, NC (FHA|USDA|VA) | 5 | $1,785,000 | $357,000 | $3,223 | 3.46% |

| Boston-Cambridge-Newton, MA-NH (FHA|USDA|VA) | 5 | $1,555,000 | $311,000 | $2,799 | 2.75% |

| Wapakoneta, OH (FHA|USDA|VA) | 9 | $1,495,000 | $166,111 | $2,349 | 2.71% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 2 | $1,490,000 | $745,000 | $3,747 | 3.25% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 6 | $1,390,000 | $231,667 | $4,751 | 3.12% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 4 | $1,310,000 | $327,500 | $3,477 | 2.59% |

| Cullowhee, NC (FHA|USDA|VA) | 4 | $1,300,000 | $325,000 | $4,089 | 3.34% |

| Sandusky, OH (FHA|USDA|VA) | 4 | $1,140,000 | $285,000 | $3,342 | 2.31% |

| BAY CITY, MI (FHA|USDA|VA) | 1 | $1,105,000 | $1,105,000 | $0 | 4.22% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 5 | $1,005,000 | $201,000 | $3,207 | 3.08% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 5 | $975,000 | $195,000 | $3,666 | 2.45% |

| Georgetown, SC (FHA|USDA|VA) | 4 | $960,000 | $240,000 | $2,966 | 2.75% |

| Angola, IN (FHA|USDA|VA) | 3 | $945,000 | $315,000 | $2,228 | 2.83% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 2 | $930,000 | $465,000 | $5,192 | 2.56% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 1 | $925,000 | $925,000 | $0 | 3.94% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 2 | $860,000 | $430,000 | $2,848 | 2.81% |

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 2 | $860,000 | $430,000 | $3,339 | 2.56% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 4 | $830,000 | $207,500 | $2,645 | 2.59% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 2 | $800,000 | $400,000 | $3,742 | 2.56% |

| Brevard, NC (FHA|USDA|VA) | 2 | $760,000 | $380,000 | $3,631 | 2.94% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 2 | $740,000 | $370,000 | $2,536 | 2.50% |

| Findlay, OH (FHA|USDA|VA) | 4 | $690,000 | $172,500 | $3,090 | 3.22% |

| Washington Court House, OH (FHA|USDA|VA) | 5 | $685,000 | $137,000 | $2,627 | 2.75% |

| Forest City, NC (FHA|USDA|VA) | 2 | $680,000 | $340,000 | $3,937 | 3.25% |

| Marietta, OH (FHA|USDA|VA) | 5 | $665,000 | $133,000 | $3,203 | 2.70% |

| Salem, OH (FHA|USDA|VA) | 3 | $655,000 | $218,333 | $3,041 | 3.00% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 1 | $625,000 | $625,000 | $3,941 | 3.13% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 2 | $600,000 | $300,000 | $2,933 | 2.75% |

| COLUMBIA, SC (FHA|USDA|VA) | 2 | $590,000 | $295,000 | $3,327 | 2.94% |

| Coldwater, MI (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $0 | 4.20% |

| Wilmington, OH (FHA|USDA|VA) | 4 | $530,000 | $132,500 | $2,736 | 2.34% |

| Los Angeles-Long Beach-Anaheim, CA (FHA|USDA|VA) | 2 | $520,000 | $260,000 | $2,807 | 2.06% |

| Glenwood Springs, CO (FHA|USDA|VA) | 1 | $515,000 | $515,000 | $4,284 | 2.50% |

| FLAGSTAFF, AZ (FHA|USDA|VA) | 1 | $515,000 | $515,000 | $3,285 | 2.75% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 1 | $515,000 | $515,000 | $6,106 | 2.75% |

| Pinehurst-Southern Pines, NC (FHA|USDA|VA) | 1 | $505,000 | $505,000 | $3,261 | 3.88% |

| Tiffin, OH (FHA|USDA|VA) | 4 | $500,000 | $125,000 | $2,832 | 2.88% |

| KALAMAZOO-PORTAGE, MI (FHA|USDA|VA) | 1 | $495,000 | $495,000 | $3,185 | 2.50% |

| YOUNGSTOWN-WARREN-BOARDMAN, OH-PA (FHA|USDA|VA) | 4 | $480,000 | $120,000 | $3,007 | 3.56% |

| Fremont, OH (FHA|USDA|VA) | 3 | $475,000 | $158,333 | $2,694 | 3.29% |

| THE VILLAGES, FL (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $2,213 | 2.69% |

| WHEELING, WV-OH (FHA|USDA|VA) | 3 | $425,000 | $141,667 | $3,013 | 3.13% |

| SACRAMENTO-ROSEVILLE-FOLSOM, CA (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $2,395 | 2.63% |

| LEXINGTON-FAYETTE, KY (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $2,326 | 3.08% |

| Sevierville, TN (FHA|USDA|VA) | 1 | $415,000 | $415,000 | $3,380 | 2.88% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 3 | $405,000 | $135,000 | $3,049 | 2.92% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 3 | $395,000 | $131,667 | $2,942 | 2.75% |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (FHA|USDA|VA) | 2 | $390,000 | $195,000 | $2,812 | 2.44% |

| Morehead City, NC (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $0 | 3.65% |

| OCALA, FL (FHA|USDA|VA) | 3 | $375,000 | $125,000 | $2,735 | 3.13% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 1 | $365,000 | $365,000 | $2,577 | 2.88% |

| LAKELAND-WINTER HAVEN, FL (FHA|USDA|VA) | 1 | $365,000 | $365,000 | $4,219 | 2.38% |

| KNOXVILLE, TN (FHA|USDA|VA) | 1 | $365,000 | $365,000 | $0 | 3.50% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $3,087 | 2.81% |

| Traverse City, MI (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $2,822 | 2.38% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $3,757 | 2.38% |

| PANAMA CITY, FL (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $5,270 | 2.75% |

| PITTSBURGH, PA (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $4,072 | 2.63% |

| Chillicothe, OH (FHA|USDA|VA) | 5 | $305,000 | $61,000 | $2,240 | 3.28% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $0 | 4.50% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $3,575 | 2.50% |

| INDIANAPOLIS-CARMEL-ANDERSON, IN (FHA|USDA|VA) | 2 | $290,000 | $145,000 | $2,491 | 2.56% |

| MISSOULA, MT (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $3,360 | 2.63% |

| Decatur, IN (FHA|USDA|VA) | 2 | $280,000 | $140,000 | $2,006 | 3.25% |

| SOUTH BEND-MISHAWAKA, IN-MI (FHA|USDA|VA) | 2 | $280,000 | $140,000 | $1,654 | 2.38% |

| LIMA, OH (FHA|USDA|VA) | 4 | $270,000 | $67,500 | $2,202 | 3.31% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 2 | $260,000 | $130,000 | $2,544 | 3.63% |

| Point Pleasant, WV-OH (FHA|USDA|VA) | 2 | $250,000 | $125,000 | $2,819 | 2.75% |

| Ellensburg, WA (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,779 | 3.00% |

| BLOOMINGTON, IL (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,792 | 2.75% |

| BLACKSBURG-CHRISTIANSBURG, VA (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $2,875 | 2.50% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,802 | 2.50% |

| TUCSON, AZ (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $3,432 | 2.13% |

| BRUNSWICK, GA (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $0 | 3.21% |

| WEIRTON-STEUBENVILLE, WV-OH (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $3,422 | 2.88% |

| GREENVILLE, NC (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $2,471 | 3.63% |

| FLINT, MI (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $2,288 | 2.38% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,457 | 2.13% |

| Boone, NC (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $3,579 | 3.38% |

| KOKOMO, IN (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,403 | 2.63% |

| London, KY (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,742 | 2.38% |

| WILLIAMSPORT, PA (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $3,297 | 2.88% |

| Mount Sterling, KY (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $2,507 | 3.63% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,112 | 2.38% |

| RICHMOND, VA (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,647 | 2.00% |

| Portsmouth, OH (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $0 | 4.25% |

| Defiance, OH (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $2,403 | 3.99% |

| LAFAYETTE-WEST LAFAYETTE, IN (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $1,749 | 2.38% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $2,703 | 3.38% |

| EVANSVILLE, IN-KY (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $1,994 | 2.75% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $3,060 | 2.38% |

| Russellville, AR (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $1,836 | 2.75% |

Similar Lenders

We use machine learning to identify the top lenders compared against The Park National Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 153

Similarity Rank: 203

Similarity Rank: 264

Similarity Rank: 350

Similarity Rank: 438

Similarity Rank: 520

Similarity Rank: 540

Similarity Rank: 651

Similarity Rank: 660

Similarity Rank: 670

Product Mix

For 2020, The Park National Bank's most frequently originated type of loan was Conventional, with 7,902 originations. Their 2nd most popular type was HELOC, with 1,053 originations.

Loan Reason

For 2020, The Park National Bank's most frequently cited loan purpose was Refi, with 3,663 originations. The 2nd most popular reason was Home Purchase, with 2,403 originations.

Loan Duration/Length

For 2020, The Park National Bank's most frequently cited loan duration was 30 Year, with 4,037 originations. The 2nd most popular length was 15 Year, with 2,194 originations.

Origination Fees/Closing Costs

The Park National Bank's average total fees were $2,874, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 6,504 originations.

Interest Rates

During 2020, The Park National Bank's average interest rate for loans was 3.04%, while their most frequently originated rate bucket for loans was 2.5-3%, with 2,801 originations.

Loan Sizing

2020 saw The Park National Bank place emphasis on $100k-200k loans with 3,487 originations, totaling $502,775,000 in origination value.

Applicant Income

The Park National Bank lent most frequently to those with incomes in the $100k-150k range, with 1,817 originations. The second most popular income band? $50k-75k, with 1,800 originations.

Applicant Debt to Income Ratio

The Park National Bank lent most frequently to those with DTI ratios of 20-30%, with 2,685 originations. The next most common DTI ratio? 30-36%, with 1,690 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications86.10%

The Park National Bank has an average approval rate.

Pick Rate

Approvals leading to origination85.66%

The Park National Bank has an average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| 393.15 | 1 | $45,000 | $45,000 |

| NA | 9,014 | $1,615,230,000 | $179,191 |

Occupancy Type Mix

LTV Distribution

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| The Park National Bank | 1 Monument Square Urbana, OH 43078 | Full Service B&M | $35,722 |

| The Park National Bank | 1 West Main Street New Concord, OH 43762 | Full Service B&M | $57,519 |

| The Park National Bank | 100 Downtowner Plaza Coshocton, OH 43812 | Full Service B&M | $72,154 |

| The Park National Bank | 1000 Sugarbush Dr. Ashland, OH 44805 | Full Service B&M | $33,303 |

| The Park National Bank | 1001 East Main Street Lancaster, OH 43130 | Full Service B&M | $52,093 |

| The Park National Bank | 1001 West Fair Avenue Lancaster, OH 43130 | Full Service B&M | $29,722 |

| The Park National Bank | 1008 East Main Street Newark, OH 43055 | Full Service B&M | $56,383 |

| The Park National Bank | 101 West Main Street Versailles, OH 45380 | Full Service B&M | $69,856 |

| The Park National Bank | 102 South Chillicothe Street South Charleston, OH 45368 | Full Service B&M | $36,973 |

| The Park National Bank | 103 East Main Street Hebron, OH 43025 | Full Service B&M | $91,864 |

| The Park National Bank | 105 North Main Street Prospect, OH 43342 | Full Service B&M | $16,967 |

| The Park National Bank | 105 West Main Street Plain City, OH 43064 | Full Service B&M | $40,359 |

| The Park National Bank | 10515 Anderson Road Easley, SC 29642 | Full Service B&M | $38,687 |

| The Park National Bank | 1075 Nimitzview Drive Cincinnati, OH 45230 | Full Service B&M | $75,725 |

| The Park National Bank | 1111 Metropolitan Avenue Charlotte, NC 28204 | Full Service B&M | $176,715 |

| The Park National Bank | 112 North Bridge Street Perrysville, OH 44864 | Full Service B&M | $9,749 |

| The Park National Bank | 1127 Hendersonville Road Asheville, NC 28803 | Full Service B&M | $99,229 |

| The Park National Bank | 1155 North 21st Street Newark, OH 43055 | Full Service B&M | $14,401 |

| The Park National Bank | 117 Wayne Street Fort Recovery, OH 45846 | Full Service B&M | $93,162 |

| The Park National Bank | 1176 West Main Street Tipp City, OH 45371 | Full Service B&M | $34,433 |

| The Park National Bank | 1187 Ohio Pike Amelia, OH 45102 | Full Service B&M | $61,444 |

| The Park National Bank | 119 East Broadway Granville, OH 43023 | Full Service B&M | $142,809 |

| The Park National Bank | 120 North Water Street Loudonville, OH 44842 | Full Service B&M | $108,023 |

| The Park National Bank | 1201 Brandywine Blvd Zanesville, OH 43701 | Full Service B&M | $81,625 |

| The Park National Bank | 124 Trade Court, Suite A Mooresville, NC 28117 | Full Service B&M | $19,502 |

| The Park National Bank | 1274 Hill Road Pickerington, OH 43147 | Full Service Retail | $24,641 |

| The Park National Bank | 1280 North Memorial Drive Lancaster, OH 43130 | Full Service B&M | $48,901 |

| The Park National Bank | 129 Barks Rd Marion, OH 43302 | Full Service B&M | $50,654 |

| The Park National Bank | 130 West Main Street Medway, OH 45341 | Full Service B&M | $25,385 |

| The Park National Bank | 1301 West Market Street Baltimore, OH 43105 | Full Service B&M | $63,532 |

| The Park National Bank | 1302 Wagner Avenue Greenville, OH 45331 | Full Service B&M | $28,518 |

| The Park National Bank | 1314 W Main Street Troy, OH 45373 | Full Service B&M | $51,796 |

| The Park National Bank | 1365 Stoneridge Drive Gahanna, OH 43230 | Full Service Retail | $7,063 |

| The Park National Bank | 137 North Main Street Fredericktown, OH 43019 | Full Service B&M | $77,948 |

| The Park National Bank | 14 South Fifth Street Zanesville, OH 43701 | Full Service B&M | $222,123 |

| The Park National Bank | 140 East Marion Street Caledonia, OH 43314 | Full Service B&M | $17,416 |

| The Park National Bank | 143 West Main Street Lancaster, OH 43130 | Full Service B&M | $315,842 |

| The Park National Bank | 1495 Granville Road Newark, OH 43055 | Full Service B&M | $39,293 |

| The Park National Bank | 1500 Lexington Avenue Mansfield, OH 44907 | Full Service Retail | $11,408 |

| The Park National Bank | 154 Main Street Bellville, OH 44813 | Full Service B&M | $41,108 |

| The Park National Bank | 155 Mansfield Avenue Shelby, OH 44875 | Full Service B&M | $51,952 |

| The Park National Bank | 1600 Moorefield Road Springfield, OH 45503 | Full Service B&M | $33,522 |

| The Park National Bank | 1603 Covington Ave Piqua, OH 45356 | Full Service B&M | $30,626 |

| The Park National Bank | 161 East Main Street Xenia, OH 45385 | Full Service B&M | $99,404 |

| The Park National Bank | 1633 West Main Street Newark, OH 43055 | Full Service B&M | $87,398 |

| The Park National Bank | 17 West High Street Mount Gilead, OH 43338 | Full Service B&M | $96,294 |

| The Park National Bank | 1705 East Pike Zanesville, OH 43701 | Full Service B&M | $71,954 |

| The Park National Bank | 175 East Third Street Greenville, OH 45331 | Full Service B&M | $7,490 |

| The Park National Bank | 220 East State St. Newcomerstown, OH 43832 | Full Service B&M | $22,431 |

| The Park National Bank | 1756 North Limestone Street Springfield, OH 45503 | Full Service B&M | $43,517 |

| The Park National Bank | 1988 Baltimore Reynsburg Road Reynoldsburg, OH 43068 | Full Service B&M | $11,372 |

| The Park National Bank | 2 South Main Street Mechanicsburg, OH 43044 | Full Service B&M | $41,582 |

| The Park National Bank | 200 Civic Center Dr, Suite 700 Columbus, OH 43215 | Full Service B&M | $187,638 |

| The Park National Bank | 200 South Church Street Spartanburg, SC 29306 | Full Service B&M | $325,554 |

| The Park National Bank | 201 North Main Street New Carlisle, OH 45344 | Full Service B&M | $80,572 |

| The Park National Bank | 2035 South Dayton Lakeview Road New Carlisle, OH 45344 | Full Service B&M | $26,730 |

| The Park National Bank | 206 N. Main Street New Lexington, OH 43764 | Full Service B&M | $50,812 |

| The Park National Bank | 2127 Maysville Ave Zanesville, OH 43701 | Full Service B&M | $43,776 |

| The Park National Bank | 2148 G Eagle Pass Wooster, OH 44691 | Full Service B&M | $4,831 |

| The Park National Bank | 215 North Wayne Street Piqua, OH 45356 | Full Service B&M | $120,890 |

| The Park National Bank | 218 North Main Street Hendersonville, NC 28792 | Full Service B&M | $37,253 |

| The Park National Bank | 225 North Clay Street Millersburg, OH 44654 | Full Service B&M | $53,964 |

| The Park National Bank | 229 North 3rd Street Coshocton, OH 43812 | Full Service B&M | $15,925 |

| The Park National Bank | 245 North Seltzer Street Crestline, OH 44827 | Full Service B&M | $41,732 |

| The Park National Bank | 25 Main Street Milford, OH 45150 | Full Service B&M | $24,306 |

| The Park National Bank | 2730 East Main Street Springfield, OH 45503 | Full Service B&M | $41,755 |

| The Park National Bank | 276 East Main Street Lexington, OH 44904 | Full Service B&M | $61,013 |

| The Park National Bank | 2810 Maysville Pike Zanesville, OH 43701 | Full Service B&M | $33,136 |

| The Park National Bank | 2900 Columbus Lancaster, Northwest Lancaster, OH 43130 | Full Service Retail | $18,974 |

| The Park National Bank | 3 North Main Street Mansfield, OH 44902 | Full Service B&M | $252,107 |

| The Park National Bank | 304 North Main Street Anderson, SC 29621 | Full Service B&M | $78,127 |

| The Park National Bank | 325 North Lexington-Springmill Road Ontario, OH 44906 | Full Service B&M | $62,716 |

| The Park National Bank | 33 South Main Street Utica, OH 43080 | Full Service B&M | $59,244 |

| The Park National Bank | 3387 Maple Avenue Zanesville, OH 43701 | Full Service B&M | $17,293 |

| The Park National Bank | 35 West Main Street, Drawer F Centerburg, OH 43011 | Full Service B&M | $64,981 |

| The Park National Bank | 350 East Broad Street Pataskala, OH 43062 | Full Service Retail | $97,330 |

| The Park National Bank | 3680 Marion Drive Enon, OH 45323 | Full Service B&M | $53,022 |

| The Park National Bank | 3825 Edwards Road, Suite 520 Cincinnati, OH 45209 | Full Service B&M | $42,060 |

| The Park National Bank | 4 S Market St Danville, OH 43014 | Full Service B&M | $40,887 |

| The Park National Bank | 40 South Limestone Street Springfield, OH 45502 | Full Service B&M | $224,743 |

| The Park National Bank | 401 South Sandusky Avenue Bucyrus, OH 44820 | Full Service B&M | $105,547 |

| The Park National Bank | 4550 Eastgate Blvd Cincinnati, OH 45245 | Full Service B&M | $58,027 |

| The Park National Bank | 460 West Cook Road Mansfield, OH 44907 | Full Service B&M | $42,147 |

| The Park National Bank | 499 S Broadway Greenville, OH 45331 | Full Service B&M | $157,232 |

| The Park National Bank | 50 Marion Avenue Mansfield, OH 44903 | Full Service B&M | $26,070 |

| The Park National Bank | 50 North Third Street Newark, OH 43055 | Full Service B&M | $834,508 |

| The Park National Bank | 8 Public Square Galion, OH 44833 | Full Service B&M | $48,393 |

| The Park National Bank | 5100 State Route 132 Owensville, OH 45160 | Full Service B&M | $47,069 |

| The Park National Bank | 545 South Third Street Louisville, KY 40202 | Full Service B&M | $13,477 |

| The Park National Bank | 567 Hebron Road Heath, OH 43056 | Full Service B&M | $70,694 |

| The Park National Bank | 60 West Coshocton Street Johnstown, OH 43031 | Full Service B&M | $72,712 |

| The Park National Bank | 603 North Main Street Arcanum, OH 45304 | Full Service B&M | $46,508 |

| The Park National Bank | 61 N. Market Street Logan, OH 43138 | Full Service B&M | $35,662 |

| The Park National Bank | 6195 Gender Road Canal Winchester, OH 43110 | Full Service Retail | $9,941 |

| The Park National Bank | 6501 Calhoun Memorial Highway Easley, SC 29640 | Full Service B&M | $39,577 |

| The Park National Bank | 7140 North High Street Worthington, OH 43085 | Full Service B&M | $38,205 |

| The Park National Bank | 720 Gardner Road Springboro, OH 45066 | Full Service B&M | $20,118 |

| The Park National Bank | 758 Wheeling Avenue Cambridge, OH 43725 | Full Service B&M | $4,681 |

| The Park National Bank | 797 Ashland Road Mansfield, OH 44905 | Full Service B&M | $51,052 |

| The Park National Bank | 8 West Maple Street North Lewisburg, OH 43060 | Full Service B&M | $24,284 |

| The Park National Bank | 800 North Main Street Celina, OH 45822 | Full Service B&M | $27,788 |

| The Park National Bank | 800 South 30th Street Heath, OH 43056 | Full Service B&M | $53,401 |

| The Park National Bank | 810 Coshocton Avenue Mount Vernon, OH 43050 | Full Service B&M | $59,914 |

| The Park National Bank | 82 West Washington Street Jamestown, OH 45335 | Full Service B&M | $66,721 |

| The Park National Bank | 828-830 Scioto Street Urbana, OH 43078 | Full Service B&M | $42,512 |

| The Park National Bank | 8366 Princeton-Glendale Road - Suite A West Chester, OH 45069 | Full Service B&M | $15,362 |

| The Park National Bank | 85 Main Street Butler, OH 44822 | Full Service B&M | $29,873 |

| The Park National Bank | 8641 Blackjack Road Mount Vernon, OH 43050 | Full Service B&M | $22,865 |

| The Park National Bank | 889 North Trimble Road Mansfield, OH 44906 | Full Service B&M | $22,626 |

| The Park National Bank | 898 E. State Street Athens, OH 45701 | Full Service B&M | $31,946 |

| The Park National Bank | 91 West Dave Longaberger Ave Dresden, OH 43821 | Full Service B&M | $52,046 |

| The Park National Bank | 937 North Pleasantburg Drive Greenville, SC 29607 | Full Service B&M | $102,226 |

| The Park National Bank | 990 Military Rd Zanesville, OH 43701 | Full Service B&M | $150,074 |

| The Park National Bank | 990 North 21st Street Newark, OH 43055 | Full Service B&M | $88,074 |

| The Park National Bank | One South Main Street Mount Vernon, OH 43050 | Full Service B&M | $385,806 |

For 2020, The Park National Bank had 115 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $353,364 |

| Net interest income | $326,375 |

| Total noninterest income | $118,516 |

| Gross Fiduciary activities income | $28,873 |

| Service charges on deposit accounts | $8,790 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $80,853 |

| Pre-tax net operating income | $145,140 |

| Securities gains (or losses, -) | $5,715 |

| Income before extraordinary items | $123,730 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $123,730 |

| Minority interest net income | $0 |

| Net income | $123,730 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $119,043 |

The Park National Bank's gross interest income from loans was $353,364,000.

The Park National Bank's net interest income from loans was $326,375,000.

The Park National Bank's fee based income from loans was $8,790,000.

The Park National Bank's net income from loans was $123,730,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $26,989 |

| Provision for credit losses | $30,813 |

| Total noninterest expense | $268,938 |

| Salaries and employee benefits | $158,868 |

| Premises and equipment expense | $32,352 |

| Additional noninterest expense | $77,718 |

| Applicable income taxes | $27,125 |

| Net charge-offs | $1,184 |

| Cash dividends | $75,000 |

The Park National Bank's interest expense for loans was $26,989,000.

The Park National Bank's payroll and benefits expense were $158,868,000.

The Park National Bank's property, plant and equipment expenses $32,352,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 1.0% |

| Real Estate loans | 2.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 3.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 1.0% |

| HELOC loans | 0.0% |

| All other family | 1.0% |

| Commercial & industrial loans | 1.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.0% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $7,820,983 |

| Deposits held in domestic offices | $7,820,983 |

| Deposits by Individuals, partnerships, and corporations | $7,257,379 |

| Deposits by U.S. Government | $0 |

| Deposits by States and political subdivisions in the U.S. | $540,324 |

| Deposits by Commercial banks and other depository institutions in U.S. | $23,280 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $1,037,542 |

| Demand deposits | $1,037,542 |

| Nontransaction accounts | $6,783,441 |

| Money market deposit accounts (MMDAs) | $4,146,807 |

| Other savings deposits (excluding MMDAs) | $1,772,062 |

| Total time deposits | $864,572 |

| Total time and savings deposits | $6,783,441 |

| Noninterest-bearing deposits | $2,978,005 |

| Interest-bearing deposits | $4,842,978 |

| Retail deposits | $7,734,107 |

| IRAs and Keogh plan accounts | $187,432 |

| Brokered deposits | $10,928 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $9,249,291 |

| Cash & Balances due from depository institutions | $370,642 |

| Interest-bearing balances | $215,086 |

| Total securities | $1,077,998 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $7,079,974 |

| Loan and leases loss allowance | $84,321 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $103,369 |

| Other real estate owned | $838 |

| Goodwill and other intangibles | $181,065 |

| All other assets | $435,405 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $9,249,291 |

| Total Liabilities | $8,290,661 |

| Total deposits | $7,820,983 |

| Interest-bearing deposits | $4,842,978 |

| Deposits held in domestic offices | $7,820,983 |

| % insured (estimated) | $78 |

| Federal funds purchased and repurchase agreements | $319,149 |

| Trading liabilities | $0 |

| Other borrowed funds | $25,000 |

| Subordinated debt | $25,000 |

| All other liabilities | $100,529 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $7,079,974 |

| Loan and leases loss allowance | $84,321 |

| Total loans and leases (domestic) | $7,164,295 |

| All real estate loans | $3,903,109 |

| Real estate loans in domestic offices | $3,903,109 |

| Construction and development loans | $343,421 |

| Residential 1-4 family construction | $118,254 |

| Other construction, all land development and other land | $225,167 |

| Loans secured by nonfarm nonresidential properties | $1,614,212 |

| Nonfarm nonresidential secured by owner-occupied properties | $700,854 |

| Commercial real estate & other non-farm, non-residential | $913,358 |

| Multifamily residential real estate | $151,343 |

| 1-4 family residential loans | $1,660,156 |

| Farmland loans | $133,977 |

| Loans held in foreign offices | $0 |

| Farm loans | $56,729 |

| Commercial and industrial loans | $1,095,742 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $1,648,160 |

| Credit card loans | $0 |

| Related Plans | $2,366 |

| Consumer Auto Loans | $1,108,129 |

| Other loans to individuals | $537,665 |

| All other loans & leases | $460,555 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $384,543 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $0 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $15,960 |

| Non 1-4 family restructured loans & leases | $5,498 |

| Total loans and leases (foreign) | $0 |

The Park National Bank had $7,079,974,000 of loans outstanding in 2020. $3,903,109,000 of loans were in real estate loans. $343,421,000 of loans were in development loans. $151,343,000 of loans were in multifamily mortgage loans. $1,660,156,000 of loans were in 1-4 family mortgage loans. $56,729,000 of loans were in farm loans. $0 of loans were in credit card loans. $1,108,129,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 3,189 | $671,574 | $210,591 |

| Nonfarm, nonresidential loans - <$100k | 703 | $25,641 | $36,474 |

| Nonfarm, nonresidential loans - $100-250k | 1,094 | $128,190 | $117,176 |

| Nonfarm, nonresidential loans - $250k-1MM | 1,392 | $517,743 | $371,942 |

| Commercial & Industrial, US addressed loans - <$1MM | 8,967 | $586,869 | $65,448 |

| Commercial & Industrial, US addressed loans - <$100k | 6,542 | $155,579 | $23,782 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,412 | $138,152 | $97,841 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,013 | $293,138 | $289,376 |

| Farmland loans - <$1MM | 467 | $66,762 | $142,959 |

| Farmland loans - <$100k | 142 | $6,769 | $47,669 |

| Farmland loans - $100-250k | 196 | $24,770 | $126,378 |

| Farmland loans - $250k-1MM | 129 | $35,223 | $273,047 |

| Agriculture operations loans - <$1MM | 895 | $42,558 | $47,551 |

| Agriculture operations loans - <$100k | 726 | $17,066 | $23,507 |

| Agriculture operations loans - $100-250k | 113 | $12,105 | $107,124 |

| Agriculture operations loans - $250k-1MM | 56 | $13,387 | $239,054 |