Simmons Bank Mortgage Rates, Fees & Info

Pine Bluff, ARLEI: 549300DPRWSBUY619V27

Tax ID: 71-0162300

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Simmons Bank is a small bank specializing in Home Purchase and Refi loans. Simmons Bank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Little Rock, Dallas, Nashville, Fayetteville, and Jonesboro among others. We have data for 175 markets. (Some data included below & more in-depth data is available with an active subscription.)Simmons Bank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Simmons Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 7.09% | 8/3/25 |

| 30 Year Conventional Purchase | 7.25% | 8/3/25 |

| 30 Year Conventional Refi | 7.35% | 8/3/25 |

| 30 Year Cash-out Refi | 7.16% | 8/3/25 |

| 30 Year FHA Purchase | 7.11% | 8/3/25 |

| 30 Year FHA Refi | 7.42% | 8/3/25 |

| 30 Year VA Purchase | 6.64% | 8/3/25 |

| 30 Year VA Refi | 6.08% | 8/3/25 |

| 30 Year USDA Purchase | 6.88% | 8/3/25 |

| 15 Year Conventional Purchase | 7.11% | 8/3/25 |

| 15 Year Conventional Refi | 9.03% | 8/3/25 |

| 15 Year Cash-out Refi | 9.03% | 8/3/25 |

| 15 Year FHA Purchase | 6.00% | 8/3/25 |

| 15 Year VA Refi | 6.00% | 8/3/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

Simmons Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from Simmons Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

6,318Origination Dollar Volume (All Markets)

$1,647,260,000Employee count

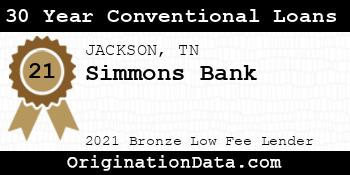

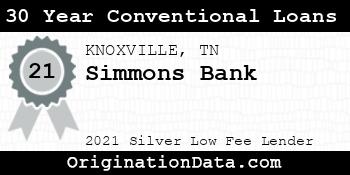

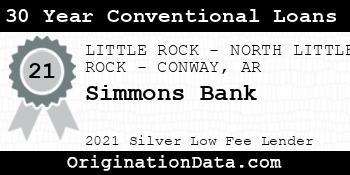

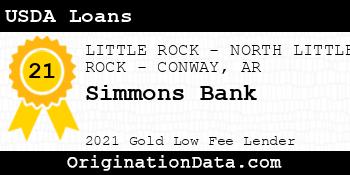

2,857 Show all (30) awardsSimmons Bank - 2021

Simmons Bank is a 2021 , due to their low .

For 2021, less than of lenders were eligible for this award.

Work for Simmons Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR (FHA|USDA|VA) | 952 | $233,920,000 | $245,714 | $3,146 | 3.25% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 359 | $198,415,000 | $552,688 | $4,287 | 3.00% |

| Outside of Metro Areas | 638 | $91,590,000 | $143,558 | $2,951 | 3.70% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 296 | $86,280,000 | $291,486 | $4,060 | 3.56% |

| FAYETTEVILLE-SPRINGDALE-ROGERS, AR (FHA|USDA|VA) | 266 | $83,170,000 | $312,669 | $3,048 | 3.36% |

| JONESBORO, AR (FHA|USDA|VA) | 307 | $63,805,000 | $207,834 | $3,517 | 3.47% |

| JACKSON, TN (FHA|USDA|VA) | 309 | $62,115,000 | $201,019 | $3,394 | 3.26% |

| COLUMBIA, MO (FHA|USDA|VA) | 274 | $61,910,000 | $225,949 | $1,951 | 3.46% |

| OKLAHOMA CITY, OK (FHA|USDA|VA) | 177 | $54,995,000 | $310,706 | $3,586 | 3.34% |

| INDIANAPOLIS-CARMEL-ANDERSON, IN (FHA|USDA|VA) | 2 | $54,560,000 | $27,280,000 | $0 | 3.00% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 32 | $50,280,000 | $1,571,250 | $5,747 | 3.24% |

| WICHITA, KS (FHA|USDA|VA) | 78 | $49,900,000 | $639,744 | $2,757 | 3.16% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 164 | $46,490,000 | $283,476 | $4,226 | 3.40% |

| Stillwater, OK (FHA|USDA|VA) | 200 | $42,620,000 | $213,100 | $3,546 | 3.14% |

| Searcy, AR (FHA|USDA|VA) | 189 | $33,825,000 | $178,968 | $3,257 | 3.18% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 186 | $33,340,000 | $179,247 | $3,324 | 3.46% |

| HOT SPRINGS, AR (FHA|USDA|VA) | 162 | $32,340,000 | $199,630 | $2,854 | 3.24% |

| AUBURN-OPELIKA, AL (FHA|USDA|VA) | 1 | $29,505,000 | $29,505,000 | $0 | 2.75% |

| SPRINGFIELD, MO (FHA|USDA|VA) | 133 | $23,065,000 | $173,421 | $2,553 | 3.50% |

| PINE BLUFF, AR (FHA|USDA|VA) | 149 | $19,675,000 | $132,047 | $3,309 | 3.48% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 2 | $19,050,000 | $9,525,000 | $1,338 | 4.00% |

| Martin, TN (FHA|USDA|VA) | 141 | $16,985,000 | $120,461 | $2,763 | 3.49% |

| JOPLIN, MO (FHA|USDA|VA) | 27 | $16,585,000 | $614,259 | $2,697 | 3.66% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 51 | $15,095,000 | $295,980 | $2,471 | 3.52% |

| KNOXVILLE, TN (FHA|USDA|VA) | 65 | $14,335,000 | $220,538 | $3,384 | 3.29% |

| Branson, MO (FHA|USDA|VA) | 100 | $14,280,000 | $142,800 | $2,498 | 4.26% |

| Russellville, AR (FHA|USDA|VA) | 95 | $14,055,000 | $147,947 | $2,402 | 3.67% |

| FORT SMITH, AR-OK (FHA|USDA|VA) | 78 | $12,670,000 | $162,436 | $3,151 | 3.30% |

| West Plains, MO (FHA|USDA|VA) | 78 | $11,290,000 | $144,744 | $2,614 | 3.27% |

| Dyersburg, TN (FHA|USDA|VA) | 84 | $10,870,000 | $129,405 | $2,772 | 3.37% |

| TULSA, OK (FHA|USDA|VA) | 48 | $10,360,000 | $215,833 | $3,513 | 3.15% |

| SHERMAN-DENISON, TX (FHA|USDA|VA) | 38 | $8,950,000 | $235,526 | $4,565 | 3.53% |

| Union City, TN (FHA|USDA|VA) | 83 | $8,375,000 | $100,904 | $2,613 | 3.66% |

| Paragould, AR (FHA|USDA|VA) | 46 | $7,640,000 | $166,087 | $2,710 | 3.54% |

| Sedalia, MO (FHA|USDA|VA) | 44 | $6,730,000 | $152,955 | $2,147 | 3.37% |

| AUSTIN-ROUND ROCK-GEORGETOWN, TX (FHA|USDA|VA) | 17 | $6,715,000 | $395,000 | $4,149 | 2.94% |

| Athens, TN (FHA|USDA|VA) | 49 | $6,525,000 | $133,163 | $3,241 | 3.62% |

| El Dorado, AR (FHA|USDA|VA) | 42 | $5,510,000 | $131,190 | $2,365 | 4.15% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 9 | $3,995,000 | $443,889 | $2,739 | 2.75% |

| Boston-Cambridge-Newton, MA-NH (FHA|USDA|VA) | 7 | $3,125,000 | $446,429 | $4,366 | 2.59% |

| Breckenridge, CO (FHA|USDA|VA) | 1 | $2,905,000 | $2,905,000 | $5,802 | 3.75% |

| Batesville, AR (FHA|USDA|VA) | 18 | $2,730,000 | $151,667 | $2,368 | 3.54% |

| Mountain Home, AR (FHA|USDA|VA) | 12 | $2,690,000 | $224,167 | $3,041 | 3.38% |

| LAS VEGAS-HENDERSON-PARADISE, NV (FHA|USDA|VA) | 5 | $2,365,000 | $473,000 | $3,678 | 2.98% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 6 | $2,280,000 | $380,000 | $4,814 | 2.81% |

| Gainesville, TX (FHA|USDA|VA) | 13 | $2,245,000 | $172,692 | $3,632 | 3.29% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 7 | $2,195,000 | $313,571 | $2,814 | 2.96% |

| Durant, OK (FHA|USDA|VA) | 12 | $2,180,000 | $181,667 | $3,268 | 4.31% |

| Frankfort, KY (FHA|USDA|VA) | 1 | $2,165,000 | $2,165,000 | $0 | 2.99% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 4 | $1,770,000 | $442,500 | $3,160 | 3.22% |

| Brownsville, TN (FHA|USDA|VA) | 12 | $1,750,000 | $145,833 | $2,925 | 4.06% |

| JEFFERSON CITY, MO (FHA|USDA|VA) | 11 | $1,585,000 | $144,091 | $1,981 | 3.62% |

| ASHEVILLE, NC (FHA|USDA|VA) | 4 | $1,550,000 | $387,500 | $2,888 | 3.13% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 5 | $1,515,000 | $303,000 | $4,788 | 3.33% |

| Athens, TX (FHA|USDA|VA) | 4 | $1,430,000 | $357,500 | $4,466 | 3.00% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 4 | $1,380,000 | $345,000 | $3,047 | 3.19% |

| BATON ROUGE, LA (FHA|USDA|VA) | 4 | $1,380,000 | $345,000 | $3,470 | 3.09% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 3 | $1,295,000 | $431,667 | $4,046 | 2.58% |

| Ada, OK (FHA|USDA|VA) | 9 | $1,205,000 | $133,889 | $2,478 | 4.46% |

| Sevierville, TN (FHA|USDA|VA) | 3 | $1,115,000 | $371,667 | $4,245 | 2.75% |

| KINGSPORT-BRISTOL, TN-VA (FHA|USDA|VA) | 2 | $1,110,000 | $555,000 | $3,521 | 3.44% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 6 | $1,070,000 | $178,333 | $3,067 | 2.65% |

| MIDLAND, TX (FHA|USDA|VA) | 3 | $1,055,000 | $351,667 | $3,258 | 2.83% |

| Corsicana, TX (FHA|USDA|VA) | 2 | $1,030,000 | $515,000 | $6,067 | 3.25% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 3 | $1,025,000 | $341,667 | $2,678 | 2.92% |

| CORPUS CHRISTI, TX (FHA|USDA|VA) | 3 | $1,005,000 | $335,000 | $4,804 | 3.21% |

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 2 | $990,000 | $495,000 | $5,051 | 3.44% |

| OLYMPIA-LACEY-TUMWATER, WA (FHA|USDA|VA) | 1 | $975,000 | $975,000 | $5,049 | 3.25% |

| McPherson, KS (FHA|USDA|VA) | 3 | $825,000 | $275,000 | $3,929 | 2.88% |

| Camden, AR (FHA|USDA|VA) | 5 | $825,000 | $165,000 | $3,338 | 3.05% |

| Arkadelphia, AR (FHA|USDA|VA) | 5 | $815,000 | $163,000 | $2,719 | 3.18% |

| MORRISTOWN, TN (FHA|USDA|VA) | 3 | $805,000 | $268,333 | $2,584 | 3.38% |

| Blytheville, AR (FHA|USDA|VA) | 8 | $800,000 | $100,000 | $3,878 | 3.81% |

| Bonham, TX (FHA|USDA|VA) | 4 | $760,000 | $190,000 | $3,812 | 2.97% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 3 | $745,000 | $248,333 | $3,108 | 3.35% |

| Malvern, AR (FHA|USDA|VA) | 4 | $700,000 | $175,000 | $3,572 | 3.62% |

| PROVO-OREM, UT (FHA|USDA|VA) | 2 | $620,000 | $310,000 | $2,357 | 2.44% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 1 | $605,000 | $605,000 | $6,148 | 3.38% |

| Greenville, MS (FHA|USDA|VA) | 2 | $590,000 | $295,000 | $5,842 | 4.13% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 2 | $570,000 | $285,000 | $3,225 | 2.81% |

| Ardmore, OK (FHA|USDA|VA) | 5 | $565,000 | $113,000 | $3,366 | 3.42% |

| BOWLING GREEN, KY (FHA|USDA|VA) | 2 | $560,000 | $280,000 | $2,892 | 3.19% |

| GRAND RAPIDS-KENTWOOD, MI (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $3,911 | 2.88% |

| COLORADO SPRINGS, CO (FHA|USDA|VA) | 1 | $545,000 | $545,000 | $1,986 | 2.25% |

| MOBILE, AL (FHA|USDA|VA) | 1 | $535,000 | $535,000 | $6,229 | 4.75% |

| Tullahoma-Manchester, TN (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $3,511 | 3.08% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 2 | $510,000 | $255,000 | $5,194 | 3.31% |

| Lebanon, MO (FHA|USDA|VA) | 3 | $505,000 | $168,333 | $3,234 | 3.29% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 1 | $505,000 | $505,000 | $2,754 | 2.63% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 2 | $490,000 | $245,000 | $3,774 | 3.53% |

| Lewisburg, TN (FHA|USDA|VA) | 3 | $485,000 | $161,667 | $2,291 | 4.17% |

| Kirksville, MO (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $0 | 4.40% |

| Miami, OK (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $4,950 | 4.50% |

| DAYTON-KETTERING, OH (FHA|USDA|VA) | 1 | $465,000 | $465,000 | $3,443 | 2.38% |

| CHARLOTTESVILLE, VA (FHA|USDA|VA) | 1 | $465,000 | $465,000 | $4,838 | 2.75% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 1 | $455,000 | $455,000 | $3,980 | 2.88% |

| Hutchinson, KS (FHA|USDA|VA) | 7 | $455,000 | $65,000 | $1,627 | 3.88% |

| ALEXANDRIA, LA (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $4,162 | 4.13% |

| Granbury, TX (FHA|USDA|VA) | 4 | $420,000 | $105,000 | $0 | 5.25% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 1 | $405,000 | $405,000 | $4,899 | 2.88% |

| Tahlequah, OK (FHA|USDA|VA) | 3 | $405,000 | $135,000 | $3,057 | 4.52% |

| Oxford, MS (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $3,027 | 3.95% |

| Lawrenceburg, TN (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $4,009 | 2.81% |

| LONGVIEW, TX (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $3,602 | 2.88% |

| ANN ARBOR, MI (FHA|USDA|VA) | 1 | $395,000 | $395,000 | $2,196 | 2.88% |

| JACKSON, MS (FHA|USDA|VA) | 1 | $395,000 | $395,000 | $3,993 | 3.75% |

| LAFAYETTE, LA (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $5,277 | 4.25% |

| SANTA FE, NM (FHA|USDA|VA) | 1 | $365,000 | $365,000 | $4,522 | 2.50% |

| Paducah, KY-IL (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $4,536 | 3.00% |

| LUBBOCK, TX (FHA|USDA|VA) | 3 | $355,000 | $118,333 | $3,056 | 3.33% |

| MINNEAPOLIS-ST. PAUL-BLOOMINGTON, MN-WI (FHA|USDA|VA) | 1 | $355,000 | $355,000 | $2,636 | 2.88% |

| OGDEN-CLEARFIELD, UT (FHA|USDA|VA) | 1 | $345,000 | $345,000 | $2,848 | 2.75% |

| Ponca City, OK (FHA|USDA|VA) | 3 | $345,000 | $115,000 | $0 | 4.33% |

| LAS CRUCES, NM (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $2,140 | 2.50% |

| DULUTH, MN-WI (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $3,334 | 2.38% |

| Farmington, MO (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $2,966 | 3.38% |

| ST. GEORGE, UT (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $2,221 | 2.75% |

| TYLER, TX (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $3,808 | 2.75% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $4,553 | 3.63% |

| TUSCALOOSA, AL (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $0 | 4.00% |

| SEBRING-AVON PARK, FL (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $4,114 | 2.50% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $2,638 | 3.19% |

| Paris, TX (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $2,421 | 2.75% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $3,185 | 3.00% |

| BALTIMORE-COLUMBIA-TOWSON, MD (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $8,906 | 3.25% |

| FORT COLLINS, CO (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,085 | 3.38% |

| FLINT, MI (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,919 | 2.88% |

| APPLETON, WI (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,521 | 2.25% |

| MORGANTOWN, WV (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,453 | 2.00% |

| Warrensburg, MO (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,384 | 4.50% |

| Ruidoso, NM (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $2,391 | 2.63% |

| LAWTON, OK (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $3,584 | 2.69% |

| Hope, AR (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $0 | 4.80% |

| Hannibal, MO (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,752 | 4.50% |

| Cookeville, TN (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $3,265 | 3.00% |

| WORCESTER, MA-CT (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,018 | 2.88% |

| COLLEGE STATION-BRYAN, TX (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $4,365 | 2.50% |

| Harrison, AR (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $6,334 | 3.13% |

| MUNCIE, IN (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $2,688 | 2.50% |

| RICHMOND, VA (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $4,465 | 2.75% |

| Greeneville, TN (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $2,249 | 2.88% |

| Willmar, MN (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $2,750 | 3.88% |

| Selma, AL (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,913 | 3.13% |

| ELKHART-GOSHEN, IN (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $3,302 | 2.88% |

| Jasper, AL (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $3,065 | 2.38% |

| Muskogee, OK (FHA|USDA|VA) | 6 | $210,000 | $35,000 | $2,443 | 4.28% |

| Dodge City, KS (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $0 | 3.39% |

| LAKELAND-WINTER HAVEN, FL (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $4,888 | 3.88% |

| Bennington, VT (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $4,329 | 3.13% |

| Helena-West Helena, AR (FHA|USDA|VA) | 2 | $200,000 | $100,000 | $2,258 | 2.56% |

| EL PASO, TX (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $3,562 | 2.88% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $2,016 | 3.00% |

| MONROE, LA (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $6,586 | 3.00% |

| Paris, TN (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $2,904 | 2.88% |

| VIRGINIA BEACH-NORFOLK-NEWPORT NEWS, VA-NC (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $2,011 | 3.13% |

| TOPEKA, KS (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $2,831 | 3.50% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,600 | 2.38% |

| TEXARKANA, TX-AR (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $0 | 4.45% |

| Mexico, MO (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,023 | 2.88% |

| Dayton, TN (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $5,213 | 2.75% |

| CLEVELAND, TN (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $3,739 | 2.75% |

| Murray, KY (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $2,071 | 3.00% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $2,470 | 3.00% |

| Clovis, NM (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $5,035 | 2.88% |

| McAlester, OK (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $3,445 | 4.13% |

| ST. JOSEPH, MO-KS (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $0 | 4.65% |

| Madisonville, KY (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,692 | 3.00% |

| MANHATTAN, KS (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,225 | 3.25% |

| WICHITA FALLS, TX (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $3,065 | 3.00% |

| Mayfield, KY (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $2,490 | 2.38% |

| Safford, AZ (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $2,313 | 2.25% |

| Indianola, MS (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $2,456 | 3.00% |

| ENID, OK (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $0 | 5.00% |

| Rolla, MO (FHA|USDA|VA) | 2 | $60,000 | $30,000 | $1,545 | 6.72% |

| Parsons, KS (FHA|USDA|VA) | 1 | $15,000 | $15,000 | $0 | 5.25% |

Similar Lenders

We use machine learning to identify the top lenders compared against Simmons Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 136

Similarity Rank: 140

Similarity Rank: 208

Similarity Rank: 220

Similarity Rank: 224

Similarity Rank: 240

Similarity Rank: 264

Similarity Rank: 304

Similarity Rank: 328

Similarity Rank: 336

Product Mix

For 2021, Simmons Bank's most frequently originated type of loan was Conventional, with 4,975 originations. Their 2nd most popular type was HELOC, with 695 originations.

Loan Reason

For 2021, Simmons Bank's most frequently cited loan purpose was Home Purchase, with 3,166 originations. The 2nd most popular reason was Refi, with 1,839 originations.

Loan Duration/Length

For 2021, Simmons Bank's most frequently cited loan duration was 30 Year, with 3,758 originations. The 2nd most popular length was 15 Year, with 856 originations.

Origination Fees/Closing Costs

Simmons Bank's average total fees were $3,489, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 3,661 originations.

Interest Rates

During 2021, Simmons Bank's average interest rate for loans was 3.10%, while their most frequently originated rate bucket for loans was 2.5-3%, with 2,216 originations.

Loan Sizing

2021 saw Simmons Bank place emphasis on $100k-200k loans with 2,303 originations, totaling $338,155,000 in origination value.

Applicant Income

Simmons Bank lent most frequently to those with incomes in the $50k or less range, with 1,281 originations. The second most popular income band? $50k-75k, with 1,206 originations.

Applicant Debt to Income Ratio

Simmons Bank lent most frequently to those with DTI ratios of 20-30%, with 1,413 originations. The next most common DTI ratio? 30-36%, with 1,056 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications87.95%

Simmons Bank has an average approval rate.

Pick Rate

Approvals leading to origination74.93%

Simmons Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 6,318 | $1,647,260,000 | $260,725 |

Occupancy Type Mix

| Dwelling Type | Originations | Total Value | Average Loan |

|---|---|---|---|

| 6,318 | $1,647,260,000 | $260,725 |

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2021 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| SIMMONS FIRST NATIONAL CORPORATION | Conventional home mortgage | Closing on a mortgage | 1 | 20.0% |

| SIMMONS FIRST NATIONAL CORPORATION | Conventional home mortgage | Trouble during payment process | 2 | 40.0% |

| SIMMONS FIRST NATIONAL CORPORATION | Other type of mortgage | Applying for a mortgage or refinancing an existing mortgage | 2 | 40.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Simmons Bank | 108 East Speedway Dermott, AR 71638 | Full Service B&M | $22,097 |

| Simmons Bank | 100 East 30th Hutchinson, KS 67502 | Full Service B&M | $69,317 |

| Simmons Bank | 100 East Reelfoot Avenue Union City, TN 38261 | Full Service B&M | $136,992 |

| Simmons Bank | 100 N Hester Street Suite 056 Stillwater, OK 74078 | Full Service B&M | $82,936 |

| Simmons Bank | 100 Werner Street Hot Springs, AR 71913 | Full Service B&M | $85,297 |

| Simmons Bank | 100 West Commercial Street Ozark, AR 72949 | Full Service B&M | $39,664 |

| Simmons Bank | 100 West Grove Street El Dorado, AR 71730 | Full Service B&M | $162,189 |

| Simmons Bank | 1000 South Highway Drive Fenton, MO 63026 | Full Service B&M | $85,484 |

| Simmons Bank | 1001 Howdershell Road Florissant, MO 63031 | Full Service B&M | $78,975 |

| Simmons Bank | 1002 South Mt. Olive Siloam Springs, AR 72761 | Full Service B&M | $16,780 |

| Simmons Bank | 101 S Church Street Dresden, TN 38225 | Full Service B&M | $99,103 |

| Simmons Bank | 10111 West 21st St. North Wichita, KS 67205 | Full Service B&M | $27,690 |

| Simmons Bank | 10300 N. Rodney Parham Rd Little Rock, AR 72227 | Full Service B&M | $82,742 |

| Simmons Bank | 10301 Clayton Road Frontenac, MO 63131 | Full Service Retail | $135,662 |

| Simmons Bank | 10425 Stagecoach Road Little Rock, AR 72210 | Full Service B&M | $60,371 |

| Simmons Bank | 105 West 6th Street Mountain View, MO 65548 | Full Service B&M | $84,353 |

| Simmons Bank | 106 University Street Martin, TN 38237 | Full Service B&M | $149,469 |

| Simmons Bank | 107 North Poplar Street Kenton, TN 38233 | Full Service B&M | $45,623 |

| Simmons Bank | 109 East Nifong Boulevard Columbia, MO 65203 | Full Service B&M | $147,867 |

| Simmons Bank | 1100 Rogers Street Clarksville, AR 72830 | Full Service B&M | $54,782 |

| Simmons Bank | 111 North 8th Street Rogers, AR 72756 | Full Service B&M | $48,401 |

| Simmons Bank | 111 West Main Street Tishomingo, OK 73460 | Full Service B&M | $78,151 |

| Simmons Bank | 1112 East California Street Gainesville, TX 76240 | Full Service B&M | $66,719 |

| Simmons Bank | 11300 Highway 51 South Atoka, TN 38004 | Full Service B&M | $68,976 |

| Simmons Bank | 1135 Nashville Pike Gallatin, TN 37066 | Full Service B&M | $300,575 |

| Simmons Bank | 115 West Washington Avenue Union City, TN 38261 | Limited, Administrative | $0 |

| Simmons Bank | 11525 Financial Center Parkway Little Rock, AR 72211 | Full Service B&M | $100,916 |

| Simmons Bank | 117 Boyer Avenue Lincoln, AR 72744 | Full Service B&M | $64,669 |

| Simmons Bank | 117 Raymond Hirsch Pkwy White House, TN 37188 | Full Service B&M | $71,897 |

| Simmons Bank | 11781 Manchester Road Des Peres, MO 63131 | Full Service B&M | $60,585 |

| Simmons Bank | 11811 Custard Rd Frisco, TX 75035 | Full Service B&M | $80,302 |

| Simmons Bank | 1203 Murfreesboro Road, #549 Franklin, TN 37064 | Full Service B&M | $31,030 |

| Simmons Bank | 12121 East 21st Street North Wichita, KS 67206 | Full Service B&M | $47,028 |

| Simmons Bank | 1215 Highway 411 Vonore, TN 37885 | Full Service B&M | $43,504 |

| Simmons Bank | 1222 Demonbreun Street, Suite 105 Nashville, TN 37203 | Full Service B&M | $87,646 |

| Simmons Bank | 125 North Poplar Searcy, AR 72143 | Full Service B&M | $19,109 |

| Simmons Bank | 128 Plaza Madill, OK 73446 | Full Service B&M | $84,063 |

| Simmons Bank | 1300 East Main Street Davis, OK 73030 | Full Service B&M | $51,451 |

| Simmons Bank | 1323 Military Benton, AR 72015 | Full Service B&M | $79,355 |

| Simmons Bank | 1350 Spur Drive Suite 270 Marshfield, MO 65706 | Full Service B&M | $41,509 |

| Simmons Bank | 14 Public Square Stockton, MO 65785 | Full Service B&M | $81,006 |

| Simmons Bank | 1401 W. Highway J. Ozark, MO 65721 | Full Service B&M | $53,465 |

| Simmons Bank | 1406 South Highway 32 El Dorado Springs, MO 64744 | Full Service B&M | $38,468 |

| Simmons Bank | 1411 South Walton Boulevard Bentonville, AR 72712 | Full Service B&M | $41,607 |

| Simmons Bank | 1414 East Primrose Springfield, MO 65804 | Full Service B&M | $65,408 |

| Simmons Bank | 142 East Main Street Sharon, TN 38255 | Full Service B&M | $54,551 |

| Simmons Bank | 1431 Albert Pike Hot Springs, AR 71913 | Full Service B&M | $97,307 |

| Simmons Bank | 1458 South Sam Houston Boulevard Houston, MO 65483 | Full Service B&M | $106,060 |

| Simmons Bank | 1500 South Utica Avenue Tulsa, OK 74104 | Full Service B&M | $220,745 |

| Simmons Bank | 1519 East Main Street Brownsville, TN 38012 | Limited, Drive-thru | $0 |

| Simmons Bank | 1540 State Highway 248 Branson, MO 65616 | Full Service B&M | $54,653 |

| Simmons Bank | 15670 W. 135th Olathe, KS 66062 | Full Service B&M | $68,178 |

| Simmons Bank | 1601 South Kelly Avenue Edmond, OK 73013 | Full Service B&M | $176,546 |

| Simmons Bank | 1603 Lbj Freeway Farmers Branch, TX 75234 | Full Service B&M | $130,079 |

| Simmons Bank | 1612 South Congress Parkway Athens, TN 37303 | Full Service B&M | $147,910 |

| Simmons Bank | 1616 East Arlington Street Ada, OK 74820 | Full Service B&M | $525,125 |

| Simmons Bank | 165 Main Street Mammoth Spring, AR 72554 | Full Service B&M | $38,798 |

| Simmons Bank | 16600 Chenal Parkway Little Rock, AR 72211 | Full Service B&M | $163,128 |

| Simmons Bank | 1701 N Us Hwy 287 Mansfield, TX 76063 | Full Service B&M | $70,798 |

| Simmons Bank | 1704 North University Drive Pine Bluff, AR 71601 | Full Service B&M | $53,738 |

| Simmons Bank | 1720 South Caraway Road Jonesboro, AR 72401 | Full Service B&M | $174,623 |

| Simmons Bank | 17263 Wildhorse Creek Road Chesterfield, MO 63005 | Full Service B&M | $75,034 |

| Simmons Bank | 1783 Highway 65 South Clinton, AR 72031 | Full Service B&M | $59,618 |

| Simmons Bank | 1800 Se Blue Parkway Lees Summit, MO 64063 | Full Service B&M | $129,687 |

| Simmons Bank | 1802 East State Route K West Plains, MO 65775 | Full Service B&M | $57,546 |

| Simmons Bank | 1809 East Harding Avenue Pine Bluff, AR 71601 | Full Service B&M | $98,470 |

| Simmons Bank | 1862 Highway 45 Bypass Jackson, TN 38305 | Full Service B&M | $69,905 |

| Simmons Bank | 1900 South Scott Boulevard Columbia, MO 65203 | Full Service B&M | $112,118 |

| Simmons Bank | 1904 E Broadway Columbia, MO 65201 | Limited, Drive-thru | $0 |

| Simmons Bank | 1918 South Sangre Road Stillwater, OK 74074 | Full Service B&M | $155,945 |

| Simmons Bank | 1955 South Highland Avenue Jackson, TN 38301 | Full Service B&M | $33,807 |

| Simmons Bank | 200 North Stadium Columbia, MO 65201 | Full Service B&M | $104,798 |

| Simmons Bank | 201 Carnahan Drive Maumelle, AR 72113 | Full Service B&M | $77,333 |

| Simmons Bank | 201 South Dean A. Mcgee Avenue Wynnewood, OK 73098 | Full Service B&M | $41,585 |

| Simmons Bank | 202 North Kentucky Street Kingston, TN 37763 | Full Service B&M | $60,205 |

| Simmons Bank | 202 Ritter Street Weiner, AR 72479 | Full Service B&M | $41,168 |

| Simmons Bank | 202 South Rockwood Drive Cabot, AR 72023 | Full Service B&M | $49,940 |

| Simmons Bank | 203 Pirate Lane Crane, MO 65633 | Full Service B&M | $48,705 |

| Simmons Bank | 205 Linwood Drive Paragould, AR 72450 | Full Service B&M | $51,835 |

| Simmons Bank | 205 North Main Avenue Dyersburg, TN 38024 | Full Service B&M | $84,022 |

| Simmons Bank | 205 Sylamore Avenue Mountain View, AR 72560 | Full Service B&M | $33,649 |

| Simmons Bank | 2050 Hall Johnson Road Grapevine, TX 76051 | Full Service B&M | $86,669 |

| Simmons Bank | 20622 Arch Street, Suite 5 Hensley, AR 72065 | Full Service B&M | $87,035 |

| Simmons Bank | 208 East Taliaferro Street Madill, OK 73446 | Limited, Drive-thru | $0 |

| Simmons Bank | 208 South White Street Athens, TN 37303 | Full Service B&M | $113,891 |

| Simmons Bank | 210 N West Bypass Avenue Springfield, MO 65802 | Full Service B&M | $70,033 |

| Simmons Bank | 21159 Main Street Reeds Spring, MO 65737 | Full Service B&M | $62,173 |

| Simmons Bank | 2200 W 7th Ste 112 Fort Worth, TX 76107 | Full Service B&M | $146,813 |

| Simmons Bank | 2201 Midtown Lane Fort Worth, TX 76104 | Full Service B&M | $122,723 |

| Simmons Bank | 2305 Zero Street Fort Smith, AR 72906 | Full Service B&M | $76,283 |

| Simmons Bank | 2310 Parr Avenue Dyersburg, TN 38024 | Full Service B&M | $66,882 |

| Simmons Bank | 2311 West 7th Street Joplin, MO 64801 | Full Service B&M | $11,866 |

| Simmons Bank | 2350 Malvern Avenue Hot Springs, AR 71901 | Full Service B&M | $75,106 |

| Simmons Bank | 2350 South Range Line Road Joplin, MO 64804 | Full Service B&M | $128,176 |

| Simmons Bank | 2401 Crestwood Road North Little Rock, AR 72116 | Full Service B&M | $113,990 |

| Simmons Bank | 2455 Highway K O Fallon, MO 63368 | Full Service B&M | $58,125 |

| Simmons Bank | 2523 North Classen Blvd. Oklahoma City, OK 73106 | Full Service B&M | $63,180 |

| Simmons Bank | 2525 N. Commerce Street Ardmore, OK 73401 | Full Service B&M | $109,855 |

| Simmons Bank | 2601 South Hulen Street Fort Worth, TX 76109 | Full Service B&M | $120,620 |

| Simmons Bank | 2611 University Boulevard Durant, OK 74701 | Full Service B&M | $32,055 |

| Simmons Bank | 2628 North Central Avenue Humboldt, TN 38343 | Full Service B&M | $130,487 |

| Simmons Bank | 2628 West 28th Avenue Pine Bluff, AR 71603 | Full Service B&M | $87,447 |

| Simmons Bank | 2675 Westglen Farms Dr Wildwood, MO 63011 | Full Service B&M | $12,596 |

| Simmons Bank | 2711 Olive Street Pine Bluff, AR 71603 | Full Service B&M | $54,934 |

| Simmons Bank | 2800 Kavanaugh Boulevard Little Rock, AR 72205 | Full Service B&M | $136,063 |

| Simmons Bank | 2809 East Sunshine Springfield, MO 65804 | Full Service B&M | $76,028 |

| Simmons Bank | 2820 West Fm 120 Denison, TX 75020 | Full Service B&M | $88,234 |

| Simmons Bank | 2832 West Sunset Springdale, AR 72762 | Full Service B&M | $75,341 |

| Simmons Bank | 291 East Main Street Hendersonville, TN 37075 | Full Service B&M | $73,877 |

| Simmons Bank | 2911 F.M. 691 Denison, TX 75020 | Full Service B&M | $92,739 |

| Simmons Bank | 2911 Turtle Creek Blvd Dallas, TX 75219 | Limited, Drive-thru | $0 |

| Simmons Bank | 300 North Lincoln Avenue Star City, AR 71667 | Full Service B&M | $55,193 |

| Simmons Bank | 300 Northcreek Blvd Goodlettsville, TN 37072 | Full Service B&M | $97,952 |

| Simmons Bank | 300 Us Hwy 65 North Marshall, AR 72650 | Full Service B&M | $73,594 |

| Simmons Bank | 3079 East Main Russellville, AR 72801 | Full Service B&M | $111,084 |

| Simmons Bank | 308 South Main Street Stillwater, OK 74074 | Full Service B&M | $79,386 |

| Simmons Bank | 308 West Main Street Brownsville, TN 38012 | Full Service B&M | $72,581 |

| Simmons Bank | 3100 Paris Road Columbia, MO 65202 | Full Service B&M | $212,330 |

| Simmons Bank | 3109 North Reynolds Road Bryant, AR 72022 | Full Service B&M | $79,728 |

| Simmons Bank | 3111 Martin Luther King Boulevard Fayetteville, AR 72701 | Full Service B&M | $42,637 |

| Simmons Bank | 3131 Shields Boulevard Oklahoma City, OK 73126 | Full Service B&M | $41,464 |

| Simmons Bank | 347 West Church Street Lexington, TN 38351 | Full Service B&M | $54,023 |

| Simmons Bank | 3607 South Houston Levee Road Collierville, TN 38017 | Full Service B&M | $41,896 |

| Simmons Bank | 3641 Matlock Rd Arlington, TX 76015 | Full Service B&M | $100,157 |

| Simmons Bank | 3737 Sw Loop 820 Fort Worth, TX 76133 | Full Service B&M | $153,654 |

| Simmons Bank | 3803 Camden Road, Ste 30 Pine Bluff, AR 71603 | Full Service B&M | $97,416 |

| Simmons Bank | 3901 Camp Robinson Road North Little Rock, AR 72118 | Full Service B&M | $26,542 |

| Simmons Bank | 3975 West New Hope Road Rogers, AR 72758 | Full Service B&M | $38,412 |

| Simmons Bank | 400 Highway 65 South Dumas, AR 71639 | Full Service B&M | $63,485 |

| Simmons Bank | 401 East 4th Street Lockwood, MO 65682 | Full Service B&M | $64,812 |

| Simmons Bank | 401 South Main Searcy, AR 72143 | Full Service B&M | $109,331 |

| Simmons Bank | 4033 North Shiloh Drive Fayetteville, AR 72703 | Full Service B&M | $63,974 |

| Simmons Bank | 4100 International Plz, Ste 900 Fort Worth, TX 76109 | Full Service B&M | $0 |

| Simmons Bank | 414 Oak Street Conway, AR 72032 | Full Service B&M | $82,263 |

| Simmons Bank | 4200 Rogers Avenue Fort Smith, AR 72903 | Full Service B&M | $38,333 |

| Simmons Bank | 4220 North Rodney Parham Road Little Rock, AR 72212 | Full Service B&M | $118,637 |

| Simmons Bank | 425 West Capitol Little Rock, AR 72201 | Full Service B&M | $373,848 |

| Simmons Bank | 4301 Manchester Avenue Saint Louis, MO 63110 | Full Service B&M | $161,070 |

| Simmons Bank | 4420 Dollarway Road Pine Bluff, AR 71602 | Full Service B&M | $10,158 |

| Simmons Bank | 4625 South National Avenue Springfield, MO 65810 | Full Service B&M | $92,085 |

| Simmons Bank | 473 Hwy 425 N Monticello, AR 71655 | Full Service B&M | $59,919 |

| Simmons Bank | 480 Oil Well Road Jackson, TN 38305 | Full Service B&M | $123,509 |

| Simmons Bank | 4809 Camp Bowie Blvd Fort Worth, TX 76107 | Full Service B&M | $122,588 |

| Simmons Bank | 500 Corporate Center Drive Franklin, TN 37067 | Full Service B&M | $32,482 |

| Simmons Bank | 500 E Mt Vernon Blvd Mount Vernon, MO 65712 | Full Service B&M | $54,623 |

| Simmons Bank | 500 West Grand Avenue Chickasha, OK 73018 | Full Service B&M | $63,034 |

| Simmons Bank | 501 Main Street Pine Bluff, AR 71601 | Limited, Drive-thru | $0 |

| Simmons Bank | 501 S Main St Pine Bluff, AR 71601 | Full Service B&M | $1,469,770 |

| Simmons Bank | 501 West Washington Jonesboro, AR 72401 | Full Service B&M | $89,173 |

| Simmons Bank | 521 East Main Street Charleston, AR 72933 | Full Service B&M | $63,993 |

| Simmons Bank | 524 N. Main Street South Hutchinson, KS 67505 | Full Service B&M | $22,775 |

| Simmons Bank | 535 South Timberlane Drive El Dorado, AR 71730 | Full Service B&M | $54,798 |

| Simmons Bank | 5384 Poplar Avenue, Suite 200 Memphis, TN 38119 | Full Service B&M | $95,817 |

| Simmons Bank | 5401 S. Lindbergh Blvd Saint Louis, MO 63123 | Full Service B&M | $98,444 |

| Simmons Bank | 5500 Kavanaugh Boulevard Little Rock, AR 72207 | Full Service B&M | $116,358 |

| Simmons Bank | 7324 Rogers Avenue Fort Smith, AR 72903 | Full Service B&M | $38,256 |

| Simmons Bank | 551 Southwest Wilshire Burleson, TX 76028 | Full Service B&M | $96,170 |

| Simmons Bank | 5601 South University Little Rock, AR 72209 | Full Service B&M | $46,239 |

| Simmons Bank | 5739 Telegraph Road Saint Louis, MO 63129 | Full Service B&M | $81,890 |

| Simmons Bank | 5950 Berkshire Ln, Ste 400 Dallas, TX 75225 | Full Service B&M | $295,503 |

| Simmons Bank | 600 Salem Road Conway, AR 72034 | Full Service B&M | $115,798 |

| Simmons Bank | 601 E 3rd St Little Rock, AR 72201 | Full Service Cyber Office | $177,707 |

| Simmons Bank | 601 East Third Street Little Rock, AR 72201 | Limited, Administrative | $0 |

| Simmons Bank | 605 South Broadway Street South Fulton, TN 38257 | Full Service B&M | $16,884 |

| Simmons Bank | 608 South Main Street Stillwater, OK 74074 | Full Service B&M | $228,191 |

| Simmons Bank | 6100 Mexico Road Saint Peters, MO 63376 | Full Service B&M | $75,656 |

| Simmons Bank | 611 Big Bend Road Manchester, MO 63021 | Full Service B&M | $62,523 |

| Simmons Bank | 612 South Main Street Hamburg, AR 71646 | Full Service B&M | $47,602 |

| Simmons Bank | 6301 Waterford Boulevard, Suite 101 Oklahoma City, OK 73118 | Full Service B&M | $167,867 |

| Simmons Bank | 6712 Baseline Road Little Rock, AR 72209 | Full Service B&M | $62,633 |

| Simmons Bank | 695 East Farm Road 120 Pottsboro, TX 75076 | Full Service B&M | $12,889 |

| Simmons Bank | 700 N. Hwy 377 Whitesboro, TX 76273 | Full Service B&M | $64,669 |

| Simmons Bank | 701 W. Mt. Vernon Nixa, MO 65714 | Full Service B&M | $45,088 |

| Simmons Bank | 710 S. Foothills Plaza Drive Maryville, TN 37801 | Full Service B&M | $63,087 |

| Simmons Bank | 711 Southwest Drive Jonesboro, AR 72401 | Full Service B&M | $104,837 |

| Simmons Bank | 7151 Natural Bridge Road Saint Louis, MO 63121 | Full Service B&M | $73,614 |

| Simmons Bank | 720 East Peyton Street Sherman, TX 75090 | Full Service B&M | $195,435 |

| Simmons Bank | 7200 W. University Dr., Ste. 110 Mckinney, TX 75071 | Full Service B&M | $2,802 |

| Simmons Bank | 728 North Highway 65 Lake Village, AR 71653 | Full Service B&M | $117,310 |

| Simmons Bank | 7308 Northwest Expressway Oklahoma City, OK 73132 | Full Service B&M | $19,666 |

| Simmons Bank | 740 South Saginaw Boulevard Saginaw, TX 76179 | Full Service B&M | $109,436 |

| Simmons Bank | 741 South Main Street Middleton, TN 38052 | Full Service B&M | $52,089 |

| Simmons Bank | 800 North Arkansas Avenue Russellville, AR 72801 | Full Service B&M | $121,325 |

| Simmons Bank | 800 Ozark Cabool, MO 65689 | Full Service B&M | $19,989 |

| Simmons Bank | 801 East Broadway Columbia, MO 65201 | Full Service B&M | $335,090 |

| Simmons Bank | 805 New Highway 68 West Sweetwater, TN 37874 | Full Service B&M | $63,163 |

| Simmons Bank | 8083 Watson Road Webster Groves, MO 63119 | Full Service B&M | $24,892 |

| Simmons Bank | 809 West Market Street Bolivar, TN 38008 | Full Service B&M | $77,061 |

| Simmons Bank | 8107 Dollarway Road White Hall, AR 71602 | Full Service B&M | $135,088 |

| Simmons Bank | 8151 Clayton Road Saint Louis, MO 63117 | Full Service B&M | $274,469 |

| Simmons Bank | 818 Thompson Boulevard Sedalia, MO 65301 | Full Service B&M | $95,347 |

| Simmons Bank | 8415 East 21st Street, Suite 150 Wichita, KS 67206 | Full Service B&M | $108,361 |

| Simmons Bank | 900 West Main Street Durant, OK 74701 | Full Service B&M | $45,465 |

| Simmons Bank | 901 N Asu Blvd Beebe, AR 72012 | Full Service B&M | $6,158 |

| Simmons Bank | 921 North Eight Street Gunter, TX 75058 | Full Service B&M | $53,246 |

| Simmons Bank | 924 Broadway At I-630 Little Rock, AR 72201 | Limited, Drive-thru | $0 |

| Simmons Bank | 925 East U.S. Business Highway 60-63 Willow Springs, MO 65793 | Full Service B&M | $57,073 |

| Simmons Bank | 9420 Manchester Road Saint Louis, MO 63119 | Full Service B&M | $98,856 |

| Simmons Bank | 9652 Strong Highway Strong, AR 71765 | Full Service B&M | $31,014 |

| Simmons Bank | 9769 Olive Boulevard Saint Louis, MO 63132 | Full Service B&M | $91,051 |

| Simmons Bank | 985 Wentzville Parkway Wentzville, MO 63385 | Full Service B&M | $50,191 |

| Simmons Bank | 9921 South Pennsylvania Avenue Oklahoma City, OK 73159 | Full Service B&M | $45,673 |

| Simmons Bank | 9945 Watson Road Saint Louis, MO 63126 | Full Service B&M | $18,996 |

| Simmons Bank | Highway 411 North Madisonville, TN 37354 | Full Service B&M | $104,370 |

| Simmons Bank | N Crossover Road Fayetteville, AR 72703 | Full Service B&M | $60,713 |

For 2021, Simmons Bank had 205 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $671,018 |

| Net interest income | $610,499 |

| Total noninterest income | $196,983 |

| Gross Fiduciary activities income | $28,308 |

| Service charges on deposit accounts | $43,232 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $125,443 |

| Pre-tax net operating income | $357,951 |

| Securities gains (or losses, -) | $15,741 |

| Income before extraordinary items | $301,113 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $301,113 |

| Minority interest net income | $0 |

| Net income | $301,113 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $288,362 |

Simmons Bank's gross interest income from loans was $671,018,000.

Simmons Bank's net interest income from loans was $610,499,000.

Simmons Bank's fee based income from loans was $43,232,000.

Simmons Bank's net income from loans was $301,113,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $60,519 |

| Provision for credit losses | $-32,704 |

| Total noninterest expense | $482,235 |

| Salaries and employee benefits | $250,112 |

| Premises and equipment expense | $57,233 |

| Additional noninterest expense | $174,890 |

| Applicable income taxes | $72,579 |

| Net charge-offs | $14,959 |

| Cash dividends | $225,835 |

Simmons Bank's interest expense for loans was $60,519,000.

Simmons Bank's payroll and benefits expense were $250,112,000.

Simmons Bank's property, plant and equipment expenses $57,233,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.4% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $19,550,035 |

| Deposits held in domestic offices | $19,550,035 |

| Deposits by Individuals, partnerships, and corporations | $16,260,108 |

| Deposits by U.S. Government | $622 |

| Deposits by States and political subdivisions in the U.S. | $3,037,245 |

| Deposits by Commercial banks and other depository institutions in U.S. | $252,060 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $10,674,389 |

| Demand deposits | $5,920,415 |

| Nontransaction accounts | $8,875,646 |

| Money market deposit accounts (MMDAs) | $5,184,617 |

| Other savings deposits (excluding MMDAs) | $1,238,312 |

| Total time deposits | $2,452,717 |

| Total time and savings deposits | $13,629,620 |

| Noninterest-bearing deposits | $5,508,549 |

| Interest-bearing deposits | $14,041,486 |

| Retail deposits | $18,309,337 |

| IRAs and Keogh plan accounts | $381,821 |

| Brokered deposits | $465,967 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $24,685,744 |

| Cash & Balances due from depository institutions | $1,649,318 |

| Interest-bearing balances | $1,440,136 |

| Total securities | $8,650,011 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $11,840,916 |

| Loan and leases loss allowance | $205,329 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $437,150 |

| Other real estate owned | $4,544 |

| Goodwill and other intangibles | $1,252,108 |

| All other assets | $851,697 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $24,685,744 |

| Total Liabilities | $21,261,825 |

| Total deposits | $19,550,035 |

| Interest-bearing deposits | $14,041,486 |

| Deposits held in domestic offices | $19,550,035 |

| % insured (estimated) | $62 |

| Federal funds purchased and repurchase agreements | $185,403 |

| Trading liabilities | $0 |

| Other borrowed funds | $1,364,872 |

| Subordinated debt | $0 |

| All other liabilities | $161,515 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $11,840,916 |

| Loan and leases loss allowance | $205,329 |

| Total loans and leases (domestic) | $12,046,245 |

| All real estate loans | $9,204,868 |

| Real estate loans in domestic offices | $9,204,868 |

| Construction and development loans | $1,326,433 |

| Residential 1-4 family construction | $288,801 |

| Other construction, all land development and other land | $1,037,632 |

| Loans secured by nonfarm nonresidential properties | $4,940,022 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,434,870 |

| Commercial real estate & other non-farm, non-residential | $3,505,152 |

| Multifamily residential real estate | $470,292 |

| 1-4 family residential loans | $2,116,640 |

| Farmland loans | $351,481 |

| Loans held in foreign offices | $0 |

| Farm loans | $169,122 |

| Commercial and industrial loans | $2,013,740 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $284,693 |

| Credit card loans | $160,575 |

| Related Plans | $23,567 |

| Consumer Auto Loans | $48,547 |

| Other loans to individuals | $52,004 |

| All other loans & leases | $373,822 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $281,065 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $0 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $3,890 |

| Non 1-4 family restructured loans & leases | $1,202 |

| Total loans and leases (foreign) | $0 |

Simmons Bank had $11,840,916,000 of loans outstanding in 2021. $9,204,868,000 of loans were in real estate loans. $1,326,433,000 of loans were in development loans. $470,292,000 of loans were in multifamily mortgage loans. $2,116,640,000 of loans were in 1-4 family mortgage loans. $169,122,000 of loans were in farm loans. $160,575,000 of loans were in credit card loans. $48,547,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 2,637 | $594,931 | $225,609 |

| Nonfarm, nonresidential loans - <$100k | 553 | $21,211 | $38,356 |

| Nonfarm, nonresidential loans - $100-250k | 823 | $96,433 | $117,173 |

| Nonfarm, nonresidential loans - $250k-1MM | 1,261 | $477,287 | $378,499 |

| Commercial & Industrial, US addressed loans - <$1MM | 6,156 | $455,894 | $74,057 |

| Commercial & Industrial, US addressed loans - <$100k | 4,107 | $83,218 | $20,262 |

| Commercial & Industrial, US addressed loans - $100-250k | 991 | $92,017 | $92,853 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,058 | $280,659 | $265,273 |

| Farmland loans - <$1MM | 1,294 | $134,427 | $103,885 |

| Farmland loans - <$100k | 606 | $22,772 | $37,578 |

| Farmland loans - $100-250k | 467 | $53,787 | $115,176 |

| Farmland loans - $250k-1MM | 221 | $57,868 | $261,846 |

| Agriculture operations loans - <$1MM | 1,164 | $47,679 | $40,961 |

| Agriculture operations loans - <$100k | 909 | $18,050 | $19,857 |

| Agriculture operations loans - $100-250k | 172 | $15,080 | $87,674 |

| Agriculture operations loans - $250k-1MM | 83 | $14,549 | $175,289 |