Iberiabank Mortgage Rates, Fees & Info

Lafayette, LALEI: H98JYKDFKFZ5ZPCSMT69

Tax ID: 72-0218470

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Iberiabank is a mid-sized bank specializing in Home Purchase and Refi loans. Iberiabank has a high proportion of conventional loans. They have a a low proportion of FHA loans. (This may mean they shy away from first time homebuyers.) They have a low ratio of USDA loans. Their top markets by origination volume include: Miami, New Orleans, Houston, Dallas, and Fayetteville among others. We have data for 216 markets. (Some data included below & more in-depth data is available with an active subscription.)Iberiabank has an average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Iberiabank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

Originations

13,704Origination Dollar Volume (All Markets)

$4,366,960,000Employee count

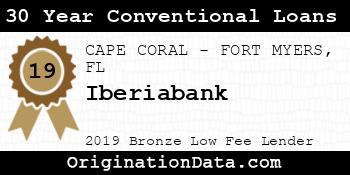

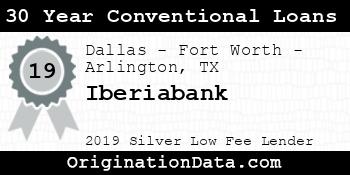

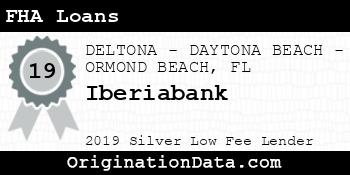

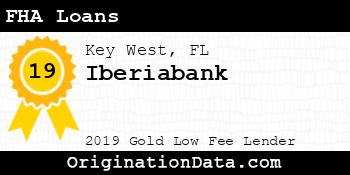

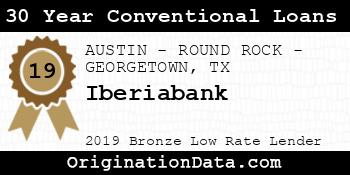

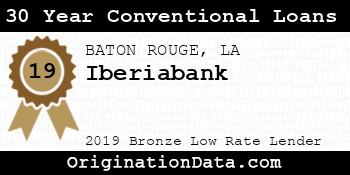

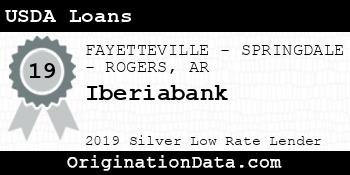

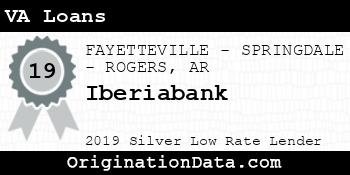

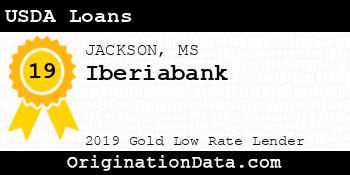

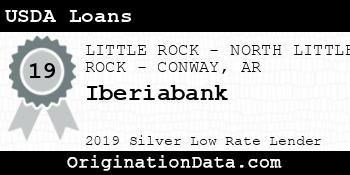

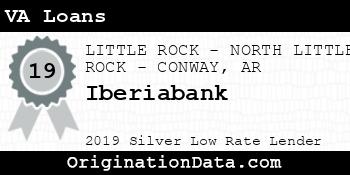

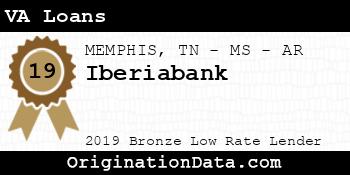

3,148 Show all (34) awardsIberiabank - 2019

Iberiabank is a 2019 , due to their low .

For 2019, less than of lenders were eligible for this award.

Work for Iberiabank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 773 | $579,015,000 | $749,049 | $7,015 | 4.15% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 1,593 | $440,765,000 | $276,689 | $4,047 | 4.33% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 242 | $291,060,000 | $1,202,727 | $6,180 | 3.94% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 556 | $258,830,000 | $465,522 | $4,298 | 4.10% |

| FAYETTEVILLE-SPRINGDALE-ROGERS, AR (FHA|USDA|VA) | 970 | $204,920,000 | $211,258 | $3,472 | 4.14% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 661 | $173,235,000 | $262,080 | $5,065 | 4.04% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 407 | $167,975,000 | $412,715 | $4,447 | 4.21% |

| LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR (FHA|USDA|VA) | 798 | $158,060,000 | $198,070 | $3,036 | 4.21% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 711 | $157,085,000 | $220,935 | $3,927 | 4.12% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 437 | $139,075,000 | $318,249 | $4,605 | 4.23% |

| Key West, FL (FHA|USDA|VA) | 245 | $136,195,000 | $555,898 | $8,172 | 4.10% |

| New York-Newark-Jersey City, NY-NJ-PA (FHA|USDA|VA) | 76 | $124,400,000 | $1,636,842 | $20,931 | 3.88% |

| BATON ROUGE, LA (FHA|USDA|VA) | 572 | $123,870,000 | $216,556 | $3,489 | 4.23% |

| LAFAYETTE, LA (FHA|USDA|VA) | 860 | $109,920,000 | $127,814 | $3,295 | 4.41% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 297 | $97,825,000 | $329,377 | $5,179 | 4.24% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 280 | $95,870,000 | $342,393 | $3,619 | 4.12% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 335 | $84,115,000 | $251,090 | $3,210 | 4.21% |

| JACKSON, MS (FHA|USDA|VA) | 368 | $77,850,000 | $211,549 | $4,022 | 3.97% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 136 | $59,530,000 | $437,721 | $4,786 | 4.21% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 265 | $56,585,000 | $213,528 | $2,807 | 4.19% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 266 | $54,680,000 | $205,564 | $4,587 | 4.21% |

| Outside of Metro Areas | 301 | $52,765,000 | $175,299 | $3,425 | 4.34% |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (FHA|USDA|VA) | 68 | $46,670,000 | $686,324 | $4,477 | 4.28% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 124 | $45,030,000 | $363,145 | $3,808 | 4.21% |

| LAKE CHARLES, LA (FHA|USDA|VA) | 326 | $42,570,000 | $130,583 | $3,188 | 4.63% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 151 | $35,815,000 | $237,185 | $3,408 | 4.35% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 189 | $35,135,000 | $185,899 | $4,327 | 4.24% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 88 | $33,270,000 | $378,068 | $5,106 | 4.17% |

| JONESBORO, AR (FHA|USDA|VA) | 168 | $32,250,000 | $191,964 | $3,121 | 4.40% |

| MOBILE, AL (FHA|USDA|VA) | 120 | $30,720,000 | $256,000 | $4,022 | 4.16% |

| COLLEGE STATION-BRYAN, TX (FHA|USDA|VA) | 1 | $27,005,000 | $27,005,000 | $0 | 4.67% |

| MONROE, LA (FHA|USDA|VA) | 152 | $24,610,000 | $161,908 | $3,614 | 4.54% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 26 | $20,330,000 | $781,923 | $7,198 | 4.35% |

| AUSTIN-ROUND ROCK-GEORGETOWN, TX (FHA|USDA|VA) | 22 | $18,640,000 | $847,273 | $8,635 | 3.94% |

| BRIDGEPORT-STAMFORD-NORWALK, CT (FHA|USDA|VA) | 10 | $16,420,000 | $1,642,000 | $11,640 | 3.83% |

| Morgan City, LA (FHA|USDA|VA) | 128 | $14,490,000 | $113,203 | $3,165 | 4.54% |

| GAINESVILLE, FL (FHA|USDA|VA) | 4 | $14,480,000 | $3,620,000 | $2,828 | 4.13% |

| Glenwood Springs, CO (FHA|USDA|VA) | 4 | $14,380,000 | $3,595,000 | $21,625 | 4.03% |

| HOUMA-THIBODAUX, LA (FHA|USDA|VA) | 126 | $14,180,000 | $112,540 | $2,909 | 4.27% |

| SHREVEPORT-BOSSIER CITY, LA (FHA|USDA|VA) | 51 | $13,855,000 | $271,667 | $3,350 | 4.35% |

| GULFPORT-BILOXI, MS (FHA|USDA|VA) | 45 | $13,475,000 | $299,444 | $3,685 | 4.25% |

| BRUNSWICK, GA (FHA|USDA|VA) | 3 | $11,905,000 | $3,968,333 | $17,992 | 4.55% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 9 | $9,935,000 | $1,103,889 | $6,073 | 3.99% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 29 | $8,755,000 | $301,897 | $4,949 | 4.14% |

| Opelousas, LA (FHA|USDA|VA) | 63 | $7,095,000 | $112,619 | $3,031 | 4.46% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 28 | $6,270,000 | $223,929 | $3,387 | 4.18% |

| Edwards, CO (FHA|USDA|VA) | 2 | $5,610,000 | $2,805,000 | $6,348 | 3.88% |

| SALINAS, CA (FHA|USDA|VA) | 2 | $5,430,000 | $2,715,000 | $6,200 | 3.50% |

| LAS VEGAS-HENDERSON-PARADISE, NV (FHA|USDA|VA) | 2 | $5,350,000 | $2,675,000 | $7,675 | 3.69% |

| Alexander City, AL (FHA|USDA|VA) | 5 | $5,025,000 | $1,005,000 | $9,431 | 4.70% |

| Cullowhee, NC (FHA|USDA|VA) | 9 | $4,855,000 | $539,444 | $5,302 | 4.40% |

| Tullahoma-Manchester, TN (FHA|USDA|VA) | 25 | $4,515,000 | $180,600 | $4,597 | 4.08% |

| LOUISVILLE, KY (FHA|USDA|VA) | 5 | $3,905,000 | $781,000 | $3,852 | 4.25% |

| ATHENS-CLARKE COUNTY, GA (FHA|USDA|VA) | 9 | $3,735,000 | $415,000 | $4,101 | 4.14% |

| DECATUR, AL (FHA|USDA|VA) | 18 | $3,660,000 | $203,333 | $3,839 | 4.46% |

| BOULDER, CO (FHA|USDA|VA) | 2 | $3,320,000 | $1,660,000 | $4,716 | 4.56% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 7 | $3,125,000 | $446,429 | $4,413 | 3.94% |

| Cullman, AL (FHA|USDA|VA) | 10 | $3,080,000 | $308,000 | $4,034 | 4.34% |

| Ruston, LA (FHA|USDA|VA) | 31 | $2,855,000 | $92,097 | $2,845 | 4.64% |

| Breckenridge, CO (FHA|USDA|VA) | 4 | $2,850,000 | $712,500 | $3,644 | 3.69% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 7 | $2,745,000 | $392,143 | $3,926 | 3.96% |

| HAMMOND, LA (FHA|USDA|VA) | 23 | $2,715,000 | $118,043 | $3,438 | 4.39% |

| Shelbyville, TN (FHA|USDA|VA) | 14 | $2,700,000 | $192,857 | $4,170 | 4.15% |

| HOT SPRINGS, AR (FHA|USDA|VA) | 16 | $2,690,000 | $168,125 | $3,114 | 4.13% |

| COLUMBIA, SC (FHA|USDA|VA) | 5 | $2,635,000 | $527,000 | $3,929 | 4.00% |

| Jefferson, GA (FHA|USDA|VA) | 12 | $2,430,000 | $202,500 | $3,174 | 4.26% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 4 | $2,400,000 | $600,000 | $5,552 | 4.25% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 5 | $2,375,000 | $475,000 | $5,303 | 4.20% |

| Heber, UT (FHA|USDA|VA) | 1 | $2,365,000 | $2,365,000 | $5,734 | 3.38% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 8 | $2,330,000 | $291,250 | $2,739 | 4.01% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 9 | $2,215,000 | $246,111 | $3,831 | 4.00% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 13 | $2,175,000 | $167,308 | $3,661 | 4.36% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 2 | $2,140,000 | $1,070,000 | $2,264 | 3.63% |

| Bozeman, MT (FHA|USDA|VA) | 2 | $2,130,000 | $1,065,000 | $6,210 | 3.81% |

| Paragould, AR (FHA|USDA|VA) | 8 | $2,120,000 | $265,000 | $2,902 | 4.26% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 3 | $1,945,000 | $648,333 | $5,633 | 3.89% |

| Lewisburg, TN (FHA|USDA|VA) | 9 | $1,805,000 | $200,556 | $5,077 | 4.06% |

| MONTGOMERY, AL (FHA|USDA|VA) | 7 | $1,785,000 | $255,000 | $2,549 | 4.35% |

| Okeechobee, FL (FHA|USDA|VA) | 1 | $1,755,000 | $1,755,000 | $7,080 | 3.13% |

| Russellville, AR (FHA|USDA|VA) | 11 | $1,705,000 | $155,000 | $2,811 | 4.34% |

| OXNARD-THOUSAND OAKS-VENTURA, CA (FHA|USDA|VA) | 2 | $1,680,000 | $840,000 | $4,223 | 3.31% |

| KNOXVILLE, TN (FHA|USDA|VA) | 8 | $1,600,000 | $200,000 | $4,659 | 3.85% |

| ASHEVILLE, NC (FHA|USDA|VA) | 4 | $1,590,000 | $397,500 | $3,725 | 4.32% |

| Steamboat Springs, CO (FHA|USDA|VA) | 1 | $1,505,000 | $1,505,000 | $4,030 | 3.00% |

| SAVANNAH, GA (FHA|USDA|VA) | 4 | $1,500,000 | $375,000 | $5,721 | 4.13% |

| OCEAN CITY, NJ (FHA|USDA|VA) | 1 | $1,485,000 | $1,485,000 | $44,112 | 3.88% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 8 | $1,440,000 | $180,000 | $3,003 | 5.32% |

| DeRidder, LA (FHA|USDA|VA) | 11 | $1,415,000 | $128,636 | $2,653 | 4.61% |

| OCALA, FL (FHA|USDA|VA) | 7 | $1,405,000 | $200,714 | $4,996 | 4.64% |

| FLORENCE-MUSCLE SHOALS, AL (FHA|USDA|VA) | 6 | $1,350,000 | $225,000 | $3,324 | 4.19% |

| TULSA, OK (FHA|USDA|VA) | 6 | $1,340,000 | $223,333 | $3,045 | 6.69% |

| BOWLING GREEN, KY (FHA|USDA|VA) | 3 | $1,325,000 | $441,667 | $3,475 | 4.25% |

| Oxford, MS (FHA|USDA|VA) | 6 | $1,290,000 | $215,000 | $2,849 | 3.98% |

| TYLER, TX (FHA|USDA|VA) | 3 | $1,285,000 | $428,333 | $3,402 | 3.79% |

| Boone, NC (FHA|USDA|VA) | 1 | $1,285,000 | $1,285,000 | $4,395 | 3.75% |

| Malone, NY (FHA|USDA|VA) | 1 | $1,255,000 | $1,255,000 | $7,670 | 3.50% |

| JACKSON, TN (FHA|USDA|VA) | 9 | $1,245,000 | $138,333 | $3,310 | 3.71% |

| LAKELAND-WINTER HAVEN, FL (FHA|USDA|VA) | 9 | $1,245,000 | $138,333 | $5,572 | 3.62% |

| RICHMOND, VA (FHA|USDA|VA) | 1 | $1,215,000 | $1,215,000 | $5,283 | 4.13% |

| SAN DIEGO-CHULA VISTA-CARLSBAD, CA (FHA|USDA|VA) | 1 | $1,215,000 | $1,215,000 | $4,495 | 4.38% |

| Los Angeles-Long Beach-Anaheim, CA (FHA|USDA|VA) | 2 | $1,210,000 | $605,000 | $4,822 | 4.58% |

| TUSCALOOSA, AL (FHA|USDA|VA) | 6 | $1,200,000 | $200,000 | $3,093 | 4.55% |

| BARNSTABLE TOWN, MA (FHA|USDA|VA) | 2 | $1,190,000 | $595,000 | $4,789 | 3.94% |

| GAINESVILLE, GA (FHA|USDA|VA) | 5 | $1,185,000 | $237,000 | $4,451 | 4.00% |

| Albertville, AL (FHA|USDA|VA) | 5 | $1,175,000 | $235,000 | $3,467 | 3.83% |

| VIRGINIA BEACH-NORFOLK-NEWPORT NEWS, VA-NC (FHA|USDA|VA) | 3 | $1,165,000 | $388,333 | $9,203 | 3.50% |

| Brevard, NC (FHA|USDA|VA) | 2 | $1,160,000 | $580,000 | $5,751 | 3.88% |

| CLARKSVILLE, TN-KY (FHA|USDA|VA) | 6 | $1,150,000 | $191,667 | $4,093 | 4.13% |

| MCALLEN-EDINBURG-MISSION, TX (FHA|USDA|VA) | 2 | $1,140,000 | $570,000 | $6,623 | 4.63% |

| OKLAHOMA CITY, OK (FHA|USDA|VA) | 4 | $1,130,000 | $282,500 | $3,243 | 3.91% |

| FORT SMITH, AR-OK (FHA|USDA|VA) | 7 | $1,105,000 | $157,857 | $2,999 | 3.91% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 7 | $1,065,000 | $152,143 | $2,613 | 3.81% |

| JACKSONVILLE, NC (FHA|USDA|VA) | 1 | $1,065,000 | $1,065,000 | $0 | 4.70% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 2 | $1,060,000 | $530,000 | $3,321 | 4.00% |

| PORTLAND-SOUTH PORTLAND, ME (FHA|USDA|VA) | 2 | $1,010,000 | $505,000 | $1,638 | 6.85% |

| Sebastian-Vero Beach, FL (FHA|USDA|VA) | 4 | $990,000 | $247,500 | $5,140 | 4.03% |

| SANTA FE, NM (FHA|USDA|VA) | 1 | $955,000 | $955,000 | $0 | 5.50% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 3 | $945,000 | $315,000 | $2,769 | 4.13% |

| Pinehurst-Southern Pines, NC (FHA|USDA|VA) | 2 | $920,000 | $460,000 | $3,873 | 4.19% |

| Torrington, CT (FHA|USDA|VA) | 1 | $905,000 | $905,000 | $8,307 | 3.50% |

| Mountain Home, AR (FHA|USDA|VA) | 7 | $895,000 | $127,857 | $1,430 | 5.46% |

| Vicksburg, MS (FHA|USDA|VA) | 4 | $890,000 | $222,500 | $4,080 | 2.81% |

| Kalispell, MT (FHA|USDA|VA) | 1 | $855,000 | $855,000 | $7,081 | 3.25% |

| Bonham, TX (FHA|USDA|VA) | 2 | $840,000 | $420,000 | $5,823 | 4.19% |

| PANAMA CITY, FL (FHA|USDA|VA) | 4 | $820,000 | $205,000 | $3,613 | 4.22% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 4 | $810,000 | $202,500 | $5,344 | 4.64% |

| AUBURN-OPELIKA, AL (FHA|USDA|VA) | 4 | $770,000 | $192,500 | $3,437 | 4.16% |

| CAPE GIRARDEAU, MO-IL (FHA|USDA|VA) | 2 | $750,000 | $375,000 | $1,942 | 4.00% |

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 1 | $725,000 | $725,000 | $2,485 | 3.50% |

| Athens, TX (FHA|USDA|VA) | 2 | $710,000 | $355,000 | $3,583 | 3.88% |

| BURLINGTON, NC (FHA|USDA|VA) | 2 | $710,000 | $355,000 | $3,032 | 4.13% |

| Lawrenceburg, TN (FHA|USDA|VA) | 6 | $710,000 | $118,333 | $4,097 | 4.33% |

| Jennings, LA (FHA|USDA|VA) | 6 | $710,000 | $118,333 | $2,759 | 4.32% |

| San Francisco-Oakland-Berkeley, CA (FHA|USDA|VA) | 1 | $705,000 | $705,000 | $3,867 | 3.50% |

| SPARTANBURG, SC (FHA|USDA|VA) | 5 | $695,000 | $139,000 | $3,835 | 4.72% |

| McMinnville, TN (FHA|USDA|VA) | 4 | $670,000 | $167,500 | $6,183 | 4.16% |

| SAN ANGELO, TX (FHA|USDA|VA) | 2 | $640,000 | $320,000 | $3,066 | 4.88% |

| Big Spring, TX (FHA|USDA|VA) | 1 | $625,000 | $625,000 | $7,293 | 4.25% |

| CLEVELAND, TN (FHA|USDA|VA) | 2 | $620,000 | $310,000 | $2,990 | 3.88% |

| RALEIGH-CARY, NC (FHA|USDA|VA) | 2 | $610,000 | $305,000 | $3,476 | 4.00% |

| Searcy, AR (FHA|USDA|VA) | 5 | $585,000 | $117,000 | $2,256 | 4.23% |

| ALEXANDRIA, LA (FHA|USDA|VA) | 4 | $570,000 | $142,500 | $3,295 | 3.94% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 1 | $565,000 | $565,000 | $5,955 | 4.75% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 2 | $520,000 | $260,000 | $1,572 | 3.81% |

| HATTIESBURG, MS (FHA|USDA|VA) | 3 | $505,000 | $168,333 | $3,530 | 3.83% |

| Atmore, AL (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $3,338 | 3.75% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (FHA|USDA|VA) | 1 | $475,000 | $475,000 | $4,661 | 4.00% |

| Seneca, SC (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $2,535 | 3.63% |

| AMARILLO, TX (FHA|USDA|VA) | 1 | $465,000 | $465,000 | $5,892 | 4.38% |

| PINE BLUFF, AR (FHA|USDA|VA) | 5 | $465,000 | $93,000 | $1,865 | 4.15% |

| Meridian, MS (FHA|USDA|VA) | 4 | $450,000 | $112,500 | $3,536 | 4.90% |

| GADSDEN, AL (FHA|USDA|VA) | 1 | $435,000 | $435,000 | $3,644 | 3.88% |

| TRENTON-PRINCETON, NJ (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $6,079 | 4.13% |

| Calhoun, GA (FHA|USDA|VA) | 1 | $405,000 | $405,000 | $3,557 | 3.75% |

| Batesville, AR (FHA|USDA|VA) | 7 | $395,000 | $56,429 | $574 | 4.84% |

| COLORADO SPRINGS, CO (FHA|USDA|VA) | 1 | $395,000 | $395,000 | $2,848 | 3.88% |

| POUGHKEEPSIE-NEWBURGH-MIDDLETOWN, NY (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $5,355 | 4.00% |

| MANCHESTER-NASHUA, NH (FHA|USDA|VA) | 1 | $375,000 | $375,000 | $3,410 | 3.75% |

| BOISE CITY, ID (FHA|USDA|VA) | 1 | $375,000 | $375,000 | $2,500 | 3.25% |

| SACRAMENTO-ROSEVILLE-FOLSOM, CA (FHA|USDA|VA) | 1 | $375,000 | $375,000 | $10,451 | 3.75% |

| Starkville, MS (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $3,975 | 4.06% |

| Talladega-Sylacauga, AL (FHA|USDA|VA) | 1 | $355,000 | $355,000 | $0 | 5.50% |

| CORPUS CHRISTI, TX (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $2,602 | 4.50% |

| Mineral Wells, TX (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $3,533 | 3.63% |

| COLUMBUS, GA-AL (FHA|USDA|VA) | 2 | $320,000 | $160,000 | $2,749 | 3.94% |

| McComb, MS (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $2,934 | 4.13% |

| Mount Pleasant, TX (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $3,672 | 3.50% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $3,963 | 4.38% |

| Columbus, MS (FHA|USDA|VA) | 1 | $305,000 | $305,000 | $6,612 | 3.88% |

| Bogalusa, LA (FHA|USDA|VA) | 2 | $300,000 | $150,000 | $5,367 | 4.18% |

| LONGVIEW, TX (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $4,572 | 4.38% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $3,035 | 3.88% |

| CINCINNATI, OH-KY-IN (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $8,284 | 3.63% |

| PITTSBURGH, PA (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $4,012 | 3.69% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $4,828 | 3.63% |

| Brookhaven, MS (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $7,268 | 4.50% |

| Durango, CO (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,974 | 3.75% |

| SANTA ROSA-PETALUMA, CA (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $0 | 5.21% |

| OWENSBORO, KY (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,966 | 4.00% |

| SEBRING-AVON PARK, FL (FHA|USDA|VA) | 3 | $225,000 | $75,000 | $2,728 | 3.76% |

| NEW BERN, NC (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $2,689 | 4.25% |

| THE VILLAGES, FL (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $0 | 3.79% |

| VICTORIA, TX (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $0 | 3.99% |

| CARBONDALE-MARION, IL (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $2,702 | 4.38% |

| Fort Polk South, LA (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $1,858 | 3.63% |

| COLUMBIA, MO (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $1,752 | 4.00% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $7,954 | 3.88% |

| Port Lavaca, TX (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,639 | 3.38% |

| Blytheville, AR (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $4,644 | 3.38% |

| EL PASO, TX (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,874 | 4.25% |

| Statesboro, GA (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,474 | 4.00% |

| KALAMAZOO-PORTAGE, MI (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,882 | 4.88% |

| Branson, MO (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $1,563 | 4.38% |

| LUBBOCK, TX (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $3,773 | 3.88% |

| SHERMAN-DENISON, TX (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,738 | 5.13% |

| Arkadelphia, AR (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $1,937 | 4.75% |

| Malvern, AR (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,589 | 3.50% |

| Rolla, MO (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $1,057 | 4.75% |

| DOTHAN, AL (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,449 | 4.25% |

| Laurel, MS (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,760 | 4.88% |

| Richmond-Berea, KY (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,775 | 4.50% |

| Poplar Bluff, MO (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $1,866 | 4.75% |

| Clewiston, FL (FHA|USDA|VA) | 2 | $100,000 | $50,000 | $4,688 | 2.50% |

| KILLEEN-TEMPLE, TX (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $2,497 | 4.13% |

| WACO, TX (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $4,136 | 5.13% |

| Palatka, FL (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $2,438 | 4.13% |

| Crossville, TN (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $2,436 | 4.13% |

| TEXARKANA, TX-AR (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $0 | 3.99% |

| Vidalia, GA (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $4,050 | 5.13% |

| Laurinburg, NC (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $2,716 | 5.50% |

| Lake City, FL (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $0 | 5.39% |

| Forrest City, AR (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $1,809 | 4.25% |

| WILMINGTON, NC (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $0 | 3.79% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 1 | $35,000 | $35,000 | $4,012 | 5.50% |

| MACON-BIBB COUNTY, GA (FHA|USDA|VA) | 1 | $25,000 | $25,000 | $0 | 3.99% |

| Kennett, MO (FHA|USDA|VA) | 1 | $15,000 | $15,000 | $0 | 3.99% |

Similar Lenders

We use machine learning to identify the top lenders compared against Iberiabank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 33

Similarity Rank: 42

Similarity Rank: 56

Similarity Rank: 64

Similarity Rank: 104

Similarity Rank: 104

Similarity Rank: 150

Similarity Rank: 180

Similarity Rank: 190

Similarity Rank: 192

Product Mix

For 2019, Iberiabank's most frequently originated type of loan was Conventional, with 8,196 originations. Their 2nd most popular type was HELOC, with 3,782 originations.

Loan Reason

For 2019, Iberiabank's most frequently cited loan purpose was Home Purchase, with 7,192 originations. The 2nd most popular reason was Refi, with 3,202 originations.

Loan Duration/Length

For 2019, Iberiabank's most frequently cited loan duration was 30 Year, with 11,728 originations. The 2nd most popular length was 15 Year, with 864 originations.

Origination Fees/Closing Costs

Iberiabank's average total fees were $4,589, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 6,101 originations.

Interest Rates

During 2019, Iberiabank's average interest rate for loans was 4.16%, while their most frequently originated rate bucket for loans was 3-4%, with 7,749 originations.

Loan Sizing

2019 saw Iberiabank place emphasis on $200k-400k loans with 4,440 originations, totaling $1,242,560,000 in origination value.

Applicant Income

Iberiabank lent most frequently to those with incomes in the $100k-150k range, with 2,524 originations. The second most popular income band? $50k-75k, with 2,395 originations.

Applicant Debt to Income Ratio

Iberiabank lent most frequently to those with DTI ratios of 20-30%, with 3,055 originations. The next most common DTI ratio? 30-36%, with 2,199 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications86.31%

Iberiabank has an average approval rate.

Pick Rate

Approvals leading to origination79.76%

Iberiabank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 13,704 | $4,366,960,000 | $318,663 |

Occupancy Type Mix

LTV Distribution

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Iberiabank | 205 Rice Street Pocahontas, AR 72455 | Full Service B&M | $74,154 |

| Iberiabank | 100 East Packwood Avenue Maitland, FL 32751 | Full Service B&M | $175,177 |

| Iberiabank | 100 Euclid Avenue Mountain Brook, AL 35213 | Full Service B&M | $64,272 |

| Iberiabank | 100 South 28th Rogers, AR 72756 | Full Service B&M | $33,240 |

| Iberiabank | 100 Springfield Drive Woodstock, GA 30188 | Full Service B&M | $71,626 |

| Iberiabank | 1000 Kennedy Drive Key West, FL 33040 | Full Service B&M | $100,970 |

| Iberiabank | 1000 Memorial City Way Houston, TX 77024 | Full Service B&M | $59,117 |

| Iberiabank | 1001 Seventh Street Morgan City, LA 70380 | Full Service B&M | $52,932 |

| Iberiabank | 1003 Southeast Blvd Morgan City, LA 70380 | Full Service B&M | $31,506 |

| Iberiabank | 1010 Mansell Road, Suite 160 Roswell, GA 30076 | Full Service B&M | $26,804 |

| Iberiabank | 1010 N Germantown Parkway Cordova, TN 38016 | Full Service B&M | $15,367 |

| Iberiabank | 102 N W 37th Avenue Miami, FL 33125 | Full Service B&M | $118,067 |

| Iberiabank | 10323 Gulf Hwy Lake Charles, LA 70605 | Full Service B&M | $46,528 |

| Iberiabank | 1075 Duval Street Key West, FL 33040 | Full Service B&M | $67,315 |

| Iberiabank | 10901 North Rodney Parham Road Little Rock, AR 72212 | Full Service B&M | $90,775 |

| Iberiabank | 11 Greenway Plaza, Suite 2700 Houston, TX 77046 | Limited, Administrative | $0 |

| Iberiabank | 110 East Court Street Suite 101 Greenville, SC 29601 | Full Service B&M | $25,779 |

| Iberiabank | 1100 E. Main Street Broussard, LA 70518 | Full Service B&M | $51,942 |

| Iberiabank | 111 Center Street, Suite 102 Little Rock, AR 72201 | Full Service B&M | $60,212 |

| Iberiabank | 1111 Brickell Avenue Miami, FL 33131 | Full Service B&M | $283,742 |

| Iberiabank | 1120 Jefferson Terrace New Iberia, LA 70560 | Full Service B&M | $1,919,302 |

| Iberiabank | 1201 South Andrews Avenue Fort Lauderdale, FL 33301 | Full Service B&M | $175,324 |

| Iberiabank | 121 Southwest Third Street Walnut Ridge, AR 72476 | Full Service B&M | $57,250 |

| Iberiabank | 12719 Cantrell Road Little Rock, AR 72223 | Full Service B&M | $66,709 |

| Iberiabank | 12920 Airline Highway Baton Rouge, LA 70817 | Full Service B&M | $53,636 |

| Iberiabank | 1296 Union Avenue Memphis, TN 38104 | Full Service B&M | $9,731 |

| Iberiabank | 1300 Oliver Road Monroe, LA 71201 | Full Service B&M | $223,522 |

| Iberiabank | 1301 Decatur Highway Fultondale, AL 35068 | Full Service B&M | $83,772 |

| Iberiabank | 1315 W Indiantown Rd Jupiter, FL 33458 | Full Service B&M | $221,416 |

| Iberiabank | 1327 North Trenton Street Ruston, LA 71270 | Full Service B&M | $218 |

| Iberiabank | 135 West Bay Street Jacksonville, FL 32202 | Full Service B&M | $89,833 |

| Iberiabank | 1409 Oretha Castle Haley Blvd, Ste. A New Orleans, LA 70113 | Full Service Retail | $2,887 |

| Iberiabank | 1410 Rees Street Breaux Bridge, LA 70517 | Full Service B&M | $43,637 |

| Iberiabank | 14150 Coursey Boulevard Baton Rouge, LA 70817 | Full Service B&M | $64,470 |

| Iberiabank | 1420 West Orange Blossom Trail Apopka, FL 32712 | Full Service B&M | $106,002 |

| Iberiabank | 15 West I-65 Service Road North Mobile, AL 36606 | Full Service B&M | $213,096 |

| Iberiabank | 1901 Edgewater Drive Orlando, FL 32804 | Full Service B&M | $45,390 |

| Iberiabank | 150 South Pine Island Road, Suite 100 Plantation, FL 33324 | Full Service B&M | $86,848 |

| Iberiabank | 1501 Alton Road Miami Beach, FL 33139 | Full Service B&M | $105,905 |

| Iberiabank | 1515 Sunset Drive, Suite 12 Coral Gables, FL 33143 | Full Service B&M | $322,829 |

| Iberiabank | 1601 Center Street Deer Park, TX 77536 | Full Service B&M | $93,283 |

| Iberiabank | 1645 Palm Beach Lakes Boulevard West Palm Beach, FL 33401 | Full Service B&M | $191,582 |

| Iberiabank | 1700 East Highland Drive Jonesboro, AR 72401 | Full Service B&M | $178,258 |

| Iberiabank | 171 3rd Street Baton Rouge, LA 70801 | Full Service B&M | $6,992 |

| Iberiabank | 1720 Manhattan Blvd Harvey, LA 70058 | Full Service B&M | $111,163 |

| Iberiabank | 180 Royal Palm Way Palm Beach, FL 33480 | Full Service B&M | $616,510 |

| Iberiabank | 1801 North Military Trail Boca Raton, FL 33431 | Full Service B&M | $101,987 |

| Iberiabank | 1820 Barataria Boulevard Marrero, LA 70072 | Full Service B&M | $97,658 |

| Iberiabank | 18841 Northeast 29th Avenue Aventura, FL 33180 | Full Service B&M | $100,724 |

| Iberiabank | 1905 Pine Ridge Road Naples, FL 34109 | Full Service B&M | $50,183 |

| Iberiabank | 200 East Veterans Memorial Drive Kaplan, LA 70548 | Full Service B&M | $38,115 |

| Iberiabank | 200 Olivia Drive Newport, AR 72112 | Full Service B&M | $40,564 |

| Iberiabank | 200 S. Biscayne Boulevard, Suite 2850 Miami, FL 33131 | Full Service B&M | $130,315 |

| Iberiabank | 200 Scientific Drive Norcross, GA 30092 | Full Service B&M | $99,501 |

| Iberiabank | 200 West Congress Street Lafayette, LA 70501 | Full Service B&M | $104,894 |

| Iberiabank | 200 Westgate Road Lafayette, LA 70506 | Full Service B&M | $73,596 |

| Iberiabank | 2000 Kaliste Saloom Road Lafayette, LA 70508 | Full Service B&M | $1 |

| Iberiabank | 2000 Pga Blvd North Palm Beach, FL 33408 | Full Service B&M | $35,662 |

| Iberiabank | 2000 Pga Blvd. North Palm Beach, FL 33408 | Full Service Cyber Office | $0 |

| Iberiabank | 201 North Franklin Street Tampa, FL 33602 | Full Service B&M | $87,975 |

| Iberiabank | 2025 3rd Avenue N, Ste 100 Birmingham, AL 35203 | Full Service B&M | $21,952 |

| Iberiabank | 2060 Gause Boulevard East Slidell, LA 70461 | Full Service B&M | $53,512 |

| Iberiabank | 2109 Ponce De Leon Boulevard Coral Gables, FL 33134 | Full Service B&M | $566,477 |

| Iberiabank | 2180 Immokalee Road Naples, FL 34110 | Full Service B&M | $59,326 |

| Iberiabank | 2200 West Pinhook Road Lafayette, LA 70508 | Full Service B&M | $1,065,308 |

| Iberiabank | 2221 Johnson Ferry Road Atlanta, GA 30319 | Full Service B&M | $85,574 |

| Iberiabank | 2247 First Street Fort Myers, FL 33919 | Full Service B&M | $120,832 |

| Iberiabank | 22530 Us Highway 98, Suite 100 Fairhope, AL 36532 | Full Service B&M | $89,725 |

| Iberiabank | 2340 Woodcrest Place Birmingham, AL 35209 | Full Service B&M | $382,011 |

| Iberiabank | 2401 Canal Street New Orleans, LA 70119 | Full Service B&M | $19,096 |

| Iberiabank | 2422 East Robinson Springdale, AR 72764 | Full Service B&M | $21,349 |

| Iberiabank | 250 A1a North Ponte Vedra Beach, FL 32082 | Full Service B&M | $42,426 |

| Iberiabank | 2500 Dallas Parkway, Suite 100 Plano, TX 75093 | Full Service B&M | $93,719 |

| Iberiabank | 2504 Poplar Avenue Memphis, TN 38112 | Full Service B&M | $2,859 |

| Iberiabank | 2555 Peachtree Parkway Cumming, GA 30041 | Full Service B&M | $83,506 |

| Iberiabank | 2555 West Holcomb Blvd Houston, TX 77030 | Full Service B&M | $36,541 |

| Iberiabank | 260 Crandon Blvd Key Biscayne, FL 33149 | Full Service B&M | $32,425 |

| Iberiabank | 2601 Moss Street Lafayette, LA 70501 | Full Service B&M | $46,792 |

| Iberiabank | 2602 Johnston Street Lafayette, LA 70503 | Full Service B&M | $84,567 |

| Iberiabank | 2695 Pelham Parkway Pelham, AL 35124 | Full Service B&M | $31,887 |

| Iberiabank | 2702 South Culberhouse Street, Suite U Jonesboro, AR 72401 | Full Service B&M | $32,187 |

| Iberiabank | 2765 John Hawkins Pkwy Hoover, AL 35244 | Full Service B&M | $25,656 |

| Iberiabank | 280 Park Avenue, 29th Floor East New York, NY 10017 | Full Service B&M | $104,656 |

| Iberiabank | 2815 University Parkway Sarasota, FL 34243 | Full Service B&M | $40,618 |

| Iberiabank | 2824 Cahaba Road Birmingham, AL 35223 | Full Service B&M | $55,617 |

| Iberiabank | 284 Sam Houston Jones Parkway Lake Charles, LA 70611 | Full Service B&M | $55,303 |

| Iberiabank | 285 West Esplanade Avenue Kenner, LA 70065 | Full Service B&M | $53,120 |

| Iberiabank | 2900 Ridgelake Drive Metairie, LA 70002 | Full Service B&M | $188,690 |

| Iberiabank | 2901 Ryan Street Lake Charles, LA 70601 | Full Service B&M | $41,634 |

| Iberiabank | 2970 Peachtree Road, Nw, Suite 100 Atlanta, GA 30305 | Full Service B&M | $235,323 |

| Iberiabank | 2987 Clairmont Road, Ne, Suite 150 Atlanta, GA 30329 | Full Service B&M | $74,929 |

| Iberiabank | 3001 Sthwy. 14 Lake Charles, LA 70601 | Full Service B&M | $25,987 |

| Iberiabank | 301 Harrison Avenue New Orleans, LA 70124 | Full Service B&M | $12,843 |

| Iberiabank | 3100 Tampa Road Oldsmar, FL 34677 | Full Service B&M | $33,439 |

| Iberiabank | 3120 Gentilly Blvd New Orleans, LA 70122 | Full Service B&M | $6,052 |

| Iberiabank | 315 E. Robinson Street Orlando, FL 32801 | Full Service Retail | $0 |

| Iberiabank | 320 Texas Street Shreveport, LA 71101 | Full Service B&M | $88,976 |

| Iberiabank | 3275 Nw 87th Avenue Miami, FL 33172 | Full Service B&M | $128,110 |

| Iberiabank | 332 Settlers Trace Lafayette, LA 70508 | Full Service B&M | $164,431 |

| Iberiabank | 3323 17th Street Sarasota, FL 34235 | Full Service B&M | $58,524 |

| Iberiabank | 3351 North Causeway Boulevard Metairie, LA 70002 | Limited, Drive-thru | $0 |

| Iberiabank | 3412 Saint Charles Avenue New Orleans, LA 70115 | Full Service B&M | $86,073 |

| Iberiabank | 3430 Weddington Drive Fayetteville, AR 72704 | Full Service B&M | $25,678 |

| Iberiabank | 35 Ocean Reef Drive, Suite 100 Key Largo, FL 33037 | Full Service B&M | $131,534 |

| Iberiabank | 3555 Perkins Road Baton Rouge, LA 70808 | Full Service B&M | $38,830 |

| Iberiabank | 3625 Cumberland Boulevard, Building Two Atlanta, GA 30339 | Full Service B&M | $412,829 |

| Iberiabank | 370 Grove Park Memphis, TN 38117 | Full Service B&M | $35,417 |

| Iberiabank | 3700 Essen Lane Baton Rouge, LA 70809 | Full Service B&M | $701,217 |

| Iberiabank | 3801 Veterans Memorial Boulevard Metairie, LA 70002 | Full Service B&M | $104,271 |

| Iberiabank | 3810 Richmond Avenue Houston, TX 77027 | Full Service B&M | $998,799 |

| Iberiabank | 3838 Tamiami Trail Naples, FL 34103 | Full Service B&M | $668,639 |

| Iberiabank | 400 Arthur Godfrey Road, Suite 102 Miami Beach, FL 33140 | Full Service B&M | $157,648 |

| Iberiabank | 400 Meridian Street N, Suite 108 Huntsville, AL 35801 | Full Service B&M | $18 |

| Iberiabank | 400 North Vienna Street Ruston, LA 71270 | Full Service B&M | $70,217 |

| Iberiabank | 4010 West Congress Street Lafayette, LA 70506 | Full Service B&M | $49,823 |

| Iberiabank | 4011 Canal Street New Orleans, LA 70119 | Full Service B&M | $22,480 |

| Iberiabank | 403 North Lewis Street New Iberia, LA 70560 | Full Service B&M | $149,114 |

| Iberiabank | 4100 Maplewood Drive Sulphur, LA 70663 | Full Service B&M | $36,170 |

| Iberiabank | 4105 N Himes Avenue Tampa, FL 33607 | Full Service B&M | $56,975 |

| Iberiabank | 420 South Main Street Jonesboro, AR 72401 | Full Service B&M | $47,172 |

| Iberiabank | 428 9th St South Naples, FL 34102 | Full Service B&M | $39,787 |

| Iberiabank | 428 East Landry Street Opelousas, LA 70570 | Full Service B&M | $48,055 |

| Iberiabank | 44 West Flagler Street Miami, FL 33130 | Full Service B&M | $278,371 |

| Iberiabank | 4440 Nelson Road Lake Charles, LA 70605 | Full Service B&M | $570,182 |

| Iberiabank | 4494 Highway 27 South Sulphur, LA 70665 | Full Service B&M | $52,684 |

| Iberiabank | 450 E. Las Olas Boulevard, Ste. 1220 Fort Lauderdale, FL 33301 | Full Service B&M | $144,307 |

| Iberiabank | 4600 Jfk Boulevard North Little Rock, AR 72116 | Full Service B&M | $37,354 |

| Iberiabank | 463 Heymann Boulevard Lafayette, LA 70503 | Full Service B&M | $105,629 |

| Iberiabank | 4670 Summerlin Rd Fort Myers, FL 33919 | Full Service B&M | $77,491 |

| Iberiabank | 468 Metairie Rd Metairie, LA 70005 | Full Service B&M | $66,599 |

| Iberiabank | 4700 Whitesburg Drive Sw, Suite 150 Huntsville, AL 35802 | Full Service B&M | $223,386 |

| Iberiabank | 4894 Poplar Avenue Memphis, TN 38117 | Full Service B&M | $46,040 |

| Iberiabank | 4909 Prytania Street New Orleans, LA 70115 | Full Service B&M | $69,474 |

| Iberiabank | 500 4th Street North Saint Petersburg, FL 33701 | Full Service B&M | $48,340 |

| Iberiabank | 502 North Us Highway 17 92 Longwood, FL 32750 | Full Service B&M | $72,053 |

| Iberiabank | 505 Wekiva Springs Road, Suite 700 Longwood, FL 32779 | Full Service B&M | $40,886 |

| Iberiabank | 5079 Sweetwater Blvd Sugar Land, TX 77479 | Full Service B&M | $30,239 |

| Iberiabank | 5111 Highway 5 North Bryant, AR 72022 | Full Service B&M | $58,217 |

| Iberiabank | 5120 Citrus Boulevard Harahan, LA 70123 | Full Service B&M | $50,502 |

| Iberiabank | 5121 Johnston Street Lafayette, LA 70503 | Full Service B&M | $136,904 |

| Iberiabank | 520 West Highway 436 Altamonte Springs, FL 32714 | Full Service B&M | $99,189 |

| Iberiabank | 5247 Golden Gate Parkway Naples, FL 34116 | Full Service B&M | $12,335 |

| Iberiabank | 53 Hughes Road Madison, AL 35758 | Full Service B&M | $38,057 |

| Iberiabank | 5310 E. State Road 64 Bradenton, FL 34208 | Full Service B&M | $38,559 |

| Iberiabank | 5601 Overseas Highway Marathon, FL 33050 | Full Service B&M | $116,684 |

| Iberiabank | 576 North Parkerson Crowley, LA 70526 | Full Service B&M | $65,497 |

| Iberiabank | 5800 R Street Little Rock, AR 72207 | Full Service B&M | $213,206 |

| Iberiabank | 5844 14th Street, West (U.S. 41) Bradenton, FL 34207 | Full Service B&M | $55,937 |

| Iberiabank | 5901 Miami Lakes Drive East Miami Lakes, FL 33014 | Full Service B&M | $94,867 |

| Iberiabank | 60 North Court Avenue, First Floor Orlando, FL 32801 | Full Service B&M | $168,320 |

| Iberiabank | 600 Wilkinson Street, Ste 100 Orlando, FL 32803 | Full Service B&M | $204,588 |

| Iberiabank | 601 Poydras Street, Suite 100 New Orleans, LA 70130 | Full Service B&M | $1,096,817 |

| Iberiabank | 605 Bald Eagle Drive Marco Island, FL 34145 | Full Service B&M | $91,790 |

| Iberiabank | 605 N Olive Avenue West Palm Beach, FL 33401 | Full Service B&M | $68,705 |

| Iberiabank | 610 Mcmillan Road West Monroe, LA 71291 | Full Service B&M | $90,436 |

| Iberiabank | 612 S. Dale Mabry Hwy Tampa, FL 33609 | Full Service B&M | $62,634 |

| Iberiabank | 613 Montgomery Hwy Vestavia Hills, AL 35216 | Full Service B&M | $65,415 |

| Iberiabank | 6235 S. Claiborne Avenue New Orleans, LA 70125 | Full Service B&M | $40,140 |

| Iberiabank | 6309 S. Claiborne Ave. New Orleans, LA 70125 | Limited, Drive-thru | $0 |

| Iberiabank | 64 North Royal Street Mobile, AL 36602 | Full Service B&M | $140,943 |

| Iberiabank | 6651 Orion Drive Fort Myers, FL 33912 | Full Service B&M | $125,160 |

| Iberiabank | 6985 Fern Loop Shreveport, LA 71105 | Full Service B&M | $70,854 |

| Iberiabank | 70470 Highway 21 Covington, LA 70433 | Full Service B&M | $47,180 |

| Iberiabank | 706 Barrow Street Houma, LA 70360 | Full Service B&M | $52,729 |

| Iberiabank | 706 South Walton Blvd Bentonville, AR 72712 | Full Service B&M | $78,205 |

| Iberiabank | 709 Canton Road Marietta, GA 30060 | Full Service B&M | $79,118 |

| Iberiabank | 7090 County Road 46a Lake Mary, FL 32746 | Full Service B&M | $84,070 |

| Iberiabank | 7325 Highland Road Baton Rouge, LA 70808 | Full Service B&M | $37,511 |

| Iberiabank | 7465 Poplar Avenue Germantown, TN 38138 | Full Service B&M | $185,494 |

| Iberiabank | 7580 Winkler Road Fort Myers, FL 33908 | Full Service B&M | $50,540 |

| Iberiabank | 775 Airport Road North Naples, FL 34104 | Full Service B&M | $68,239 |

| Iberiabank | 777 Pasadena Avenue South Saint Petersburg, FL 33707 | Full Service B&M | $74,779 |

| Iberiabank | 783 South Orange Avenue Sarasota, FL 34236 | Full Service B&M | $213,909 |

| Iberiabank | 7860 Wolf River Parkway Germantown, TN 38138 | Full Service B&M | $43,990 |

| Iberiabank | 8019 Desiard Street Monroe, LA 71203 | Full Service B&M | $42,743 |

| Iberiabank | 804 Green Valley Road, Suite 102 Greensboro, NC 27408 | Full Service B&M | $7,764 |

| Iberiabank | 805 Veterans Drive Carencro, LA 70520 | Full Service B&M | $78,733 |

| Iberiabank | 812 Del Prado Blvd Cape Coral, FL 33990 | Full Service Retail | $77,116 |

| Iberiabank | 8181 S. Tamiami Trail Sarasota, FL 34231 | Full Service B&M | $96,942 |

| Iberiabank | 8201 Preston Road - Suite 200 Dallas, TX 75225 | Full Service B&M | $479,172 |

| Iberiabank | 821 West 49th Street Hialeah, FL 33012 | Full Service B&M | $903,982 |

| Iberiabank | 840 Denning Drive Winter Park, FL 32789 | Full Service B&M | $242,238 |

| Iberiabank | 850 North Causeway Boulevard Mandeville, LA 70448 | Full Service B&M | $60,645 |

| Iberiabank | 8910 West Sam Houston Pkwy North Houston, TX 77040 | Full Service B&M | $24,613 |

| Iberiabank | 900 Se 6th Avenue Delray Beach, FL 33483 | Full Service B&M | $55,046 |

| Iberiabank | 9100 South Dadeland Boulevard Miami, FL 33156 | Full Service B&M | $183,962 |

| Iberiabank | 9101 College Pointe Court Fort Myers, FL 33919 | Full Service B&M | $65,671 |

| Iberiabank | 9132 Strada Place, Ste 11105 Naples, FL 34108 | Full Service B&M | $79,763 |

| Iberiabank | 916 Fifth Avenue Kinder, LA 70648 | Full Service B&M | $42,873 |

| Iberiabank | 918 S Orange Ave Orlando, FL 32806 | Full Service B&M | $124,902 |

| Iberiabank | 9300 Jefferson Highway River Ridge, LA 70123 | Full Service B&M | $57,423 |

For 2019, Iberiabank had 191 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $1,309,958 |

| Net interest income | $995,681 |

| Total noninterest income | $208,722 |

| Gross Fiduciary activities income | $17,058 |

| Service charges on deposit accounts | $51,836 |

| Trading account gains and fees | $6,763 |

| Additional Noninterest Income | $133,065 |

| Pre-tax net operating income | $505,588 |

| Securities gains (or losses, -) | $-907 |

| Income before extraordinary items | $389,643 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $389,643 |

| Minority interest net income | $0 |

| Net income | $389,643 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $390,359 |

Iberiabank's gross interest income from loans was $1,309,958,000.

Iberiabank's net interest income from loans was $995,681,000.

Iberiabank's fee based income from loans was $51,836,000.

Iberiabank's net income from loans was $389,643,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $314,277 |

| Provision for credit losses | $39,850 |

| Total noninterest expense | $658,965 |

| Salaries and employee benefits | $335,622 |

| Premises and equipment expense | $71,726 |

| Additional noninterest expense | $251,617 |

| Applicable income taxes | $115,038 |

| Net charge-offs | $30,546 |

| Cash dividends | $190,000 |

Iberiabank's interest expense for loans was $314,277,000.

Iberiabank's payroll and benefits expense were $335,622,000.

Iberiabank's property, plant and equipment expenses $71,726,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 1.8% |

| Other individual loans | 0.0% |

| Auto loans | 1.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $25,393,033 |

| Deposits held in domestic offices | $25,393,033 |

| Deposits by Individuals, partnerships, and corporations | $23,326,608 |

| Deposits by U.S. Government | $25 |

| Deposits by States and political subdivisions in the U.S. | $2,011,320 |

| Deposits by Commercial banks and other depository institutions in U.S. | $55,080 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $2,524,042 |

| Demand deposits | $1,563,708 |

| Nontransaction accounts | $22,868,991 |

| Money market deposit accounts (MMDAs) | $9,121,284 |

| Other savings deposits (excluding MMDAs) | $9,472,801 |

| Total time deposits | $4,274,906 |

| Total time and savings deposits | $23,829,325 |

| Noninterest-bearing deposits | $6,488,877 |

| Interest-bearing deposits | $18,904,156 |

| Retail deposits | $22,667,335 |

| IRAs and Keogh plan accounts | $255,871 |

| Brokered deposits | $1,281,875 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $31,614,914 |

| Cash & Balances due from depository institutions | $884,124 |

| Interest-bearing balances | $604,139 |

| Total securities | $4,118,269 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $24,090,839 |

| Loan and leases loss allowance | $146,588 |

| Trading account assets | $104,151 |

| Bank premises and fixed assets | $409,223 |

| Other real estate owned | $27,985 |

| Goodwill and other intangibles | $1,288,324 |

| All other assets | $691,999 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $31,614,914 |

| Total Liabilities | $27,367,311 |

| Total deposits | $25,393,033 |

| Interest-bearing deposits | $18,904,156 |

| Deposits held in domestic offices | $25,393,033 |

| % insured (estimated) | $47 |

| Federal funds purchased and repurchase agreements | $204,208 |

| Trading liabilities | $11,799 |

| Other borrowed funds | $1,225,237 |

| Subordinated debt | $0 |

| All other liabilities | $533,034 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $24,090,839 |

| Loan and leases loss allowance | $146,588 |

| Total loans and leases (domestic) | $24,237,427 |

| All real estate loans | $17,100,673 |

| Real estate loans in domestic offices | $17,100,673 |

| Construction and development loans | $1,535,675 |

| Residential 1-4 family construction | $242,039 |

| Other construction, all land development and other land | $1,293,636 |

| Loans secured by nonfarm nonresidential properties | $7,034,266 |

| Nonfarm nonresidential secured by owner-occupied properties | $2,560,540 |

| Commercial real estate & other non-farm, non-residential | $4,473,726 |

| Multifamily residential real estate | $1,215,484 |

| 1-4 family residential loans | $7,277,417 |

| Farmland loans | $37,831 |

| Loans held in foreign offices | $0 |

| Farm loans | $39,005 |

| Commercial and industrial loans | $5,211,934 |

| To non-U.S. addressees | $554 |

| Loans to individuals | $568,535 |

| Credit card loans | $33,173 |

| Related Plans | $162,844 |

| Consumer Auto Loans | $15,052 |

| Other loans to individuals | $357,466 |

| All other loans & leases | $1,317,280 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $459,357 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $231,661 |

| Loans secured by real estate to non-U.S. addressees | $170,570 |

| Restructured Loans & leases | $62,064 |

| Non 1-4 family restructured loans & leases | $32,894 |

| Total loans and leases (foreign) | $0 |

Iberiabank had $24,090,839,000 of loans outstanding in 2019. $17,100,673,000 of loans were in real estate loans. $1,535,675,000 of loans were in development loans. $1,215,484,000 of loans were in multifamily mortgage loans. $7,277,417,000 of loans were in 1-4 family mortgage loans. $39,005,000 of loans were in farm loans. $33,173,000 of loans were in credit card loans. $15,052,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 2,885 | $865,868 | $300,128 |

| Nonfarm, nonresidential loans - <$100k | 235 | $11,413 | $48,566 |

| Nonfarm, nonresidential loans - $100-250k | 785 | $95,798 | $122,036 |

| Nonfarm, nonresidential loans - $250k-1MM | 1,865 | $758,657 | $406,787 |

| Commercial & Industrial, US addressed loans - <$1MM | 12,504 | $693,890 | $55,493 |

| Commercial & Industrial, US addressed loans - <$100k | 9,334 | $164,009 | $17,571 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,548 | $130,969 | $84,605 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,622 | $398,912 | $245,938 |

| Farmland loans - <$1MM | 36 | $7,078 | $196,611 |

| Farmland loans - <$100k | 8 | $354 | $44,250 |

| Farmland loans - $100-250k | 11 | $1,467 | $133,364 |

| Farmland loans - $250k-1MM | 17 | $5,257 | $309,235 |

| Agriculture operations loans - <$1MM | 170 | $10,512 | $61,835 |

| Agriculture operations loans - <$100k | 97 | $2,020 | $20,825 |

| Agriculture operations loans - $100-250k | 45 | $3,948 | $87,733 |

| Agriculture operations loans - $250k-1MM | 28 | $4,544 | $162,286 |