Renasant Bank Mortgage Rates, Fees & Info

Tupelo, MSLEI: 5493002RF1ERFA2XR050

Tax ID: 64-0220550

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Bank Data

Review & Overview

Renasant Bank is a mid-sized bank specializing in Home Purchase and Refi loans. Renasant Bank has a high proportion of conventional loans. They have an average proportion of FHA loans. They have a low ratio of USDA loans. Their top markets by origination volume include: Atlanta, Birmingham, Nashville, Jackson, and Memphis among others. We have data for 308 markets. (Some data included below & more in-depth data is available with an active subscription.)Renasant Bank has an above average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Renasant Bank is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

SimulatedRates™Mortgage Type |

Simulated Rate | Simulation Date |

|---|---|---|

| Home Equity Line of Credit (HELOC) | 6.72% | 8/3/25 |

| 30 Year Conventional Purchase | 6.75% | 8/3/25 |

| 30 Year Conventional Refi | 6.88% | 8/3/25 |

| 30 Year Cash-out Refi | 7.11% | 8/3/25 |

| 30 Year FHA Purchase | 7.18% | 8/3/25 |

| 30 Year FHA Refi | 7.18% | 8/3/25 |

| 30 Year VA Purchase | 6.41% | 8/3/25 |

| 30 Year VA Refi | 6.18% | 8/3/25 |

| 30 Year USDA Purchase | 7.02% | 8/3/25 |

| 30 Year USDA Refi | 6.91% | 8/3/25 |

| 15 Year Conventional Purchase | 5.20% | 8/3/25 |

| 15 Year Conventional Refi | 6.56% | 8/3/25 |

| 15 Year Cash-out Refi | 6.56% | 8/3/25 |

| 15 Year FHA Purchase | 6.82% | 8/3/25 |

| 15 Year VA Purchase | 6.42% | 8/3/25 |

| These are simulated rates generated by our proprietary machine learning models. These are not guaranteed by the bank. They are our estimates based on a lender's past behaviors combined with current market conditions. Contact an individual lender for their actual rates. Our models use fixed rate terms for conforming loans, 700+ FICO, 10% down for FHA and 20% for conventional. These are based on consensus, historical data-- not advertised promotional rates. | ||

Renasant Bank Mortgage Calculator

Your Estimates

Estimated Loan Payment: Update the calculator values and click calculate payment!

This is not an official calculator from Renasant Bank. It uses our SimulatedRate™

technology, basic math and reasonable assumptions to calculate mortgage payments derived from our simulations and your inputs.

The default purchase price is the median sales price across the US for 2022Q4, per FRED.

Originations

15,393Origination Dollar Volume (All Markets)

$3,201,105,000Employee count

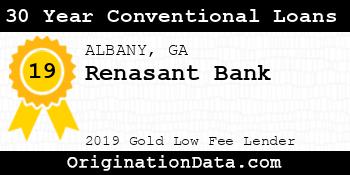

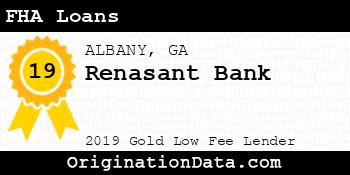

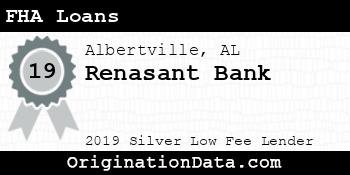

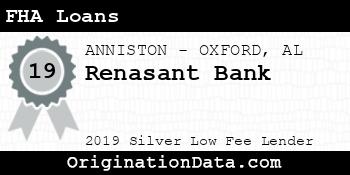

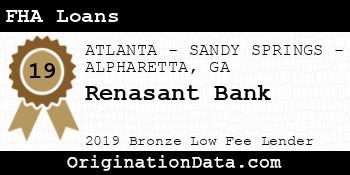

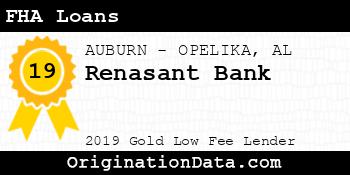

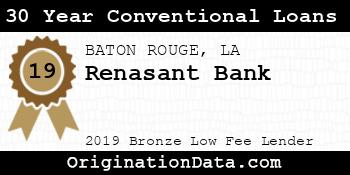

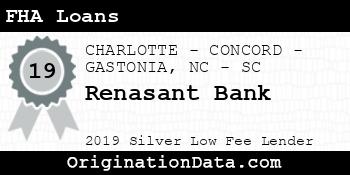

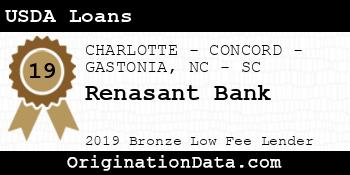

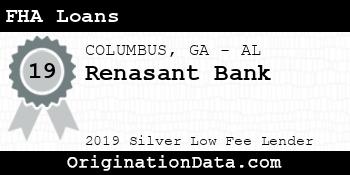

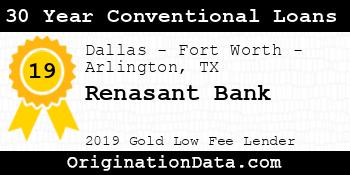

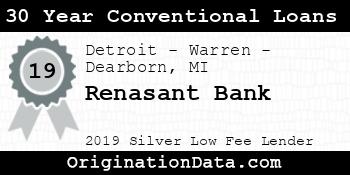

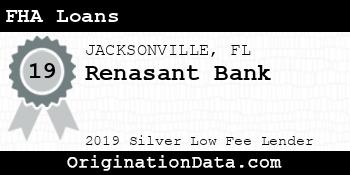

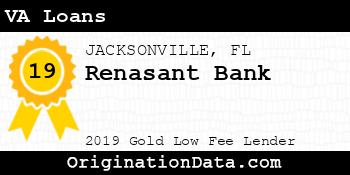

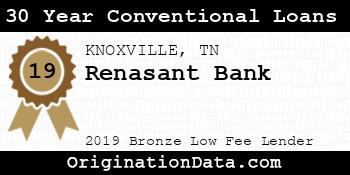

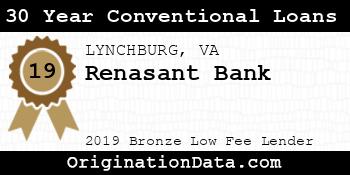

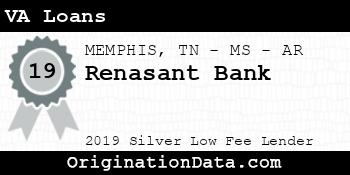

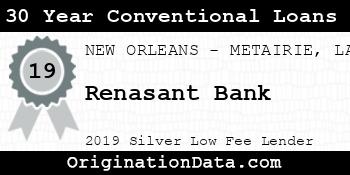

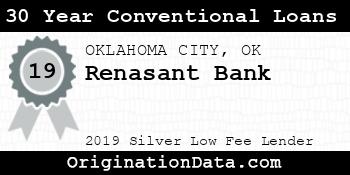

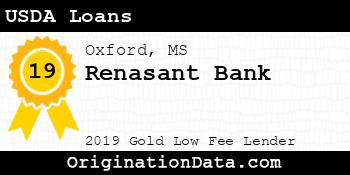

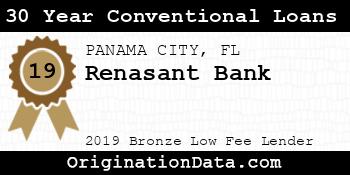

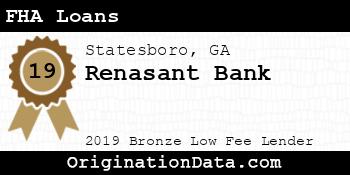

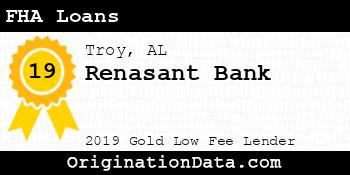

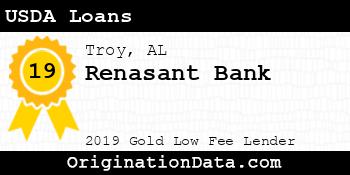

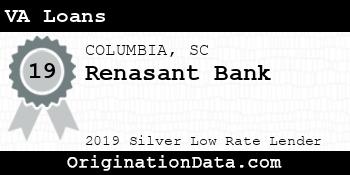

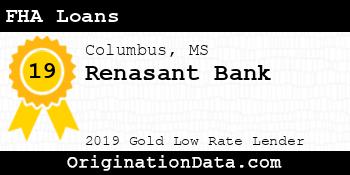

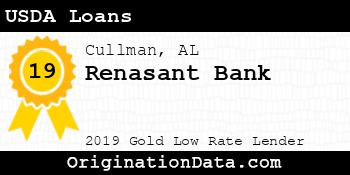

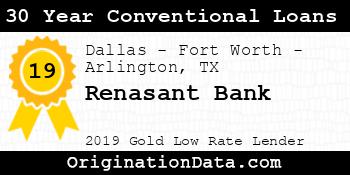

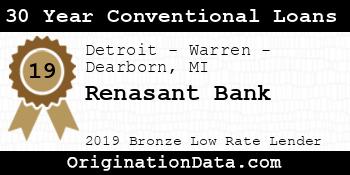

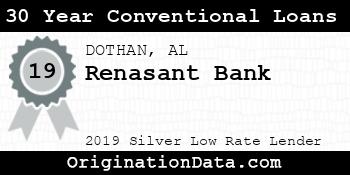

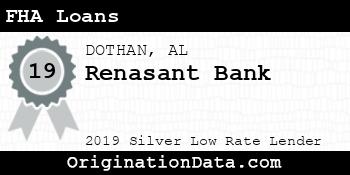

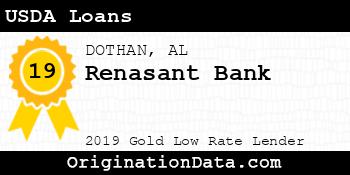

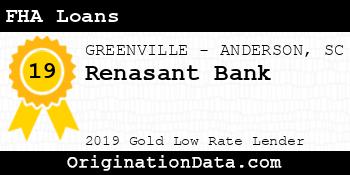

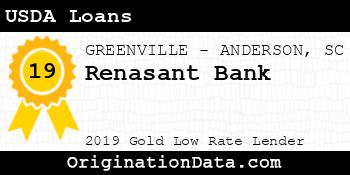

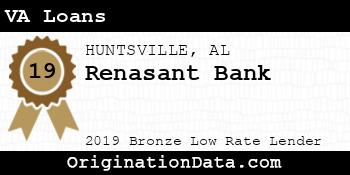

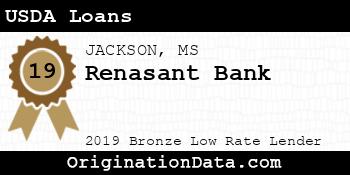

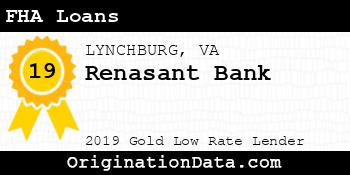

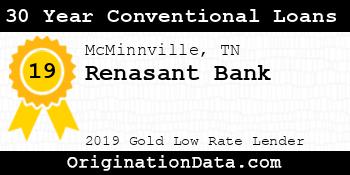

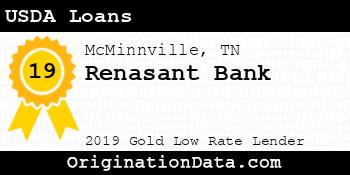

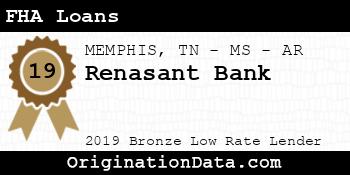

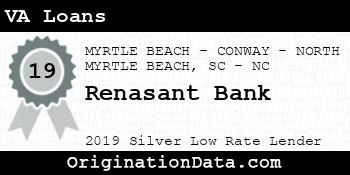

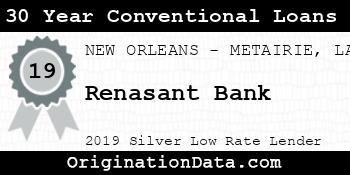

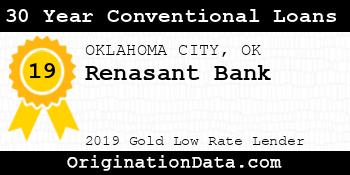

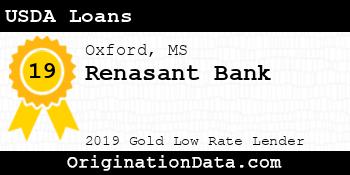

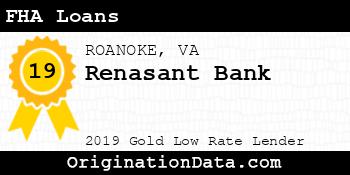

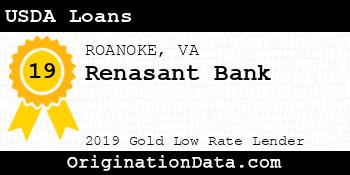

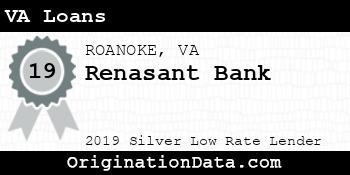

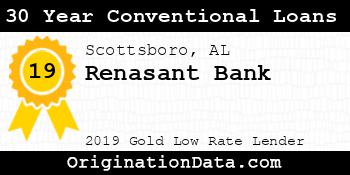

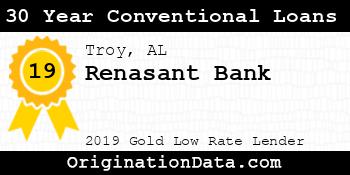

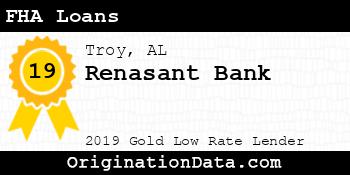

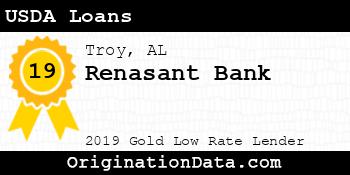

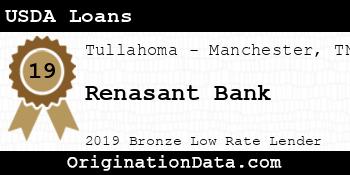

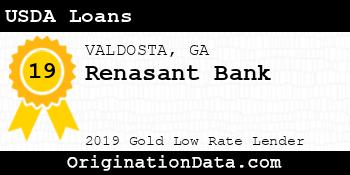

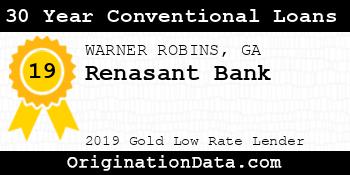

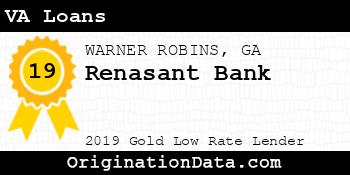

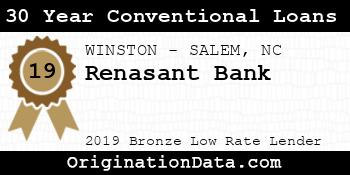

2,527 Show all (104) awardsRenasant Bank - 2019

Renasant Bank is a 2019 , due to their low .

For 2019, less than of lenders were eligible for this award.

Work for Renasant Bank?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 1,271 | $346,195,000 | $272,380 | $4,522 | 4.54% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 994 | $243,190,000 | $244,658 | $3,896 | 4.28% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 783 | $200,445,000 | $255,996 | $3,885 | 4.95% |

| JACKSON, MS (FHA|USDA|VA) | 838 | $169,460,000 | $202,220 | $3,764 | 4.66% |

| Outside of Metro Areas | 1,325 | $167,625,000 | $126,509 | $3,704 | 4.71% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 724 | $147,770,000 | $204,102 | $3,640 | 4.75% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 346 | $122,250,000 | $353,324 | $4,143 | 4.16% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 301 | $114,565,000 | $380,615 | $5,557 | 4.37% |

| AUBURN-OPELIKA, AL (FHA|USDA|VA) | 343 | $86,005,000 | $250,743 | $3,457 | 4.21% |

| Tupelo, MS (FHA|USDA|VA) | 696 | $85,470,000 | $122,802 | $3,096 | 4.92% |

| Oxford, MS (FHA|USDA|VA) | 250 | $77,270,000 | $309,080 | $4,142 | 4.71% |

| MONTGOMERY, AL (FHA|USDA|VA) | 277 | $55,795,000 | $201,426 | $3,901 | 4.23% |

| DOTHAN, AL (FHA|USDA|VA) | 268 | $53,290,000 | $198,843 | $3,695 | 4.11% |

| ROANOKE, VA (FHA|USDA|VA) | 225 | $44,605,000 | $198,244 | $4,340 | 3.94% |

| LYNCHBURG, VA (FHA|USDA|VA) | 222 | $42,810,000 | $192,838 | $3,764 | 4.06% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 178 | $39,840,000 | $223,820 | $3,752 | 4.43% |

| SAVANNAH, GA (FHA|USDA|VA) | 190 | $38,490,000 | $202,579 | $4,659 | 4.56% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 185 | $37,195,000 | $201,054 | $4,155 | 3.84% |

| PANAMA CITY, FL (FHA|USDA|VA) | 187 | $37,035,000 | $198,048 | $3,807 | 4.47% |

| COLUMBUS, GA-AL (FHA|USDA|VA) | 214 | $35,740,000 | $167,009 | $3,584 | 4.12% |

| TUSCALOOSA, AL (FHA|USDA|VA) | 156 | $34,140,000 | $218,846 | $4,244 | 4.32% |

| Starkville, MS (FHA|USDA|VA) | 156 | $29,420,000 | $188,590 | $4,101 | 4.87% |

| MACON-BIBB COUNTY, GA (FHA|USDA|VA) | 160 | $29,150,000 | $182,188 | $4,094 | 4.62% |

| MOBILE, AL (FHA|USDA|VA) | 154 | $28,930,000 | $187,857 | $3,553 | 4.26% |

| DECATUR, AL (FHA|USDA|VA) | 197 | $28,795,000 | $146,168 | $3,774 | 4.65% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 133 | $28,085,000 | $211,165 | $5,604 | 3.71% |

| KNOXVILLE, TN (FHA|USDA|VA) | 131 | $26,305,000 | $200,802 | $3,826 | 4.80% |

| VALDOSTA, GA (FHA|USDA|VA) | 151 | $25,165,000 | $166,656 | $4,455 | 4.54% |

| Columbus, MS (FHA|USDA|VA) | 133 | $21,965,000 | $165,150 | $4,237 | 4.62% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 86 | $21,890,000 | $254,535 | $3,502 | 4.22% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 103 | $21,345,000 | $207,233 | $4,801 | 4.09% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 100 | $21,100,000 | $211,000 | $4,150 | 4.00% |

| RALEIGH-CARY, NC (FHA|USDA|VA) | 67 | $18,755,000 | $279,925 | $4,069 | 3.91% |

| Enterprise, AL (FHA|USDA|VA) | 95 | $18,215,000 | $191,737 | $3,928 | 4.03% |

| ALBANY, GA (FHA|USDA|VA) | 202 | $17,810,000 | $88,168 | $3,189 | 5.31% |

| GADSDEN, AL (FHA|USDA|VA) | 116 | $17,180,000 | $148,103 | $4,079 | 3.99% |

| SPARTANBURG, SC (FHA|USDA|VA) | 95 | $17,175,000 | $180,789 | $6,571 | 3.89% |

| FLORENCE-MUSCLE SHOALS, AL (FHA|USDA|VA) | 89 | $15,795,000 | $177,472 | $3,501 | 4.14% |

| Cullman, AL (FHA|USDA|VA) | 82 | $15,480,000 | $188,780 | $4,694 | 4.10% |

| Albertville, AL (FHA|USDA|VA) | 92 | $14,840,000 | $161,304 | $4,034 | 4.12% |

| Troy, AL (FHA|USDA|VA) | 78 | $14,570,000 | $186,795 | $4,847 | 3.85% |

| Corinth, MS (FHA|USDA|VA) | 106 | $14,120,000 | $133,208 | $3,242 | 5.06% |

| Statesboro, GA (FHA|USDA|VA) | 98 | $13,910,000 | $141,939 | $4,364 | 5.02% |

| Thomasville, GA (FHA|USDA|VA) | 58 | $13,490,000 | $232,586 | $4,785 | 3.69% |

| COLUMBIA, SC (FHA|USDA|VA) | 71 | $13,445,000 | $189,366 | $5,289 | 3.84% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 67 | $12,365,000 | $184,552 | $3,808 | 4.29% |

| ANNISTON-OXFORD, AL (FHA|USDA|VA) | 71 | $11,745,000 | $165,423 | $4,592 | 4.45% |

| Scottsboro, AL (FHA|USDA|VA) | 62 | $11,450,000 | $184,677 | $3,711 | 4.03% |

| Alexander City, AL (FHA|USDA|VA) | 34 | $11,140,000 | $327,647 | $4,408 | 4.03% |

| WARNER ROBINS, GA (FHA|USDA|VA) | 49 | $10,895,000 | $222,347 | $4,291 | 3.84% |

| WILMINGTON, NC (FHA|USDA|VA) | 32 | $10,790,000 | $337,188 | $4,768 | 4.05% |

| BRUNSWICK, GA (FHA|USDA|VA) | 32 | $10,510,000 | $328,438 | $5,830 | 4.23% |

| Grenada, MS (FHA|USDA|VA) | 117 | $10,505,000 | $89,786 | $2,892 | 5.41% |

| Ozark, AL (FHA|USDA|VA) | 49 | $10,485,000 | $213,980 | $4,276 | 4.19% |

| CHARLOTTESVILLE, VA (FHA|USDA|VA) | 31 | $10,225,000 | $329,839 | $5,394 | 3.93% |

| LaGrange, GA-AL (FHA|USDA|VA) | 82 | $10,200,000 | $124,390 | $3,007 | 4.67% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 38 | $10,180,000 | $267,895 | $7,067 | 4.11% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 44 | $9,880,000 | $224,545 | $3,296 | 3.72% |

| Fort Payne, AL (FHA|USDA|VA) | 52 | $8,670,000 | $166,731 | $4,103 | 4.14% |

| BLACKSBURG-CHRISTIANSBURG, VA (FHA|USDA|VA) | 39 | $8,625,000 | $221,154 | $4,341 | 4.08% |

| Tullahoma-Manchester, TN (FHA|USDA|VA) | 46 | $8,500,000 | $184,783 | $4,360 | 4.34% |

| KINGSPORT-BRISTOL, TN-VA (FHA|USDA|VA) | 50 | $8,040,000 | $160,800 | $3,953 | 5.25% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 41 | $7,405,000 | $180,610 | $3,482 | 4.06% |

| Bozeman, MT (FHA|USDA|VA) | 25 | $7,305,000 | $292,200 | $6,117 | 4.13% |

| McMinnville, TN (FHA|USDA|VA) | 41 | $6,985,000 | $170,366 | $4,248 | 3.92% |

| GREENVILLE, NC (FHA|USDA|VA) | 30 | $6,950,000 | $231,667 | $3,784 | 4.02% |

| BATON ROUGE, LA (FHA|USDA|VA) | 27 | $6,825,000 | $252,778 | $4,027 | 3.89% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 25 | $6,645,000 | $265,800 | $3,903 | 3.73% |

| LEXINGTON-FAYETTE, KY (FHA|USDA|VA) | 31 | $6,295,000 | $203,065 | $3,097 | 3.91% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 18 | $6,210,000 | $345,000 | $6,096 | 3.80% |

| JOHNSON CITY, TN (FHA|USDA|VA) | 54 | $6,110,000 | $113,148 | $3,393 | 5.46% |

| GAINESVILLE, FL (FHA|USDA|VA) | 32 | $6,030,000 | $188,438 | $3,608 | 4.89% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 19 | $5,995,000 | $315,526 | $3,700 | 3.83% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 26 | $5,970,000 | $229,615 | $3,997 | 4.18% |

| Talladega-Sylacauga, AL (FHA|USDA|VA) | 31 | $5,555,000 | $179,194 | $4,264 | 4.48% |

| Douglas, GA (FHA|USDA|VA) | 46 | $5,540,000 | $120,435 | $4,097 | 3.95% |

| GAINESVILLE, GA (FHA|USDA|VA) | 20 | $5,270,000 | $263,500 | $4,641 | 4.43% |

| West Point, MS (FHA|USDA|VA) | 35 | $4,755,000 | $135,857 | $3,647 | 5.54% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 21 | $4,625,000 | $220,238 | $4,233 | 4.11% |

| Dublin, GA (FHA|USDA|VA) | 31 | $4,555,000 | $146,935 | $3,895 | 3.90% |

| Cookeville, TN (FHA|USDA|VA) | 25 | $4,185,000 | $167,400 | $4,120 | 4.40% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 7 | $4,125,000 | $589,286 | $9,037 | 4.21% |

| London, KY (FHA|USDA|VA) | 25 | $4,105,000 | $164,200 | $2,892 | 3.97% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 14 | $4,050,000 | $289,286 | $4,204 | 4.32% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 15 | $3,955,000 | $263,667 | $6,634 | 4.10% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 17 | $3,895,000 | $229,118 | $2,820 | 3.85% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 18 | $3,860,000 | $214,444 | $2,575 | 3.79% |

| HARRISONBURG, VA (FHA|USDA|VA) | 13 | $3,795,000 | $291,923 | $5,504 | 3.71% |

| Eufaula, AL-GA (FHA|USDA|VA) | 26 | $3,680,000 | $141,538 | $3,605 | 4.14% |

| HATTIESBURG, MS (FHA|USDA|VA) | 21 | $3,655,000 | $174,048 | $4,328 | 4.34% |

| JACKSONVILLE, NC (FHA|USDA|VA) | 18 | $3,620,000 | $201,111 | $3,028 | 4.41% |

| Richmond-Berea, KY (FHA|USDA|VA) | 18 | $3,610,000 | $200,556 | $3,308 | 3.92% |

| ASHEVILLE, NC (FHA|USDA|VA) | 15 | $3,595,000 | $239,667 | $4,376 | 3.83% |

| LAS VEGAS-HENDERSON-PARADISE, NV (FHA|USDA|VA) | 11 | $3,515,000 | $319,545 | $3,351 | 3.91% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 14 | $3,480,000 | $248,571 | $3,601 | 4.02% |

| Cleveland, MS (FHA|USDA|VA) | 24 | $3,480,000 | $145,000 | $3,029 | 4.95% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 16 | $3,470,000 | $216,875 | $4,381 | 3.49% |

| RICHMOND, VA (FHA|USDA|VA) | 16 | $3,340,000 | $208,750 | $4,451 | 3.97% |

| Calhoun, GA (FHA|USDA|VA) | 22 | $3,320,000 | $150,909 | $4,892 | 4.31% |

| SALT LAKE CITY, UT (FHA|USDA|VA) | 9 | $3,065,000 | $340,556 | $3,154 | 3.51% |

| Seneca, SC (FHA|USDA|VA) | 14 | $3,050,000 | $217,857 | $5,333 | 3.85% |

| Natchitoches, LA (FHA|USDA|VA) | 17 | $3,045,000 | $179,118 | $5,051 | 3.77% |

| Brookhaven, MS (FHA|USDA|VA) | 18 | $3,020,000 | $167,778 | $2,900 | 4.37% |

| Morehead City, NC (FHA|USDA|VA) | 11 | $2,925,000 | $265,909 | $3,933 | 4.18% |

| OKLAHOMA CITY, OK (FHA|USDA|VA) | 14 | $2,910,000 | $207,857 | $3,520 | 3.95% |

| Dayton, TN (FHA|USDA|VA) | 13 | $2,905,000 | $223,462 | $4,061 | 3.75% |

| GULFPORT-BILOXI, MS (FHA|USDA|VA) | 16 | $2,830,000 | $176,875 | $4,405 | 3.76% |

| CINCINNATI, OH-KY-IN (FHA|USDA|VA) | 9 | $2,825,000 | $313,889 | $3,924 | 3.42% |

| Meridian, MS (FHA|USDA|VA) | 17 | $2,775,000 | $163,235 | $4,134 | 4.69% |

| COLORADO SPRINGS, CO (FHA|USDA|VA) | 8 | $2,710,000 | $338,750 | $3,124 | 3.83% |

| RENO, NV (FHA|USDA|VA) | 8 | $2,650,000 | $331,250 | $3,630 | 3.83% |

| Jefferson, GA (FHA|USDA|VA) | 14 | $2,640,000 | $188,571 | $4,194 | 4.22% |

| JACKSON, TN (FHA|USDA|VA) | 17 | $2,605,000 | $153,235 | $2,742 | 4.68% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 11 | $2,535,000 | $230,455 | $3,142 | 3.99% |

| CLEVELAND-ELYRIA, OH (FHA|USDA|VA) | 9 | $2,535,000 | $281,667 | $3,133 | 3.75% |

| MINNEAPOLIS-ST. PAUL-BLOOMINGTON, MN-WI (FHA|USDA|VA) | 8 | $2,450,000 | $306,250 | $3,096 | 3.47% |

| Lawrenceburg, TN (FHA|USDA|VA) | 17 | $2,415,000 | $142,059 | $4,045 | 4.35% |

| OCALA, FL (FHA|USDA|VA) | 17 | $2,395,000 | $140,882 | $2,876 | 4.67% |

| Vidalia, GA (FHA|USDA|VA) | 17 | $2,255,000 | $132,647 | $3,691 | 4.30% |

| ATHENS-CLARKE COUNTY, GA (FHA|USDA|VA) | 12 | $2,180,000 | $181,667 | $4,549 | 4.27% |

| Greenwood, MS (FHA|USDA|VA) | 17 | $2,165,000 | $127,353 | $3,635 | 4.74% |

| Bainbridge, GA (FHA|USDA|VA) | 13 | $2,165,000 | $166,538 | $4,929 | 4.05% |

| VIRGINIA BEACH-NORFOLK-NEWPORT NEWS, VA-NC (FHA|USDA|VA) | 8 | $2,140,000 | $267,500 | $4,475 | 4.00% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 8 | $2,130,000 | $266,250 | $4,811 | 3.77% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 9 | $2,095,000 | $232,778 | $4,568 | 4.10% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 7 | $2,085,000 | $297,857 | $4,695 | 4.00% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 7 | $2,065,000 | $295,000 | $2,648 | 3.46% |

| Pinehurst-Southern Pines, NC (FHA|USDA|VA) | 7 | $2,055,000 | $293,571 | $5,670 | 3.80% |

| LOUISVILLE, KY (FHA|USDA|VA) | 7 | $2,055,000 | $293,571 | $5,014 | 3.80% |

| Somerset, KY (FHA|USDA|VA) | 12 | $2,050,000 | $170,833 | $3,295 | 3.95% |

| Cullowhee, NC (FHA|USDA|VA) | 6 | $2,040,000 | $340,000 | $4,646 | 3.96% |

| BOWLING GREEN, KY (FHA|USDA|VA) | 9 | $2,005,000 | $222,778 | $2,929 | 4.01% |

| Danville, VA (FHA|USDA|VA) | 11 | $1,925,000 | $175,000 | $3,700 | 4.13% |

| SANTA FE, NM (FHA|USDA|VA) | 6 | $1,910,000 | $318,333 | $3,087 | 3.79% |

| INDIANAPOLIS-CARMEL-ANDERSON, IN (FHA|USDA|VA) | 9 | $1,805,000 | $200,556 | $2,834 | 3.61% |

| Cornelia, GA (FHA|USDA|VA) | 9 | $1,785,000 | $198,333 | $4,229 | 3.87% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 8 | $1,720,000 | $215,000 | $5,542 | 3.84% |

| PROVO-OREM, UT (FHA|USDA|VA) | 5 | $1,625,000 | $325,000 | $5,252 | 3.65% |

| Lewisburg, TN (FHA|USDA|VA) | 10 | $1,620,000 | $162,000 | $5,742 | 4.88% |

| Elizabeth City, NC (FHA|USDA|VA) | 8 | $1,600,000 | $200,000 | $4,119 | 4.08% |

| AUSTIN-ROUND ROCK-GEORGETOWN, TX (FHA|USDA|VA) | 6 | $1,550,000 | $258,333 | $3,544 | 3.87% |

| Jasper, AL (FHA|USDA|VA) | 9 | $1,545,000 | $171,667 | $4,562 | 4.32% |

| NEW BERN, NC (FHA|USDA|VA) | 5 | $1,475,000 | $295,000 | $3,523 | 4.43% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 5 | $1,455,000 | $291,000 | $3,393 | 3.70% |

| COLUMBUS, OH (FHA|USDA|VA) | 6 | $1,430,000 | $238,333 | $2,955 | 3.96% |

| CLEVELAND, TN (FHA|USDA|VA) | 7 | $1,395,000 | $199,286 | $3,961 | 3.98% |

| Lake City, FL (FHA|USDA|VA) | 8 | $1,370,000 | $171,250 | $4,480 | 5.12% |

| ALBUQUERQUE, NM (FHA|USDA|VA) | 6 | $1,350,000 | $225,000 | $3,497 | 3.79% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 3 | $1,315,000 | $438,333 | $6,372 | 4.33% |

| Georgetown, SC (FHA|USDA|VA) | 7 | $1,295,000 | $185,000 | $4,397 | 4.04% |

| LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR (FHA|USDA|VA) | 6 | $1,270,000 | $211,667 | $2,931 | 3.75% |

| Sevierville, TN (FHA|USDA|VA) | 4 | $1,270,000 | $317,500 | $3,060 | 4.84% |

| Cedartown, GA (FHA|USDA|VA) | 9 | $1,235,000 | $137,222 | $3,840 | 4.25% |

| STAUNTON, VA (FHA|USDA|VA) | 6 | $1,230,000 | $205,000 | $4,083 | 4.02% |

| OMAHA-COUNCIL BLUFFS, NE-IA (FHA|USDA|VA) | 6 | $1,200,000 | $200,000 | $2,951 | 3.56% |

| Tifton, GA (FHA|USDA|VA) | 6 | $1,180,000 | $196,667 | $5,200 | 4.33% |

| Crossville, TN (FHA|USDA|VA) | 7 | $1,135,000 | $162,143 | $3,566 | 4.18% |

| Moultrie, GA (FHA|USDA|VA) | 9 | $1,125,000 | $125,000 | $3,107 | 4.35% |

| BOULDER, CO (FHA|USDA|VA) | 2 | $1,080,000 | $540,000 | $4,527 | 3.69% |

| THE VILLAGES, FL (FHA|USDA|VA) | 5 | $1,075,000 | $215,000 | $1,986 | 4.65% |

| FLORENCE, SC (FHA|USDA|VA) | 6 | $1,060,000 | $176,667 | $4,944 | 3.69% |

| ROME, GA (FHA|USDA|VA) | 7 | $1,055,000 | $150,714 | $3,397 | 4.43% |

| Lumberton, NC (FHA|USDA|VA) | 3 | $1,015,000 | $338,333 | $4,055 | 4.42% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 6 | $970,000 | $161,667 | $2,866 | 3.94% |

| BOISE CITY, ID (FHA|USDA|VA) | 4 | $940,000 | $235,000 | $3,313 | 3.75% |

| LAFAYETTE, LA (FHA|USDA|VA) | 5 | $915,000 | $183,000 | $3,852 | 3.40% |

| FORT COLLINS, CO (FHA|USDA|VA) | 3 | $895,000 | $298,333 | $3,111 | 3.54% |

| OGDEN-CLEARFIELD, UT (FHA|USDA|VA) | 3 | $885,000 | $295,000 | $2,339 | 3.58% |

| FLAGSTAFF, AZ (FHA|USDA|VA) | 3 | $875,000 | $291,667 | $3,423 | 3.50% |

| Gaffney, SC (FHA|USDA|VA) | 6 | $860,000 | $143,333 | $5,253 | 3.56% |

| Washington, NC (FHA|USDA|VA) | 4 | $830,000 | $207,500 | $3,444 | 4.28% |

| GOLDSBORO, NC (FHA|USDA|VA) | 4 | $830,000 | $207,500 | $4,619 | 4.28% |

| Palatka, FL (FHA|USDA|VA) | 5 | $815,000 | $163,000 | $3,922 | 4.45% |

| Batesville, AR (FHA|USDA|VA) | 7 | $815,000 | $116,429 | $4,660 | 3.96% |

| Greeneville, TN (FHA|USDA|VA) | 6 | $810,000 | $135,000 | $3,519 | 5.00% |

| Key West, FL (FHA|USDA|VA) | 2 | $790,000 | $395,000 | $7,113 | 4.19% |

| Boone, NC (FHA|USDA|VA) | 3 | $785,000 | $261,667 | $5,663 | 4.08% |

| Bluefield, WV-VA (FHA|USDA|VA) | 7 | $785,000 | $112,143 | $2,760 | 4.21% |

| Milledgeville, GA (FHA|USDA|VA) | 4 | $780,000 | $195,000 | $4,255 | 3.81% |

| MISSOULA, MT (FHA|USDA|VA) | 2 | $760,000 | $380,000 | $3,629 | 3.50% |

| Los Alamos, NM (FHA|USDA|VA) | 3 | $745,000 | $248,333 | $3,520 | 3.66% |

| Murray, KY (FHA|USDA|VA) | 2 | $730,000 | $365,000 | $3,669 | 3.56% |

| Shelbyville, TN (FHA|USDA|VA) | 4 | $720,000 | $180,000 | $2,508 | 5.09% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 3 | $715,000 | $238,333 | $4,192 | 3.38% |

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 1 | $715,000 | $715,000 | $22,554 | 3.25% |

| Fitzgerald, GA (FHA|USDA|VA) | 6 | $690,000 | $115,000 | $5,040 | 4.52% |

| SUMTER, SC (FHA|USDA|VA) | 4 | $660,000 | $165,000 | $3,639 | 3.72% |

| Union City, TN (FHA|USDA|VA) | 5 | $655,000 | $131,000 | $2,587 | 4.00% |

| Hailey, ID (FHA|USDA|VA) | 2 | $650,000 | $325,000 | $3,830 | 3.93% |

| AKRON, OH (FHA|USDA|VA) | 2 | $640,000 | $320,000 | $2,528 | 4.06% |

| FAYETTEVILLE-SPRINGDALE-ROGERS, AR (FHA|USDA|VA) | 3 | $635,000 | $211,667 | $3,439 | 3.79% |

| Athens, TN (FHA|USDA|VA) | 4 | $630,000 | $157,500 | $4,000 | 3.84% |

| Brevard, NC (FHA|USDA|VA) | 2 | $630,000 | $315,000 | $3,231 | 3.56% |

| Pahrump, NV (FHA|USDA|VA) | 3 | $615,000 | $205,000 | $3,096 | 4.04% |

| Toccoa, GA (FHA|USDA|VA) | 5 | $605,000 | $121,000 | $3,740 | 3.58% |

| HINESVILLE, GA (FHA|USDA|VA) | 4 | $600,000 | $150,000 | $1,596 | 4.84% |

| Vicksburg, MS (FHA|USDA|VA) | 4 | $590,000 | $147,500 | $2,393 | 4.88% |

| HUNTINGTON-ASHLAND, WV-KY-OH (FHA|USDA|VA) | 3 | $585,000 | $195,000 | $3,208 | 4.13% |

| Mount Airy, NC (FHA|USDA|VA) | 5 | $575,000 | $115,000 | $4,126 | 3.63% |

| BURLINGTON, NC (FHA|USDA|VA) | 3 | $565,000 | $188,333 | $3,305 | 3.83% |

| Paducah, KY-IL (FHA|USDA|VA) | 3 | $565,000 | $188,333 | $2,912 | 3.67% |

| TUCSON, AZ (FHA|USDA|VA) | 3 | $545,000 | $181,667 | $2,866 | 3.67% |

| Henderson, NC (FHA|USDA|VA) | 2 | $530,000 | $265,000 | $4,335 | 4.69% |

| Selma, AL (FHA|USDA|VA) | 2 | $520,000 | $260,000 | $5,595 | 3.63% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 3 | $515,000 | $171,667 | $4,469 | 3.96% |

| LINCOLN, NE (FHA|USDA|VA) | 3 | $505,000 | $168,333 | $3,236 | 3.83% |

| Blackfoot, ID (FHA|USDA|VA) | 2 | $500,000 | $250,000 | $3,678 | 3.50% |

| ANN ARBOR, MI (FHA|USDA|VA) | 2 | $500,000 | $250,000 | $2,273 | 4.00% |

| WINCHESTER, VA-WV (FHA|USDA|VA) | 2 | $490,000 | $245,000 | $3,426 | 3.50% |

| TOLEDO, OH (FHA|USDA|VA) | 2 | $490,000 | $245,000 | $3,147 | 3.56% |

| YUMA, AZ (FHA|USDA|VA) | 3 | $485,000 | $161,667 | $3,291 | 4.21% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 4 | $480,000 | $120,000 | $3,563 | 5.22% |

| GRAND RAPIDS-KENTWOOD, MI (FHA|USDA|VA) | 1 | $475,000 | $475,000 | $2,968 | 3.50% |

| JONESBORO, AR (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $2,528 | 3.63% |

| LUBBOCK, TX (FHA|USDA|VA) | 1 | $455,000 | $455,000 | $4,950 | 3.63% |

| Greenwood, SC (FHA|USDA|VA) | 1 | $445,000 | $445,000 | $0 | 5.50% |

| DAYTON-KETTERING, OH (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $2,387 | 3.50% |

| MIDLAND, TX (FHA|USDA|VA) | 1 | $435,000 | $435,000 | $6,094 | 3.75% |

| Kill Devil Hills, NC (FHA|USDA|VA) | 1 | $425,000 | $425,000 | $3,292 | 3.88% |

| BALTIMORE-COLUMBIA-TOWSON, MD (FHA|USDA|VA) | 1 | $415,000 | $415,000 | $3,837 | 4.00% |

| PRESCOTT VALLEY-PRESCOTT, AZ (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $2,201 | 3.63% |

| Mount Sterling, KY (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $3,176 | 3.25% |

| Outside of Metro Areas | 1 | $385,000 | $385,000 | $0 | 3.13% |

| Summerville, GA (FHA|USDA|VA) | 1 | $385,000 | $385,000 | $9,638 | 4.63% |

| DALTON, GA (FHA|USDA|VA) | 2 | $380,000 | $190,000 | $4,570 | 4.00% |

| Marion, NC (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $5,407 | 3.63% |

| Paris, TN (FHA|USDA|VA) | 3 | $365,000 | $121,667 | $2,403 | 4.13% |

| Searcy, AR (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $9,353 | 3.69% |

| BILLINGS, MT (FHA|USDA|VA) | 1 | $345,000 | $345,000 | $3,898 | 3.50% |

| Atmore, AL (FHA|USDA|VA) | 3 | $345,000 | $115,000 | $2,743 | 4.66% |

| ST. GEORGE, UT (FHA|USDA|VA) | 1 | $345,000 | $345,000 | $2,644 | 3.50% |

| LAKE CHARLES, LA (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $3,794 | 3.63% |

| CHARLESTON, WV (FHA|USDA|VA) | 1 | $325,000 | $325,000 | $12,934 | 3.25% |

| CLARKSVILLE, TN-KY (FHA|USDA|VA) | 2 | $320,000 | $160,000 | $1,878 | 3.88% |

| CARSON CITY, NV (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $11,991 | 4.38% |

| Sikeston, MO (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $2,506 | 3.63% |

| Steamboat Springs, CO (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $2,816 | 3.88% |

| Newport, TN (FHA|USDA|VA) | 2 | $300,000 | $150,000 | $2,978 | 4.63% |

| Helena-West Helena, AR (FHA|USDA|VA) | 3 | $295,000 | $98,333 | $3,031 | 4.17% |

| SHERMAN-DENISON, TX (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,318 | 3.00% |

| Celina, OH (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $2,591 | 3.00% |

| IDAHO FALLS, ID (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,967 | 3.50% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,805 | 4.38% |

| KALAMAZOO-PORTAGE, MI (FHA|USDA|VA) | 1 | $265,000 | $265,000 | $2,712 | 3.50% |

| MONROE, MI (FHA|USDA|VA) | 1 | $265,000 | $265,000 | $2,389 | 4.00% |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (FHA|USDA|VA) | 2 | $260,000 | $130,000 | $3,151 | 5.06% |

| TERRE HAUTE, IN (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,457 | 3.50% |

| Traverse City, MI (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $0 | 4.00% |

| FLINT, MI (FHA|USDA|VA) | 2 | $250,000 | $125,000 | $4,291 | 3.62% |

| MANKATO, MN (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $2,571 | 3.75% |

| WICHITA, KS (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $2,861 | 3.99% |

| HAGERSTOWN-MARTINSBURG, MD-WV (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $2,254 | 3.99% |

| LAKE HAVASU CITY-KINGMAN, AZ (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,868 | 3.75% |

| Frankfort, KY (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,679 | 3.63% |

| TYLER, TX (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $3,739 | 3.75% |

| Jesup, GA (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $7,327 | 4.95% |

| Stevens Point, WI (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,251 | 3.50% |

| LANSING-EAST LANSING, MI (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $2,707 | 2.88% |

| St. Marys, GA (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $4,692 | 3.63% |

| Sebastian-Vero Beach, FL (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $3,794 | 4.00% |

| Sandpoint, ID (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $3,448 | 3.50% |

| DULUTH, MN-WI (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $2,890 | 3.63% |

| Jasper, IN (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $3,863 | 3.94% |

| MONROE, LA (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $3,937 | 4.38% |

| TULSA, OK (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $0 | 5.75% |

| McComb, MS (FHA|USDA|VA) | 2 | $210,000 | $105,000 | $2,795 | 4.38% |

| Weatherford, OK (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $2,865 | 4.38% |

| COLLEGE STATION-BRYAN, TX (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $5,318 | 2.63% |

| Danville, KY (FHA|USDA|VA) | 2 | $200,000 | $100,000 | $2,239 | 3.88% |

| Maysville, KY (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $3,581 | 3.99% |

| SOUTH BEND-MISHAWAKA, IN-MI (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,131 | 3.38% |

| SAGINAW, MI (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,625 | 3.00% |

| GRAND JUNCTION, CO (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,456 | 3.50% |

| Kinston, NC (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,249 | 3.75% |

| PUEBLO, CO (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $2,596 | 3.88% |

| FORT WAYNE, IN (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $1,773 | 3.75% |

| Shelby, NC (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $3,880 | 4.99% |

| Granbury, TX (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,575 | 3.00% |

| Sedalia, MO (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $2,001 | 4.00% |

| Clewiston, FL (FHA|USDA|VA) | 2 | $170,000 | $85,000 | $2,546 | 5.12% |

| SHREVEPORT-BOSSIER CITY, LA (FHA|USDA|VA) | 2 | $170,000 | $85,000 | $2,993 | 4.25% |

| Ardmore, OK (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $4,107 | 3.25% |

| COLUMBUS, IN (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $2,846 | 3.13% |

| Sanford, NC (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $2,762 | 3.75% |

| LIMA, OH (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,408 | 3.25% |

| Brownsville, TN (FHA|USDA|VA) | 3 | $155,000 | $51,667 | $2,246 | 5.82% |

| Gardnerville Ranchos, NV (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,638 | 3.63% |

| Cordele, GA (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,716 | 3.99% |

| COLUMBIA, MO (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,932 | 3.50% |

| CANTON-MASSILLON, OH (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,772 | 4.50% |

| Laurinburg, NC (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,594 | 5.13% |

| Natchez, MS-LA (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $3,141 | 5.13% |

| MORRISTOWN, TN (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $4,976 | 3.50% |

| Americus, GA (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,409 | 4.25% |

| Defiance, OH (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,491 | 4.25% |

| Alamogordo, NM (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,082 | 3.88% |

| LONGVIEW, TX (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $2,392 | 3.75% |

| El Dorado, AR (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,241 | 4.38% |

| MICHIGAN CITY-LA PORTE, IN (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,300 | 4.13% |

| Laurel, MS (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,791 | 3.63% |

| North Wilkesboro, NC (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $3,977 | 4.50% |

| ROCKY MOUNT, NC (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $0 | 5.00% |

| EVANSVILLE, IN-KY (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $3,365 | 3.75% |

| Picayune, MS (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $0 | 4.25% |

| Orangeburg, SC (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $0 | 4.88% |

| Forrest City, AR (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $3,186 | 4.13% |

| Greenville, MS (FHA|USDA|VA) | 2 | $50,000 | $25,000 | $1,979 | 4.56% |

| Blytheville, AR (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $2,152 | 4.88% |

Similar Lenders

We use machine learning to identify the top lenders compared against Renasant Bank based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 80

Similarity Rank: 110

Similarity Rank: 117

Similarity Rank: 136

Similarity Rank: 368

Similarity Rank: 459

Similarity Rank: 516

Similarity Rank: 534

Similarity Rank: 544

Similarity Rank: 561

Product Mix

For 2019, Renasant Bank's most frequently originated type of loan was Conventional, with 10,059 originations. Their 2nd most popular type was HELOC, with 2,149 originations.

Loan Reason

For 2019, Renasant Bank's most frequently cited loan purpose was Home Purchase, with 8,909 originations. The 2nd most popular reason was Refi, with 3,278 originations.

Loan Duration/Length

For 2019, Renasant Bank's most frequently cited loan duration was 30 Year, with 10,427 originations. The 2nd most popular length was 10 Year, with 2,053 originations.

Origination Fees/Closing Costs

Renasant Bank's average total fees were $4,123, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 6,728 originations.

Interest Rates

During 2019, Renasant Bank's average interest rate for loans was 4.16%, while their most frequently originated rate bucket for loans was 3-4%, with 6,346 originations.

Loan Sizing

2019 saw Renasant Bank place emphasis on $100k-200k loans with 5,580 originations, totaling $831,970,000 in origination value.

Applicant Income

Renasant Bank lent most frequently to those with incomes in the $50k-75k range, with 3,390 originations. The second most popular income band? $50k or less, with 2,982 originations.

Applicant Debt to Income Ratio

Renasant Bank lent most frequently to those with DTI ratios of 20-30%, with 3,598 originations. The next most common DTI ratio? 30-36%, with 2,765 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications94.28%

Renasant Bank has an average approval rate.

Pick Rate

Approvals leading to origination83.78%

Renasant Bank has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 15,393 | $3,201,105,000 | $207,958 |

Occupancy Type Mix

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2019 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| RENASANT CORPORATION | Conventional home mortgage | Applying for a mortgage or refinancing an existing mortgage | 1 | 20.0% |

| RENASANT CORPORATION | Conventional home mortgage | Struggling to pay mortgage | 1 | 20.0% |

| RENASANT CORPORATION | Conventional home mortgage | Trouble during payment process | 2 | 40.0% |

| RENASANT CORPORATION | Other type of mortgage | Closing on a mortgage | 1 | 20.0% |

Bank Details

Branches

| Bank Name | Branch | Branch Type | Deposits (000's) |

|---|---|---|---|

| Renasant Bank | 32 E Main St Bells, TN 38006 | Full Service B&M | $26,951 |

| Renasant Bank | 4726 Sw College Rd Ocala, FL 34474 | Full Service B&M | $14,130 |

| Renasant Bank | 701 Coulter Drive New Albany, MS 38652 | Full Service B&M | $4,758 |

| Renasant Bank | 100 Bates Street Batesville, MS 38606 | Full Service B&M | $23,931 |

| Renasant Bank | 301 West Fourth Street Adel, GA 31620 | Full Service B&M | $51,463 |

| Renasant Bank | 1111 East Jackson Avenue Oxford, MS 38655 | Full Service B&M | $78,451 |

| Renasant Bank | 304 South Cass Street Corinth, MS 38834 | Full Service B&M | $61,093 |

| Renasant Bank | 1114 North 2nd Street Booneville, MS 38829 | Full Service B&M | $13,419 |

| Renasant Bank | 913 U.S. Highway 278 East Amory, MS 38821 | Limited, Drive-thru | $50,442 |

| Renasant Bank | 198 East Parker Street Baxley, GA 31513 | Full Service B&M | $32,257 |

| Renasant Bank | 100 Old Canton Road And Highway 51 South Madison, MS 39110 | Full Service B&M | $0 |

| Renasant Bank | 1012 W Beacon St Philadelphia, MS 39350 | Full Service B&M | $26,495 |

| Renasant Bank | 103 East Washington Street Aberdeen, MS 39730 | Full Service B&M | $48,254 |

| Renasant Bank | 104 Heritage Lane Leesburg, GA 31763 | Full Service B&M | $52,807 |

| Renasant Bank | 104 West Main Street Reidsville, GA 30453 | Full Service B&M | $32,618 |

| Renasant Bank | 105 Town Square Bruce, MS 38915 | Full Service B&M | $25,660 |

| Renasant Bank | 105 W King Street Johnson City, TN 37604 | Full Service B&M | $34,639 |

| Renasant Bank | 106 E College St Columbiana, AL 35051 | Full Service B&M | $110,598 |

| Renasant Bank | 106 East Crogan Street Lawrenceville, GA 30046 | Full Service B&M | $121,551 |

| Renasant Bank | 1069 Highland Colony Parkway Ridgeland, MS 39157 | Full Service B&M | $0 |

| Renasant Bank | 1069 Highland Colony Parkway Ridgeland, MS 39157 | Full Service B&M | $156,432 |

| Renasant Bank | 107 Inverness Cors Birmingham, AL 35242 | Full Service B&M | $39,783 |

| Renasant Bank | 1100 Central Street Water Valley, MS 38965 | Full Service B&M | $25,519 |

| Renasant Bank | 11655 Medlock Bridge Road Johns Creek, GA 30097 | Full Service B&M | $129,688 |

| Renasant Bank | 120 8th Avenue Childersburg, AL 35044 | Full Service B&M | $19,938 |

| Renasant Bank | 120 South Main Street Sardis, MS 38666 | Full Service B&M | $16,778 |

| Renasant Bank | 1285 West Government Street Brandon, MS 39042 | Full Service B&M | $58,963 |

| Renasant Bank | 1309 Stratford Road, Southeast Decatur, AL 35601 | Full Service B&M | $37,746 |

| Renasant Bank | 1314 Sunset Drive Grenada, MS 38901 | Full Service B&M | $5,335 |

| Renasant Bank | 1320 Johnson Ferry Road Marietta, GA 30068 | Full Service B&M | $10,741 |

| Renasant Bank | 135 James Patyon Boulevard Sylacauga, AL 35150 | Full Service B&M | $38,286 |

| Renasant Bank | 140 Long Hollow Pike Goodlettsville, TN 37072 | Full Service B&M | $34,900 |

| Renasant Bank | 1409 East Silver Springs Blvd Ocala, FL 34470 | Full Service B&M | $102,064 |

| Renasant Bank | 141 Hurricane Shoals Road Ne Lawrenceville, GA 30046 | Full Service B&M | $802,635 |

| Renasant Bank | 1427 Highway 145 Guntown, MS 38849 | Limited, Drive-thru | $24,121 |

| Renasant Bank | 1449 Dunwoody Village Parkway Dunwoody, GA 30338 | Full Service B&M | $36,360 |

| Renasant Bank | 145 Reinhardt College Parkway Canton, GA 30114 | Full Service B&M | $77,238 |

| Renasant Bank | 14625 Depot Street Coffeeville, MS 38922 | Full Service B&M | $16,233 |

| Renasant Bank | 1505 South Harper Road Corinth, MS 38834 | Full Service B&M | $40,524 |

| Renasant Bank | 1537 South Commerce Street Grenada, MS 38901 | Full Service B&M | $84,316 |

| Renasant Bank | 1600 Highland Colony Parkway Madison, MS 39110 | Full Service B&M | $52,603 |

| Renasant Bank | 164 Veterans Boulevard Tupelo, MS 38804 | Limited, Drive-thru | $29,373 |

| Renasant Bank | 16404 Nw 17th Drive Alachua, FL 32615 | Full Service B&M | $22,449 |

| Renasant Bank | 165 West I-65 Service Road North Mobile, AL 36608 | Full Service B&M | $22,767 |

| Renasant Bank | 1661 Aaron Brenner Drive Memphis, TN 38120 | Limited, Mobile/Seasonal Office | $0 |

| Renasant Bank | 1661 Aaron Brenner Drive, Suite 100 Memphis, TN 38120 | Full Service B&M | $391,476 |

| Renasant Bank | 16863 Highway 280 Chelsea, AL 35043 | Full Service B&M | $35,403 |

| Renasant Bank | 173 Northside Drive East Statesboro, GA 30458 | Full Service B&M | $38,318 |

| Renasant Bank | 180 East Commerce Hernando, MS 38632 | Full Service B&M | $47,765 |

| Renasant Bank | 1820 West End Avenue Nashville, TN 37203 | Full Service B&M | $216,314 |

| Renasant Bank | 1830 Modaus Road Decatur, AL 35603 | Full Service B&M | $137,740 |

| Renasant Bank | 190 Village Centre East Woodstock, GA 30188 | Full Service B&M | $35,894 |

| Renasant Bank | 1901 University Avenue Oxford, MS 38655 | Limited, Drive-thru | $7,359 |

| Renasant Bank | 1934 Spillway Road Brandon, MS 39047 | Full Service B&M | $19,627 |

| Renasant Bank | 1943 East Glenn Avenue Auburn, AL 36830 | Full Service B&M | $18,853 |

| Renasant Bank | 2 Magnolia Boulevard Port Wentworth, GA 31407 | Full Service B&M | $35,106 |

| Renasant Bank | 200 Loftus Drive Albany, GA 31705 | Full Service B&M | $77,305 |

| Renasant Bank | 200 West Side Square Suite 101 Huntsville, AL 35801 | Full Service B&M | $5,289 |

| Renasant Bank | 2001 Park Place Tower Birmingham, AL 35203 | Full Service B&M | $101,939 |

| Renasant Bank | 201 North Main Street Amory, MS 38821 | Full Service B&M | $78,032 |

| Renasant Bank | 201 S. Jackson Street Crystal Springs, MS 39059 | Full Service B&M | $36,948 |

| Renasant Bank | 2046 Union Avenue Memphis, TN 38104 | Full Service B&M | $11,960 |

| Renasant Bank | 209 Troy Street Tupelo, MS 38801 | Full Service B&M | $726,987 |

| Renasant Bank | 210 Industrial Road South Tupelo, MS 38801 | Limited, Drive-thru | $28,155 |

| Renasant Bank | 2100 Grayson Hwy. Grayson, GA 30017 | Full Service B&M | $117,519 |

| Renasant Bank | 211 Lee Street, N.E. Decatur, AL 35601 | Full Service B&M | $147,180 |

| Renasant Bank | 213 West Market Street Booneville, MS 38829 | Full Service B&M | $115,692 |

| Renasant Bank | 216 South Broadway Street Tupelo, MS 38804 | Limited, Drive-thru | $0 |

| Renasant Bank | 2177 Germantown Germantown, TN 38138 | Full Service B&M | $132,677 |

| Renasant Bank | 22 East Jarman Street Hazlehurst, GA 31539 | Full Service B&M | $66,257 |

| Renasant Bank | 220 Highway 12 E Kosciusko, MS 39090 | Full Service B&M | $13,443 |

| Renasant Bank | 2200 Abbott Martin Road, Suite 101 Nashville, TN 37215 | Full Service B&M | $75,920 |

| Renasant Bank | 221 East Washington Street Kosciusko, MS 39090 | Full Service B&M | $147,354 |

| Renasant Bank | 225 Mitylene Park Drive Montgomery, AL 36117 | Full Service B&M | $37,421 |

| Renasant Bank | 2255 Buford Hwy Buford, GA 30518 | Full Service B&M | $63,578 |

| Renasant Bank | 232 Broad Street Shannon, MS 38868 | Full Service B&M | $28,151 |

| Renasant Bank | 2400 West State Street Bristol, TN 37620 | Full Service B&M | $24,433 |

| Renasant Bank | 2488 East Main Street Snellville, GA 30078 | Full Service B&M | $138,082 |

| Renasant Bank | 251 Highway 515 Jasper, GA 30143 | Full Service B&M | $86,881 |

| Renasant Bank | 2518 University Blvd Tuscaloosa, AL 35401 | Full Service B&M | $47,769 |

| Renasant Bank | 2527 Jackson Avenue West Oxford, MS 38655 | Full Service B&M | $24,486 |

| Renasant Bank | 26164 West Main Street West Point, MS 39773 | Full Service B&M | $72,021 |

| Renasant Bank | 275 South Main Street Alpharetta, GA 30004 | Full Service B&M | $39,135 |

| Renasant Bank | 2751 West Main Street Tupelo, MS 38801 | Full Service B&M | $46,050 |

| Renasant Bank | 300 East Bankhead Street New Albany, MS 38652 | Full Service B&M | $54,985 |

| Renasant Bank | 3002 Mccullough Boulevard Belden, MS 38826 | Limited, Drive-thru | $6,308 |

| Renasant Bank | 301 North Church Street Louisville, MS 39339 | Full Service B&M | $76,488 |

| Renasant Bank | 306 East Sunflower Road Cleveland, MS 38732 | Limited, Drive-thru | $0 |

| Renasant Bank | 308 East Sunflower Road Cleveland, MS 38732 | Full Service B&M | $41,098 |

| Renasant Bank | 3082 West Goodman Road Horn Lake, MS 38637 | Full Service B&M | $27,583 |

| Renasant Bank | 309 Highway 15 North Pontotoc, MS 38863 | Full Service B&M | $120,162 |

| Renasant Bank | 310 West Oglethorpe Boulevard Albany, GA 31701 | Full Service B&M | $13,206 |

| Renasant Bank | 3101 Highway 80 East Pearl, MS 39208 | Full Service B&M | $20,964 |

| Renasant Bank | 3169 Holcomb Bridge Road, Suite 202 Norcross, GA 30071 | Full Service Retail | $60,101 |

| Renasant Bank | 3216 20th Avenue Valley, AL 36854 | Full Service B&M | $40,974 |

| Renasant Bank | 329 East Broadway Avenue Maryville, TN 37804 | Full Service B&M | $73,200 |

| Renasant Bank | 3295 Inner Perimeter Road Valdosta, GA 31602 | Full Service B&M | $63,109 |

| Renasant Bank | 3328 Peachtree Road, Suite 150 Atlanta, GA 30326 | Full Service B&M | $2,412 |

| Renasant Bank | 3330 S Liberty St Canton, MS 39046 | Full Service B&M | $69,702 |

| Renasant Bank | 335 South Main Street Statesboro, GA 30458 | Full Service B&M | $104,985 |

| Renasant Bank | 3415 George Busbee Parkway Nw, Suite 100 Kennesaw, GA 30144 | Full Service B&M | $2,595 |

| Renasant Bank | 3513 Pelham Parkway Pelham, AL 35124 | Full Service B&M | $49,013 |

| Renasant Bank | 36250 Emerald Coast Parkway Destin, FL 32541 | Full Service B&M | $4,876 |

| Renasant Bank | 367 Mobile Street Saltillo, MS 38866 | Full Service B&M | $35,139 |

| Renasant Bank | 3680 North Gloster Street Tupelo, MS 38801 | Full Service B&M | $38,368 |

| Renasant Bank | 37 Main Street Pontotoc, MS 38863 | Full Service B&M | $13,218 |

| Renasant Bank | 370 East Main Street Hendersonville, TN 37075 | Full Service B&M | $29,623 |

| Renasant Bank | 381 Nw Depot St Durant, MS 39063 | Full Service B&M | $26,099 |

| Renasant Bank | 400 Summit Street Winona, MS 38967 | Full Service B&M | $29,972 |

| Renasant Bank | 401 Vernon Street Lagrange, GA 30240 | Full Service B&M | $16,691 |

| Renasant Bank | 407 E. Jackson Boulevard Jonesborough, TN 37659 | Full Service B&M | $19,130 |

| Renasant Bank | 411 Highway 80 E Clinton, MS 39056 | Full Service B&M | $37,186 |

| Renasant Bank | 420 Old Mill Road Cartersville, GA 30120 | Full Service B&M | $33,893 |

| Renasant Bank | 4245 Balmoral Drive Huntsville, AL 35801 | Full Service B&M | $81,864 |

| Renasant Bank | 4247 Lakeland Dr Flowood, MS 39232 | Full Service B&M | $66,670 |

| Renasant Bank | 4373 Newberry Road Gainesville, FL 32607 | Full Service B&M | $82,276 |

| Renasant Bank | 44 Church Street Birmingham, AL 35213 | Full Service B&M | $35,060 |

| Renasant Bank | 4422 Lebanon Road Hermitage, TN 37076 | Full Service B&M | $73,939 |

| Renasant Bank | 4475 Towne Lake Parkway Woodstock, GA 30189 | Full Service B&M | $53,855 |

| Renasant Bank | 463 West Duval Street Lake City, FL 32055 | Full Service B&M | $24,649 |

| Renasant Bank | 480 Peachtree Industrial Blvd Suwanee, GA 30024 | Full Service B&M | $20,960 |

| Renasant Bank | 485 Dacula Rd, Dacula Dacula, GA 30019 | Full Service B&M | $3,441 |

| Renasant Bank | 494 Monroe Street Macon, GA 31201 | Full Service B&M | $0 |

| Renasant Bank | 4961 Forsyth Road Macon, GA 31210 | Full Service B&M | $97,210 |

| Renasant Bank | 500 Canton Road Cumming, GA 30040 | Full Service B&M | $82,630 |

| Renasant Bank | 500 East Lampkin Street Starkville, MS 39759 | Full Service B&M | $327,418 |

| Renasant Bank | 5033 Raymond Street Verona, MS 38879 | Full Service B&M | $13,100 |

| Renasant Bank | 504 North Main Street Sylvester, GA 31791 | Full Service B&M | $31,650 |

| Renasant Bank | 508 Constitution Drive Iuka, MS 38852 | Full Service B&M | $26,293 |

| Renasant Bank | 510 Church Road West Southaven, MS 38671 | Full Service B&M | $34,167 |

| Renasant Bank | 511 South Church Street Okolona, MS 38860 | Full Service B&M | $17,691 |

| Renasant Bank | 5225 Windward Parkway Alpharetta, GA 30004 | Full Service B&M | $26,785 |

| Renasant Bank | 5240 Poplar Avenue, Suite 100 Memphis, TN 38119 | Full Service B&M | $137,244 |

| Renasant Bank | 5264 Poplar Avenue Memphis, TN 38119 | Full Service B&M | $89,311 |

| Renasant Bank | 5319 Atlanta Highway Flowery Branch, GA 30542 | Full Service B&M | $46,736 |

| Renasant Bank | 5395 Highway 9 Alpharetta, GA 30004 | Full Service B&M | $23,916 |

| Renasant Bank | 544 Veterans Boulevard Calhoun City, MS 38916 | Full Service B&M | $47,932 |

| Renasant Bank | 595 18th Avenue North Columbus, MS 39701 | Full Service B&M | $93,070 |

| Renasant Bank | 600 South Columbia Avenue Rincon, GA 31326 | Full Service B&M | $34,202 |

| Renasant Bank | 6224 Sugarloaf Pkwy Duluth, GA 30097 | Full Service B&M | $78,411 |

| Renasant Bank | 6333 Whitesville Road Columbus, GA 31904 | Full Service B&M | $9,911 |

| Renasant Bank | 649 North Caldwell Drive Hazlehurst, MS 39083 | Full Service B&M | $15,642 |

| Renasant Bank | 6515 Sugarloaf Parkway Duluth, GA 30097 | Full Service B&M | $41,758 |

| Renasant Bank | 6543 Goodman Road Olive Branch, MS 38654 | Full Service B&M | $195,713 |

| Renasant Bank | 6671 Summer Avenue Bartlett, TN 38134 | Full Service B&M | $18,531 |

| Renasant Bank | 6890 Cockrum Road Olive Branch, MS 38654 | Full Service B&M | $50,965 |

| Renasant Bank | 721 North Westover Boulevard Albany, GA 31707 | Full Service B&M | $153,091 |

| Renasant Bank | 732 Lake Harbour Ridgeland, MS 39157 | Full Service B&M | $41,983 |

| Renasant Bank | 7500 Airways Boulevard Southaven, MS 38671 | Full Service B&M | $40,565 |

| Renasant Bank | 7600 Highway 72 West Madison, AL 35758 | Full Service B&M | $21,760 |

| Renasant Bank | 7605 Sw Highway 200 Ocala, FL 34476 | Full Service B&M | $31,046 |

| Renasant Bank | 78 North Broad Street Winder, GA 30680 | Full Service B&M | $72,968 |

| Renasant Bank | 796 West Poplar Avenue Collierville, TN 38017 | Full Service B&M | $43,530 |

| Renasant Bank | 8 Commerce Street, Suite 100 Montgomery, AL 36104 | Full Service B&M | $41,174 |

| Renasant Bank | 802 South Laurel Street Springfield, GA 31329 | Full Service B&M | $91,161 |

| Renasant Bank | 806 Highway 12 W Starkville, MS 39759 | Full Service B&M | $33,329 |

| Renasant Bank | 82 A&b Clark Boulevard Tupelo, MS 38804 | Full Service B&M | $29,996 |

| Renasant Bank | 880 Holcomb Bridge Road Roswell, GA 30076 | Full Service B&M | $30,451 |

| Renasant Bank | 880 Joe Frank Harris Parkway Cartersville, GA 30120 | Full Service B&M | $65,073 |

| Renasant Bank | 90 Steve Tate Road Marble Hill, GA 30148 | Full Service B&M | $24,558 |

| Renasant Bank | 9027 Ms Highway 15 Ackerman, MS 39735 | Full Service B&M | $50,814 |

| Renasant Bank | 905 Main Street Columbus, MS 39701 | Full Service B&M | $0 |

| Renasant Bank | 9135 Carothers Parkway Franklin, TN 37067 | Full Service B&M | $67,765 |

| Renasant Bank | 951 South Gloster Street Tupelo, MS 38801 | Limited, Drive-thru | $15,379 |

| Renasant Bank | 966 Hwy 51 S Madison, MS 39110 | Full Service Retail | $41,152 |

| Renasant Bank | 9925 Haynes Bridge Road, Suite 100 Johns Creek, GA 30022 | Full Service B&M | $62,174 |

For 2019, Renasant Bank had 166 branches.

Yearly Performance Overview

Bank Income

| Item | Value (in 000's) |

|---|---|

| Total interest income | $542,457 |

| Net interest income | $456,896 |

| Total noninterest income | $152,249 |

| Gross Fiduciary activities income | $5,805 |

| Service charges on deposit accounts | $34,860 |

| Trading account gains and fees | $0 |

| Additional Noninterest Income | $111,584 |

| Pre-tax net operating income | $231,065 |

| Securities gains (or losses, -) | $348 |

| Income before extraordinary items | $179,246 |

| Discontinued Operations (Extraordinary gains, net) | $0 |

| Net income of bank and minority interests | $179,246 |

| Minority interest net income | $0 |

| Net income | $179,246 |

| Sale, conversion, retirement of capital stock, net | $0 |

| Net operating income | $178,971 |

Renasant Bank's gross interest income from loans was $542,457,000.

Renasant Bank's net interest income from loans was $456,896,000.

Renasant Bank's fee based income from loans was $34,860,000.

Renasant Bank's net income from loans was $179,246,000.

Bank Expenses

| Item | Value (in 000's) |

|---|---|

| Total interest expense | $85,561 |

| Provision for credit losses | $7,050 |

| Total noninterest expense | $371,030 |

| Salaries and employee benefits | $250,784 |

| Premises and equipment expense | $46,970 |

| Additional noninterest expense | $73,276 |

| Applicable income taxes | $52,167 |

| Net charge-offs | $3,914 |

| Cash dividends | $132,564 |

Renasant Bank's interest expense for loans was $85,561,000.

Renasant Bank's payroll and benefits expense were $250,784,000.

Renasant Bank's property, plant and equipment expenses $46,970,000.

Loan Performance

| Type of Loan | % of Loans Noncurrent (30+ days, end of period snapshot) |

|---|---|

| All loans | 0.0% |

| Real Estate loans | 0.0% |

| Construction & Land Development loans | 0.0% |

| Nonfarm, nonresidential loans | 0.0% |

| Multifamily residential loans | 0.0% |

| 1-4 family residential loans | 0.0% |

| HELOC loans | 0.0% |

| All other family | 0.0% |

| Commercial & industrial loans | 0.0% |

| Personal loans | 0.0% |

| Credit card loans | 0.0% |

| Other individual loans | 0.0% |

| Auto loans | 0.0% |

| Other consumer loans | 0.0% |

| Unsecured commercial real estate loans | 0.0% |

Deposits

| Type | Value (in 000's) |

|---|---|

| Total deposits | $10,238,795 |

| Deposits held in domestic offices | $10,238,795 |

| Deposits by Individuals, partnerships, and corporations | $8,819,556 |

| Deposits by U.S. Government | $0 |

| Deposits by States and political subdivisions in the U.S. | $1,413,370 |

| Deposits by Commercial banks and other depository institutions in U.S. | $5,869 |

| Deposits by Banks in foreign countries | $0 |

| Deposits by Foreign governments and official institutions | $0 |

| Transaction accounts | $3,005,776 |

| Demand deposits | $2,658,934 |

| Nontransaction accounts | $7,233,019 |

| Money market deposit accounts (MMDAs) | $4,401,504 |

| Other savings deposits (excluding MMDAs) | $667,820 |

| Total time deposits | $2,163,695 |

| Total time and savings deposits | $7,579,861 |

| Noninterest-bearing deposits | $2,574,336 |

| Interest-bearing deposits | $7,664,459 |

| Retail deposits | $9,672,131 |

| IRAs and Keogh plan accounts | $283,070 |

| Brokered deposits | $5,135 |

| Deposits held in foreign offices | $0 |

Assets

| Asset | Value (in 000's) |

|---|---|

| Total Assets | $13,387,533 |

| Cash & Balances due from depository institutions | $411,091 |

| Interest-bearing balances | $220,026 |

| Total securities | $1,288,960 |

| Federal funds sold & reverse repurchase | $0 |

| Net loans and leases | $9,955,748 |

| Loan and leases loss allowance | $52,162 |

| Trading account assets | $0 |

| Bank premises and fixed assets | $309,697 |

| Other real estate owned | $8,010 |

| Goodwill and other intangibles | $1,032,292 |

| All other assets | $381,735 |

Liabilities

| Liabilities | Value (in 000's) |

|---|---|

| Total liabilities and capital | $13,387,533 |

| Total Liabilities | $11,085,034 |

| Total deposits | $10,238,795 |

| Interest-bearing deposits | $7,664,459 |

| Deposits held in domestic offices | $10,238,795 |

| % insured (estimated) | $76 |

| Federal funds purchased and repurchase agreements | $9,091 |

| Trading liabilities | $0 |

| Other borrowed funds | $632,338 |

| Subordinated debt | $0 |

| All other liabilities | $204,810 |

Issued Loan Types

| Type | Value (in 000's) |

|---|---|

| Net loans and leases | $9,955,748 |

| Loan and leases loss allowance | $52,162 |

| Total loans and leases (domestic) | $10,007,910 |

| All real estate loans | $8,255,633 |

| Real estate loans in domestic offices | $8,255,633 |

| Construction and development loans | $1,158,596 |

| Residential 1-4 family construction | $289,050 |

| Other construction, all land development and other land | $869,546 |

| Loans secured by nonfarm nonresidential properties | $3,670,753 |

| Nonfarm nonresidential secured by owner-occupied properties | $1,555,748 |

| Commercial real estate & other non-farm, non-residential | $2,115,005 |

| Multifamily residential real estate | $335,890 |

| 1-4 family residential loans | $3,008,860 |

| Farmland loans | $81,534 |

| Loans held in foreign offices | $0 |

| Farm loans | $11,802 |

| Commercial and industrial loans | $1,333,903 |

| To non-U.S. addressees | $0 |

| Loans to individuals | $302,430 |

| Credit card loans | $0 |

| Related Plans | $11,245 |

| Consumer Auto Loans | $33,512 |

| Other loans to individuals | $257,673 |

| All other loans & leases | $104,142 |

| Loans to foreign governments and official institutions | $0 |

| Other loans | $4,475 |

| Loans to depository institutions and acceptances of other banks | $0 |

| Loans not secured by real estate | $0 |

| Loans secured by real estate to non-U.S. addressees | $0 |

| Restructured Loans & leases | $11,954 |

| Non 1-4 family restructured loans & leases | $4,158 |

| Total loans and leases (foreign) | $0 |

Renasant Bank had $9,955,748,000 of loans outstanding in 2019. $8,255,633,000 of loans were in real estate loans. $1,158,596,000 of loans were in development loans. $335,890,000 of loans were in multifamily mortgage loans. $3,008,860,000 of loans were in 1-4 family mortgage loans. $11,802,000 of loans were in farm loans. $0 of loans were in credit card loans. $33,512,000 of loans were in the auto loan category.

Small Business Loans

| Categorization | # of Loans in Category | $ amount of loans (in 000's) | Average $/loan |

|---|---|---|---|

| Nonfarm, nonresidential loans - <$1MM | 4,813 | $966,167 | $200,741 |

| Nonfarm, nonresidential loans - <$100k | 1,023 | $36,195 | $35,381 |

| Nonfarm, nonresidential loans - $100-250k | 1,553 | $170,587 | $109,844 |

| Nonfarm, nonresidential loans - $250k-1MM | 2,237 | $759,385 | $339,466 |

| Commercial & Industrial, US addressed loans - <$1MM | 9,154 | $481,505 | $52,601 |

| Commercial & Industrial, US addressed loans - <$100k | 5,673 | $92,019 | $16,221 |

| Commercial & Industrial, US addressed loans - $100-250k | 1,801 | $109,082 | $60,567 |

| Commercial & Industrial, US addressed loans - $250k-1MM | 1,680 | $280,404 | $166,907 |

| Farmland loans - <$1MM | 376 | $28,886 | $76,824 |

| Farmland loans - <$100k | 173 | $5,172 | $29,896 |

| Farmland loans - $100-250k | 153 | $15,439 | $100,908 |

| Farmland loans - $250k-1MM | 50 | $8,275 | $165,500 |

| Agriculture operations loans - <$1MM | 208 | $7,106 | $34,163 |

| Agriculture operations loans - <$100k | 156 | $2,899 | $18,583 |

| Agriculture operations loans - $100-250k | 40 | $2,037 | $50,925 |

| Agriculture operations loans - $250k-1MM | 12 | $2,170 | $180,833 |