Home Point Financial Corporation Mortgage Rates, Fees & Info

EAST LANSING, MILEI: 549300BRJZYHYKT4BJ84

Tax ID: 20-8921389

Latest/2024 | 2023 Data | 2022 Data | 2021 Data | 2020 Data | 2019 Data | 2018 Data

Jump to:

Mortgage Data

Review & Overview

Home Point Financial Corporation is a large mortgage company specializing in Home Purchase and Refi loans. Home Point Financial Corporation has a high proportion of conventional loans. They have an average proportion of FHA loans. They have a low ratio of USDA loans. Their top markets by origination volume include: Los Angeles, New York, Chicago, Riverside, and San Diego among others. We have data for 739 markets. (Some data included below & more in-depth data is available with an active subscription.)Home Point Financial Corporation has an above average approval rate when compared to the average across all lenders. They have a below average pick rate when compared to similar lenders. Home Point Financial Corporation is typically a low fee lender. (We use the term "fees" to include things like closing costs and other costs incurred by borrowers-- whether they are paid out of pocket or rolled into the loan.) They typically have about average rates.

We show data for every lender and do not change our ratings-- even if an organization is a paid advertiser. Our consensus data does have lag, but it is highly correlated to a lender's rates & fees relative to their markets. This means that if a bank is a low fee/rate lender the past-- chances are they are still one today. Our SimulatedRates™ use advanced statistical techniques to forecast different rates based on a lender's historical data.

Mortgage seekers: Choose your metro area here to explore the lowest fee & rate lenders.

Mortgage professionals: We have various tools to make your lives easier. Contact us to see how we can help with your market research, analytics or advertising needs.

Originations

44,035Origination Dollar Volume (All Markets)

$12,587,775,000HOME POINT FINANCIAL CORPORATION - 2019

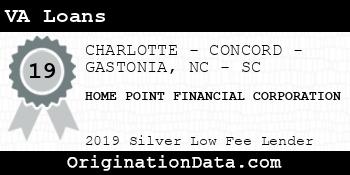

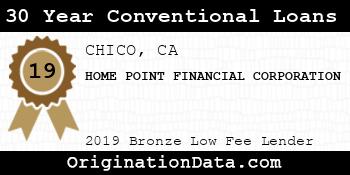

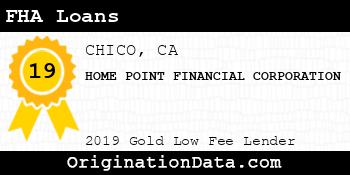

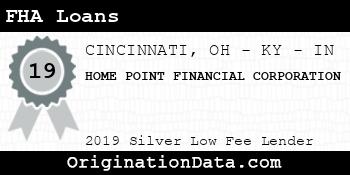

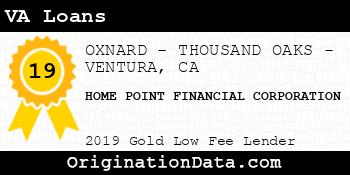

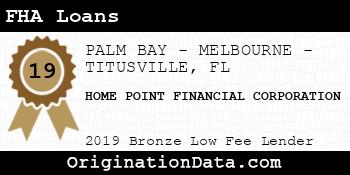

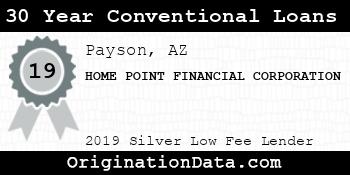

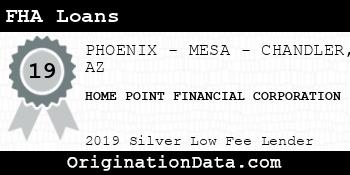

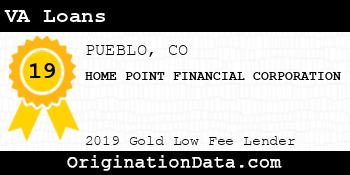

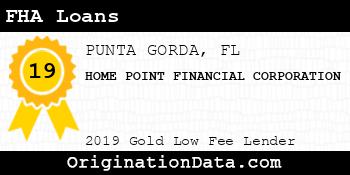

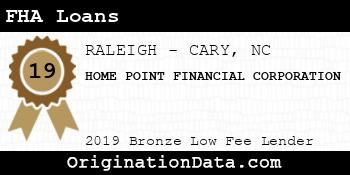

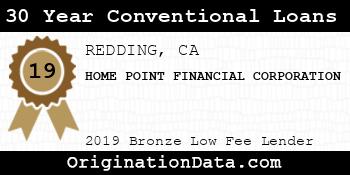

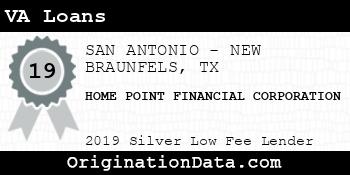

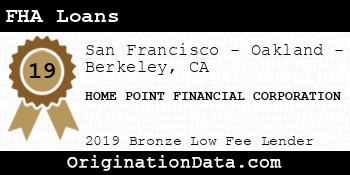

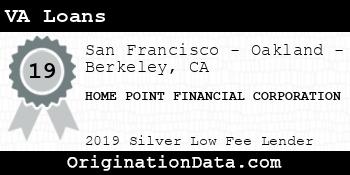

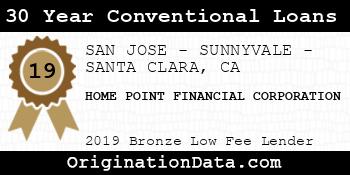

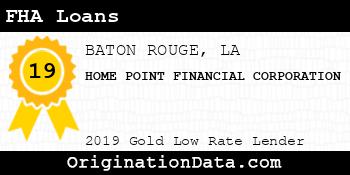

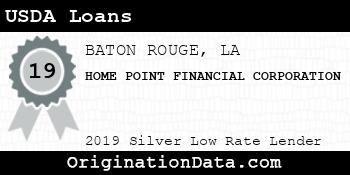

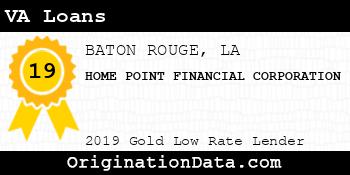

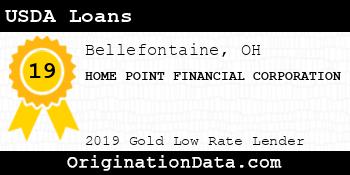

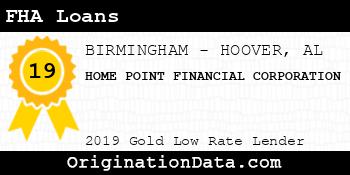

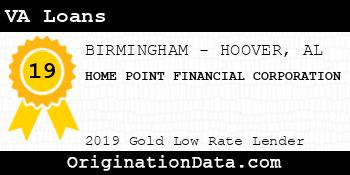

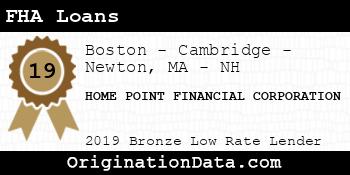

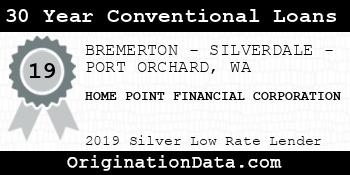

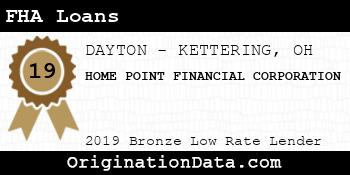

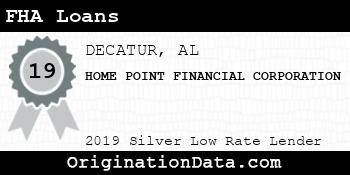

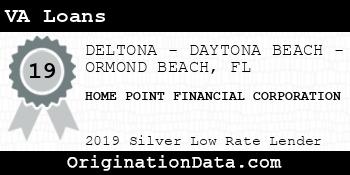

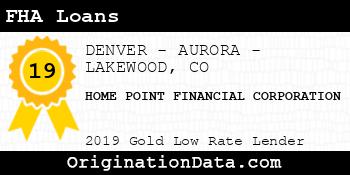

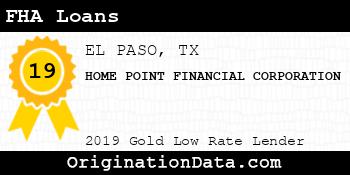

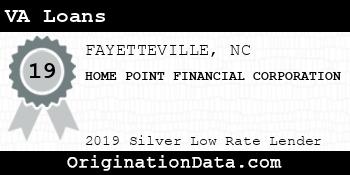

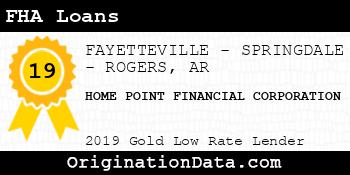

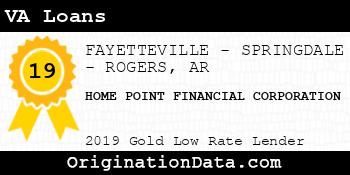

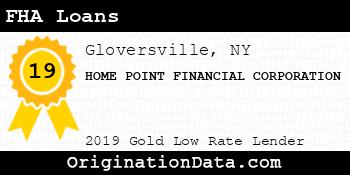

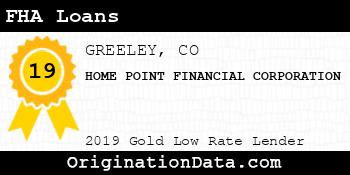

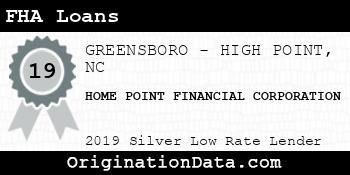

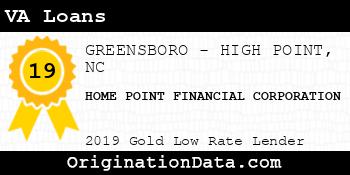

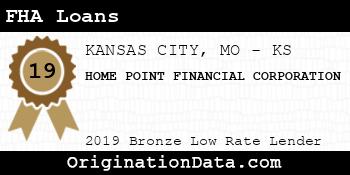

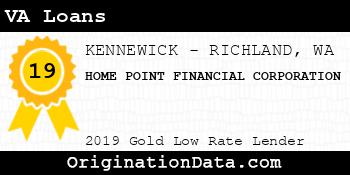

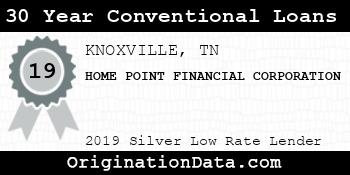

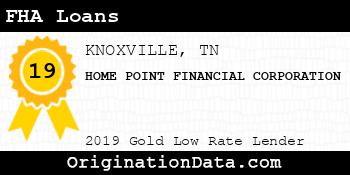

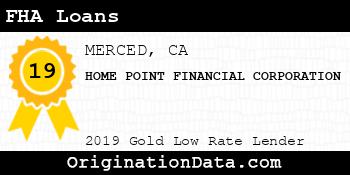

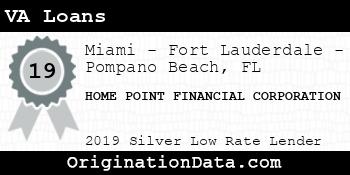

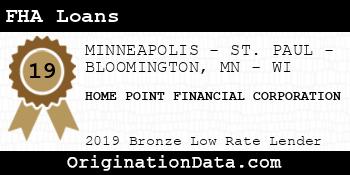

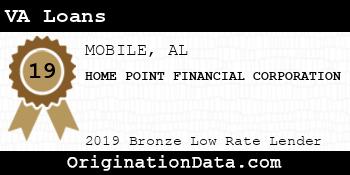

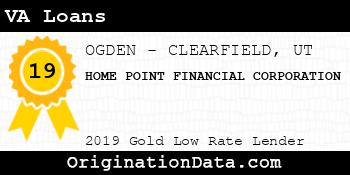

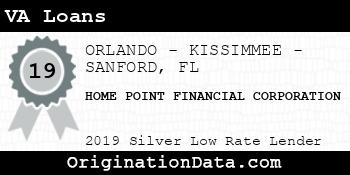

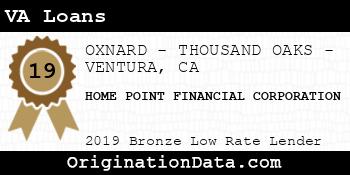

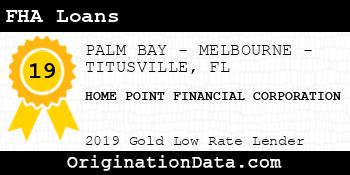

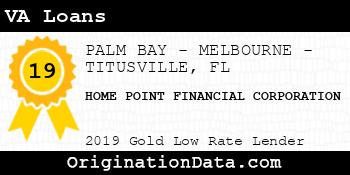

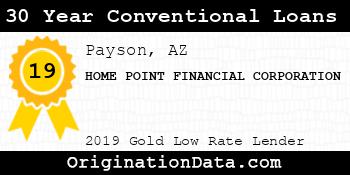

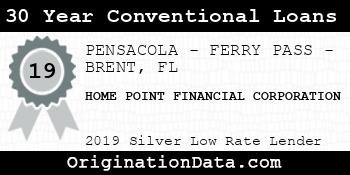

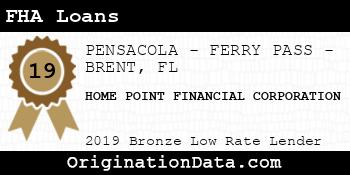

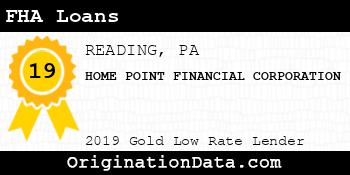

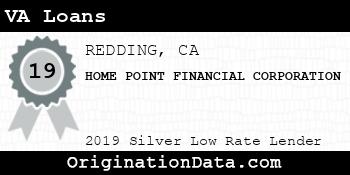

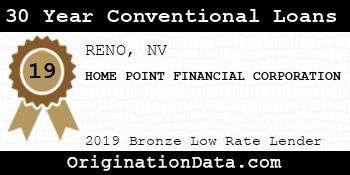

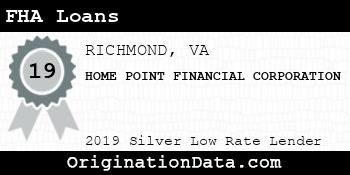

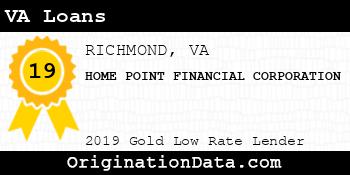

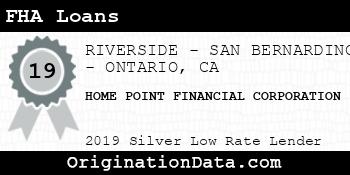

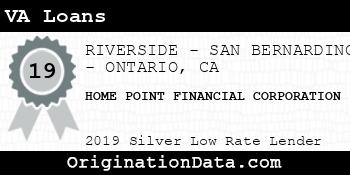

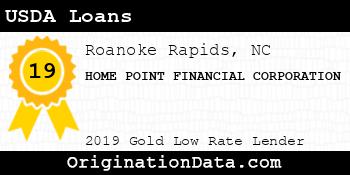

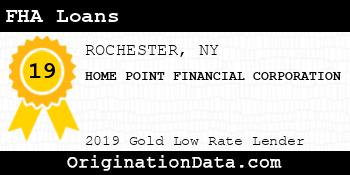

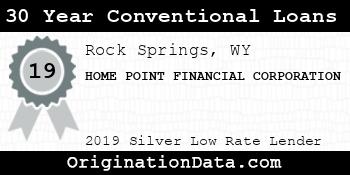

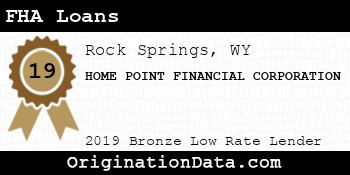

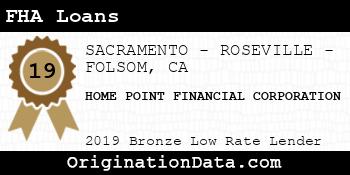

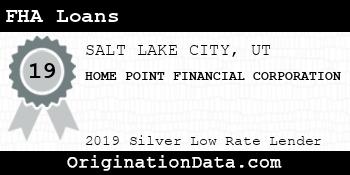

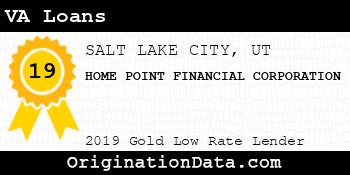

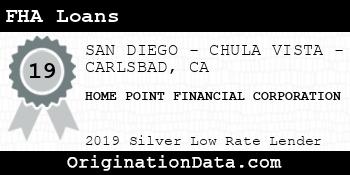

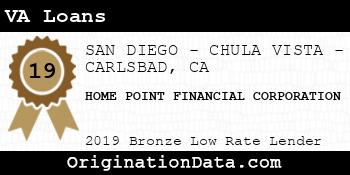

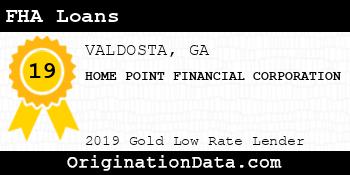

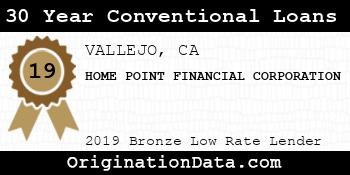

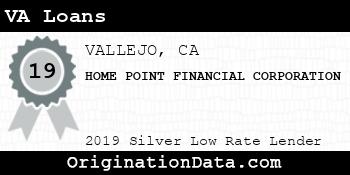

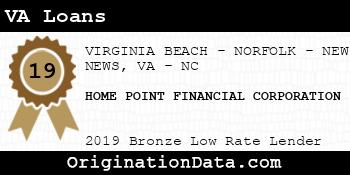

HOME POINT FINANCIAL CORPORATION is a 2019 , due to their low .

For 2019, less than of lenders were eligible for this award.

Work for HOME POINT FINANCIAL CORPORATION?

Use this award on your own site. Either save and use the images below, or pass the provided image embed code to your development team.

Top Markets

Zoom/scroll map to see bank's per metro statistics. Subscribers can configure state/metro/county granularity, assorted fields and quantity of results. This map shows top 10 markets in the map viewport, as defined by descending origination volume.

| Market | Originations | Total Value | Average Loan | Average Fees | Average Rate |

|---|---|---|---|---|---|

| Los Angeles-Long Beach-Anaheim, CA (FHA|USDA|VA) | 2,328 | $1,092,030,000 | $469,085 | $6,866 | 4.00% |

| New York-Newark-Jersey City, NY-NJ-PA (FHA|USDA|VA) | 2,019 | $744,585,000 | $368,789 | $9,576 | 4.10% |

| Chicago-Naperville-Elgin, IL-IN-WI (FHA|USDA|VA) | 2,346 | $592,040,000 | $252,361 | $5,433 | 4.25% |

| RIVERSIDE-SAN BERNARDINO-ONTARIO, CA (FHA|USDA|VA) | 1,414 | $475,690,000 | $336,414 | $6,110 | 3.94% |

| SAN DIEGO-CHULA VISTA-CARLSBAD, CA (FHA|USDA|VA) | 980 | $459,660,000 | $469,041 | $6,558 | 3.77% |

| Washington-Arlington-Alexandria, DC-VA-MD-WV (FHA|USDA|VA) | 1,017 | $391,525,000 | $384,980 | $7,487 | 3.93% |

| DENVER-AURORA-LAKEWOOD, CO (FHA|USDA|VA) | 1,001 | $353,755,000 | $353,402 | $5,501 | 3.94% |

| San Francisco-Oakland-Berkeley, CA (FHA|USDA|VA) | 680 | $332,090,000 | $488,368 | $5,792 | 3.99% |

| ATLANTA-SANDY SPRINGS-ALPHARETTA, GA (FHA|USDA|VA) | 1,142 | $294,800,000 | $258,144 | $5,608 | 3.99% |

| Philadelphia-Camden-Wilmington, PA-NJ-DE-MD (FHA|USDA|VA) | 1,044 | $261,810,000 | $250,776 | $6,725 | 4.11% |

| LAS VEGAS-HENDERSON-PARADISE, NV (FHA|USDA|VA) | 999 | $259,415,000 | $259,675 | $5,361 | 4.07% |

| TAMPA-ST. PETERSBURG-CLEARWATER, FL (FHA|USDA|VA) | 1,120 | $258,070,000 | $230,420 | $6,139 | 4.15% |

| PHOENIX-MESA-CHANDLER, AZ (FHA|USDA|VA) | 937 | $256,565,000 | $273,815 | $4,410 | 3.82% |

| Miami-Fort Lauderdale-Pompano Beach, FL (FHA|USDA|VA) | 886 | $248,700,000 | $280,700 | $7,478 | 4.27% |

| SACRAMENTO-ROSEVILLE-FOLSOM, CA (FHA|USDA|VA) | 712 | $234,470,000 | $329,312 | $5,841 | 3.87% |

| Seattle-Tacoma-Bellevue, WA (FHA|USDA|VA) | 463 | $193,445,000 | $417,808 | $5,679 | 3.86% |

| URBAN HONOLULU, HI (FHA|USDA|VA) | 332 | $189,050,000 | $569,428 | $8,280 | 3.68% |

| Outside of Metro Areas | 1,048 | $187,020,000 | $178,454 | $4,762 | 4.17% |

| Dallas-Fort Worth-Arlington, TX (FHA|USDA|VA) | 587 | $157,415,000 | $268,169 | $5,399 | 3.89% |

| Boston-Cambridge-Newton, MA-NH (FHA|USDA|VA) | 404 | $143,170,000 | $354,381 | $6,871 | 4.11% |

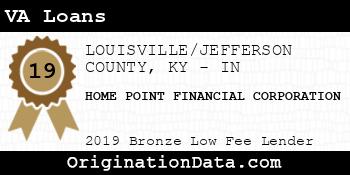

| LOUISVILLE, KY (FHA|USDA|VA) | 668 | $139,970,000 | $209,536 | $4,206 | 4.00% |

| FRESNO, CA (FHA|USDA|VA) | 482 | $131,350,000 | $272,510 | $6,202 | 4.02% |

| ORLANDO-KISSIMMEE-SANFORD, FL (FHA|USDA|VA) | 530 | $129,220,000 | $243,811 | $6,126 | 4.16% |

| HOUSTON-THE WOODLANDS-SUGAR LAND, TX (FHA|USDA|VA) | 486 | $124,740,000 | $256,667 | $5,848 | 4.11% |

| SAN JOSE-SUNNYVALE-SANTA CLARA, CA (FHA|USDA|VA) | 229 | $116,725,000 | $509,716 | $4,721 | 4.01% |

| MODESTO, CA (FHA|USDA|VA) | 427 | $116,025,000 | $271,721 | $5,994 | 3.93% |

| MINNEAPOLIS-ST. PAUL-BLOOMINGTON, MN-WI (FHA|USDA|VA) | 397 | $110,775,000 | $279,030 | $5,325 | 4.09% |

| SALT LAKE CITY, UT (FHA|USDA|VA) | 342 | $107,890,000 | $315,468 | $5,220 | 3.94% |

| North Port-Sarasota-Bradenton, FL (FHA|USDA|VA) | 391 | $99,115,000 | $253,491 | $5,360 | 4.02% |

| LAFAYETTE, LA (FHA|USDA|VA) | 446 | $96,370,000 | $216,076 | $5,308 | 3.85% |

| STOCKTON, CA (FHA|USDA|VA) | 298 | $89,840,000 | $301,477 | $6,773 | 3.78% |

| COLORADO SPRINGS, CO (FHA|USDA|VA) | 278 | $84,280,000 | $303,165 | $5,725 | 3.72% |

| Detroit-Warren-Dearborn, MI (FHA|USDA|VA) | 374 | $81,430,000 | $217,727 | $4,645 | 4.15% |

| PROVIDENCE-WARWICK, RI-MA (FHA|USDA|VA) | 295 | $79,575,000 | $269,746 | $6,325 | 4.03% |

| BALTIMORE-COLUMBIA-TOWSON, MD (FHA|USDA|VA) | 248 | $75,000,000 | $302,419 | $7,763 | 3.91% |

| KANSAS CITY, MO-KS (FHA|USDA|VA) | 306 | $71,090,000 | $232,320 | $4,652 | 4.11% |

| HARRISBURG-CARLISLE, PA (FHA|USDA|VA) | 359 | $70,625,000 | $196,727 | $5,582 | 3.96% |

| PORTLAND-VANCOUVER-HILLSBORO, OR-WA (FHA|USDA|VA) | 195 | $66,885,000 | $343,000 | $6,566 | 3.83% |

| OXNARD-THOUSAND OAKS-VENTURA, CA (FHA|USDA|VA) | 128 | $62,420,000 | $487,656 | $7,149 | 3.86% |

| BRIDGEPORT-STAMFORD-NORWALK, CT (FHA|USDA|VA) | 176 | $60,810,000 | $345,511 | $6,659 | 3.82% |

| ALBANY-SCHENECTADY-TROY, NY (FHA|USDA|VA) | 314 | $60,220,000 | $191,783 | $6,740 | 4.22% |

| SANTA ROSA-PETALUMA, CA (FHA|USDA|VA) | 126 | $57,930,000 | $459,762 | $7,746 | 4.06% |

| DAPHNE-FAIRHOPE-FOLEY, AL (FHA|USDA|VA) | 233 | $56,865,000 | $244,056 | $5,007 | 4.11% |

| BIRMINGHAM-HOOVER, AL (FHA|USDA|VA) | 229 | $52,905,000 | $231,026 | $5,075 | 3.97% |

| BAKERSFIELD, CA (FHA|USDA|VA) | 243 | $51,775,000 | $213,066 | $5,604 | 3.86% |

| BATON ROUGE, LA (FHA|USDA|VA) | 219 | $51,325,000 | $234,361 | $5,143 | 3.79% |

| JACKSONVILLE, FL (FHA|USDA|VA) | 209 | $50,945,000 | $243,756 | $5,413 | 3.99% |

| PITTSBURGH, PA (FHA|USDA|VA) | 269 | $49,855,000 | $185,335 | $7,112 | 4.10% |

| NEW ORLEANS-METAIRIE, LA (FHA|USDA|VA) | 197 | $49,605,000 | $251,802 | $6,680 | 3.88% |

| COLUMBUS, OH (FHA|USDA|VA) | 235 | $48,555,000 | $206,617 | $4,677 | 4.12% |

| ST. LOUIS, MO-IL (FHA|USDA|VA) | 235 | $48,415,000 | $206,021 | $4,886 | 4.23% |

| VALLEJO, CA (FHA|USDA|VA) | 126 | $47,060,000 | $373,492 | $6,270 | 3.81% |

| AUSTIN-ROUND ROCK-GEORGETOWN, TX (FHA|USDA|VA) | 158 | $45,510,000 | $288,038 | $5,925 | 4.05% |

| HUNTSVILLE, AL (FHA|USDA|VA) | 182 | $45,260,000 | $248,681 | $4,256 | 3.69% |

| HARTFORD-EAST HARTFORD-MIDDLETOWN, CT (FHA|USDA|VA) | 191 | $44,555,000 | $233,272 | $5,847 | 3.82% |

| BARNSTABLE TOWN, MA (FHA|USDA|VA) | 145 | $44,465,000 | $306,655 | $5,129 | 4.19% |

| VIRGINIA BEACH-NORFOLK-NEWPORT NEWS, VA-NC (FHA|USDA|VA) | 163 | $43,775,000 | $268,558 | $5,857 | 3.92% |

| CAPE CORAL-FORT MYERS, FL (FHA|USDA|VA) | 173 | $39,895,000 | $230,607 | $5,544 | 4.03% |

| BUFFALO-CHEEKTOWAGA, NY (FHA|USDA|VA) | 215 | $39,525,000 | $183,837 | $4,698 | 4.15% |

| CLEVELAND-ELYRIA, OH (FHA|USDA|VA) | 209 | $39,515,000 | $189,067 | $5,259 | 4.28% |

| GREELEY, CO (FHA|USDA|VA) | 124 | $38,960,000 | $314,194 | $5,945 | 3.97% |

| WORCESTER, MA-CT (FHA|USDA|VA) | 151 | $37,215,000 | $246,457 | $6,252 | 4.18% |

| CHARLOTTE-CONCORD-GASTONIA, NC-SC (FHA|USDA|VA) | 147 | $36,655,000 | $249,354 | $4,776 | 3.89% |

| LAKELAND-WINTER HAVEN, FL (FHA|USDA|VA) | 189 | $36,535,000 | $193,307 | $5,821 | 4.27% |

| RALEIGH-CARY, NC (FHA|USDA|VA) | 129 | $35,945,000 | $278,643 | $4,360 | 3.94% |

| INDIANAPOLIS-CARMEL-ANDERSON, IN (FHA|USDA|VA) | 183 | $35,705,000 | $195,109 | $4,575 | 4.15% |

| OGDEN-CLEARFIELD, UT (FHA|USDA|VA) | 125 | $35,675,000 | $285,400 | $5,776 | 3.87% |

| BOULDER, CO (FHA|USDA|VA) | 80 | $33,740,000 | $421,750 | $4,795 | 4.04% |

| CHARLESTON-NORTH CHARLESTON, SC (FHA|USDA|VA) | 116 | $33,120,000 | $285,517 | $6,070 | 3.88% |

| NEW HAVEN-MILFORD, CT (FHA|USDA|VA) | 144 | $32,870,000 | $228,264 | $5,505 | 4.03% |

| PENSACOLA-FERRY PASS-BRENT, FL (FHA|USDA|VA) | 120 | $32,550,000 | $271,250 | $5,620 | 3.73% |

| SAN ANTONIO-NEW BRAUNFELS, TX (FHA|USDA|VA) | 112 | $29,540,000 | $263,750 | $7,299 | 4.48% |

| PROVO-OREM, UT (FHA|USDA|VA) | 95 | $28,695,000 | $302,053 | $5,787 | 3.82% |

| FORT COLLINS, CO (FHA|USDA|VA) | 96 | $28,670,000 | $298,646 | $4,951 | 3.87% |

| Truckee-Grass Valley, CA (FHA|USDA|VA) | 87 | $28,615,000 | $328,908 | $4,972 | 4.02% |

| LAKE CHARLES, LA (FHA|USDA|VA) | 139 | $27,815,000 | $200,108 | $5,652 | 4.08% |

| SAN LUIS OBISPO-PASO ROBLES, CA (FHA|USDA|VA) | 59 | $27,375,000 | $463,983 | $6,324 | 3.96% |

| PORT ST. LUCIE, FL (FHA|USDA|VA) | 117 | $27,275,000 | $233,120 | $5,714 | 4.06% |

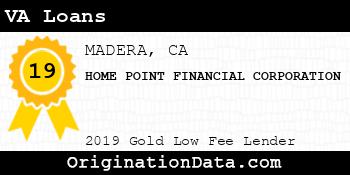

| MADERA, CA (FHA|USDA|VA) | 109 | $26,825,000 | $246,101 | $5,754 | 3.99% |

| EL CENTRO, CA (FHA|USDA|VA) | 116 | $26,140,000 | $225,345 | $6,906 | 3.59% |

| KNOXVILLE, TN (FHA|USDA|VA) | 119 | $25,445,000 | $213,824 | $5,229 | 3.86% |

| DELTONA-DAYTONA BEACH-ORMOND BEACH, FL (FHA|USDA|VA) | 113 | $25,055,000 | $221,726 | $5,151 | 4.09% |

| SIOUX CITY, IA-NE-SD (FHA|USDA|VA) | 138 | $23,320,000 | $168,986 | $4,380 | 4.09% |

| OMAHA-COUNCIL BLUFFS, NE-IA (FHA|USDA|VA) | 117 | $21,945,000 | $187,564 | $3,997 | 4.10% |

| Rock Springs, WY (FHA|USDA|VA) | 95 | $20,935,000 | $220,368 | $7,183 | 3.88% |

| NASHVILLE-DAVIDSON-MURFREESBORO-FRANKLIN, TN (FHA|USDA|VA) | 71 | $20,885,000 | $294,155 | $5,912 | 4.06% |

| OCEAN CITY, NJ (FHA|USDA|VA) | 90 | $20,730,000 | $230,333 | $5,740 | 4.06% |

| JEFFERSON CITY, MO (FHA|USDA|VA) | 107 | $20,655,000 | $193,037 | $4,140 | 3.92% |

| RICHMOND, VA (FHA|USDA|VA) | 79 | $20,565,000 | $260,316 | $5,325 | 3.82% |

| GREENVILLE-ANDERSON, SC (FHA|USDA|VA) | 96 | $20,560,000 | $214,167 | $5,305 | 4.02% |

| ABILENE, TX (FHA|USDA|VA) | 101 | $20,465,000 | $202,624 | $4,870 | 4.26% |

| DOVER, DE (FHA|USDA|VA) | 88 | $20,440,000 | $232,273 | $6,561 | 4.02% |

| LAREDO, TX (FHA|USDA|VA) | 82 | $20,420,000 | $249,024 | $7,030 | 4.10% |

| MADISON, WI (FHA|USDA|VA) | 84 | $20,410,000 | $242,976 | $3,445 | 4.12% |

| SALINAS, CA (FHA|USDA|VA) | 42 | $20,190,000 | $480,714 | $6,996 | 3.72% |

| PUNTA GORDA, FL (FHA|USDA|VA) | 100 | $19,820,000 | $198,200 | $4,972 | 3.99% |

| OKLAHOMA CITY, OK (FHA|USDA|VA) | 88 | $19,130,000 | $217,386 | $5,304 | 4.16% |

| MANCHESTER-NASHUA, NH (FHA|USDA|VA) | 76 | $19,110,000 | $251,447 | $4,328 | 4.28% |

| VISALIA, CA (FHA|USDA|VA) | 76 | $19,070,000 | $250,921 | $5,595 | 4.05% |

| POUGHKEEPSIE-NEWBURGH-MIDDLETOWN, NY (FHA|USDA|VA) | 69 | $18,845,000 | $273,116 | $6,807 | 4.08% |

| MERCED, CA (FHA|USDA|VA) | 76 | $18,510,000 | $243,553 | $6,309 | 3.79% |

| DES MOINES-WEST DES MOINES, IA (FHA|USDA|VA) | 76 | $17,930,000 | $235,921 | $5,399 | 3.63% |

| CRESTVIEW-FORT WALTON BEACH-DESTIN, FL (FHA|USDA|VA) | 59 | $17,855,000 | $302,627 | $6,221 | 3.72% |

| SALISBURY, MD-DE (FHA|USDA|VA) | 78 | $17,630,000 | $226,026 | $5,917 | 4.07% |

| GULFPORT-BILOXI, MS (FHA|USDA|VA) | 83 | $17,215,000 | $207,410 | $5,190 | 3.77% |

| PALM BAY-MELBOURNE-TITUSVILLE, FL (FHA|USDA|VA) | 69 | $16,295,000 | $236,159 | $5,215 | 3.95% |

| MOBILE, AL (FHA|USDA|VA) | 81 | $15,925,000 | $196,605 | $4,573 | 4.19% |

| CINCINNATI, OH-KY-IN (FHA|USDA|VA) | 77 | $15,755,000 | $204,610 | $5,142 | 4.19% |

| AUGUSTA-RICHMOND COUNTY, GA-SC (FHA|USDA|VA) | 72 | $15,250,000 | $211,806 | $5,566 | 3.73% |

| REDDING, CA (FHA|USDA|VA) | 58 | $15,180,000 | $261,724 | $4,765 | 3.89% |

| MORGANTOWN, WV (FHA|USDA|VA) | 70 | $15,110,000 | $215,857 | $5,573 | 3.90% |

| HANFORD-CORCORAN, CA (FHA|USDA|VA) | 63 | $15,055,000 | $238,968 | $6,172 | 3.79% |

| SALEM, OR (FHA|USDA|VA) | 61 | $14,955,000 | $245,164 | $7,656 | 4.04% |

| ALLENTOWN-BETHLEHEM-EASTON, PA-NJ (FHA|USDA|VA) | 69 | $14,855,000 | $215,290 | $6,757 | 4.20% |

| WINSTON-SALEM, NC (FHA|USDA|VA) | 86 | $14,670,000 | $170,581 | $4,526 | 4.04% |

| Cambridge, MD (FHA|USDA|VA) | 73 | $14,295,000 | $195,822 | $4,596 | 4.07% |

| CHICO, CA (FHA|USDA|VA) | 52 | $14,290,000 | $274,808 | $4,849 | 3.94% |

| BREMERTON-SILVERDALE-PORT ORCHARD, WA (FHA|USDA|VA) | 40 | $14,080,000 | $352,000 | $5,501 | 3.73% |

| FAYETTEVILLE-SPRINGDALE-ROGERS, AR (FHA|USDA|VA) | 68 | $13,300,000 | $195,588 | $4,548 | 3.77% |

| SAVANNAH, GA (FHA|USDA|VA) | 55 | $13,285,000 | $241,545 | $4,559 | 3.90% |

| AUBURN-OPELIKA, AL (FHA|USDA|VA) | 58 | $12,880,000 | $222,069 | $4,165 | 4.01% |

| PRESCOTT VALLEY-PRESCOTT, AZ (FHA|USDA|VA) | 53 | $12,505,000 | $235,943 | $5,024 | 4.00% |

| OLYMPIA-LACEY-TUMWATER, WA (FHA|USDA|VA) | 39 | $12,395,000 | $317,821 | $4,858 | 3.84% |

| TUCSON, AZ (FHA|USDA|VA) | 51 | $12,265,000 | $240,490 | $4,092 | 3.72% |

| NAPLES-MARCO ISLAND, FL (FHA|USDA|VA) | 41 | $12,255,000 | $298,902 | $6,626 | 4.21% |

| PUEBLO, CO (FHA|USDA|VA) | 56 | $12,130,000 | $216,607 | $4,586 | 3.87% |

| YUBA CITY, CA (FHA|USDA|VA) | 42 | $11,790,000 | $280,714 | $5,996 | 3.64% |

| HAGERSTOWN-MARTINSBURG, MD-WV (FHA|USDA|VA) | 58 | $11,730,000 | $202,241 | $5,128 | 4.17% |

| TRENTON-PRINCETON, NJ (FHA|USDA|VA) | 42 | $11,070,000 | $263,571 | $7,823 | 4.12% |

| MILWAUKEE-WAUKESHA, WI (FHA|USDA|VA) | 46 | $11,020,000 | $239,565 | $4,067 | 4.24% |

| SPOKANE-SPOKANE VALLEY, WA (FHA|USDA|VA) | 39 | $10,465,000 | $268,333 | $4,101 | 3.87% |

| Edwards, CO (FHA|USDA|VA) | 24 | $10,390,000 | $432,917 | $5,859 | 3.87% |

| COLUMBIA, SC (FHA|USDA|VA) | 45 | $10,355,000 | $230,111 | $3,846 | 3.86% |

| YORK-HANOVER, PA (FHA|USDA|VA) | 50 | $10,150,000 | $203,000 | $5,731 | 3.95% |

| READING, PA (FHA|USDA|VA) | 50 | $10,140,000 | $202,800 | $5,741 | 4.11% |

| TYLER, TX (FHA|USDA|VA) | 41 | $9,845,000 | $240,122 | $6,715 | 3.83% |

| ASHEVILLE, NC (FHA|USDA|VA) | 41 | $9,835,000 | $239,878 | $4,618 | 4.02% |

| SANTA MARIA-SANTA BARBARA, CA (FHA|USDA|VA) | 26 | $9,820,000 | $377,692 | $4,654 | 3.84% |

| SHREVEPORT-BOSSIER CITY, LA (FHA|USDA|VA) | 53 | $9,725,000 | $183,491 | $5,432 | 3.92% |

| SANTA CRUZ-WATSONVILLE, CA (FHA|USDA|VA) | 19 | $9,725,000 | $511,842 | $7,037 | 3.99% |

| CEDAR RAPIDS, IA (FHA|USDA|VA) | 44 | $9,620,000 | $218,636 | $3,925 | 3.79% |

| ERIE, PA (FHA|USDA|VA) | 63 | $9,425,000 | $149,603 | $6,570 | 4.35% |

| MYRTLE BEACH-CONWAY-NORTH MYRTLE BEACH, SC-NC (FHA|USDA|VA) | 39 | $9,365,000 | $240,128 | $4,287 | 3.93% |

| ST. CLOUD, MN (FHA|USDA|VA) | 49 | $9,245,000 | $188,673 | $4,616 | 4.10% |

| CLEVELAND, TN (FHA|USDA|VA) | 47 | $9,155,000 | $194,787 | $3,992 | 3.95% |

| RENO, NV (FHA|USDA|VA) | 26 | $8,850,000 | $340,385 | $5,467 | 3.84% |

| STATE COLLEGE, PA (FHA|USDA|VA) | 46 | $8,830,000 | $191,957 | $7,351 | 4.13% |

| KAHULUI-WAILUKU-LAHAINA, HI (FHA|USDA|VA) | 16 | $8,780,000 | $548,750 | $5,616 | 3.72% |

| DURHAM-CHAPEL HILL, NC (FHA|USDA|VA) | 34 | $8,730,000 | $256,765 | $4,286 | 4.17% |

| Sonora, CA (FHA|USDA|VA) | 33 | $8,065,000 | $244,394 | $5,451 | 3.98% |

| CANTON-MASSILLON, OH (FHA|USDA|VA) | 47 | $8,055,000 | $171,383 | $4,143 | 4.23% |

| Morehead City, NC (FHA|USDA|VA) | 25 | $7,805,000 | $312,200 | $5,278 | 3.88% |

| ROCHESTER, NY (FHA|USDA|VA) | 50 | $7,790,000 | $155,800 | $5,015 | 4.07% |

| GREENSBORO-HIGH POINT, NC (FHA|USDA|VA) | 44 | $7,770,000 | $176,591 | $4,785 | 4.01% |

| GLENS FALLS, NY (FHA|USDA|VA) | 50 | $7,750,000 | $155,000 | $5,378 | 4.25% |

| KALAMAZOO-PORTAGE, MI (FHA|USDA|VA) | 38 | $7,690,000 | $202,368 | $4,252 | 3.85% |

| PORTLAND-SOUTH PORTLAND, ME (FHA|USDA|VA) | 26 | $7,520,000 | $289,231 | $4,226 | 3.92% |

| WILMINGTON, NC (FHA|USDA|VA) | 32 | $7,410,000 | $231,563 | $4,749 | 3.91% |

| WICHITA, KS (FHA|USDA|VA) | 42 | $7,360,000 | $175,238 | $3,999 | 4.18% |

| SCRANTON--WILKES-BARRE, PA (FHA|USDA|VA) | 40 | $7,290,000 | $182,250 | $5,584 | 3.97% |

| NORWICH-NEW LONDON, CT (FHA|USDA|VA) | 34 | $7,280,000 | $214,118 | $5,410 | 4.28% |

| NAPA, CA (FHA|USDA|VA) | 15 | $7,205,000 | $480,333 | $7,033 | 4.08% |

| LYNCHBURG, VA (FHA|USDA|VA) | 39 | $7,185,000 | $184,231 | $4,180 | 3.92% |

| TALLAHASSEE, FL (FHA|USDA|VA) | 30 | $7,060,000 | $235,333 | $6,971 | 4.25% |

| LEXINGTON-FAYETTE, KY (FHA|USDA|VA) | 37 | $6,835,000 | $184,730 | $4,958 | 4.14% |

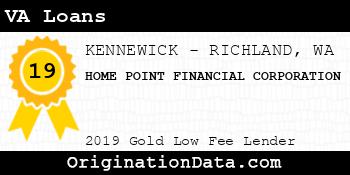

| KENNEWICK-RICHLAND, WA (FHA|USDA|VA) | 24 | $6,740,000 | $280,833 | $4,549 | 3.80% |

| Ukiah, CA (FHA|USDA|VA) | 21 | $6,565,000 | $312,619 | $7,420 | 3.71% |

| OCALA, FL (FHA|USDA|VA) | 41 | $6,555,000 | $159,878 | $4,504 | 4.39% |

| Hilo, HI (FHA|USDA|VA) | 17 | $6,535,000 | $384,412 | $6,878 | 3.64% |

| GRAND JUNCTION, CO (FHA|USDA|VA) | 27 | $6,495,000 | $240,556 | $5,006 | 3.83% |

| JACKSONVILLE, NC (FHA|USDA|VA) | 36 | $6,470,000 | $179,722 | $3,997 | 3.96% |

| JACKSON, MS (FHA|USDA|VA) | 28 | $6,470,000 | $231,071 | $5,054 | 3.96% |

| LINCOLN, NE (FHA|USDA|VA) | 26 | $6,440,000 | $247,692 | $3,371 | 4.21% |

| VALDOSTA, GA (FHA|USDA|VA) | 37 | $6,245,000 | $168,784 | $5,256 | 3.90% |

| Salina, KS (FHA|USDA|VA) | 35 | $6,205,000 | $177,286 | $3,403 | 4.52% |

| UTICA-ROME, NY (FHA|USDA|VA) | 46 | $6,150,000 | $133,696 | $5,335 | 4.07% |

| WINCHESTER, VA-WV (FHA|USDA|VA) | 23 | $6,115,000 | $265,870 | $5,402 | 4.05% |

| ALBUQUERQUE, NM (FHA|USDA|VA) | 31 | $6,105,000 | $196,935 | $4,333 | 4.20% |

| Watertown-Fort Atkinson, WI (FHA|USDA|VA) | 30 | $6,090,000 | $203,000 | $2,974 | 4.14% |

| AKRON, OH (FHA|USDA|VA) | 34 | $6,090,000 | $179,118 | $4,101 | 4.27% |

| Heber, UT (FHA|USDA|VA) | 13 | $6,005,000 | $461,923 | $6,934 | 3.76% |

| SYRACUSE, NY (FHA|USDA|VA) | 41 | $5,965,000 | $145,488 | $5,167 | 4.07% |

| ELIZABETHTOWN-FORT KNOX, KY (FHA|USDA|VA) | 32 | $5,960,000 | $186,250 | $4,609 | 4.17% |

| Williston, ND (FHA|USDA|VA) | 24 | $5,900,000 | $245,833 | $4,909 | 4.13% |

| DECATUR, AL (FHA|USDA|VA) | 27 | $5,815,000 | $215,370 | $5,051 | 3.53% |

| MEMPHIS, TN-MS-AR (FHA|USDA|VA) | 21 | $5,635,000 | $268,333 | $5,012 | 3.94% |

| Gloversville, NY (FHA|USDA|VA) | 37 | $5,575,000 | $150,676 | $5,651 | 4.19% |

| SPRINGFIELD, MO (FHA|USDA|VA) | 31 | $5,575,000 | $179,839 | $3,576 | 4.31% |

| ANN ARBOR, MI (FHA|USDA|VA) | 22 | $5,520,000 | $250,909 | $4,232 | 3.97% |

| GAINESVILLE, FL (FHA|USDA|VA) | 29 | $5,495,000 | $189,483 | $5,604 | 4.28% |

| DULUTH, MN-WI (FHA|USDA|VA) | 31 | $5,455,000 | $175,968 | $4,822 | 4.16% |

| Bellefontaine, OH (FHA|USDA|VA) | 44 | $5,400,000 | $122,727 | $4,134 | 4.10% |

| TULSA, OK (FHA|USDA|VA) | 29 | $5,395,000 | $186,034 | $5,218 | 4.50% |

| BOISE CITY, ID (FHA|USDA|VA) | 15 | $5,235,000 | $349,000 | $5,417 | 3.98% |

| EL PASO, TX (FHA|USDA|VA) | 31 | $5,235,000 | $168,871 | $6,128 | 3.98% |

| Marquette, MI (FHA|USDA|VA) | 28 | $5,220,000 | $186,429 | $4,696 | 3.97% |

| SPARTANBURG, SC (FHA|USDA|VA) | 26 | $5,200,000 | $200,000 | $4,379 | 3.99% |

| Opelousas, LA (FHA|USDA|VA) | 26 | $4,900,000 | $188,462 | $5,066 | 3.93% |

| Albertville, AL (FHA|USDA|VA) | 24 | $4,740,000 | $197,500 | $3,925 | 3.82% |

| ATLANTIC CITY-HAMMONTON, NJ (FHA|USDA|VA) | 19 | $4,715,000 | $248,158 | $6,572 | 3.91% |

| FAYETTEVILLE, NC (FHA|USDA|VA) | 25 | $4,665,000 | $186,600 | $4,299 | 3.80% |

| GAINESVILLE, GA (FHA|USDA|VA) | 18 | $4,650,000 | $258,333 | $5,721 | 4.03% |

| TOLEDO, OH (FHA|USDA|VA) | 25 | $4,545,000 | $181,800 | $5,173 | 3.90% |

| Payson, AZ (FHA|USDA|VA) | 16 | $4,540,000 | $283,750 | $3,749 | 3.98% |

| COLUMBUS, GA-AL (FHA|USDA|VA) | 24 | $4,530,000 | $188,750 | $4,557 | 3.59% |

| TOPEKA, KS (FHA|USDA|VA) | 27 | $4,495,000 | $166,481 | $5,247 | 3.85% |

| MEDFORD, OR (FHA|USDA|VA) | 15 | $4,465,000 | $297,667 | $7,851 | 4.08% |

| CHATTANOOGA, TN-GA (FHA|USDA|VA) | 20 | $4,450,000 | $222,500 | $5,104 | 4.02% |

| LANCASTER, PA (FHA|USDA|VA) | 19 | $4,365,000 | $229,737 | $7,316 | 4.01% |

| LAKE HAVASU CITY-KINGMAN, AZ (FHA|USDA|VA) | 18 | $4,360,000 | $242,222 | $4,009 | 4.02% |

| DAYTON-KETTERING, OH (FHA|USDA|VA) | 23 | $4,265,000 | $185,435 | $5,623 | 4.05% |

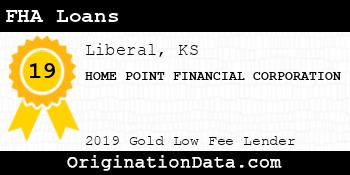

| Liberal, KS (FHA|USDA|VA) | 34 | $4,150,000 | $122,059 | $6,111 | 4.42% |

| JACKSON, MI (FHA|USDA|VA) | 25 | $4,115,000 | $164,600 | $3,742 | 4.31% |

| GETTYSBURG, PA (FHA|USDA|VA) | 16 | $3,910,000 | $244,375 | $7,301 | 3.80% |

| CORPUS CHRISTI, TX (FHA|USDA|VA) | 17 | $3,905,000 | $229,706 | $6,272 | 3.98% |

| Torrington, CT (FHA|USDA|VA) | 16 | $3,780,000 | $236,250 | $6,914 | 3.70% |

| EAST STROUDSBURG, PA (FHA|USDA|VA) | 18 | $3,760,000 | $208,889 | $6,625 | 3.98% |

| Breckenridge, CO (FHA|USDA|VA) | 11 | $3,755,000 | $341,364 | $3,523 | 4.24% |

| EUGENE-SPRINGFIELD, OR (FHA|USDA|VA) | 14 | $3,700,000 | $264,286 | $4,740 | 4.08% |

| CORVALLIS, OR (FHA|USDA|VA) | 13 | $3,685,000 | $283,462 | $5,249 | 4.04% |

| Steamboat Springs, CO (FHA|USDA|VA) | 9 | $3,645,000 | $405,000 | $5,192 | 3.94% |

| ST. GEORGE, UT (FHA|USDA|VA) | 15 | $3,645,000 | $243,000 | $3,932 | 3.86% |

| MORRISTOWN, TN (FHA|USDA|VA) | 20 | $3,640,000 | $182,000 | $5,263 | 4.04% |

| CALIFORNIA-LEXINGTON PARK, MD (FHA|USDA|VA) | 10 | $3,620,000 | $362,000 | $7,634 | 3.86% |

| GRAND RAPIDS-KENTWOOD, MI (FHA|USDA|VA) | 18 | $3,610,000 | $200,556 | $3,412 | 4.28% |

| Scottsburg, IN (FHA|USDA|VA) | 22 | $3,600,000 | $163,636 | $4,282 | 4.10% |

| Urbana, OH (FHA|USDA|VA) | 22 | $3,600,000 | $163,636 | $4,801 | 3.88% |

| ANCHORAGE, AK (FHA|USDA|VA) | 11 | $3,565,000 | $324,091 | $5,804 | 3.50% |

| Outside of Metro Areas | 11 | $3,535,000 | $321,364 | $6,551 | 3.91% |

| PANAMA CITY, FL (FHA|USDA|VA) | 15 | $3,515,000 | $234,333 | $4,466 | 4.05% |

| KANKAKEE, IL (FHA|USDA|VA) | 19 | $3,515,000 | $185,000 | $4,340 | 4.19% |

| SPRINGFIELD, MA (FHA|USDA|VA) | 18 | $3,500,000 | $194,444 | $5,666 | 4.10% |

| HOMOSASSA SPRINGS, FL (FHA|USDA|VA) | 23 | $3,485,000 | $151,522 | $4,756 | 4.53% |

| Concord, NH (FHA|USDA|VA) | 15 | $3,485,000 | $232,333 | $3,630 | 4.37% |

| TUSCALOOSA, AL (FHA|USDA|VA) | 18 | $3,440,000 | $191,111 | $5,843 | 3.79% |

| FARGO, ND-MN (FHA|USDA|VA) | 12 | $3,420,000 | $285,000 | $5,847 | 3.57% |

| Jennings, LA (FHA|USDA|VA) | 21 | $3,415,000 | $162,619 | $5,538 | 3.93% |

| Oak Harbor, WA (FHA|USDA|VA) | 9 | $3,395,000 | $377,222 | $6,080 | 3.75% |

| HINESVILLE, GA (FHA|USDA|VA) | 15 | $3,375,000 | $225,000 | $6,304 | 3.64% |

| ALBANY-LEBANON, OR (FHA|USDA|VA) | 13 | $3,375,000 | $259,615 | $7,827 | 3.76% |

| Glenwood Springs, CO (FHA|USDA|VA) | 10 | $3,350,000 | $335,000 | $6,284 | 4.16% |

| Amsterdam, NY (FHA|USDA|VA) | 25 | $3,335,000 | $133,400 | $5,818 | 4.33% |

| LITTLE ROCK-NORTH LITTLE ROCK-CONWAY, AR (FHA|USDA|VA) | 15 | $3,315,000 | $221,000 | $4,396 | 3.97% |

| Easton, MD (FHA|USDA|VA) | 11 | $3,305,000 | $300,455 | $4,850 | 4.09% |

| Fort Leonard Wood, MO (FHA|USDA|VA) | 18 | $3,180,000 | $176,667 | $1,693 | 4.03% |

| BEND, OR (FHA|USDA|VA) | 12 | $3,180,000 | $265,000 | $6,106 | 3.84% |

| MOUNT VERNON-ANACORTES, WA (FHA|USDA|VA) | 10 | $3,170,000 | $317,000 | $4,626 | 3.88% |

| Jefferson, GA (FHA|USDA|VA) | 15 | $3,155,000 | $210,333 | $4,945 | 4.20% |

| Durango, CO (FHA|USDA|VA) | 9 | $3,135,000 | $348,333 | $3,396 | 4.08% |

| CHARLOTTESVILLE, VA (FHA|USDA|VA) | 11 | $3,075,000 | $279,545 | $7,474 | 3.89% |

| Clarksburg, WV (FHA|USDA|VA) | 18 | $3,040,000 | $168,889 | $4,381 | 4.30% |

| Sevierville, TN (FHA|USDA|VA) | 13 | $3,005,000 | $231,154 | $6,096 | 4.36% |

| DeRidder, LA (FHA|USDA|VA) | 13 | $2,955,000 | $227,308 | $5,687 | 4.01% |

| Pahrump, NV (FHA|USDA|VA) | 14 | $2,950,000 | $210,714 | $5,356 | 4.02% |

| ROANOKE, VA (FHA|USDA|VA) | 16 | $2,950,000 | $184,375 | $4,818 | 3.83% |

| Hutchinson, KS (FHA|USDA|VA) | 20 | $2,910,000 | $145,500 | $3,328 | 4.12% |

| Ottawa, IL (FHA|USDA|VA) | 15 | $2,905,000 | $193,667 | $4,488 | 4.12% |

| LEBANON, PA (FHA|USDA|VA) | 16 | $2,900,000 | $181,250 | $7,154 | 4.17% |

| Roanoke Rapids, NC (FHA|USDA|VA) | 22 | $2,900,000 | $131,818 | $3,618 | 3.94% |

| Shelton, WA (FHA|USDA|VA) | 12 | $2,860,000 | $238,333 | $5,429 | 3.75% |

| WAUSAU-WESTON, WI (FHA|USDA|VA) | 17 | $2,835,000 | $166,765 | $4,724 | 4.19% |

| PARKERSBURG-VIENNA, WV (FHA|USDA|VA) | 17 | $2,825,000 | $166,176 | $5,778 | 3.95% |

| HAMMOND, LA (FHA|USDA|VA) | 15 | $2,695,000 | $179,667 | $6,352 | 4.02% |

| BELLINGHAM, WA (FHA|USDA|VA) | 10 | $2,680,000 | $268,000 | $4,176 | 3.65% |

| DOTHAN, AL (FHA|USDA|VA) | 15 | $2,645,000 | $176,333 | $5,919 | 4.33% |

| Klamath Falls, OR (FHA|USDA|VA) | 11 | $2,625,000 | $238,636 | $5,208 | 3.97% |

| COLUMBIA, MO (FHA|USDA|VA) | 13 | $2,605,000 | $200,385 | $4,302 | 4.23% |

| Bardstown, KY (FHA|USDA|VA) | 13 | $2,575,000 | $198,077 | $5,171 | 3.87% |

| FLAGSTAFF, AZ (FHA|USDA|VA) | 8 | $2,570,000 | $321,250 | $5,469 | 3.47% |

| FLINT, MI (FHA|USDA|VA) | 15 | $2,545,000 | $169,667 | $5,407 | 4.42% |

| MONROE, LA (FHA|USDA|VA) | 13 | $2,535,000 | $195,000 | $4,668 | 4.19% |

| Show Low, AZ (FHA|USDA|VA) | 13 | $2,515,000 | $193,462 | $3,845 | 3.85% |

| LONGVIEW, WA (FHA|USDA|VA) | 8 | $2,480,000 | $310,000 | $4,595 | 3.59% |

| Beaver Dam, WI (FHA|USDA|VA) | 13 | $2,475,000 | $190,385 | $3,889 | 3.90% |

| YOUNGSTOWN-WARREN-BOARDMAN, OH-PA (FHA|USDA|VA) | 16 | $2,460,000 | $153,750 | $6,087 | 4.02% |

| SIERRA VISTA-DOUGLAS, AZ (FHA|USDA|VA) | 10 | $2,460,000 | $246,000 | $2,834 | 3.66% |

| MONTGOMERY, AL (FHA|USDA|VA) | 11 | $2,425,000 | $220,455 | $6,902 | 4.08% |

| YAKIMA, WA (FHA|USDA|VA) | 9 | $2,405,000 | $267,222 | $5,080 | 3.92% |

| Fairmont, WV (FHA|USDA|VA) | 16 | $2,400,000 | $150,000 | $5,729 | 4.33% |

| Frankfort, KY (FHA|USDA|VA) | 15 | $2,385,000 | $159,000 | $4,713 | 4.36% |

| THE VILLAGES, FL (FHA|USDA|VA) | 8 | $2,370,000 | $296,250 | $8,941 | 3.76% |

| Washington Court House, OH (FHA|USDA|VA) | 15 | $2,365,000 | $157,667 | $4,530 | 4.22% |

| JANESVILLE-BELOIT, WI (FHA|USDA|VA) | 12 | $2,350,000 | $195,833 | $4,015 | 4.20% |

| WILLIAMSPORT, PA (FHA|USDA|VA) | 14 | $2,350,000 | $167,857 | $5,654 | 3.95% |

| Brainerd, MN (FHA|USDA|VA) | 12 | $2,350,000 | $195,833 | $4,680 | 4.39% |

| BRUNSWICK, GA (FHA|USDA|VA) | 10 | $2,350,000 | $235,000 | $5,008 | 4.12% |

| Guymon, OK (FHA|USDA|VA) | 17 | $2,315,000 | $136,176 | $7,142 | 4.38% |

| Clearlake, CA (FHA|USDA|VA) | 8 | $2,280,000 | $285,000 | $6,466 | 3.94% |

| Cañon City, CO (FHA|USDA|VA) | 12 | $2,270,000 | $189,167 | $3,933 | 4.01% |

| BILLINGS, MT (FHA|USDA|VA) | 9 | $2,245,000 | $249,444 | $5,505 | 4.29% |

| HUNTINGTON-ASHLAND, WV-KY-OH (FHA|USDA|VA) | 13 | $2,235,000 | $171,923 | $5,146 | 3.98% |

| Okeechobee, FL (FHA|USDA|VA) | 13 | $2,235,000 | $171,923 | $5,074 | 3.78% |

| CLARKSVILLE, TN-KY (FHA|USDA|VA) | 10 | $2,220,000 | $222,000 | $3,575 | 3.87% |

| SHEBOYGAN, WI (FHA|USDA|VA) | 9 | $2,195,000 | $243,889 | $5,261 | 3.94% |

| CHAMBERSBURG-WAYNESBORO, PA (FHA|USDA|VA) | 11 | $2,155,000 | $195,909 | $5,138 | 4.06% |

| FORT WAYNE, IN (FHA|USDA|VA) | 12 | $2,120,000 | $176,667 | $4,063 | 3.93% |

| Boone, NC (FHA|USDA|VA) | 7 | $2,075,000 | $296,429 | $4,853 | 4.13% |

| Eureka-Arcata, CA (FHA|USDA|VA) | 6 | $2,050,000 | $341,667 | $5,600 | 4.04% |

| JOPLIN, MO (FHA|USDA|VA) | 17 | $2,045,000 | $120,294 | $5,003 | 4.43% |

| ATHENS-CLARKE COUNTY, GA (FHA|USDA|VA) | 8 | $2,030,000 | $253,750 | $3,529 | 4.12% |

| CARBONDALE-MARION, IL (FHA|USDA|VA) | 11 | $2,005,000 | $182,273 | $3,954 | 3.83% |

| HATTIESBURG, MS (FHA|USDA|VA) | 10 | $2,000,000 | $200,000 | $5,146 | 3.82% |

| CASPER, WY (FHA|USDA|VA) | 5 | $1,985,000 | $397,000 | $4,822 | 4.20% |

| MIDLAND, TX (FHA|USDA|VA) | 8 | $1,980,000 | $247,500 | $5,421 | 4.31% |

| JACKSON, TN (FHA|USDA|VA) | 12 | $1,980,000 | $165,000 | $6,895 | 3.81% |

| SHERMAN-DENISON, TX (FHA|USDA|VA) | 9 | $1,965,000 | $218,333 | $5,356 | 3.90% |

| HICKORY-LENOIR-MORGANTON, NC (FHA|USDA|VA) | 10 | $1,880,000 | $188,000 | $4,222 | 4.09% |

| HILTON HEAD ISLAND-BLUFFTON, SC (FHA|USDA|VA) | 8 | $1,840,000 | $230,000 | $5,750 | 3.86% |

| JONESBORO, AR (FHA|USDA|VA) | 14 | $1,840,000 | $131,429 | $5,181 | 4.41% |

| Whitewater, WI (FHA|USDA|VA) | 8 | $1,800,000 | $225,000 | $4,729 | 4.14% |

| ALTOONA, PA (FHA|USDA|VA) | 15 | $1,785,000 | $119,000 | $5,345 | 4.25% |

| Key West, FL (FHA|USDA|VA) | 5 | $1,765,000 | $353,000 | $7,722 | 4.15% |

| Centralia, WA (FHA|USDA|VA) | 6 | $1,720,000 | $286,667 | $8,567 | 4.10% |

| BEAUMONT-PORT ARTHUR, TX (FHA|USDA|VA) | 8 | $1,700,000 | $212,500 | $5,931 | 4.48% |

| Sebastian-Vero Beach, FL (FHA|USDA|VA) | 7 | $1,665,000 | $237,857 | $5,451 | 4.01% |

| WENATCHEE, WA (FHA|USDA|VA) | 6 | $1,620,000 | $270,000 | $3,978 | 4.10% |

| DAVENPORT-MOLINE-ROCK ISLAND, IA-IL (FHA|USDA|VA) | 9 | $1,615,000 | $179,444 | $6,238 | 3.97% |

| Granbury, TX (FHA|USDA|VA) | 6 | $1,610,000 | $268,333 | $6,149 | 4.04% |

| Newport, OR (FHA|USDA|VA) | 6 | $1,590,000 | $265,000 | $8,776 | 4.17% |

| AMES, IA (FHA|USDA|VA) | 7 | $1,575,000 | $225,000 | $4,936 | 3.66% |

| FLORENCE-MUSCLE SHOALS, AL (FHA|USDA|VA) | 7 | $1,575,000 | $225,000 | $3,929 | 3.93% |

| Red Bluff, CA (FHA|USDA|VA) | 5 | $1,575,000 | $315,000 | $9,260 | 3.30% |

| LAWRENCE, KS (FHA|USDA|VA) | 8 | $1,570,000 | $196,250 | $4,025 | 4.08% |

| Kalispell, MT (FHA|USDA|VA) | 7 | $1,565,000 | $223,571 | $6,827 | 3.98% |

| Talladega-Sylacauga, AL (FHA|USDA|VA) | 11 | $1,565,000 | $142,273 | $4,362 | 3.70% |

| LONGVIEW, TX (FHA|USDA|VA) | 7 | $1,565,000 | $223,571 | $7,506 | 3.95% |

| Arcadia, FL (FHA|USDA|VA) | 8 | $1,560,000 | $195,000 | $6,195 | 4.19% |

| ROCKFORD, IL (FHA|USDA|VA) | 10 | $1,550,000 | $155,000 | $4,920 | 4.34% |

| SEBRING-AVON PARK, FL (FHA|USDA|VA) | 12 | $1,550,000 | $129,167 | $4,934 | 4.25% |

| WATERLOO-CEDAR FALLS, IA (FHA|USDA|VA) | 7 | $1,545,000 | $220,714 | $3,537 | 3.45% |

| Willmar, MN (FHA|USDA|VA) | 6 | $1,530,000 | $255,000 | $5,241 | 4.08% |

| Kapaa, HI (FHA|USDA|VA) | 4 | $1,530,000 | $382,500 | $2,796 | 3.59% |

| YUMA, AZ (FHA|USDA|VA) | 6 | $1,520,000 | $253,333 | $3,786 | 3.58% |

| LANSING-EAST LANSING, MI (FHA|USDA|VA) | 12 | $1,520,000 | $126,667 | $4,753 | 4.49% |

| Athens, TN (FHA|USDA|VA) | 9 | $1,505,000 | $167,222 | $5,188 | 4.43% |

| Wooster, OH (FHA|USDA|VA) | 10 | $1,480,000 | $148,000 | $5,384 | 4.65% |

| Meadville, PA (FHA|USDA|VA) | 13 | $1,475,000 | $113,462 | $5,452 | 4.11% |

| KILLEEN-TEMPLE, TX (FHA|USDA|VA) | 7 | $1,465,000 | $209,286 | $4,076 | 3.59% |

| TEXARKANA, TX-AR (FHA|USDA|VA) | 9 | $1,465,000 | $162,778 | $4,463 | 4.11% |

| Lock Haven, PA (FHA|USDA|VA) | 11 | $1,465,000 | $133,182 | $7,136 | 4.48% |

| Mount Airy, NC (FHA|USDA|VA) | 8 | $1,440,000 | $180,000 | $4,965 | 4.31% |

| Holland, MI (FHA|USDA|VA) | 6 | $1,410,000 | $235,000 | $4,093 | 4.06% |

| MANSFIELD, OH (FHA|USDA|VA) | 13 | $1,385,000 | $106,538 | $4,233 | 4.67% |

| Pinehurst-Southern Pines, NC (FHA|USDA|VA) | 5 | $1,385,000 | $277,000 | $4,106 | 3.50% |

| Oneonta, NY (FHA|USDA|VA) | 10 | $1,380,000 | $138,000 | $4,745 | 4.36% |

| Calhoun, GA (FHA|USDA|VA) | 8 | $1,370,000 | $171,250 | $4,574 | 3.98% |

| Pottsville, PA (FHA|USDA|VA) | 7 | $1,365,000 | $195,000 | $5,005 | 3.91% |

| Marinette, WI-MI (FHA|USDA|VA) | 5 | $1,365,000 | $273,000 | $4,110 | 4.77% |

| BURLINGTON, NC (FHA|USDA|VA) | 6 | $1,360,000 | $226,667 | $3,494 | 4.25% |

| GADSDEN, AL (FHA|USDA|VA) | 8 | $1,350,000 | $168,750 | $4,218 | 4.11% |

| SIOUX FALLS, SD (FHA|USDA|VA) | 6 | $1,340,000 | $223,333 | $4,549 | 3.68% |

| Georgetown, SC (FHA|USDA|VA) | 6 | $1,330,000 | $221,667 | $7,119 | 4.38% |

| Huntsville, TX (FHA|USDA|VA) | 6 | $1,310,000 | $218,333 | $4,070 | 4.50% |

| Brookings, OR (FHA|USDA|VA) | 1 | $1,305,000 | $1,305,000 | $2,338 | 3.75% |

| Hailey, ID (FHA|USDA|VA) | 4 | $1,290,000 | $322,500 | $5,259 | 3.90% |

| EVANSVILLE, IN-KY (FHA|USDA|VA) | 7 | $1,285,000 | $183,571 | $4,806 | 4.41% |

| STAUNTON, VA (FHA|USDA|VA) | 6 | $1,270,000 | $211,667 | $8,122 | 3.60% |

| Seneca, SC (FHA|USDA|VA) | 7 | $1,265,000 | $180,714 | $3,912 | 3.80% |

| AMARILLO, TX (FHA|USDA|VA) | 7 | $1,265,000 | $180,714 | $4,744 | 4.05% |

| HARRISONBURG, VA (FHA|USDA|VA) | 6 | $1,260,000 | $210,000 | $4,195 | 3.89% |

| GRAND FORKS, ND-MN (FHA|USDA|VA) | 5 | $1,245,000 | $249,000 | $5,228 | 3.95% |

| Atmore, AL (FHA|USDA|VA) | 6 | $1,240,000 | $206,667 | $7,257 | 3.73% |

| MACON-BIBB COUNTY, GA (FHA|USDA|VA) | 8 | $1,240,000 | $155,000 | $5,266 | 4.12% |

| LaGrange, GA-AL (FHA|USDA|VA) | 6 | $1,230,000 | $205,000 | $5,448 | 4.23% |

| Batesville, AR (FHA|USDA|VA) | 10 | $1,230,000 | $123,000 | $4,183 | 4.70% |

| DuBois, PA (FHA|USDA|VA) | 12 | $1,220,000 | $101,667 | $5,573 | 4.58% |

| Susanville, CA (FHA|USDA|VA) | 4 | $1,220,000 | $305,000 | $5,725 | 3.65% |

| MANKATO, MN (FHA|USDA|VA) | 5 | $1,215,000 | $243,000 | $3,877 | 4.18% |

| Evanston, WY (FHA|USDA|VA) | 5 | $1,205,000 | $241,000 | $7,687 | 3.63% |

| DUBUQUE, IA (FHA|USDA|VA) | 7 | $1,205,000 | $172,143 | $3,188 | 3.64% |

| GOLDSBORO, NC (FHA|USDA|VA) | 6 | $1,190,000 | $198,333 | $4,365 | 4.04% |

| MCALLEN-EDINBURG-MISSION, TX (FHA|USDA|VA) | 5 | $1,185,000 | $237,000 | $4,927 | 3.90% |

| FLORENCE, SC (FHA|USDA|VA) | 6 | $1,180,000 | $196,667 | $4,657 | 3.94% |

| ODESSA, TX (FHA|USDA|VA) | 6 | $1,180,000 | $196,667 | $5,355 | 4.29% |

| BLOOMSBURG-BERWICK, PA (FHA|USDA|VA) | 7 | $1,165,000 | $166,429 | $7,364 | 4.23% |

| LUBBOCK, TX (FHA|USDA|VA) | 6 | $1,160,000 | $193,333 | $5,173 | 3.65% |

| LEWISTON-AUBURN, ME (FHA|USDA|VA) | 5 | $1,155,000 | $231,000 | $5,124 | 4.07% |

| KINGSTON, NY (FHA|USDA|VA) | 4 | $1,150,000 | $287,500 | $8,455 | 4.22% |

| BROWNSVILLE-HARLINGEN, TX (FHA|USDA|VA) | 8 | $1,150,000 | $143,750 | $5,650 | 4.25% |

| RACINE, WI (FHA|USDA|VA) | 7 | $1,145,000 | $163,571 | $4,676 | 4.00% |

| New Castle, PA (FHA|USDA|VA) | 7 | $1,145,000 | $163,571 | $6,318 | 4.11% |

| Sunbury, PA (FHA|USDA|VA) | 8 | $1,140,000 | $142,500 | $6,449 | 4.03% |

| Salem, OH (FHA|USDA|VA) | 6 | $1,140,000 | $190,000 | $4,321 | 4.19% |

| MONROE, MI (FHA|USDA|VA) | 6 | $1,130,000 | $188,333 | $6,027 | 4.31% |

| Sedalia, MO (FHA|USDA|VA) | 8 | $1,090,000 | $136,250 | $3,014 | 4.31% |

| ANNISTON-OXFORD, AL (FHA|USDA|VA) | 8 | $1,090,000 | $136,250 | $5,054 | 4.15% |

| Traverse City, MI (FHA|USDA|VA) | 6 | $1,090,000 | $181,667 | $4,469 | 4.16% |

| Jasper, AL (FHA|USDA|VA) | 5 | $1,085,000 | $217,000 | $6,198 | 3.95% |

| CHEYENNE, WY (FHA|USDA|VA) | 4 | $1,080,000 | $270,000 | $5,929 | 4.00% |

| VINELAND-BRIDGETON, NJ (FHA|USDA|VA) | 6 | $1,080,000 | $180,000 | $6,094 | 4.02% |

| Spirit Lake, IA (FHA|USDA|VA) | 7 | $1,075,000 | $153,571 | $3,514 | 4.13% |

| COLLEGE STATION-BRYAN, TX (FHA|USDA|VA) | 4 | $1,070,000 | $267,500 | $4,909 | 4.06% |

| Montrose, CO (FHA|USDA|VA) | 5 | $1,065,000 | $213,000 | $4,543 | 3.77% |

| CHARLESTON, WV (FHA|USDA|VA) | 5 | $1,055,000 | $211,000 | $5,441 | 3.98% |

| LAWTON, OK (FHA|USDA|VA) | 5 | $1,055,000 | $211,000 | $5,012 | 4.45% |

| Faribault-Northfield, MN (FHA|USDA|VA) | 4 | $1,050,000 | $262,500 | $8,017 | 3.94% |

| Crescent City, CA (FHA|USDA|VA) | 4 | $1,030,000 | $257,500 | $5,754 | 4.25% |

| ROME, GA (FHA|USDA|VA) | 5 | $1,025,000 | $205,000 | $6,612 | 3.73% |

| Hutchinson, MN (FHA|USDA|VA) | 5 | $1,005,000 | $201,000 | $3,642 | 4.02% |

| HOUMA-THIBODAUX, LA (FHA|USDA|VA) | 7 | $1,005,000 | $143,571 | $4,592 | 4.50% |

| Fort Morgan, CO (FHA|USDA|VA) | 4 | $1,000,000 | $250,000 | $7,382 | 3.69% |

| Palatka, FL (FHA|USDA|VA) | 8 | $1,000,000 | $125,000 | $5,091 | 4.50% |

| PEORIA, IL (FHA|USDA|VA) | 5 | $995,000 | $199,000 | $4,680 | 4.55% |

| NILES, MI (FHA|USDA|VA) | 6 | $990,000 | $165,000 | $4,953 | 4.02% |

| KINGSPORT-BRISTOL, TN-VA (FHA|USDA|VA) | 5 | $975,000 | $195,000 | $6,374 | 3.83% |

| Richmond, IN (FHA|USDA|VA) | 12 | $960,000 | $80,000 | $3,815 | 4.53% |

| Athens, TX (FHA|USDA|VA) | 5 | $955,000 | $191,000 | $5,886 | 3.87% |

| Shawnee, OK (FHA|USDA|VA) | 4 | $950,000 | $237,500 | $4,750 | 4.28% |

| Lewistown, PA (FHA|USDA|VA) | 6 | $950,000 | $158,333 | $6,686 | 4.08% |

| IOWA CITY, IA (FHA|USDA|VA) | 4 | $950,000 | $237,500 | $5,628 | 3.53% |

| NEW BERN, NC (FHA|USDA|VA) | 5 | $915,000 | $183,000 | $3,943 | 3.73% |

| WARNER ROBINS, GA (FHA|USDA|VA) | 5 | $895,000 | $179,000 | $4,986 | 3.50% |

| Ada, OK (FHA|USDA|VA) | 4 | $890,000 | $222,500 | $6,398 | 3.96% |

| Ashland, OH (FHA|USDA|VA) | 6 | $890,000 | $148,333 | $4,241 | 4.33% |

| Iron Mountain, MI-WI (FHA|USDA|VA) | 7 | $865,000 | $123,571 | $3,858 | 4.50% |

| Roseburg, OR (FHA|USDA|VA) | 3 | $855,000 | $285,000 | $4,307 | 3.71% |

| MICHIGAN CITY-LA PORTE, IN (FHA|USDA|VA) | 4 | $850,000 | $212,500 | $4,087 | 4.34% |

| LAS CRUCES, NM (FHA|USDA|VA) | 5 | $845,000 | $169,000 | $5,410 | 3.55% |

| FOND DU LAC, WI (FHA|USDA|VA) | 4 | $840,000 | $210,000 | $3,058 | 4.34% |

| BLOOMINGTON, IN (FHA|USDA|VA) | 3 | $835,000 | $278,333 | $5,341 | 4.75% |

| Cullman, AL (FHA|USDA|VA) | 6 | $830,000 | $138,333 | $4,279 | 4.54% |

| Adrian, MI (FHA|USDA|VA) | 7 | $825,000 | $117,857 | $3,669 | 4.44% |

| Baraboo, WI (FHA|USDA|VA) | 4 | $820,000 | $205,000 | $4,508 | 3.78% |

| MANHATTAN, KS (FHA|USDA|VA) | 4 | $820,000 | $205,000 | $5,899 | 4.31% |

| Warrensburg, MO (FHA|USDA|VA) | 6 | $820,000 | $136,667 | $2,684 | 3.92% |

| Tullahoma-Manchester, TN (FHA|USDA|VA) | 5 | $815,000 | $163,000 | $4,388 | 4.35% |

| IDAHO FALLS, ID (FHA|USDA|VA) | 3 | $815,000 | $271,667 | $10,529 | 3.83% |

| LOGAN, UT-ID (FHA|USDA|VA) | 4 | $810,000 | $202,500 | $2,790 | 3.81% |

| Huntingdon, PA (FHA|USDA|VA) | 8 | $800,000 | $100,000 | $5,402 | 4.51% |

| GRANTS PASS, OR (FHA|USDA|VA) | 4 | $790,000 | $197,500 | $6,819 | 4.06% |

| Augusta-Waterville, ME (FHA|USDA|VA) | 4 | $790,000 | $197,500 | $4,748 | 3.72% |

| Moses Lake, WA (FHA|USDA|VA) | 2 | $790,000 | $395,000 | $3,148 | 3.81% |

| Astoria, OR (FHA|USDA|VA) | 3 | $785,000 | $261,667 | $5,066 | 3.71% |

| Lake City, FL (FHA|USDA|VA) | 5 | $775,000 | $155,000 | $3,462 | 4.03% |

| BLACKSBURG-CHRISTIANSBURG, VA (FHA|USDA|VA) | 4 | $770,000 | $192,500 | $4,296 | 4.06% |

| Freeport, IL (FHA|USDA|VA) | 9 | $765,000 | $85,000 | $3,504 | 4.60% |

| Columbus, MS (FHA|USDA|VA) | 4 | $760,000 | $190,000 | $3,613 | 3.88% |

| Cornelia, GA (FHA|USDA|VA) | 3 | $755,000 | $251,667 | $4,582 | 3.46% |

| Craig, CO (FHA|USDA|VA) | 3 | $755,000 | $251,667 | $5,210 | 3.96% |

| Meridian, MS (FHA|USDA|VA) | 3 | $755,000 | $251,667 | $3,368 | 3.96% |

| Forest City, NC (FHA|USDA|VA) | 3 | $755,000 | $251,667 | $5,662 | 3.41% |

| Jasper, IN (FHA|USDA|VA) | 4 | $750,000 | $187,500 | $5,003 | 4.00% |

| London, KY (FHA|USDA|VA) | 4 | $750,000 | $187,500 | $4,563 | 4.28% |

| GREENVILLE, NC (FHA|USDA|VA) | 4 | $750,000 | $187,500 | $5,342 | 3.66% |

| Picayune, MS (FHA|USDA|VA) | 4 | $750,000 | $187,500 | $4,331 | 4.12% |

| Shelby, NC (FHA|USDA|VA) | 3 | $745,000 | $248,333 | $6,887 | 3.17% |

| WALLA WALLA, WA (FHA|USDA|VA) | 3 | $735,000 | $245,000 | $2,541 | 4.08% |

| BINGHAMTON, NY (FHA|USDA|VA) | 5 | $725,000 | $145,000 | $4,768 | 4.53% |

| St. Marys, GA (FHA|USDA|VA) | 3 | $725,000 | $241,667 | $6,467 | 3.33% |

| BISMARCK, ND (FHA|USDA|VA) | 3 | $715,000 | $238,333 | $8,369 | 4.13% |

| WEIRTON-STEUBENVILLE, WV-OH (FHA|USDA|VA) | 4 | $710,000 | $177,500 | $4,428 | 4.00% |

| Marion, OH (FHA|USDA|VA) | 4 | $710,000 | $177,500 | $2,692 | 3.97% |

| ST. JOSEPH, MO-KS (FHA|USDA|VA) | 3 | $705,000 | $235,000 | $7,308 | 3.75% |

| Athens, OH (FHA|USDA|VA) | 5 | $705,000 | $141,000 | $4,299 | 4.53% |

| Bozeman, MT (FHA|USDA|VA) | 2 | $700,000 | $350,000 | $4,576 | 4.24% |

| Owatonna, MN (FHA|USDA|VA) | 4 | $700,000 | $175,000 | $4,125 | 4.22% |

| Port Angeles, WA (FHA|USDA|VA) | 3 | $685,000 | $228,333 | $7,011 | 3.46% |

| Fort Payne, AL (FHA|USDA|VA) | 4 | $680,000 | $170,000 | $3,238 | 3.65% |

| Morgan City, LA (FHA|USDA|VA) | 4 | $680,000 | $170,000 | $5,585 | 3.81% |

| Cedartown, GA (FHA|USDA|VA) | 4 | $660,000 | $165,000 | $4,736 | 4.06% |

| SPRINGFIELD, OH (FHA|USDA|VA) | 4 | $660,000 | $165,000 | $4,620 | 4.03% |

| BECKLEY, WV (FHA|USDA|VA) | 5 | $655,000 | $131,000 | $5,135 | 4.17% |

| Gardnerville Ranchos, NV (FHA|USDA|VA) | 2 | $650,000 | $325,000 | $2,786 | 4.13% |

| Lewisburg, TN (FHA|USDA|VA) | 2 | $650,000 | $325,000 | $8,997 | 4.31% |

| Mount Vernon, IL (FHA|USDA|VA) | 4 | $650,000 | $162,500 | $2,705 | 3.53% |

| Sandusky, OH (FHA|USDA|VA) | 4 | $640,000 | $160,000 | $5,682 | 4.38% |

| Farmington, MO (FHA|USDA|VA) | 4 | $630,000 | $157,500 | $5,752 | 4.28% |

| Manitowoc, WI (FHA|USDA|VA) | 3 | $625,000 | $208,333 | $6,634 | 3.54% |

| WHEELING, WV-OH (FHA|USDA|VA) | 5 | $625,000 | $125,000 | $5,286 | 4.13% |

| Ottawa, KS (FHA|USDA|VA) | 4 | $610,000 | $152,500 | $4,012 | 4.09% |

| Wisconsin Rapids-Marshfield, WI (FHA|USDA|VA) | 3 | $605,000 | $201,667 | $5,637 | 3.83% |

| Rexburg, ID (FHA|USDA|VA) | 2 | $600,000 | $300,000 | $6,847 | 3.50% |

| Angola, IN (FHA|USDA|VA) | 2 | $590,000 | $295,000 | $6,900 | 4.13% |

| BOWLING GREEN, KY (FHA|USDA|VA) | 3 | $585,000 | $195,000 | $3,664 | 4.17% |

| Vineyard Haven, MA (FHA|USDA|VA) | 1 | $585,000 | $585,000 | $14,821 | 4.13% |

| Corinth, MS (FHA|USDA|VA) | 2 | $580,000 | $290,000 | $5,190 | 4.50% |

| Sanford, NC (FHA|USDA|VA) | 3 | $575,000 | $191,667 | $2,188 | 3.75% |

| Kerrville, TX (FHA|USDA|VA) | 2 | $560,000 | $280,000 | $6,404 | 3.88% |

| Olean, NY (FHA|USDA|VA) | 3 | $555,000 | $185,000 | $8,825 | 4.50% |

| ALBANY, GA (FHA|USDA|VA) | 3 | $555,000 | $185,000 | $5,662 | 3.54% |

| ROCHESTER, MN (FHA|USDA|VA) | 3 | $555,000 | $185,000 | $4,783 | 4.38% |

| West Plains, MO (FHA|USDA|VA) | 3 | $555,000 | $185,000 | $6,628 | 4.29% |

| Elizabeth City, NC (FHA|USDA|VA) | 3 | $545,000 | $181,667 | $3,354 | 3.67% |

| CHAMPAIGN-URBANA, IL (FHA|USDA|VA) | 3 | $545,000 | $181,667 | $5,405 | 4.17% |

| Greenwood, SC (FHA|USDA|VA) | 3 | $545,000 | $181,667 | $5,007 | 3.88% |

| SUMTER, SC (FHA|USDA|VA) | 2 | $540,000 | $270,000 | $4,535 | 3.25% |

| Washington, IN (FHA|USDA|VA) | 4 | $540,000 | $135,000 | $2,989 | 3.44% |

| Searcy, AR (FHA|USDA|VA) | 4 | $540,000 | $135,000 | $5,450 | 4.66% |

| COLUMBUS, IN (FHA|USDA|VA) | 4 | $540,000 | $135,000 | $2,746 | 4.59% |

| Keene, NH (FHA|USDA|VA) | 3 | $535,000 | $178,333 | $5,648 | 4.58% |

| The Dalles, OR (FHA|USDA|VA) | 2 | $530,000 | $265,000 | $4,920 | 4.56% |

| ROCKY MOUNT, NC (FHA|USDA|VA) | 4 | $530,000 | $132,500 | $4,543 | 4.56% |

| DALTON, GA (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $5,241 | 4.50% |

| EAU CLAIRE, WI (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $9,154 | 4.37% |

| LA CROSSE-ONALASKA, WI-MN (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $10,537 | 3.91% |

| APPLETON, WI (FHA|USDA|VA) | 3 | $525,000 | $175,000 | $2,792 | 4.33% |

| Chillicothe, OH (FHA|USDA|VA) | 4 | $520,000 | $130,000 | $3,765 | 4.16% |

| Houghton, MI (FHA|USDA|VA) | 5 | $515,000 | $103,000 | $4,789 | 3.88% |

| Oskaloosa, IA (FHA|USDA|VA) | 3 | $515,000 | $171,667 | $2,678 | 3.63% |

| Burley, ID (FHA|USDA|VA) | 2 | $510,000 | $255,000 | $3,530 | 5.19% |

| Worthington, MN (FHA|USDA|VA) | 3 | $505,000 | $168,333 | $3,134 | 3.88% |

| Selinsgrove, PA (FHA|USDA|VA) | 3 | $505,000 | $168,333 | $7,051 | 3.92% |

| Hillsdale, MI (FHA|USDA|VA) | 2 | $500,000 | $250,000 | $3,785 | 3.93% |

| Hudson, NY (FHA|USDA|VA) | 3 | $495,000 | $165,000 | $5,799 | 3.83% |

| Gillette, WY (FHA|USDA|VA) | 3 | $495,000 | $165,000 | $3,412 | 4.17% |

| Grand Rapids, MN (FHA|USDA|VA) | 3 | $485,000 | $161,667 | $2,818 | 3.75% |

| Stillwater, OK (FHA|USDA|VA) | 1 | $485,000 | $485,000 | $4,976 | 5.75% |

| Red Wing, MN (FHA|USDA|VA) | 2 | $480,000 | $240,000 | $5,294 | 4.31% |

| Zanesville, OH (FHA|USDA|VA) | 3 | $475,000 | $158,333 | $4,072 | 3.79% |

| Mount Vernon, OH (FHA|USDA|VA) | 3 | $475,000 | $158,333 | $3,700 | 3.71% |

| Beatrice, NE (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $2,893 | 4.18% |

| La Grande, OR (FHA|USDA|VA) | 2 | $470,000 | $235,000 | $4,482 | 4.00% |

| Tupelo, MS (FHA|USDA|VA) | 3 | $465,000 | $155,000 | $5,260 | 4.75% |

| Dayton, TN (FHA|USDA|VA) | 3 | $465,000 | $155,000 | $6,055 | 4.25% |

| RAPID CITY, SD (FHA|USDA|VA) | 2 | $460,000 | $230,000 | $4,883 | 4.12% |

| ELKHART-GOSHEN, IN (FHA|USDA|VA) | 2 | $460,000 | $230,000 | $5,905 | 3.81% |

| Mountain Home, ID (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $6,228 | 3.19% |

| North Vernon, IN (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $3,942 | 4.19% |

| Milledgeville, GA (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $4,331 | 3.75% |

| Jamestown, ND (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $6,712 | 3.56% |

| Scottsboro, AL (FHA|USDA|VA) | 2 | $450,000 | $225,000 | $5,506 | 3.63% |

| Crossville, TN (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $2,867 | 3.06% |

| Andrews, TX (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $9,550 | 3.81% |

| Branson, MO (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $9,937 | 4.00% |

| LAFAYETTE-WEST LAFAYETTE, IN (FHA|USDA|VA) | 2 | $440,000 | $220,000 | $1,903 | 4.44% |

| Emporia, KS (FHA|USDA|VA) | 3 | $435,000 | $145,000 | $4,851 | 4.08% |

| Sault Ste. Marie, MI (FHA|USDA|VA) | 2 | $430,000 | $215,000 | $4,124 | 3.44% |

| Prineville, OR (FHA|USDA|VA) | 2 | $430,000 | $215,000 | $4,415 | 3.50% |

| Stephenville, TX (FHA|USDA|VA) | 3 | $425,000 | $141,667 | $4,179 | 4.87% |

| Glasgow, KY (FHA|USDA|VA) | 3 | $425,000 | $141,667 | $5,211 | 4.13% |

| Danville, VA (FHA|USDA|VA) | 3 | $425,000 | $141,667 | $3,353 | 3.92% |

| Murray, KY (FHA|USDA|VA) | 4 | $420,000 | $105,000 | $4,163 | 4.34% |

| Kearney, NE (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $6,073 | 3.75% |

| Kendallville, IN (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $4,167 | 4.19% |

| LIMA, OH (FHA|USDA|VA) | 4 | $420,000 | $105,000 | $5,313 | 3.84% |

| WACO, TX (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $2,033 | 4.25% |

| New Ulm, MN (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $3,630 | 3.75% |

| Wauchula, FL (FHA|USDA|VA) | 2 | $420,000 | $210,000 | $6,891 | 3.94% |

| Danville, KY (FHA|USDA|VA) | 3 | $415,000 | $138,333 | $6,316 | 4.08% |

| Thomaston, GA (FHA|USDA|VA) | 3 | $415,000 | $138,333 | $3,906 | 3.66% |

| SANTA FE, NM (FHA|USDA|VA) | 1 | $415,000 | $415,000 | $8,894 | 3.88% |

| Laconia, NH (FHA|USDA|VA) | 2 | $410,000 | $205,000 | $1,647 | 4.69% |

| KOKOMO, IN (FHA|USDA|VA) | 2 | $410,000 | $205,000 | $4,335 | 4.00% |

| Muscatine, IA (FHA|USDA|VA) | 2 | $410,000 | $205,000 | $3,997 | 3.63% |

| Waycross, GA (FHA|USDA|VA) | 3 | $405,000 | $135,000 | $4,602 | 3.79% |

| Indiana, PA (FHA|USDA|VA) | 4 | $400,000 | $100,000 | $5,812 | 4.47% |

| Crawfordsville, IN (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $2,848 | 3.62% |

| Auburn, NY (FHA|USDA|VA) | 4 | $400,000 | $100,000 | $5,022 | 3.69% |

| CUMBERLAND, MD-WV (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $4,552 | 4.00% |

| Newport, TN (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $4,763 | 3.31% |

| Lumberton, NC (FHA|USDA|VA) | 2 | $400,000 | $200,000 | $4,736 | 3.38% |

| Enterprise, AL (FHA|USDA|VA) | 3 | $395,000 | $131,667 | $3,283 | 4.21% |

| Dodge City, KS (FHA|USDA|VA) | 3 | $395,000 | $131,667 | $4,316 | 4.00% |

| Sayre, PA (FHA|USDA|VA) | 2 | $390,000 | $195,000 | $6,575 | 3.75% |

| Kill Devil Hills, NC (FHA|USDA|VA) | 2 | $390,000 | $195,000 | $4,920 | 4.31% |

| Hobbs, NM (FHA|USDA|VA) | 2 | $390,000 | $195,000 | $7,235 | 4.69% |

| Jamestown-Dunkirk-Fredonia, NY (FHA|USDA|VA) | 3 | $385,000 | $128,333 | $2,883 | 4.46% |

| Minden, LA (FHA|USDA|VA) | 3 | $385,000 | $128,333 | $2,747 | 4.38% |

| Hermiston-Pendleton, OR (FHA|USDA|VA) | 2 | $380,000 | $190,000 | $5,832 | 4.00% |

| Bucyrus-Galion, OH (FHA|USDA|VA) | 6 | $380,000 | $63,333 | $2,824 | 4.65% |

| Thomasville, GA (FHA|USDA|VA) | 3 | $375,000 | $125,000 | $4,662 | 4.50% |

| Aberdeen, WA (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $7,751 | 3.88% |

| Campbellsville, KY (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $4,189 | 4.25% |

| OSHKOSH-NEENAH, WI (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $3,555 | 3.75% |

| Alexandria, MN (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $5,695 | 3.94% |

| Fernley, NV (FHA|USDA|VA) | 2 | $370,000 | $185,000 | $5,048 | 3.56% |

| Cordele, GA (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $4,107 | 4.50% |

| Wilson, NC (FHA|USDA|VA) | 2 | $360,000 | $180,000 | $2,351 | 3.88% |

| Laurel, MS (FHA|USDA|VA) | 1 | $355,000 | $355,000 | $4,625 | 4.63% |

| Jacksonville, TX (FHA|USDA|VA) | 2 | $350,000 | $175,000 | $6,959 | 4.06% |

| Big Rapids, MI (FHA|USDA|VA) | 2 | $350,000 | $175,000 | $4,454 | 4.37% |

| Norwalk, OH (FHA|USDA|VA) | 2 | $350,000 | $175,000 | $3,728 | 5.13% |

| Selma, AL (FHA|USDA|VA) | 3 | $345,000 | $115,000 | $3,174 | 4.50% |

| SOUTH BEND-MISHAWAKA, IN-MI (FHA|USDA|VA) | 2 | $340,000 | $170,000 | $4,668 | 4.94% |

| Cookeville, TN (FHA|USDA|VA) | 2 | $340,000 | $170,000 | $4,636 | 4.25% |

| Summerville, GA (FHA|USDA|VA) | 2 | $340,000 | $170,000 | $6,201 | 3.63% |

| HOT SPRINGS, AR (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $2,034 | 3.50% |

| TERRE HAUTE, IN (FHA|USDA|VA) | 3 | $335,000 | $111,667 | $6,195 | 4.33% |

| Cullowhee, NC (FHA|USDA|VA) | 1 | $335,000 | $335,000 | $2,502 | 3.88% |

| Bay City, TX (FHA|USDA|VA) | 2 | $330,000 | $165,000 | $3,660 | 4.94% |

| ALEXANDRIA, LA (FHA|USDA|VA) | 2 | $330,000 | $165,000 | $7,089 | 3.69% |

| JOHNSTOWN, PA (FHA|USDA|VA) | 2 | $330,000 | $165,000 | $7,505 | 4.81% |

| Madison, IN (FHA|USDA|VA) | 3 | $325,000 | $108,333 | $3,768 | 4.63% |

| Clewiston, FL (FHA|USDA|VA) | 2 | $320,000 | $160,000 | $5,465 | 4.44% |

| Rochelle, IL (FHA|USDA|VA) | 2 | $320,000 | $160,000 | $2,580 | 4.00% |

| Berlin, NH (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $2,827 | 3.25% |

| TWIN FALLS, ID (FHA|USDA|VA) | 1 | $315,000 | $315,000 | $9,171 | 3.00% |

| Cedar City, UT (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $3,730 | 3.75% |

| Dublin, GA (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $3,900 | 3.69% |

| Fergus Falls, MN (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $3,104 | 3.81% |

| Hays, KS (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $4,884 | 4.38% |

| Vernal, UT (FHA|USDA|VA) | 2 | $310,000 | $155,000 | $2,518 | 4.13% |

| PINE BLUFF, AR (FHA|USDA|VA) | 2 | $300,000 | $150,000 | $7,462 | 4.75% |

| Findlay, OH (FHA|USDA|VA) | 2 | $300,000 | $150,000 | $4,143 | 4.56% |

| Warren, PA (FHA|USDA|VA) | 3 | $295,000 | $98,333 | $4,545 | 4.46% |

| MISSOULA, MT (FHA|USDA|VA) | 1 | $295,000 | $295,000 | $4,755 | 3.63% |

| Greenville, MS (FHA|USDA|VA) | 2 | $290,000 | $145,000 | $5,748 | 4.62% |

| Fort Dodge, IA (FHA|USDA|VA) | 2 | $290,000 | $145,000 | $6,574 | 4.56% |

| Clinton, IA (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $6,959 | 3.88% |

| Coos Bay, OR (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $4,899 | 3.99% |

| Safford, AZ (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $6,444 | 3.38% |

| Jackson, WY-ID (FHA|USDA|VA) | 1 | $285,000 | $285,000 | $3,810 | 4.00% |

| Dumas, TX (FHA|USDA|VA) | 2 | $280,000 | $140,000 | $3,623 | 4.19% |

| BLOOMINGTON, IL (FHA|USDA|VA) | 2 | $280,000 | $140,000 | $2,442 | 4.75% |

| Winona, MN (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $2,392 | 3.63% |

| POCATELLO, ID (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $4,052 | 3.25% |

| Cleveland, MS (FHA|USDA|VA) | 1 | $275,000 | $275,000 | $3,380 | 4.50% |

| Somerset, KY (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $5,894 | 4.63% |

| Batavia, NY (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $4,604 | 4.12% |

| Ashtabula, OH (FHA|USDA|VA) | 2 | $270,000 | $135,000 | $1,651 | 4.12% |

| BURLINGTON-SOUTH BURLINGTON, VT (FHA|USDA|VA) | 1 | $265,000 | $265,000 | $8,193 | 3.88% |

| Oil City, PA (FHA|USDA|VA) | 3 | $265,000 | $88,333 | $5,507 | 4.25% |

| Malone, NY (FHA|USDA|VA) | 2 | $260,000 | $130,000 | $4,516 | 3.88% |

| JOHNSON CITY, TN (FHA|USDA|VA) | 2 | $260,000 | $130,000 | $8,647 | 5.00% |

| GRAND ISLAND, NE (FHA|USDA|VA) | 3 | $255,000 | $85,000 | $2,980 | 4.38% |

| FAIRBANKS, AK (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $5,654 | 3.25% |

| Greenville, OH (FHA|USDA|VA) | 1 | $255,000 | $255,000 | $2,723 | 3.75% |

| Sturgis, MI (FHA|USDA|VA) | 2 | $250,000 | $125,000 | $5,346 | 4.31% |

| Albemarle, NC (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $6,133 | 3.25% |

| Fairmont, MN (FHA|USDA|VA) | 1 | $245,000 | $245,000 | $11,267 | 3.75% |

| Wilmington, OH (FHA|USDA|VA) | 2 | $240,000 | $120,000 | $3,879 | 4.69% |

| Marietta, OH (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $3,963 | 3.38% |

| Bennington, VT (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $4,043 | 4.63% |

| Pontiac, IL (FHA|USDA|VA) | 3 | $235,000 | $78,333 | $4,637 | 4.42% |

| Fremont, NE (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $5,005 | 4.00% |

| FORT SMITH, AR-OK (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $4,595 | 4.50% |

| Sandpoint, ID (FHA|USDA|VA) | 1 | $235,000 | $235,000 | $9,038 | 4.25% |

| Vermillion, SD (FHA|USDA|VA) | 2 | $230,000 | $115,000 | $4,435 | 4.44% |

| Pella, IA (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $5,523 | 3.63% |

| Brookings, SD (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $3,561 | 3.50% |

| Sidney, OH (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $3,480 | 3.38% |

| Menomonie, WI (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $3,982 | 4.13% |

| Quincy, IL-MO (FHA|USDA|VA) | 1 | $225,000 | $225,000 | $9,344 | 4.25% |

| Moultrie, GA (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $6,072 | 4.50% |

| GREEN BAY, WI (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $2,875 | 5.06% |

| Sterling, IL (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $4,027 | 4.37% |

| Poplar Bluff, MO (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $1,147 | 3.69% |

| Marion, IN (FHA|USDA|VA) | 2 | $220,000 | $110,000 | $3,970 | 5.06% |

| Vidalia, GA (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $2,576 | 3.38% |

| Brenham, TX (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $5,539 | 4.75% |

| Brownsville, TN (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $11,573 | 4.00% |

| BATTLE CREEK, MI (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $8,905 | 4.25% |

| Ardmore, OK (FHA|USDA|VA) | 1 | $215,000 | $215,000 | $6,473 | 4.75% |

| Fort Polk South, LA (FHA|USDA|VA) | 2 | $210,000 | $105,000 | $5,583 | 4.56% |

| Ruston, LA (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $4,903 | 4.25% |

| Bonham, TX (FHA|USDA|VA) | 1 | $205,000 | $205,000 | $1,878 | 4.50% |

| SPRINGFIELD, IL (FHA|USDA|VA) | 2 | $200,000 | $100,000 | $2,935 | 4.13% |

| Bemidji, MN (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $3,034 | 4.49% |

| Lewisburg, PA (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $4,461 | 3.75% |

| Lincoln, IL (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $2,046 | 3.88% |

| McAlester, OK (FHA|USDA|VA) | 1 | $195,000 | $195,000 | $0 | 5.75% |

| Escanaba, MI (FHA|USDA|VA) | 2 | $190,000 | $95,000 | $4,259 | 4.25% |

| Duncan, OK (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $10,014 | 3.75% |

| Lebanon, NH-VT (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $4,295 | 4.88% |

| Brevard, NC (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $4,772 | 3.38% |

| Kennett, MO (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $7,287 | 4.63% |

| Brownwood, TX (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $1,967 | 4.13% |

| Peru, IN (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $7,929 | 3.38% |

| Orangeburg, SC (FHA|USDA|VA) | 1 | $185,000 | $185,000 | $7,421 | 4.25% |

| Platteville, WI (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $6,346 | 4.25% |

| Sheridan, WY (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $904 | 3.25% |

| Paragould, AR (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $3,986 | 4.75% |

| Point Pleasant, WV-OH (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $7,879 | 4.25% |

| Jesup, GA (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $9,954 | 6.00% |

| Scottsbluff, NE (FHA|USDA|VA) | 1 | $175,000 | $175,000 | $4,070 | 3.99% |

| Seymour, IN (FHA|USDA|VA) | 2 | $170,000 | $85,000 | $2,084 | 4.31% |

| Tiffin, OH (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $3,251 | 4.00% |

| MUSKEGON, MI (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $5,501 | 3.25% |

| Taylorville, IL (FHA|USDA|VA) | 1 | $165,000 | $165,000 | $9,658 | 3.49% |

| St. Marys, PA (FHA|USDA|VA) | 2 | $160,000 | $80,000 | $4,433 | 4.44% |

| Somerset, PA (FHA|USDA|VA) | 2 | $160,000 | $80,000 | $5,354 | 4.69% |

| Mountain Home, AR (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $6,263 | 4.25% |

| Ponca City, OK (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $10,567 | 3.25% |

| Riverton, WY (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $6,879 | 3.38% |

| Elkins, WV (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $4,315 | 3.99% |

| Price, UT (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $1,511 | 4.88% |

| Muskogee, OK (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $8,682 | 4.63% |

| Sikeston, MO (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $2,485 | 5.88% |

| Union, SC (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $6,440 | 4.25% |

| Cambridge, OH (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $8,179 | 4.13% |

| Uvalde, TX (FHA|USDA|VA) | 1 | $155,000 | $155,000 | $0 | 5.63% |

| New Castle, IN (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $4,703 | 5.25% |

| Dickinson, ND (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $2,699 | 3.99% |

| Greensburg, IN (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $1,402 | 3.38% |

| Nogales, AZ (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $8,274 | 2.75% |

| Newberry, SC (FHA|USDA|VA) | 1 | $145,000 | $145,000 | $3,327 | 4.25% |

| DANVILLE, IL (FHA|USDA|VA) | 2 | $140,000 | $70,000 | $3,244 | 4.13% |

| Las Vegas, NM (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $3,007 | 6.00% |

| Sweetwater, TX (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $5,006 | 3.63% |

| SAGINAW, MI (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $5,969 | 4.75% |

| Alexander City, AL (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $4,298 | 3.99% |

| Pittsburg, KS (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $4,174 | 4.00% |

| Kinston, NC (FHA|USDA|VA) | 1 | $135,000 | $135,000 | $2,493 | 5.75% |

| Del Rio, TX (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $0 | 4.38% |

| Butte-Silver Bow, MT (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $5,061 | 5.13% |

| Washington, NC (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,268 | 4.25% |

| Hope, AR (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $2,613 | 4.25% |

| Portsmouth, OH (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $6,094 | 4.50% |

| Effingham, IL (FHA|USDA|VA) | 1 | $125,000 | $125,000 | $5,808 | 4.00% |

| Great Bend, KS (FHA|USDA|VA) | 2 | $120,000 | $60,000 | $2,804 | 4.56% |

| Palestine, TX (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $6,967 | 4.50% |

| Van Wert, OH (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $4,143 | 5.25% |

| Wapakoneta, OH (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $7,001 | 5.25% |

| Jackson, OH (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $997 | 3.99% |

| Decatur, IN (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $3,179 | 4.63% |

| Bluffton, IN (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $925 | 4.88% |

| Alice, TX (FHA|USDA|VA) | 1 | $115,000 | $115,000 | $6,307 | 4.25% |

| Richmond-Berea, KY (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $4,326 | 3.63% |

| Durant, OK (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,662 | 3.99% |

| Wabash, IN (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $4,842 | 4.25% |

| Vicksburg, MS (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $6,080 | 4.50% |

| Atchison, KS (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $2,328 | 5.00% |

| Jacksonville, IL (FHA|USDA|VA) | 1 | $105,000 | $105,000 | $5,904 | 5.75% |

| Alpena, MI (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $5,091 | 4.75% |

| Central City, KY (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $5,719 | 4.00% |

| Douglas, GA (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $3,436 | 3.63% |

| Miami, OK (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $4,530 | 4.50% |

| Tifton, GA (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $5,115 | 4.75% |

| Paris, TX (FHA|USDA|VA) | 1 | $95,000 | $95,000 | $5,522 | 5.88% |

| DECATUR, IL (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $5,030 | 5.25% |

| Gallup, NM (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $4,947 | 4.75% |

| Paducah, KY-IL (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $5,515 | 6.00% |

| Warsaw, IN (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $3,319 | 4.88% |

| Frankfort, IN (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $3,537 | 4.75% |

| Alma, MI (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $4,941 | 4.25% |

| Shawano, WI (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $5,251 | 4.25% |

| Macomb, IL (FHA|USDA|VA) | 1 | $85,000 | $85,000 | $4,980 | 4.25% |

| Fort Madison-Keokuk, IA-IL-MO (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $5,960 | 4.75% |

| Mount Sterling, KY (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $4,671 | 4.75% |

| Mount Pleasant, MI (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $4,274 | 5.50% |

| Greenwood, MS (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $3,376 | 5.75% |

| West Point, MS (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $5,148 | 4.25% |

| North Platte, NE (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $5,528 | 5.75% |

| BANGOR, ME (FHA|USDA|VA) | 1 | $75,000 | $75,000 | $4,890 | 5.25% |

| Mayfield, KY (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $3,385 | 5.25% |

| WICHITA FALLS, TX (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $0 | 5.50% |

| ENID, OK (FHA|USDA|VA) | 1 | $65,000 | $65,000 | $4,678 | 5.25% |

| Bradford, PA (FHA|USDA|VA) | 1 | $55,000 | $55,000 | $4,175 | 4.13% |

| Spencer, IA (FHA|USDA|VA) | 1 | $45,000 | $45,000 | $2,364 | 4.63% |

Similar Lenders

We use machine learning to identify the top lenders compared against HOME POINT FINANCIAL CORPORATION based on their rates and fees, along with other useful metrics. A lower similarity rank signals a stronger match.

Similarity Rank: 48

Similarity Rank: 54

Similarity Rank: 60

Similarity Rank: 69

Similarity Rank: 95

Similarity Rank: 105

Similarity Rank: 120

Similarity Rank: 140

Similarity Rank: 160

Similarity Rank: 175

Product Mix

For 2019, Home Point Financial Corporation's most frequently originated type of loan was Conventional, with 23,217 originations. Their 2nd most popular type was FHA, with 11,531 originations.

Loan Reason

For 2019, Home Point Financial Corporation's most frequently cited loan purpose was Home Purchase, with 23,337 originations. The 2nd most popular reason was Refi, with 13,669 originations.

Loan Duration/Length

For 2019, Home Point Financial Corporation's most frequently cited loan duration was 30 Year, with 40,801 originations. The 2nd most popular length was 15 Year, with 1,955 originations.

Origination Fees/Closing Costs

Home Point Financial Corporation's average total fees were $6,002, while their most frequently occuring range of origination fees (closing costs) were in the $<1k bucket, with 18,050 originations.

Interest Rates

During 2019, Home Point Financial Corporation's average interest rate for loans was 4.04%, while their most frequently originated rate bucket for loans was 3-4%, with 25,105 originations.

Loan Sizing

2019 saw Home Point Financial Corporation place emphasis on $200k-400k loans with 21,809 originations, totaling $6,212,045,000 in origination value.

Applicant Income

Home Point Financial Corporation lent most frequently to those with incomes in the $50k or less range, with 12,384 originations. The second most popular income band? $50k-75k, with 9,850 originations.

Applicant Debt to Income Ratio

Home Point Financial Corporation lent most frequently to those with DTI ratios of 30-36%, with 6,481 originations. The next most common DTI ratio? 20-30%, with 6,372 originations.

Ethnicity Mix

Approval Rates

Total approvals of all applications94.45%

Home Point Financial Corporation has an average approval rate.

Pick Rate

Approvals leading to origination83.71%

Home Point Financial Corporation has a below average pick rate.

Points and Fees

| Points | Originations | Total Value | Average Loan |

|---|---|---|---|

| NA | 44,035 | $12,587,775,000 | $285,858 |

Occupancy Type Mix

| Dwelling Type | Originations | Total Value | Average Loan |

|---|---|---|---|

| Single Family (1-4 Units):Manufactured | 355 | $62,295,000 | $175,479 |

| Single Family (1-4 Units):Site-Built | 43,680 | $12,525,480,000 | $286,755 |

LTV Distribution

Complaints

| Bank Name | Product | Issue | 2019 CPFB Complaints | % of Total Issues |

|---|---|---|---|---|

| Home Point Financial Corporation | VA mortgage | Trouble during payment process | 6 | 5.7% |

| Home Point Financial Corporation | VA mortgage | Closing on a mortgage | 1 | 0.9% |

| Home Point Financial Corporation | VA mortgage | Credit monitoring or identity theft protection services | 1 | 0.9% |

| Home Point Financial Corporation | VA mortgage | Struggling to pay mortgage | 1 | 0.9% |

| Home Point Financial Corporation | Conventional home mortgage | Applying for a mortgage or refinancing an existing mortgage | 2 | 1.9% |

| Home Point Financial Corporation | Conventional home mortgage | Closing on a mortgage | 1 | 0.9% |

| Home Point Financial Corporation | Conventional home mortgage | Incorrect information on your report | 1 | 0.9% |

| Home Point Financial Corporation | Conventional home mortgage | Struggling to pay mortgage | 4 | 3.8% |

| Home Point Financial Corporation | Conventional home mortgage | Trouble during payment process | 46 | 43.4% |

| Home Point Financial Corporation | FHA mortgage | Applying for a mortgage or refinancing an existing mortgage | 1 | 0.9% |

| Home Point Financial Corporation | FHA mortgage | Closing on a mortgage | 3 | 2.8% |

| Home Point Financial Corporation | FHA mortgage | Incorrect information on your report | 1 | 0.9% |

| Home Point Financial Corporation | FHA mortgage | Problem with a credit reporting company's investigation into an existing problem | 1 | 0.9% |

| Home Point Financial Corporation | FHA mortgage | Struggling to pay mortgage | 12 | 11.3% |

| Home Point Financial Corporation | FHA mortgage | Trouble during payment process | 18 | 17.0% |

| Home Point Financial Corporation | Other type of mortgage | Struggling to pay mortgage | 1 | 0.9% |

| Home Point Financial Corporation | Other type of mortgage | Trouble during payment process | 4 | 3.8% |

| Home Point Financial Corporation | VA mortgage | Applying for a mortgage or refinancing an existing mortgage | 2 | 1.9% |